United Way of Greater Atlanta Volunteer Income Tax Assistance

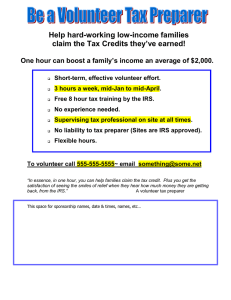

advertisement

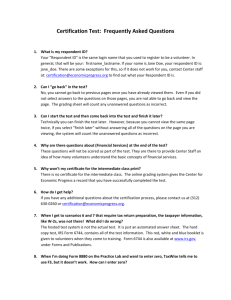

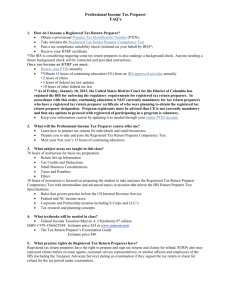

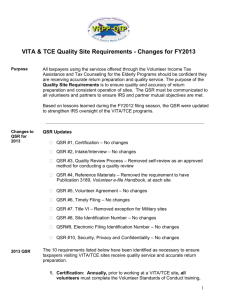

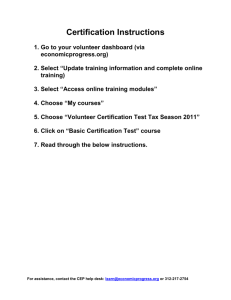

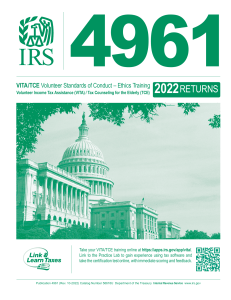

United Way of Greater Atlanta Volunteer Income Tax Assistance (VITA) Tax Preparer Volunteer Description The Volunteer Tax Preparer helps qualified working families prepare their Federal and State tax returns, using an interview-based software program, with the objective of ensuring that all eligible families apply for and receive the Earned Income Tax Credit (EITC). Tax Preparer Volunteer Responsibilities: Prepares tax returns for taxpayers who qualify for VITA assistance. Tax returns are typically a simple 1040 or 1040-EZ unless the volunteer wants to participate in further training. Answers basic taxpayer questions and refers taxpayers for additional assistance as necessary to local the IRS office, Low Income Tax Clinics (LITC), etc. Informs clients about other services available through the Atlanta Prosperity Campaign and its partners. Tax Preparer Volunteer Qualifications: Complete a training session (3-6 hrs) on basic tax law and TaxWise software in January. Pass an IRS-certification exam through Basic although you can also test up to Advanced levels. This exam is open-book, untimed. Strong computer skills. Strong interpersonal and communication skills. Good attention to detail. We have sites located across metro Atlanta. You will have the opportunity to select the site most convenient to you. We require a minimum of 15 volunteer hours during the tax season. Training Resources Completion of the IRS Certification Test(s) is NOT required prior to training. Link and Learn for self-study http://apps.irs.gov/app/vita/ Practice Lab and Certification Test Module https://www.linklearncertification.com