BIR FORM 1702 IM final draft jan 16

advertisement

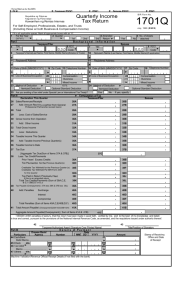

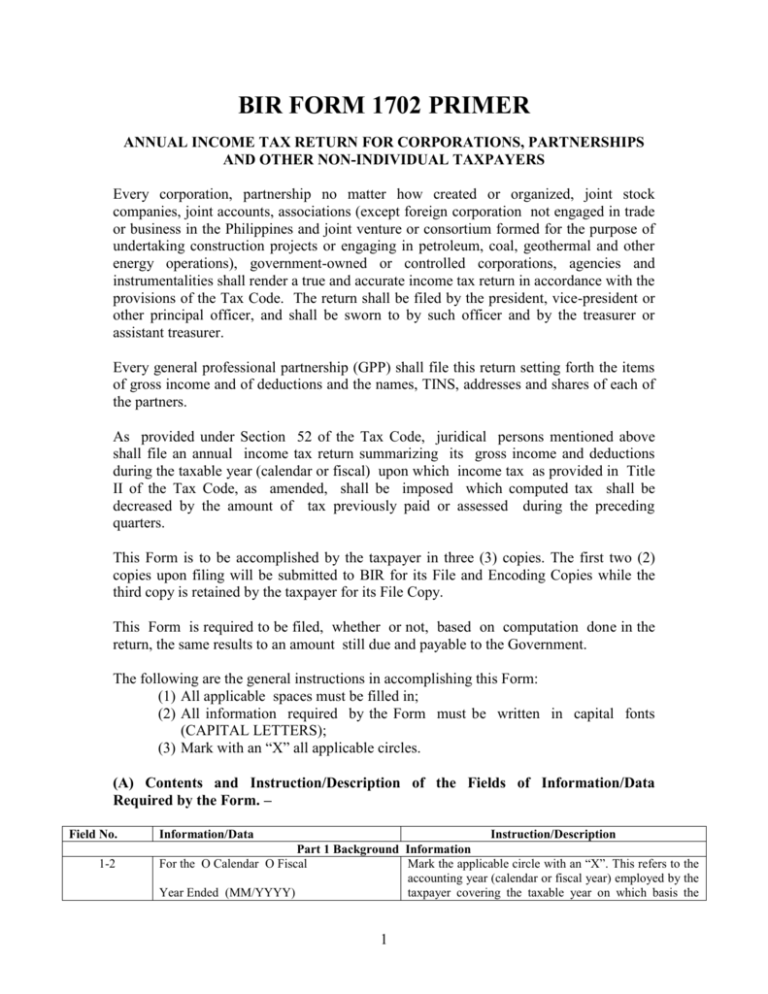

BIR FORM 1702 PRIMER ANNUAL INCOME TAX RETURN FOR CORPORATIONS, PARTNERSHIPS AND OTHER NON-INDIVIDUAL TAXPAYERS Every corporation, partnership no matter how created or organized, joint stock companies, joint accounts, associations (except foreign corporation not engaged in trade or business in the Philippines and joint venture or consortium formed for the purpose of undertaking construction projects or engaging in petroleum, coal, geothermal and other energy operations), government-owned or controlled corporations, agencies and instrumentalities shall render a true and accurate income tax return in accordance with the provisions of the Tax Code. The return shall be filed by the president, vice-president or other principal officer, and shall be sworn to by such officer and by the treasurer or assistant treasurer. Every general professional partnership (GPP) shall file this return setting forth the items of gross income and of deductions and the names, TINS, addresses and shares of each of the partners. As provided under Section 52 of the Tax Code, juridical persons mentioned above shall file an annual income tax return summarizing its gross income and deductions during the taxable year (calendar or fiscal) upon which income tax as provided in Title II of the Tax Code, as amended, shall be imposed which computed tax shall be decreased by the amount of tax previously paid or assessed during the preceding quarters. This Form is to be accomplished by the taxpayer in three (3) copies. The first two (2) copies upon filing will be submitted to BIR for its File and Encoding Copies while the third copy is retained by the taxpayer for its File Copy. This Form is required to be filed, whether or not, based on computation done in the return, the same results to an amount still due and payable to the Government. The following are the general instructions in accomplishing this Form: (1) All applicable spaces must be filled in; (2) All information required by the Form must be written in capital fonts (CAPITAL LETTERS); (3) Mark with an “X” all applicable circles. (A) Contents and Instruction/Description of the Fields of Information/Data Required by the Form. – Field No. 1-2 Information/Data Instruction/Description Part 1 Background Information For the O Calendar O Fiscal Mark the applicable circle with an “X”. This refers to the accounting year (calendar or fiscal year) employed by the Year Ended (MM/YYYY) taxpayer covering the taxable year on which basis the 1 annual income tax return is being accomplished. Calendar year means the twelve-month period beginning the month of January ending the month of December. Fiscal year means the twelve-month period beginning with any month other than the month of January. Indicate the month and the year covered by the return being filed. 3 Amended Return? O Yes O No Mark the applicable circle with an “X”. This item shall indicate whether or not the tax return being accomplished and filed for the year is a correction or an amendment to a previously filed income tax return covering the same year. 4 Short Period Return? O Yes O No Mark the applicable circle with an “X”. Short period return refers to return that is required to be filed by a juridical person whose period of filing is shorter than the expected 12-month period covered by the return either because that person has commenced operations during the interim period or is retiring from business with due notice given to the BIR. 5 Alphanumeric Tax Code (ATC) Write the alphanumeric tax code which is assigned by the Bureau upon registration based on the tax type /tax rate and the nature of the business of the taxpayer. This ATC (refer to page 3) is required to be accomplished as this serves as a tool in the Integrated Tax System (ITS) of the Bureau to sort data/information stored in the ITS database necessary to come up with statistical data and reports. IC 055 Minimum Corporate Income Tax (MCIT) O ______ ________________________ O Mark the applicable circle with an “X” if the taxpayer is subject to MCIT for this taxable period covered by this Form. A minimum MCIT of two percent (2%) of the gross income is imposed upon any domestic corporation and resident foreign corporation beginning on the fourth (4th) taxable year (whether calendar or fiscal year, depending on the accounting period employed) immediately following the taxable year in which such