HCMI Chapter 13 question bank [3-9

advertisement

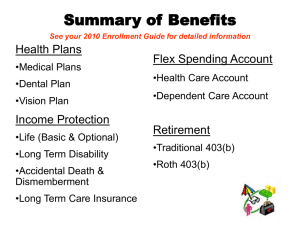

HCMII Chapter 13 terminology/ summary/ question bank Blue Cross (BC)- The forerunner of what is known today as the Blue Cross (BC) plan began in 1929 when Baylor University Hospital in Dallas, Texas, approached teachers in the Dallas school district with a plan that would guarantee up to 21 days of hospitalization per year for subscribers and each of their dependents, in exchange for a $6 annual premium. prepaid health plan- prepaid health plan (13) - contract between employer and healthcare facility (or physician) where specified medical services were performed for a predetermined fee that was paid on either a monthly or yearly basis. member hospital- By 1932 some plans modified this concept and organized community-wide programs that allowed the subscriber to be hospitalized in one of several member hospitals, which had signed contracts to provide services for special rates. American Hospital Association (AHA)- American Hospital Association (AHA) (13) - national organization that represents and serves all types of hospitals, healthcare networks, and their patients and communities; the AHA began as the accreditation agency for new prepaid hospitalization plans in 1939. Blue Shield (BS)- The Blue Shield (BS) plans began as a resolution passed by the House of Delegates at an American Medical Association meeting in 1938. This resolution supported the concept of voluntary health insurance that would encourage physicians to cooperate with prepaid healthcare plans. The first known plan was formed in Palo Alto, California, in 1939 and was called the California Physicians’ Service. Blue Cross Blue Shield (BCBS)- Blue Cross plans originally covered only hospital bills, and Blue Shield plans covered fees for physician services. Over the years, both programs increased their coverage to include almost all healthcare services. In many areas of the country, there was close cooperation between Blue Cross and Blue Shield plans that resulted in the formation of joint ventures in some states where the two corporations were housed in one building. In these joint ventures, Blue Cross Blue Shield (BCBS) shared one building and computer services but maintained separate corporate identities. nonprofit corporation- Nonprofit corporations are charitable, educational, civic, or humanitarian organizations whose profits are returned to the program of the corporation rather than distributed to shareholders and officers of the corporation. Because no profits of the organization are distributed to shareholders, the government does not tax the organization’s income. For-profit corporation- For-profit corporations pay taxes on profits generated by the corporation’s enterprises and pay dividends to shareholders on after-tax profits. preferred provider network (PPN)/ PPN provider- PARs can also contract to participate in the plan’s preferred provider network (PPN), a program that requires providers to adhere to managed care provisions. In this contractual agreement, the PPN provider (a provider who has signed a PPN contract) agrees to accept the PPN allowed rate, which is generally 10 percent lower than the PAR allowed rate. BCBS basic coverage- Minimum benefits under BCBS basic coverage routinely include the following services: ● ● ● ● ● ● ● ● ● Hospitalizations. Diagnostic laboratory services. X-rays. Surgical fees. assistant surgeon fees. Obstetric care. intensive care. Newborn care. Chemotherapy for cancer. BCBS major medical (MM) coverage- BCBS major medical (MM) coverage includes the following services in addition to basic coverage: ● ● ● ● ● ● Office visits. Outpatient nonsurgical treatment. Physical and occupational therapy. Purchase of durable medical equipment (DME). Mental health visits. allergy testing and injections. rider- Some of the contracts also include one or more riders, which are special clauses stipulating additional coverage over and above the standard contract. special accidental injury rider- The special accidental injury rider covers 100 percent of nonsurgical care sought and rendered within 24 to 72 hours (varies according to the policy) of the accidental injury. medical emergency care rider- The medical emergency care rider covers immediate treatment sought and received for sudden, severe, and unexpected conditions that if not treated would place the patient’s health in permanent jeopardy or cause permanent impairment or dysfunction of an organ or body part. Chronic or subacute conditions do not qualify for treatment under the medical emergency rider unless the symptoms suddenly become acute and require immediate medical attention. indemnity coverage- BCBS indemnity coverage offers choice and flexibility to subscribers who want to receive a full range of benefits along with the freedom to use any licensed healthcare provider. Coverage includes hospital-only or comprehensive hospital and medical coverage. Subscribers share the cost of benefits through coinsurance options, do not have to select a primary care provider, and do not need a referral to see a provider. coordinated home health and hospice care- The coordinated home health and hospice care program allows patients with this option to elect an alternative to the acute care setting. The patient’s physician must file a treatment plan with the case manager assigned to review and coordinate the case. All authorized services must be rendered by personnel from a licensed home health agency or approved hospice facility. outpatient pretreatment authorization plan (OPAP)- The outpatient pretreatment authorization plan (OPAP) requires preauthorization of outpatient physical, occupational, and speech therapy services. prospective authorization/ precertification- OPAP is also known as prospective authorization or precertification Member- The BCBS PPO plan is sometimes described as a subscriber-driven program, and BCBS substitutes the terms subscriber (or member) for policyholder (used by other commercial carriers). second surgical opinion (SSO)- The mandatory second surgical opinion (SSO) requirement is necessary when a patient is considering elective, nonemergency surgical care. The initial surgical recommendation must be made by a physician qualified to perform the anticipated surgery. If a second surgical opinion is not obtained prior to surgery, the patient’s