Business Associations Fall 2009 Gillen

Business Associations Fall 2009 Gillen

What is a business?

Broad definition = provision of goods or services

Not limited to for-profit – includes non-profit

Broad definition includes non-profit societies and charitable foundations, government activities and organizations, municipalities

Stakeholder – anyone affected by a business

Equity Investors

Creditors

Employees

Consumers

Competitors

Local Community

Managers Suppliers Broad Community

For the focus of this course look at the relationships of equity investors, creditors, managers, employees

Forms of Association

1.

Agency a.

Involves Agent (A) who is granted rights by the Principal to conduct various aspects of the business on his/her behalf b.

A affects the P’s legal relations with other parties

2.

Sole Proprietorship a.

Has one equity investor = sole proprietor b.

The SP is NOT a separate legal entity c.

It is the sole proprietor who owns the assets of the business, enters into K’s on behalf of the business, is personally liable for it d.

SP comes to an end on the death of the sole proprietor e.

Obtains funds from himself as well as from creditors i.

Frequently, the creditors will want to impose restrictions on how the business is run to protect their investment f.

The sole proprietor can engage employees and agents to help carry out the business

3.

Partnership a.

Partnership = when persons act IN COMMON with a VIEW TO PROFIT b.

More than one equity investor – they are called the partners c.

Partners act as agents for each other d.

The partnership is NOT a separate legal entity, so all the partners are personally liable e.

The partners themselves are the ones who enter K’s, hire employees/managers f.

Usually they all want to have a say in how the business is run g.

May borrow funds from creditors h.

Relationship ends on death or bankruptcy of one of the partners – but can be reconstituted afterwards

4.

Limited Partnership a.

A type of partnership that has limited partners and at least one general partner b.

The limited partners’ liability is limited to the amount of their investment c.

The general partner’s liability is not limited and so may be found personally liable for the business

1

d.

Limited partners generally have less stake in the business and so less involvement in its management e.

Again, NOT a separate legal entity f.

All the partners own the assets of the business

5.

Limited Liability Partnership a.

A type of partnership where the partners are not considered to be acting as agents for each other b.

Often formed by a group of professionals, but not limited to them in BC c.

What happens is that if a partner commits a wrong, the other partners wont be held liable for the activity unless if they were directly involved or were supervising it d.

MUST have LLP after name in order for this to work e.

Otherwise, they function as ordinary partnerships – LLP is NOT a separate legal entity

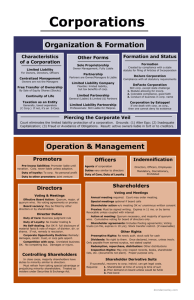

6.

Corporation a.

This IS a separate legal entity b.

It is the corporation that owns the assets and is liable in tort, contract, and criminal proceedings against it c.

Because its not a person, the corporation engages agents and directors that act on its behalf to enter K’s, hire employees etc d.

The corporation can borrow money from creditors e.

Its existence is perpetual (doesn’t end because an agent or director has died) f.

Must have at least one equity investor, rights to a corporation are sold in bundles of units called shares g.

A person who owns a stake in the corporation is thus called a shareholder h.

Liability of these equity investors/shareholders is limited to their investment i.

Must have an indication after its name to signify it’s a corporation j.

No limit on management input by shareholders

7.

Business Trust – set up a trust for the purpose of conducting a business a.

Allows you to avoid taxation that would happen in a corporation - $100 flows into the trust, $100 flows out of trust to investor, so no money left in trust and no money is taxed b.

What happens is that settlors settle the title to property with one or more persons called the trustees, who then have to use the title to the property to the benefit of other people, called the beneficiaries c.

Set out the details of the trust in a “trust instrument” d.

The settlors, trustees, and beneficiaries can be different people, or the settlors can be the beneficiaries or the trustees or both e.

A trust is NOT a separate legal entity, and the trustees are liable in law for the actions of the trust – they are the ones who enter the K’s, conduct the business, etc f.

A trust can be set up to perform like a corporation i.

The settlors (ie equity investors) settle funds with the trustees who are charged with managing the money for the beneficiaries (ie the equity investors themselves) ii.