corporation commenced its business operation. The MCIT shall be imposed whenever the corporation has zero or negative taxable income or whenever the amount of MCIT is greater than the normal income tax due from such corporation. Any excess of the MCIT over the normal income tax shall be carried forward and credited against the normal income tax for the three (3) immediate succeeding taxable years. The computation and the payment of MCIT shall apply each time a corporate income tax return is filed, whether quarterly or annual basis. If the taxpayer is not subject to the MCIT, mark the applicable circle with an “X” and fill the space indicating the applicable ATC (refer to page 3) of the juridical person. 6 Taxpayer Identification Number (TIN) Fill in the Taxpayer Identification Number (TIN) issued to the taxpayer evidencing its registration with the Bureau. The TIN comprises of a nine to thirteen (9 to 13) 2 digit numeric code where the first nine (9) digits is the TIN proper and the last four (4) digits is the branch code. The branch code shall always be 0000. 7 RDO Code Indicate the Revenue District Office Code, comprising of three (3) digits numeric or alphanumeric code, where the taxpayer’s head office is registered. For example: 001 for Laoag City, 43A for East Pasig. 8 Date of Incorporation (MM/DD/YYYY) Write the taxpayer’s date of incorporation indicating the month, day and year when the corporation has been incorporated as per Certificate of Registration issued by the Securities and Exchange Commission (SEC) and other regulatory agencies like Cooperative Development Authority, National Electrification Authority, etc. For example, if the date of incorporation is October 3, 2000, write 10 03 2000. 9 Taxpayer’s Name Write the name of the taxpayer based on the Certificate of Registration (BIR Form No. 2303) issued by the BIR. 10 Registered Address Write the registered address of the principal place of business of the taxpayer. All applicable spaces must be filled in. Unit/Room Number/Floor Building Name Lot/Block/Phase/Building Number Street Name Subdivision/Village Barangay Municipality/City Province Zip Code 11 Contact Number Write the telephone or cell phone number of the taxpayer where the taxpayer can be contacted in case there is a need to validate certain information /data contained in the return filed. 12 Email Address Write the official email address of the taxpayer wherein BIR will be able to communicate electronically in case there is a need to validate certain information/data contained in the return filed. 13 Line of Business Indicate the nature of the business the taxpayer is engaged in as indicated in the Certificate of Registration (BIR Form No. 2303). 14 Method of Deduction O Itemized Deduction O Optional Standard Deduction (OSD) Mark the applicable circle with an “X” the method of deduction employed by the taxpayer in claiming the deductions for the taxable year whether itemized or optional standard deduction. The chosen method of deduction used in the first quarter of the year shall be consistently applied throughout the year. 3 NOTE: Accomplish Supplemental Form (Schedule 4 – Tax Relief Under Special Law/International Tax Treaty), if taxpayer has multiple activities. Show the details of each and every registered activity and/or program on Section 1 of said Supplemental Form. In Section 2, indicate the type of tax regime per column (Exempt, Special Rate, Regular/Normal Rate) on page 1 and on the first three (3) columns of page 2. The sum of each tax regime shall be indicated in the appropriate total column of the concerned tax regime. Use additional sheet/s as needed. The aggregate sum for each tax regime of Schedule 4 (columns J, K and L) shall be forwarded/copied to applicable fields (columns A, B and C) in Part II and III of the Form. If there is only one activity per tax regime, fill in only Items 15, 15A to 15P, Part II and Part III of the Form. 15 Are you availing of Tax Relief under Special or International Tax Treaty? O No O Yes Mark the applicable circle with an “X”. The yes circle is applicable to those who are availing of preferential tax rates/incentives and privileges/exemptions granted by special law, international agreement or treaty. If the answer to this query is yes, the taxpayer is required to fill in the specific details to indicate the required information/data to which the particular incentive/ exemption/preferential tax rate is being availed. All applicable spaces must be filled in under the appropriate column