Sources of Financing: Debt and Equity

Sources of Financing:

Debt and Equity

If you don’t know who the fool is on the deal, it’s you!

...Michael Wolff

Planning for Capital Needs

Capital : any form of wealth employed to produce more wealth

Fixed capital : to purchase a company’s permanent or fixed assets such as land, buildings, computers, and equipment

Working capital : to support a business’s short-term operations

Growth capital : to finance a company’s growth or its expansion in a new direction

Equity vs Debt Capital

Equity capital : represents the personal investment of the owner (s) of a company

Debt capital : the financing that a small business owner has borrowed and must repay with interest

Sources of Equity Capital

Personal savings

Friends and family members

Angels

Partners

Corporate venture capital

Venture capital companies

Public stock sale

Angels

Private investors , wealthy individuals, entrepreneurs themselves, who provide money in exchange for equity stakes

Ranging from $10,000 to $2M

Every year: 230,000 angels , $23 B, 50,000 companies

Average: 10% of opportunities, 2 investments per year, $80,000 in 3.5 firms

Angel networks : 200

Patient money

Venture Capital Companies

$3-10M

Competent management

Competitive edge

Growth industry

Viable exit strategy

Intangible factors

Public Stock Sale

Advantages

Ability to raise large amounts of capital

Improved corporate image

Improved access to future financing

Use of stock for acquisitions

Listing on a stock exchange

Public Stock Sale

Disadvantages

Dilution of ownership

Loss of control

Loss of privacy

Reporting to SEC

Filing expenses

Accountability to shareholders

Pressure for short-term performance

Demands of time and timing

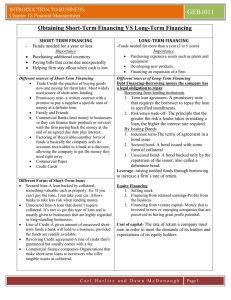

Debt Financing

Commercial banks

Non-banks

Federally-sponsored programs

State and Local

Development

Programs

Internal methods of financing

Commercial Banks

Short-term loans

Commercial loans

Lines of credit

Floor-planning

Intermediate and long-term loans

Installment loan

Term loan

Non-Bank Sources

Asset-based lenders

Vendor financing

Equipment suppliers

Commercial finance companies

Savings and loan associations

Stock brokerage houses

Insurance companies

Credit unions

Bonds

Private placements

Small business investment companies

Small business lending companies

Federally Sponsored Programs

Economic Development Administration

Department of Housing and Urban Development

Department of Agriculture’s Rural Cooperative Service

Small Business Innovation Research Program

Small Business Technology Transfer Program

Small Business Administration

Small Business Administration

Low Doc Loan Program

SBA Express Program

7A Loan Guaranty Program

CAPLine Program

Loans Involving International Trade

Section 504 Certified Development Company

Program

Microloan Program

Prequalification Loan Program

Disaster Loans

State and Local Loan

Development Programs

Capital access programs : encourages lending institutions to make loans to businesses that do not qualify for traditional financing because of higher risk

Revolving loan funds : offered by communities that combine private and public funds to make loans to small businesses, often at below-market interest rates

Internal Methods

Factoring accounts receivable

Leasing

Credit cards