out-of-pocket expenses may be greatly increased. Federal Employee Health Benefits Program (FEHBP)/ Federal Employee Program (FEP)- The Federal Employee Health Benefits Program (FEHBP) (or Federal Employee Program, FEP) is an employer-sponsored health benefits program established by an Act of Congress in 1959. The FEP began covering federal employees on July 1, 1960, and now provides benefits to more than 9 million federal enrollees and dependents through contracts with about 300 insurance carriers. service location- Claims are submitted to local plans that serve the location where the patient was seen (called a service location), regardless of the member’s FEP plan affiliation. Government-Wide Service Benefit Plan- FEP cards contain the phrase Government-Wide Service Benefit Plan under the BCBS trademark Medicare supplemental plans- BCBS corporations offer several federally designed and regulated Medicare supplemental plans (described in Chapter 14), which augment the Medicare program by paying for Medicare deductibles and copayments. These plans are better known throughout the industry as Medigap Plans and are usually identified by the word Medigap on the patient’s plan ID card Healthcare Anywhere/ BlueCard® Program- Healthcare Anywhere coverage allows “members of the independently owned and operated BCBS plans [to] have access to healthcare benefits throughout the United States and around the world, depending on their home plan benefits. Generally, the BlueCard® Program enables such members obtaining healthcare services while traveling or living in another BCBS Plan’s service area to receive the benefits of their home Plan contract and to access local provider networks. Away From Home Care® Program- The Away From Home Care® Program allows the participating BCBS Plan members who are temporarily residing outside of their home HMO service area for at least 90 days to temporarily enroll with a local HMO. Such members usually include dependent students attending school out-of-state, family members who reside in different HMO service areas, long-term travelers whose work assignment is in another state, and retirees with a dual residence. BlueWorldwide Expat- BlueWorldwide Expat provides global medical coverage for active employees and their dependents who spend more than six months outside the United States. usual, customary, and reasonable (UCR)- Other plans use a usual, customary, and reasonable (UCR) basis, which is the amount commonly charged for a particular medical service by providers within a particular geographic region for establishing their allowable rates. Summary: Blue Cross plans were initiated in 1929 and originally provided coverage for hospital bills, while Blue Shield was created in 1938 and originally covered fees for physician services. Blue Cross and Blue Shield (BCBS) plans entered into joint ventures that increased coverage of almost all healthcare services, and the BlueCross BlueShield Association (BCBSA) was created in 1986 when the separate Blue Cross association merged with the Blue Shield association. The BCBS plans were pioneers in nonprofit, prepaid health care; and competition among all health insurance payers in the United States resulted in further mergers. BCBS negotiates contracts with providers who are designated participating providers (PARs). PARs are eligible to contract with preferred provider networks, and they qualify for assignment of benefits. Nonparticipating providers do not sign such contracts, and they expect to be reimbursed the complete fee. They collect payment from the patient, and the patient receives reimbursement from BCBS. BCBS plans include fee-for-service, indemnity, managed care, Federal Employee Program, Medicare supplemental, and Healthcare Anywhere plans. Questions: 1. One of the requirements that a participating provider must comply with is to a. maintain a provider representative department to assist with billing and payment problems for submitted claims. b. make fee adjustments for the difference between amounts charged to patients for services provided and payer-approved fees. c. purchase billing manuals and newsletters published by the payer, and pay registration fees to attend payer training sessions. d. write off deductible and copay/coinsurance amounts, and accept as payment in full the BCBS-allowed fees. 2. Which is a program that requires providers to adhere to managed care provisions? a. fee-for-service b. indemnity c. preferred provider network d. traditional coverage 3. One of the expectations that a nonparticipating provider has is to _____ for services rendered. a. file the CMS-1500 claim on behalf of the patient b. obtain payment for the full fee charged c. receive reimbursement directly from the payer d. waive patient deductibles and copay/coinsurance 4. Which is considered a minimum benefit under BCBS basic coverage? a. hospitalizations b. office visits c. physical therapy d. prescription drugs 5. Which is considered a service reimbursed by BCBS major medical coverage? a. assistant surgeon fees b. chemotherapy for cancer c. diagnostic laboratory services d. mental health visits 6. Which is a special clause in an insurance contract that stipulates additional coverage over and above the standard contract? a. coinsurance b. copayment c. deductible d. rider 7. BCBS indemnity coverage is characterized by certain limitations, including a. hospital-only or comprehensive hospital and medical coverage. b. the requirement that patients identify and select a primary care provider. c. provision of care by participating licensed healthcare providers. d. the requirement that patients obtain a referral before seeing a provider. 8. Prospective authorization or precertification is a requirement of the _____ BCBS managed care plan. a. coordinated home health and hospice care b. outpatient pretreatment authorization c. second surgical opinion d. point-of-service 9. Which phrase is located on a Federal Employee Program plan ID card? a. enrollment option, such as Family, High Option Plan b. Government-Wide Service Benefit Plan c. Office of Personnel Management d. Preferred Provider Organization 10. The plan ID card for a subscriber who opts for BCBS’s Healthcare Anywhere PPO coverage uniquely contains the _____ logo. a. dental b. eyeglass c. prescription drug d. suitcase Answers: B C 3. B 4. A 5. D 6. D 7. A 8. B 9. B 10. D 1. 2.