whether Exempt, Special Rate, and/or Regular/Normal Rate (Special Tax Relief). If yes, fill out spaces below: 15A/B Investment Promotion Agency (IPA) Write the name of the investment promotion agency (IPA) which granted the exemption/incentive/preferential tax rate. For example, Board of Investment (BOI), Philippine Economic Zone Authority (PEZA), Subic Bay Metropolitan Authority (SBMA), Cooperative Development Authority (CDA), Department of Foreign Affairs (DFA), etc. 15C/D/E Legal Basis Write the specific special law, international agreement or treaty which is the legal basis for the grant of the tax exemption/ incentive/preferential tax rate. For example, EO 226 – Omnibus Investment Code, RA 7196 - PEZA Law, in the case of regular/normal rate (special tax relief) RA 8525– Adopt-a-School Program or RA 9257 Senior Citizens Act, etc. 15F/G/H Registered Activity/Program (Registration Number) Write the registered activity/program as shown in the registration certificate issued by the concerned IPA. Indicate the registration number, if applicable. Special Tax Rate Write the preferential tax rate provided by specific special law, international agreement or treaty. Indicate 0.00% if exempt from tax and/or the special tax rate in the appropriate fields, for example, 5.00%, etc. 15I/J Effectivity Date of Tax Relief 15K/L/M Indicate the start date of the effectivity on the grant of tax exemption/incentive/preferential tax rate as shown in the certificate of registration issued by the concerned IPA by writing the month, day and year. For example: May 1, 2011 as the start date, write 05 01 2011. From (MM/DD/YYYY) 4 15N/O/P To (MM/DD/YYY) Indicate the end date of the effectivity on the grant of tax exemption/incentive/preferential tax rate as shown in the certificate of registration issued by the concerned IPA by writing the month, day and year. For example: April 30, 2014 as the end date, write 04 30 2014. Part II Computation of Tax (NOTE: The tax shall be computed per tax regime.) A – Exempt; B – Special Rate; C – Regular/Normal Rate 16A/B/C Sales/Revenues/Receipts/Fees (from Item 80J/K/L) Write the amount of Sales/Revenues/Receipts/Fees (net of Sales Returns, Allowances and Discounts) during the taxable year from trade/business. 17A/B/C Less: Cost of Sales/Services (from Item 81J/K/L) Indicate the amount of direct cost incurred in generating the sales from goods/services. 18A/B/C Gross Income from Operation (Item 16 less Item17) (from Item 82J/K/L) Write the difference between the Sales/Revenues/ Receipts/Fees and the Cost of Sales/Services which is Item 16A less 17A for Exempt, 16B less 17B for Special Rate and/or 16C less 17C for Regular/Normal Rate. 19A/B/C Add: Other Taxable Income not Subjected to Final Tax (from Item 83J/K/L) Indicate the amount/s of non-business income which has not been subjected to final tax. 20A/B/C Total Gross Income (Sum of Item 18 and 19) (from Item 84J/K/L) Write the sum of gross income from operations and other taxable income not subjected to final tax which is Item18A and 19A for Exempt, 18B and 19B for Special Rate, and 18C and 19C for Regular/Normal Rate. Less: Allowable Deductions A corporation shall choose either the itemized or optional standard deduction. Indicate the amount of allowable deductions pursuant to Section 34 of the Tax Code. Corporations may elect a standard deduction in an amount not exceeding forty percent (40%) of its gross income. Taxpayer shall signify its intention to elect the optional standard deduction (OSD) by marking with “X” the circle pertaining to OSD as the method of deduction chosen in Item 14. Such election when made in the first quarter shall be irrevocable for the taxable year for which the return is made. Optional Standard Deduction (40% from Item 20) (from Item 85J/K/L) Write the amount of computed OSD if the option to use OSD is exercised. The amount of OSD is forty percent (40%) of the Gross Income. 21C A corporation who availed of and claimed the OSD is still required to submit its financial statements when it files its annual tax return and to keep such records pertaining to its gross income. OR 5 22A/B/C Regular Allowable Itemized Deduction (from Item 86J/K/L) Indicate the amount of the allowable expenses incurred during the taxable year, if the method of deduction chosen is the itemized deduction method in Item 14. The regular allowable itemized deductions refer to ordinary and necessary trade and business expenses paid or incurred during the taxable year in carrying on or which are directly attributable to the development, management, operations and/or conduct of trade and business. Itemized deductions also include interest, taxes, losses, bad debts, depreciation, depletion, charitable and other contributions, research and development and pension trust. 