FDM Powerpoint Training Slides

advertisement

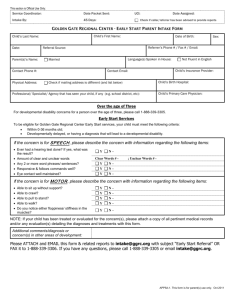

WELCOME Front Desk Managers • Please sign in • Grab a beverage Thank you for Volunteering! Agenda • Welcome • C.A.S.H. Process and Successes • New for 2016 • Role and Process • Shift Responsibilities • Amendments & Prior Year Returns • Q & A, Training Evaluations • Standards of Conduct Training Welcome & Introductions Please tell us more about you: • • • • 3 Name How did you hear about C.A.S.H.? Site location Years volunteering (if applicable) C.A.S.H. Site Process C.A.S.H. Accomplishments Year 13: 2016 Since 2002 Households Served 15,551 146,577 $ Total Returns (including EIC) $27.4m $245.9m $ EIC Benefit Returns $12.4m $119.1m 402 4940 129; $27,600 $333,450 $3,887,750 $36,644,250 C.A.S.H. Accomplishments Bank/Direct Deposit Cards Opened US Savings Bonds Purchased Tax Preparation Fees Saved (Avg $250 tax prep fee) 5 New for 2016 New for 2016 C.A.S.H. Staff Contact Information: Director: Berta Rivera Volunteer Manager: Tracy Merlau Administrative Assistant: Susan Bonkowski 295‐5732 295‐5733 295-5805 brivera@empirejustice.org tmerlau@empirejustice.org sbonkowski@empirejustice.org Volunteer Related Information: Online Training Center: www.empirejustice.org/cash/cash-training-center/ Volunteer Hub: www.cash.volunteerhub.com C.A.S.H. Website: www.empirejustice.org/cash New for 2016 Super Site Locations: Rochester Site* Volunteers of America (former Retail Center) 214 Lake Avenue Henrietta Site Kohl’s Plaza (next to Lumber Liquidators) 3150 W. Henrietta Rd, 14623 *merger of Irondequoit and Downtown 8 New for 2016 C.A.S.H. Super Site Staff and Contact Info Super Site Managers Asst. Managers Site Phone Numbers Octavio Garcia Rochester Gracie Jackson Tina Bowens Vinie Murphy Dave Garreston 585-262-2861 (Staff available: Mon-Fri: 8am-5pm) Jim Unckless Henrietta Karen Cofield Ellen Oberton Norma Cummings Cora Jones 585-427-7089 (Staff available: Mon-Thu: 1pm-5pm), Fri 1-5pm, Sat 8am-5pm) New for 2016 Returning Partner Sites • • • • • Action for a Better Community, Inc. ABC HEADSTART Program* Genesee Co-op Federal Credit Union Heritage Christian Services, Inc. * MCC - Damon Campus (Self Prep only) * *closed to public • • • • • • OACES Adult Learning Ctr (Self Prep only) * Rochester Educational Opp. Center SEIU 1199 SUNY Brockport* SUNY Brockport @ Goodwill* Veteran’s Outreach Center* New for 2016 • Open Mon. Jan. 25 – April 15 • Super Sites closed on Wednesdays to allow for preparation of Drop Off returns • Henrietta site open earlier on Fridays (11 am – 5 pm) • No appointments again this year (with one exception)*. • Two Sunday Events for specific groups (not public) • Work with group homes using drop-off model • FAST@CASH changed to Self Prep *Clients who opt for drop-off, but whose return is not eligible: Drop-off Coordinator will schedule appointment 11 New for 2016 • NEW Drop-off option at all Super Sites (to address long wait times) • New volunteer position: Drop-off Coordinator (DOC) • Screens interested clients for eligibility (includes self prep) • Makes future appointments if ineligible for drop-off • Conducts CASH Advisor conversation • Collects and scans document • Provides pick up information (week or more) New for 2016 • Acceptable forms of ID and Social Security cards for taxpayer(s) and dependents are required for new and returning clients. Sites have the right to refuse service if not available. • Note explaining this on top of each page of the Intake sheet • Returning clients were notified last year via a bright orange note stapled to their return. • 2016 Outreach materials share this information.(brochure, postcard) • Large posters with this information will be posted in the front window of sites and by the front desk. 13 New for 2016 Continuing “Save Your Refund” Promotion • $100 weekly prize drawing for taxpayers who split their refund • $25,000 Grand Prize at end of season • Great tool to encourage clients to save • NO scratch-off cards (last year at Downtown only) 14 New for 2016 Changes to Intake Paperwork • IRS Intake Sheet adds questions about Health Care coverage. • No NEW health insurance documentation required for TY 2015 • If client has 1098 T form (Tuition Statement), they must have a student billing statement for each form. (available through their online student accounts and can be printed at the site.) • New Consumer Related Problems question (#22 on C.A.S.H. Intake) with additional sheet to fill out--in accordion file-- if there are problems. 