Income Statement: What should be included on the current period's

advertisement

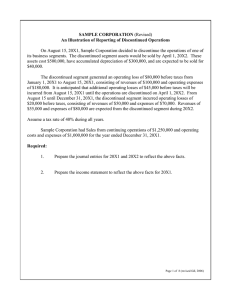

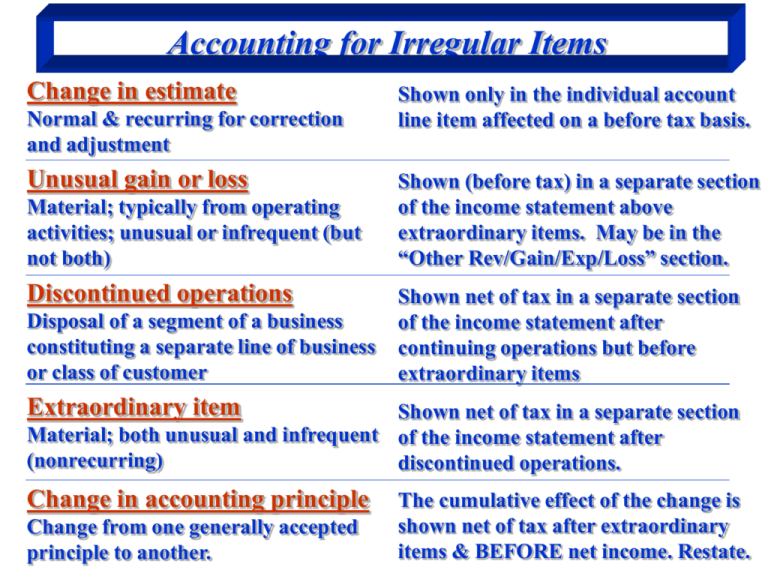

Accounting for Irregular Items Change in estimate Normal & recurring for correction and adjustment Unusual gain or loss Material; typically from operating activities; unusual or infrequent (but not both) Discontinued operations Disposal of a segment of a business constituting a separate line of business or class of customer Shown only in the individual account line item affected on a before tax basis. Shown (before tax) in a separate section of the income statement above extraordinary items. May be in the “Other Rev/Gain/Exp/Loss” section. Shown net of tax in a separate section of the income statement after continuing operations but before extraordinary items Extraordinary item Shown net of tax in a separate section Material; both unusual and infrequent of the income statement after (nonrecurring) discontinued operations. Change in accounting principle Change from one generally accepted principle to another. The cumulative effect of the change is shown net of tax after extraordinary items & BEFORE net income. Restate. Intraperiod Tax Allocation • The concept: items are presented on financial statements with their related tax effects attached to them. • Tax expense is allocated within the period to the items that helped give rise to it. After Tax Benefit = (1- TaxRate) * (TaxableCashReceipt) After Tax Cost = = (1-TaxRate) * (TaxDeductibleCashOutflow) = Irregular Items Discontinued Operations Occurs when an entity discontinues clearly separable operations, not just a disposal of assets incident to operations. May consist of: (a) income (loss) from operations during the phase-out period (the period between the “measurement date” & the “disposal date”), & (b) gain (loss) from disposal of segment assets – You must define the segment, assets, method of disposal, time periods involved, estimates of income between dates available, estimated salvage value of assets, etc. – Measurement Date is the Date the contract is signed. – Disposal Date is the Date operations close and assets sold. Extraordinary as defined in APB # 30 Irregular Items IS NOT: – write-down of receivables, inventory, deferred R&D costs or other intangible – from foreign currency translation – disposal of a segment – abandonment of facilities – effects from strikes – an adjustment of accruals of long-term contracts IS: – from early extinguishment of debt – expropriation by a foreign government – prohibition under a newly enacted law or regulation Change in Accounting Principle Irregular Items Criteria: Change from one generally accepted principle to another. Financial Statement Treatment: • The cumulative effect of the change is shown net of tax after extraordinary items but before net income. • All prior periods shown are restated. For periods not presented that are affected by the change, the beginning balance of retained earnings is also restated. Irregular Items Prior Period Adjustments: FASB #16 Adjust the beginning balance of Retained Earnings rather than have the item reflected on the income statement of any period (unless comparative statements are presented). – Prior Period Adjustments are: • The correction of errors (mistakes, omissions) • To account for the effect of operating loss tax carryforwards of purchased subsidiaries. • Reported net-of-tax.