23A/B/C 23D/E/F Special Allowable Itemized Deduction (specify) (from Item 87J/K/L/V/W/X) Indicate the amount of special allowable itemized deduction as provided under the existing regular and special laws, rules and issuances such as, but not limited to, Rooming-in and Breastfeeding Practices under RA 7600, Adopt-a-School Program under RA 8525, Senior Citizen Act under RA 9257, Free Legal Assistance under RA 9999. Allowance for NOLCO (from Item 57) Write the amount of the applied portion of Net Operating Loss Carry Over (NOLCO) computed in Item 57 of Part VI, Schedule 1A. 25A/B/C Total Itemized Deductions (Sum of Items 22, 23 & 24) (from Item 89J/K/L) Indicate the sum of the regular and special allowable itemized deductions, and allowance for NOLCO (Sum of Items 22A, 23A & 23D/ 22B, 23B, 23E, & 24B/ 22C, 23C, 23F & 24C). 26A/B/C Net Taxable Income (Item 20 less Item 21 OR Item 25) (from Item 90J/K/L) Indicate the amount of the net taxable income which is the difference between the total gross income and optional standard deduction OR the difference between the total gross income and total itemized deductions. (For taxpayers who opted to avail of OSD – Item 20C less 21C). For taxpayers who opted for itemized deductions Item 20A less 25A/ 20B less 25B/ 20C less 25C.) 27A/B/C Applicable Income Tax Rate (i.e. special rate or regular/normal rate) For Exempt, indicate 0.00%. 24B/C For Special Rate, indicate special rate under existing laws. For example: PEZA 5.00% For Regular/Normal Rate, indicate the income tax rate of 30.00% 28A/B/C 29 Income Tax Due other than MCIT (Item 26 x Item 27) Indicate the amount of tax due by multiplying the total taxable income (Item 26A/26B/26C) by the applicable tax rate (Item 27A/27B/27C). Less: Share of Other Agencies Indicate the portion of the income tax computed under the special rate due to the other agencies. For example: 2% share of LGU for PEZA enterprise. 6 30 Net Income tax Due Government (Item 28B less Item 29) 31 MCIT (2% of Gross Income in Item 20C) Write the amount of MCIT computed at two percent (2%) based on the Gross Income written/indicated in Item 20C. 32 Income Tax Due (MCIT in Item 31 or Normal Income Tax in Item 28C, whichever is higher) Indicate whichever is higher between the MCIT in Item 31 and the normal income tax other than MCIT in Item 28C. 33 Less : Tax Credits/Payments (attach proof) This refers to the amount of tax credits/payments during the year allowed to be deducted from the tax due. Proof is required to be attached. 33A Prior Years’ Excess Credits Other than MCIT Indicate the excess payments/withholding in prior year/s which are carried forward in the current year and allowed to be applied against the income tax due other than MCIT. 33B Income Tax Payment under MCIT from Previous Quarter/s Write the MCIT payments from the previous taxable quarter/s of the current year. 33C Income Tax Payment under Regular/Normal Rate from Previous Quarter/s Write the amount of the regular income tax payments from the previous quarter/s of the current year. 33D Excess MCIT Applied this Current Taxable Year Indicate the amount of the unapplied portion of the MCIT payments from the previous year/s which can only be deducted if the normal income tax for the current year is higher than the computed MCIT for the same year. 33E/F Creditable Tax Withheld from Previous Quarter/s Write the amount of the creditable income tax withheld by payor/s on the income payments made to the taxpayer in the previous taxable quarter/s of the current year. 33G/H Creditable Tax Withheld per BIR Form No. 2307 for the Fourth Quarter Write the creditable income tax withheld by payor/s on the income payments made to the taxpayer in the fourth (4th) quarter of the current year. Attach BIR Form No. 2307 issued by the payor/s. Foreign Tax Credits, if applicable Indicate the amount of income tax payments to foreign government/s on income earned abroad reported in this Form in Item 16 or Item 19. Attach proof of income tax payments to foreign government/s. Tax Paid in Return Previously Filed, if this is an Amended Return Indicate the amount of income tax paid in the previous return filed. Attach the previous return filed and proof of income tax payment. Income Tax