15 New for 2016 ESL Prepaid replacing NetSpend • Federal and/or NY refund can be deposited. • $3 per month fee • Free access to ESL ATM’s (and cash back on purchases) • Online account access & statements • No temporary card issued. Will arrive in 5-7 business days (before refund arrives) FDM Role and Process Front Desk Manager’s Role YOU PLAY A VITAL ROLE IN: • Managing the flow of the site • Setting a professional tone • Helping clients feel comfortable and informed about the process that will be followed to provide them with service. • Keeping paperwork organized • Ensuring site is well stocked with client materials • Helping the Site Manager keep the site neat and organized. Setting the Tone • Create A Professional Atmosphere – Keep front desk area neat and tidy • Throw out trash, vacuum (if necessary), pickup trash around front desk and waiting area • No food or drink at the desk, cups can be hidden under the desk. – Keep noise level at a minimum • No personal cell phone or electronic device usage at the desk. (Go outside or in site break area) • Use “inside” voice if you need to communicate with clients, volunteers, or staff, walk to person, don’t yell across the site • No loud gum chewing Setting the Tone • Be Attentive – Monitor who hasn’t returned paperwork and ask if they need help (i.e. language barrier, trouble understanding question, etc.) • Be Courteous – Let clients know (especially if eating) where the location of the restrooms and garbage bins. Process for Handling Clients • Greet each client with a smile and establish a welcoming environment. • Ensure clients sign in and note their arrival time on the Client sign in sheet.(p. 26) • The following things need to be written on the top of the Intake Sheet. (p. 15) – Sign in Number – Check box for Self Prep or Drop Off, if applicable – Callback Phone Number, if applicable – Circle Prior Year and/or Amendment, if applicable (starting in March) Process for Handling Clients • Provide each client with a multipage intake sheet (p. 15-22) and write their sequence number on the top. – Make sure to point out that there are 2 sides to each intake sheet. • Ask clients to return completed intake sheets to front desk. • Review intake sheets for completion. Return them and point out any missing information. – If they have difficulty answering any questions, encourage them to write down their best guess. CASH Advisors will be reviewing the intake sheets and will work with them to answer appropriately. When Clients Return Intake Sheets • Make sure client has filled out INCOME section. If over income, consult with Site Staff. Volunteer should NOT tell clients they don’t qualify, Site staff handles those situations. Income Guidelines: $55,000 or less for families w/ children; $40,000 or less for families w/o children. • • Once completed forms are returned: o Highlight the client’s name on the sign in sheet. o Enclose the intake sheets into 2 IRS envelopes o File in the CASH Advisor Bin in order by sign in number. (unless Drop Off or Self Prep is noted) o Find an available CASH advisor to give them the next client. Encourage them to take advantage of other services while they wait: free credit report, credit counselor (if available). When Clients choose Drop Off or Self Prep If the client shows interest let him/her know that a C.A.S.H. representative will meet with them to assess their eligibility. • File their paperwork in order of sign in number into the bin labeled DOC • Notify the DOC • Encourage them to take advantage of other services while they wait: free credit report, credit counselor (if available). • Once paperwork is given to DOC the client has completed the FDM process. Options for Long Waiting Periods Encourage clients to use the Drop Off service or give them the option to leave and come back later that day. • If they accept the option to leave and come back: – Write their cell number on the top of the intake sheet. – If they are not present when their name is called, call them and keep them at the top of the list. – Let clients know that any intake paperwork left when the site closes will