Document

advertisement

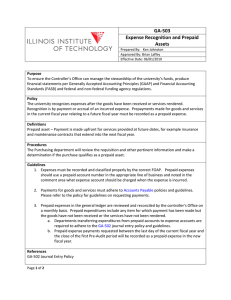

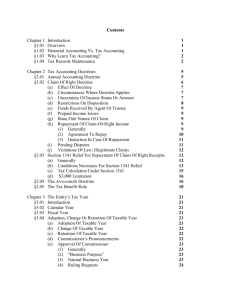

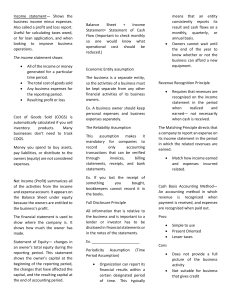

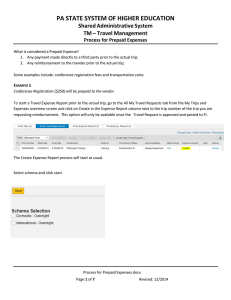

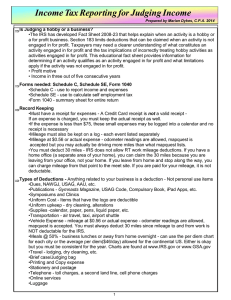

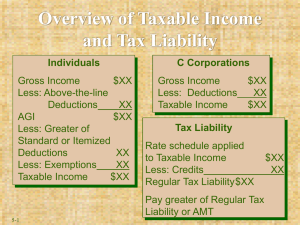

Chapter 6 Taxable Income from Business Operations Taxable Year Income is reported for the taxpayer’s “taxable year” → 12-month period which generally corresponds to its fiscal year. Individual taxpayers must generally choose a calendar year. Firms often choose a fiscal year corresponding with the annual operating cycle Changing tax years requires permission - most common reason is merger of firms with different year-ends. Cash Method Under the cash method, gross income includes cash or property actually RECEIVED during the tax year. Deductions are usually taken in the year cash or property is PAID. Cash method income includes receipt of noncash goods Anti-abuse provision: Constructive receipt doctrine. Means that you can’t “turn your back” on cash income available to you Occurs when taxpayer has unrestricted access to and control of the income. Example: pre-payment receipt of cash you have received NO constructive receipt if the amount is available only on surrender of a valuable right, or if there are substantial limits on the right to receive it. Exceptions - Cash Method Cash method - deduct expenses when PAID. A check is payment when mailed. An asset must still be capitalized. The cost of the asset may be recovered over the asset life (e.g. depreciation, cost of goods sold). Major repairs may result in IRS dispute regarding expense versus capitalization. Inventory must be accounted for on the accrual method, even for cash basis taxpayers. This is called a HYBRID method of accounting. Cash Method Deductions - Prepaid Expenses Where an expense (e.g., prepaid rent or an insurance premium) covers more than the following tax year, the deduction must be spread over the period to which the expense applies (12 month rule). Special rule for prepaid interest—must be capitalized and deducted over the period for which interest is actually charged. Exception for individuals: prepaid interest (points) can be deducted on the purchase of a home. Does not apply to refinancing.