Payment under Special Rate from Previous Quarter/s Write the income tax payments in the previous quarter/s under the tax regime of Special Rate. 33I/J 33K/L 33M to National 7 Indicate the difference between income tax due other than MCIT (Item 28B) and share of other agencies (Item 29). This refers to the share of the National Government in the income tax due under the Special Rate after deducting the share of other agencies i.e. Local Government Unit. 33N Special Tax Credits (from Item 44) (from Item 103J/K/L) Write the special tax credit granted to taxpayer by virtue of a specific special law, international agreement or tax treaty. For example: 50% of training expenses under RA 7916. 33O/P Other Credits/Payments, specify ___ Indicate the amount/s of any other payments/tax credits allowed to be applied against the tax due. 33Q/R Total Credits/ Payments (Sum of Items 33E, G, I, K, M, N & O/ 33A, B, C, D, F, H, J, L & P) Write the amount of the total of all the payments/credits claimed. (Sum of Items 33E, G, I, K, M, N & O/ 33A, B, C, D, F, H, J, L & P) 34A/B Net Tax Payable/ (Overpayment) (Item 30 less Item 33Q/ Item 32 less Item 33R) Indicate the difference between the tax due (Item 30/32) and the total payments/credits (Item33Q/33R). 35 Aggregate Tax Payable/ (Overpayment) (Sum of Item 34A & 34B) Indicate the sum of income tax payable for Special (34A) and Regular/Normal (34B) Rates. 36 Add: Penalties Indicate the amounts which are additions to the tax that serve as civil penalties imposed upon the taxpayer in cases of violations committed with respect to the filing of the income tax return and/or payment of the tax due thereon. 36A 36B 36C 36D 37 Surcharge Interest Compromise Total Penalties (Sum of Items 36A, 36B & 36C) There shall be imposed and collected as part of the tax: 1. A surcharge of twenty five percent (25%) for each of the following violations: a) Failure to file any return and pay the amount of tax or installment due on or before the due dates; b) Unless otherwise authorized by the Commissioner, filing a return with a person or office other than those with whom it is required to be filed; c) Failure to pay the full or part of the amount of tax shown on the return, or the full amount of tax due for which no return is required to be filed, on or before the due date; d) Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment. 2. A surcharge of fifty percent (50%) of the basic tax or of the deficiency tax shall be imposed in case of willful neglect to file the return within the period prescribed by the Tax Code and/or by rules and regulations or in case of a false or fraudulent return is filed. 3. Interest at the rate of twenty percent (20%) per annum on any unpaid amount of tax, from the date prescribed for the payment until it is fully paid. 4. Compromise Penalty, pursuant to existing/applicable revenue issuances. Total Amount Payable /(Overpayment) (Sum of Item 35 and 36D) Write the total amount of tax payable/ (overpayment) after adding the penalties enumerated in Item 36, if any. 8 If overpayment , mark “X” one circle only (once the choice is made, the same is irrevocable) O To be refunded O To be issued a Tax Credit Certificate (TCC) O To be carried over as tax credit For next year/quarter 38A/B/C An excess of the total tax credits/payments over the actual income tax due computed in the final adjusted return may be refunded or issued with the Tax or issued with the Tax Credit Certificate to the taxpayer or credited against its estimated income tax liabilities for the quarters of the succeeding taxable years. The taxpayer shall exercise its option by marking with an “X” the appropriate circle, which option shall be considered irrevocable for that taxable period. Thus, once the taxpayer opted to carry-over and apply the excess income tax against income tax due for the succeeding taxable year, no application for cash refund or issuance of a tax credit certificate shall be allowed. In case the taxpayer fails to signify its choice, the excess payment shall be automatically carried-over to the next taxable period. Part III Tax Relief Availment per Tax Regime Regular Income Tax Otherwise Due Indicate the regular income tax otherwise due by first (30% of the Total of Item 23 & 26) getting the sum of special allowable itemized deductions (from item 97J/K/L) in Item 23 and the net taxable income in Item 26, then multiply by the normal corporate tax rate of 30.00%. 39A/B/C Less: Income Tax Due (from Item 28) (from Item 98J/K/L) Copy the computed income tax due in Item 28. 