be shredded. Clients who do not want to wait for CA • Cross out the sign in number on their intake paperwork • Return their intake paperwork • Tell them to bring back all documents when they return at a later date • Cross out their name on the Client Sign In sheet After Client has met with CASH Advisor • Ensure the CASH Advisor gives you one empty IRS envelope along with the intake paperwork. • Make sure there is a certification level circled on the intake sheet. Legend: (B)asic, (A)dvanced, (HSA) Health Savings Account • File paperwork in sequential order by sign in number in the Tax Prep bin • If HSA is also circled, consult with a site manager to determine which preparer on the current shift is certified to prepare that return. After Client has met with CASH Advisor • Before giving a tax preparer the next client, check their nametag to verify their certification level (B, A, HSA) and give them the appropriate client. • If a Tax Preparer is only certified in Basic, give them the next Basic return and leave any Advanced returns in the bin. – Advanced Tax Preparers can prepare both Basic and Advanced level tax returns. • Once paperwork is given to the Tax Preparer the client has completed the FDM process. If Clients don’t want to wait for Tax Prep • Cross out the sign in number on their intake paperwork • Write “READY FOR TAX PREP” on their IRS envelope and return their paperwork • Tell them to bring all of their paperwork when they return, so they can skip the CASH Advisor step and wait for a tax preparer. • Cross out their name on the Client Sign In sheet Note: This does NOT guarantee they can come back at a later date and be seen right away. It just eliminates the wait time associated with the CASH Advisor step. BREAK 30 FDM Shift Responsibilities & Additional Information Opening Shift Instructions • Sign IN on the Volunteer Sign In Sheet (p 25) and wear your nametag • Greet other volunteers as they arrive and remind them to sign in and wear their nametag – Blank nametags and colored dots will be available at your station for volunteers. • Make sure Front Desk, waiting, and toy areas are clean, neat and trash has been taken out. • Consult with site manager to open the site and ask clients to form a line and follow the process for handling clients. • Before leaving the site, please touch base with the volunteer who will replace you or the site staff. • Sign OUT on the Volunteer Sign in Sheet. Closing Shift Instructions • Sign in on the Volunteer sign in sheet and wear your nametag • Greet other volunteers as they arrive and remind them to sign in and wear their nametag • During the last hour of your shift, prepare for the next day: – Make sure the area is clean and organized, and the trash is emptied. – Prepare at least 50 sets of Intake paperwork ‐ Set includes: 1‐C.A.S.H. Questionnaire and 1‐IRS Intake sheet (yellow). – Make sure all clipboards are stocked with intake paperwork. – Prepare at least 50 sets of Envelopes– Set includes: 1‐ blank envelope and 1‐envelope that has Quality Review sheet (p 23) stapled. • Sign OUT on the Volunteer Sign In Sheet and check to make sure the other volunteers have signed out • Fax volunteer sign-in sheets to 585-454-4019. DO NOT fax client sign-in sheets. Tasks to complete during any shift – Staple Quality Review sheet to IRS envelopes – As necessary, clean and organize the front desk, waiting area and the children’s toy area. – As needed, prepare clipboards with multipage intake sheet. – Check the quantity of forms and supplies for the front desk, notify the assistant site manager of any items that need to be replenished. – Remember to sign in and out, and remind all volunteers to do the same. • Towards the end of your shift, check to make sure each volunteer has signed in and out on the Volunteer Sign in Sheet. Return Clients Clients with a Tax Return or E-file issue, or missing necessary documentation (called back by site manager) • These clients are instructed to ask for the Site Manager when they return. Please follow the steps listed below for these clients: o On a Post It Note, write their name, arrival time and reason for return. o Give the note to the Site Manager and ask them to sit in the waiting area. o Unless otherwise directed by a site manager, these clients should be seen as soon as possible, they