Income Statement

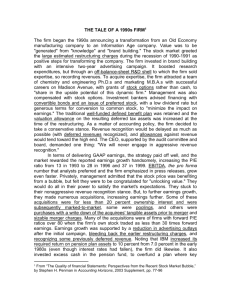

advertisement

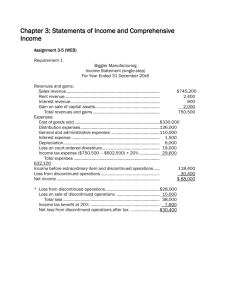

UNDERSTANDING FINANCIAL STATEMENTS • INCOME STATEMENT (Chapter 3) Income Statement • • • • Revenues less Expenses = Net Income Earnings Per Share is reported on face of IS Also called the Statement of Earnings Comparative financial statements enable users to analyze performance over multiple periods and identify significant trends. • Consolidated financial statements combine the financial results of a “parent company” with its subsidiaries. Income Statement • Income reported on income statement is based on Accrual Accounting, all revenues earned in the year & all expenses incurred in that year (NOT on the cash generated or cash paid during accounting period) • Income Statement may be presented in the multi-step or single step form. Income Statement • Single-step • All operating revenues and gains are reported first, followed by all operating expenses and other losses. • No separate section is prepared for COGS and gross profit. • Multiple-step • Divided into separate sections, various Gross Profit subtotals are reported. Operating Income • Involves separate sections for gross profit, Other Income/losses operating income, other income/losses, income before income taxes, and net income. Common size Income Statement • Analytical tool to compare firms with different level of sales. • Used to facilitate structural analysis of a firm, to evaluate trends and make industrial comparisons. • Expresses each income statement category as a percentage of net sales. • See Exhibit 3-3 Income Statement • Focus on Multi-step format (it has more detail and is more useful) • NET SALES: A firm’s sales are usually reported as Sales less Sales Returns less Sales Allowances – the major source of revenue for most companies – trends are important Income Statement (continued) Net Sales Less: Cost of Goods Sold (COGS) Cost to seller of products sold to customers. • • • If purchased, then price plus freight-in. If manufactured, then DM, DL, Manf. Ovhd. The relationship between COGS and sales is an important one. = Gross Profit • Key analytical tool in analyzing firm’s operating performance. • Gross profit percentage equals Gross profit/Sales Income Statement (continued) Gross Profit Less: Operating Expenses Selling Expenses: Advertising expenses Salesmen’ salaries General and Administrative Expenses: Office and officer salaries Payroll taxes Depreciation expense Repairs & maint. Insurance expense Rent expense Lease expense Bad debt expense Research and Development Supplies = Operating Income (or Operating Profit or Income from Operations) Measures overall performance of company’s operations Operating Income Percentage=Operating Income/Sales Income Statement (continued) Operating Income +/- Other Income/Expense Interest income Gain from sale of equipment Gain from sale of investments Interest expense Loss from sale of equipment Loss from sale of investments Loss from write-down of inventory FOR SALE Earnings before income taxes Less: Income taxes Net Earnings or Net Income (or Income from Continuing Operations) Income Statement (continued) Income from Continuing Operations +/- Income from Discontinued Operations (net of tax) +/- Extraordinary Gains and Losses (net of tax) +/- Cumulative Effect of a Change in Accounting Principle (net of tax) Net Earnings or Net Income Net Earnings Percentage =Net Earnings/Sales Income from Discontinued Operations A significant segment of a business that has been discontinued. A segment is a unit that is clearly distinguishable physically, operationally, and for financial reporting purposes. It represents either a separate, (1) major line of business, or (2) line of customers. Income from discontinued operations is segregated from income from continuing operations to assist financial statement users in assessing future cash flows of the company. Income from Discontinued Operations • Income (loss) from operations of discontinued operations (from 1/1 to measurement date) Less: Income tax • Gain (loss) from sale of discontinued operations (a)Income (loss) from operations (after measurement date) (b)Gain (loss) on disposition of segment of assets Less: Income tax Net Income from Discontinued Operations Extraordinary Gains and Losses • gains and losses that are both unusual in nature and infrequent in occurrence. • gains and losses from most natural disasters (unless frequent occurrences, then “other income/losses) • gains and losses on extinguishment of a company’s own debt (even if frequent). • does not include losses from strikes (even if infrequent). Cumulative Effect of a Change in Accounting Principle • Accounting principle changes may be required by FASB or may be made at management’s discretion. • The cumulative effect—the difference between the revenue/expense under the old and the revenue/expense under the new method up to the beginning of the year of the change. It is reported net of the tax effect. • Use the new method for the current year. Cumulative Effect of a Change in Accounting Principle The cumulative effect may be reflected either of two ways: (1) Ordinarily, in the income statement as “Cumulative Effect of Change in Accounting Principle” (2) In special cases, in the opening balance of retained earnings, with restatement of prioryears’ statements presented on a comparative basis (on Stmt. of RE) (a)changing from LIFO to FIFO (b)changing from one type of long-term contracting principle to another (c) changing from an unacceptable accounting principle to a GAAP (correction of an error) Changes in estimates • Estimates are made using the BEST available information at the statement date. • Changes in estimates should be reflected in the current period (date of the revision) and in future periods, if any, that are affected. • No “cumulative effect” of the change Earnings per share (EPS) • Earnings available to common shareholders divided by average number of common shares outstanding • If firm has “complex” capital structure, it will report basic and diluted EPS • EPS ( both basic EPS and diluted EPS) must be shown for each of the following (see Exhibit 3-4): • • • • Income from continuing operations Discontinued segment income/loss Extraordinary income/loss Cumulative effect of change of accounting principle • Net Income Earnings per share • Basic Earnings per share = Net Income number of average shares of common stock outstanding • Diluted Earnings per share = Net Income number of average shares of common stock o/s plus number of dilutable shares (dilutable shares are shares from future conversion of convertible bonds and shares from future exercise of stock options) Comprehensive Income • Beginning in 1998, companies required to report COMPREHENSIVE INCOME • Comprehensive income includes ALL changes in stockholders’equity during a period except those resulting from investments by owners and distributions to owners • Does not include: Dividends to stockholders Issuance of stock Treasury stock transactions Comprehensive Income Net Income (from Income Statement) +/- Foreign currency translation adjustments +/- Unrealized gains/losses on available-for-sale securities +/- Additional pension liabilities +/- Changes in fair market value of cash flow hedges = Comprehensive Income/Loss Comprehensive Income • Comprehensive Income may be reported in one of three ways: – on the face of the income statement – in a separate statement of comprehensive income – in a statement of stockholders’ equity