40A/B/C Tax Relief Availment Before Special Tax Credit (Item 38 less Item 39) (from Item 99J/K/L) Indicate the difference between regular income tax otherwise due in Item 38 and income tax due in Item 39. Breakdown of Item 40 - The sub-total (Item 43) should equal to Item 40 41A/B/C Tax Relief Availment on Gross/Net Income (Item 26 x 30% less Item 28) (from Item 100J/K/L) Indicate the resulting tax relief availment on gross/net income by first multiplying the net taxable income in Item 26 by the normal corporate tax rate of 30.00% and then, deducting the computed income tax due in Item 28. 42A/B/C Tax Relief on Special Allowable Itemized Deductions (Item 23 x 30%) (from Item 101J/K/L) Indicate the resulting tax relief on special allowable itemized deductions by multiplying the total special allowable itemized deductions in Item 23 by the normal corporate tax rate of 30.00%. 43A/B/C Sub Total on Item 41 & 42 which is equal to Item 40 (from Item 102J/K/L) Indicate the sum of Items 41 and 42. Special Tax Credit (from Item 103J/K/L) Copy the amount in Item 33N. Total Tax Relief Availment (Sum of Item 43 & 44) (from Item 104J/K/L) Indicate the sum of Items 43 and 44. 44B/C 45A/B/C 9 Part IV Details of Payment Space to indicate the details of the payment and the mode of payment (whether by cash/bank debit memo, check, TDM, others) identifying the drawee bank/agency; number, if any; date; and amount. Only the applicable spaces must be filled in. A – Drawee Bank/Agency B – Number C – Date (MM/DD/YYYY) D – Amount 46 Cash/Bank Debit Memo For cash payment, indicate the amount in column 46D and write “N/A” (Not Applicable) in columns A, B and C. For Bank Debit Memo (BDM), indicate the name of the bank, number, date of BDM and amount in the appropriate columns (A, B, C and D). 47 Check Indicate the name of drawee bank, check number, date of check and amount in the appropriate columns (A, B, C and D). 48 Tax Debit Memo Indicate the Tax Debit Memo (TDM) number, date and amount in the appropriate columns (A, B and C). 49 Others Ex. Special Allotment Release Order (SARO) Tax Subsidy Debit Memo (TSDM) Tax Remittance Advice (TRA) Specify other modes of payment. Indicate “N/A” or fill in appropriate columns, if applicable. Tax Subsidy Availment Certificate (TSAC) Direct Crediting Receiving Portion Stamp of Receiving Office/AAB and Date of Receipt (RO’s Signature/Bank Teller’s Initial) Space provided only for stamping and affixing the initials of the revenue officer or bank teller, as the case may be, evidencing the date of receipt of the return from the taxpayer/authorized representative. Schedule1 Computation of Net Operating Loss Carry Over A schedule which is an integral part of the form detailing the computation of Net Operating Loss Carry Over (NOLCO) and the amount of NOLCO claimed in the taxable year. 50 Gross Income Copy the amount of gross income in Item 18B/C. 51 Less: Total Deductions exclusive of NOLCO & Deductions under Special Laws Copy the amount of regular allowable itemized deductions in Item 22B/C. 52 Net Operating Loss Carry Over (to Schedule 1A) Indicate the difference between Item 50 and 51. Computation of Available Net Operating Loss Carry Over (NOLCO) A schedule which is an integral part of the form detailing the computation of available NOLCO (applied and unapplied portion). Only net operating losses incurred by the qualified taxpayer may be carried over to the next three (3) immediately succeeding taxable years following the year of such loss. Schedule 1A (attach additional sheet/s, if necessary) 10 53-56 A/B/C/D/ E Indicate the year incurred (Items 53-56) and the amount (53A-56A) for net operating loss. Net Operating Loss Year Incurred A - Amount Indicate the amounts for net operating loss carry over applied for the previous year (Items 53B-56B), applied for the current year (Items 53C-56C) and the expired portion (Items 53D-56D). Net Operating Loss Carry Over B - Applied Previous Year C - Applied Current Year D - Expired Indicate the unapplied amount of net operating loss (Items 53E-56E). E - Net Operating Loss (Unapplied) 57 Write the sum of available net operating loss carry over applied to the current year (Sum of Items 53C, 54C, 55C & 56C). Schedule 2 Computation of Excess Minimum Corporate Income Tax (MCIT) of Previous Year A schedule which is an integral part of the form detailing the computation of Excess Minimum Corporate Income Tax (MCIT) of previous year. 58-61 Total (Sum of Items 53C, 54C, 55C & 56C) (to Item 