do not need to sign in. Return Clients • *NEW* Clients with an appointment made by the DOC o These clients should be returning with completed intake paperwork signed by a CASH Advisor (back of 1st page). It should also have B, A, and/or HSA circled. o Ask clients to sign in. Write their appointment time on the top of their intake sheet. File them in the “Waiting for Tax Prep Bin”. o They don’t need to wait for walk-ins signed in ahead of them to be seen, make sure they are seen as close to their appointment time as possible. Return Clients • *NEW* Clients who used the Drop Off Service and need to pick up their completed return. o They will be returning with all of their documents, including their intake sheet, signed consent forms, and Drop Off Authorization form. o These clients can sign in on the sign in sheet and be filed in the DOC bin. They will be seen according to their sign in number. Return Clients Clients who have previously seen a CASH Advisor but were unable to wait for tax preparation. • Review their paperwork to make sure all documents are present. This includes a completed intake sheet signed by a CASH Advisor (back of first intake page) and a signed consent form. • Ask clients to sign in and put them in the “Waiting for Tax Prep” bin after the 10th client. o *NEW* - They should only have to wait for a max of 10 clients to be seen before them. Place a sticky note on the top of their paperwork that states “2nd Visit – Do Not Move”, this should ensure they are not filed in back into sequential order. They WILL most likely be seen out of order. Prior Year Returns & Amendments Prior Year Returns • C.A.S.H. can prepare tax returns for the current tax year and up to 3 previous years (2012-2015). • These returns are prepared during the month of March and if time permits, until the end of tax season. Prior Year Returns: Clients who may have failed to file on time or were not required to file but are eligible for a refund, may choose to file at a later time. • Prior year returns can only be filed by a tax preparer that is certified in that particular tax year. • Site managers will know which preparer is certified to file any given year. Amendments Amended returns are filed in order to make corrections to a tax return from a previously filed return. Most Common Reasons For An Amended Returns: – New income information (extra W‐2; interest form) – New expense form (child care receipt) – New credit information (education credit) • C.A.S.H. only prepares amended returns for clients who had their original return filed at a C.A.S.H. site. • Taxpayer should return to the C.A.S.H. site where the original return was prepared. • If the place where there original return was prepared is no longer open, we can assist them after the season ends in the C.A.S.H. main office. • If there are any questions, consult with a Site Manager. Processing Amendments & Prior Years • Ask the client to sign in and write the following on C.A.S.H. Questionnaire o Sign‐in Number o Circle “Amendment” or “Prior Year” o Write the tax year(s) for the amendment or prior year return. 2014, 2015 Processing Amendments & Prior Years • Advise the client to fill out the following sections of the intake paperwork: o C.A.S.H. Questionnaire – Name Only*. *First‐time CASH clients need to complete the entire C.A.S.H. Questionnaire o IRS Intake Sheet – all sections • Notify Site Manager so that they can let you know who is certified to prepare that return • First‐time clients only: Need to see a CASH Advisor, file their paperwork in the CASH Advisor bin. • All others can be filed in the Tax Prep bin. Need to Know What you need to know • On-the-job Trainer – First 2 weeks • 2 Front Desk Managers per shift (Max) Getting Ready For Your First Shift: • Review Your Manual & other materials • Relax – you will enjoy being a C.A.S.H. Volunteer! There will be experienced people at your site to help you get started – you will always be with others who can help or answer your questions. Have you Scheduled Your Shifts? 1. Choose a site 2. Choose the day of the week and time of day 3. Register on-line using the Volunteer Hub OR fill out the FDM Shift Sign up Sheet 4. Want help? Contact Tracy, 295-5733, tmerlau@empirejustice.org Can’t show up? If you know more than 24 hours in advance: Change your schedule on Volunteer Hub: www.cash.volunteerhub.com If you know less than 24 hours in advance: Call your Site Manager 47 • Rochester 262-2861 • Henrietta 427-7089 BREAK 48 Volunteer Standards of Conduct Training (VSC) 49 IRS Standards of Conduct 1. I will follow the Quality Site Requirements 2. I will not accept payment or solicit donations for tax return preparation. 3. I will not solicit business from clients, nor make personal use of anything I learn about them. 4. I will not knowingly prepare false returns. 5. I will not be dishonest, nor engage in any conduct which could have a negative effect on the VITA/TCE Programs. 6. I will treat all taxpayers in a professional, courteous, and respectful manner. IRS Standards of Conduct 1. I will follow the Quality Site Requirements QSR Requirements that apply directly to FDMs: • All volunteers (even non-tax preparers) must complete VSC training and sign Form 13615. • Must use the Form 13614-C (IRS intake sheet) and follow the IRS interview/intake process: o o o • 51 Clients are interviewed by the Tax Preparer and participate in a quality review of their return by a Quality Reviewer. Quality Reviewers should inform taxpayers that they are responsible for the information on their return. Both the Tax Preparer and Quality Reviewer need to be certified at the appropriate level. i.e. Advanced returns require the TP and QR to be trained to the advanced level. Follow Confidentiality Guidelines IRS Standards of Conduct 2. I will not accept payment, nor solicit donations for tax return preparation. • • • • 52 Volunteers CANNOT accept gifts or payment from clients C.A.S.H. does not accept payments or donations at any of our sites. Those who wish to support C.A.S.H. can donate to the United Way. To clients who insist on showing their gratitude, tell them cookies, brownies and pizza are always welcome and appreciated by C.A.S.H. volunteers! IRS Standards of Conduct 3. I will not solicit business from clients, nor make personal use of anything I learn about them. • No Avon books, no church literature, no selling for your kid’s fundraisers, no business cards • No contacting clients for any reason unrelated to C.A.S.H. 53 IRS Standards of Conduct 4. I will not knowingly prepare false returns. • Does not directly apply to FDMs, but --o EVERYBODY at C.A.S.H. is responsible for preparation of accurate & honest tax returns. o Do not assist clients in attempts to fraudulently increase their refund. o If you suspect a client is providing false information, notify your Site Manager. 54 IRS Standards of Conduct 5. I will not be dishonest, nor engage in any conduct which could have a negative effect on the VITA/TCE Programs. • Every penny of the client’s refund must go directly to the client, either by a check in the mail or direct deposit into their account. • Knowingly preparing a false return is a violation (not listing cash income received by client) • All C.A.S.H. volunteers must be citizens or legal residents of the United States. 55 IRS Standards of Conduct 6. I will treat all taxpayers in a professional, courteous, and respectful manner. • Tax preparation can be stressful for our clients, and wait times can be long. Some clients will be impatient and testy. Be calm and helpful. • Treat every C.A.S.H. client like a “paying customer” • At all times, protect the client’s confidential information. Do not discuss their situation in a voice loud enough to be heard by other clients. Do not leave client paperwork sitting out unattended. 56 Confidentiality All information you receive from taxpayers in your volunteer capacity is strictly confidential and should not be disclosed to unauthorized individuals. 57 IRS Standards of Conduct Failure to comply with IRS conduct standards could result in: • Ending your participation at C.A.S.H. • Deactivation of EFIN (Allows CASH to electronically file returns) • Termination of C.A.S.H.’s partnership with IRS • Loss of VITA funding (IRS Grant) • Permanent shut-down of C.A.S.H. • Criminal Investigation 58 Standards of Conduct Test • Please complete and sign Form 13615. • Complete test as a group • Bring Test, Form 13615, and Photo ID to instructor • The instructor will provide you with a nametag to wear at the sites. • Please complete the training evaluation. Thank You for Volunteering with C.A.S.H. ! 59