24) Year Indicate the taxable year covered by the MCIT. Normal Income Tax as adjusted Write the amount of normal income tax (as adjusted) for the appropriate taxable year. MCIT Write the amount of MCIT for the appropriate taxable year. Excess MCIT over Normal Income Tax as adjusted Indicate the amount of excess MCIT which is the difference between normal income tax (as adjusted) and MCIT for the appropriate taxable year. Balance MCIT still allowable as Tax Credit Write the amount of the balance MCIT still allowable as tax credit for the appropriate taxable year. Expired/Used Portion of Excess MCIT Write the amount of the expired/used portion of excess MCIT for the appropriate taxable year. Excess MCIT Applied this Current Taxable Year Indicate the amount of excess MCIT applied this current taxable year. Schedule 3 Reconciliation of Net Income Per Books Against Taxable Income(attach additional sheet/s, if necessary) A schedule which is an integral part of the form showing all the reconciling items in the financial statements added or subtracted from the net income reported in the financial statements which is to arrive at the taxable income reported in the income tax return. A – Special Rate B – Regular/Normal Rate 62A/B Net Income/(Loss) per Books Indicate the net income (loss) per books of accounts for the current year. 63A/B 64A/B Add: Non-deductible Expenses/ Taxable Other Income Write the total amount of all non-deductible expenses and taxable other income. 65A/B Total (Sum of Items 62,63 & 64) Indicate the total of Item 62 and 63. 11 66A/B 67A/B 68A/B 69A/B 70A/B 71A/B Less: Non-taxable Income and Income Subjected to Final Tax Write the total amount of all non-taxable income and income subjected to final tax. Special Deductions Write the amount of special deductions. Total (Sum of Items 66, 67, 68& 69) Indicate the total of Items 66, 57, 68 and 69. Net Taxable Income/(Loss) (Item 65 less Item 70) Indicate the difference between Item 65 and 70. Jurat Clause We declare under the penalties of perjury, that this annual return has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. 72 President/ Vice President/Principal Officer/ Accredited Tax Agent (Signature over Printed Name) Title/Position of Signatory TIN of Signatory Tax Agent Accreditation No./Atty’s Roll No. (if applicable) The return shall be filed by the president, vice-president or other principal officer, and shall be sworn to by such officer and by the treasurer or assistant treasurer. In case the return is filed by an authorized representative, the TIN of the authorized representative in the organization or business of the taxpayer must be indicated. All returns filed by an accredited tax agent on behalf of a taxpayer shall bear the following information: A. For CPAs and others (individual practitioners and members of GPPs): a.1 TIN; and a.2 Certificate of Accreditation Number, Date of Issuance, and Date of Expiry (which is within three [3] years from date of expiry). B. For members of the Philippine Bar (individual practitioners and members of GPPs); a.1 TIN; and a.2 Attorney’s Roll Number or Accreditation Number, if any. Date of Issuance Date of Expiry 73 Portion requiring the signature of the taxpayer or any person filing on his/her/its behalf such as his/her/its authorized representative or accredited tax agent (ATA) attesting to the truthfulness and correctness of the information contained in the return. Treasurer/Assistant Treasurer (Signature over Printed Name) Title/Position of Signatory TIN of Signatory Community Tax Certificate Number Space to indicate details of Community Tax Certificate issued by the Local Government indicating the place and date of issue, and the amount. Place of Issue Date of Issue (MM/DD/YYYY) Amount 12 LIST OF ATTACHMENTS (1) Certificate of Independent CPA duly accredited by the BIR (The CPA Certificate is required if the quarterly gross sales, earnings, receipts or output exceed P150,000). (2) Supplemental Form (Schedule 4) for taxpayers with multiple activities/programs per tax regime (exempt, special, regular/normal rate). (3) Duly Accomplished Account Information Form (AIF) and/or Financial Statements (FS) including the following schedules prescribed under existing revenue issuances which must form part of the Notes to the Audited FS: a) Sales/Receipts/Fees Schedule of Sales/Receipts/Fees Nature of Sales Sales from Goods/Properties Sales from Services Lease from Properties Fees from GPPs Gross Sales/Receipts/Fees Less : Sales returns and discounts Sales/Receipts/Fees Amount Pxxxx xxxx xxx xxxx Pxxxx (xxx) Pxxxx b) Cost of Sales/Services Schedule of Cost of Sales (Trading/Manufacturing) Nature of Cost of Sales Beginning Inventory, Add : Purchases of Goods Merchandise Available for Sale Less : Ending Inventory Cost of Sales Amount Pxxxx xxx Pxxxx (xxxx) Pxxxx Schedule of Cost of Services: Nature of Cost of Services Direct charges on salaries, wages and benefits Amount Pxxx Direct charges on materials, supplies, facilities Direct charges, on depreciation Direct charges on rental Direct charges on outside services Direct charges – others Cost of Services 13 xxx xxx xx xx xx Pxxxx c) Non-Operating and Taxable Other Income Schedule of Non-Operating and Other Taxable Income : Nature of Non-Operating and Taxable Other Income xxxx Total Non-Operating and Other Taxable Income Amount Pxxxx xxx xxx xxx Pxxxx d) Itemized Deductions (if taxpayer did not avail of OSD) Schedule of Itemized Deductions: Nature of Itemized Deductions Salaries and Allowances Fringe Benefits SSS, GSIS, Medicare, HDMF and Other Contributions Commissions Advertising Rental Insurance Royalties Repairs and Maintenance Representation and Entertainment Transportation and Travel Fuel and Oil Communication, light and water Supplies Interest Taxes and licenses Losses Bad Debts Depreciation Amortization of Intangibles Depletion Charitable Contribution Research and Development Amortization of Pension Trust Contribution Miscellaneous Expenses Total Allowable Deductions 14 Amount Pxxxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx Pxxxx e) Taxes and Licenses Schedule of Taxes and Licenses Nature of Taxes and Licenses xxxx Amount Pxxxx xxx xxx xxx Pxxxx Total Taxes and Licenses f) Other information prescribed to be disclosed in the Notes to FS. (4) Statement of Management’s Responsibility (SMR) for Annual Income Tax Return (5) Certificate of Income Payments Not Subjected to Withholding Tax (BIR Form No. 2304) (6) Certificate of Creditable Withholding Tax at Source (BIR Form No. 2307) (7) Duly approved Tax Debit Memo (TDM) issued by the Bureau to be used for the payment of the tax due, if applicable. Attach photocopy of the Tax Credit Certificate against which the TDM is drawn, if applicable. (8) Proof of prior years’ excess credits, if applicable. Attach prior year’s tax return, if applicable. (9) Proof of Foreign Tax Credits, if applicable. (10) For amended return, proof of tax payment and copy of previously filed return. Proof of other payments/credits (11) Certificate of Tax Treaty Relief/Entitlement issued by the concerned Investment Promotion Agency (IPA). (12) Summary Alphalist Withholding Agents of Income Payments Subjected to Withholding Tax (SAWT), if applicable. A summary list required to be submitted by the taxpayer in cases where tax credit is being claimed on the return. This summary list contains among others, total amounts of income/gross sales/gross receipts and claimed tax credits taken from all the Certificates of Creditable Withholding Tax at Source (BIR Form 2307) issued by the payors/withholding agents of the income. This summary list must contain all the information required and must be submitted in the format prescribed by Revenue Regulations No. 2-2006 and Revenue Memorandum Circular No. 3-2006; 15 (13) Proof of other tax payment/credit, if applicable. Attach proof of tax payments in the first three (3) quarters, if any. (14) Schedule of returns filed by General Professional Partnership (GPP). Name of Partner TIN Address Share in the Net Income of the GPP Deadline for Submission of Attachments For Non-Electronic Filing and Payment System (EFPS) taxpayers, these must be submitted at the same time the return is filed. In the case of those EFPS taxpayers, these attachments must be submitted within fifteen (15) days from the filing of the return. Schedules 3 (a) to (f) shall be submitted using the e-submission facility of the Bureau. For those other attachments required to be physically submitted , the same shall be submitted with the printed copy of the e-filed return together with the Filing Reference Number in accordance with Revenue Memorandum Order No. 10-06. Penalty of Incomplete Submission of Attachments Failure to submit any of the attachments applicable to the taxpayer shall be imposed with a penalty in the amount/s provided for under the existing revenue issuances for each such failure provided that such failures during the calendar year shall not exceed P25,000 pursuant to Section 250 of the Code, as amended. 16