The trust instrument is set up to appoint trustees by the beneficiary-investors

(replicating a board of directors) and trustees can be given power to delegate their powers to other people (ie managers of a corporation)

8.

Co-operative Associations a.

These are corporations set up not to give benefit and profit of dividends to the investors, but rather to people who become members of the co-operative b.

The members might receive benefits in the form of lower prices for goods or reduced fees for services

2

9.

Societies/Non-profits a.

Set up by different statutes – in BC, we have a Societies Act b.

These operate like corporations, and are separate legal entities c.

People who take on roles akin to shareholders are members who elect a board of directors that manage or supervise the management of the non-profit corporations’ activities d.

The members MAY be the persons who receive the benefits of the activities performed by the non-profit

10.

Unincorporated Association a.

These occur when people carry on activities in common with no view to profit b.

Not a separate legal entity – treated like partnerships c.

Members of these associations can be liable as agents for each other d.

Can engage other agents, employees, creditors

11.

Joint Ventures a.

This is not a legally recognized term – so NOT a separate legal entity b.

These occur when people come together with a common goal/objective c.

People agree to combine skills/resources/funds/time/knowledge in the pursuit of some common objective d.

They all agree to share in the profts and the losses

12.

Franchises a.

Involves a franchisor granting one or more rights to a franchisee such as i.

Right to sell franchisor’s products ii.

Use its name iii.

Use its methods iv.

Use its Symbol, other trade marks b.

Involves at least 1 of three basic elements i.

Know-how by the franchisor ii.

Joint purchasing power to decrease amount spent iii.

Image recognition by the franchisors’ marketing team

13.

Multiple Contracts a.

Instead of forming any association, could enter contracts for each stage of production, distribution, marketing b.

Not very cost effective – will often spend a lot of money entering into tons and tons of different contracts c.

Break everything down so there is NO joint or group activities

Accounting

Types of financial statements

1.

Income Statement

Meant to show whats been hapeening over time with profits and losses

List and add up all the revenues, list and subtract all the expenses and you are left with a gross income

2.

Balance Sheet

A snapshot in time of a businesses assets and liabilities

Can be left/right or top/down

One side should list all the sources of income (liabilities) and the other side should list the uses of the income (assets)

3

3.

Statement of retained earnings

4.

Statement of change in financial position

Key Terms

Assets = something acquired for the purposes of the business that retains value to the business over a period of time

Liabilities – fixed obligations. For example, take out a loan from the bank. You will have a fixed obligation to pay it back say once a month with a fixed percent of interest

Equity – right to residual amounts o Two types – first, on dissolution of the business, you are entitled to the equity that is left after all liabilities have been paid, and second, while the business is in operation, you are entitled to the gross profits after payment of expenses

Trade Credit – “take now, pay later” o If the business borrows from suppliers with the intention of paying them back later, then they are taking goods from the supplier on “trade credit” – this would go under

“accounts payable” on a balance sheet o If the business allows a consumer to purchase something with the promise of paying it back later, the consumer is purchasing on trade credit – this would go under accounts receivable on the balance sheet

Agency

An agent is someone who affects the legal relations of another person (the principal)

This usually occurs by the A entering into K’s on behalf of the principal o A enters the K for the principal (who is disclosed) with X. The K is between X and P, not the A and X

The agent owes a fiduciary duty to the P, but the P may be held vicariously liable for torts committed by the A in the course of his dealings

Agency and Employment o Not all employees are agents, but they can be

Not all employees have legal right to enter into K’s on behalf of their employers o Conversely, not all agents are employees

Agency and Trusts o They are similar in that both agents and trustees owe a fiduciary duty o DIFFERENCE – the acts of the A bind the P, but the acts of the trustee don’t bind the beneficiary o FURTHER – the P is liable – personal creditors of agents can come after the property held by the agent even if the agent is holding that property for the P

BUT persons who have advanced credit to a trustee not involving the trustee’s activities in connection with the trust (ie personal creditors) do not have access to the trust assets to satisfy their claim

Authority

The extent to which an agent can affect the legal relations of a principal depends on the authority the agent has.

4

Two types – actual and ostensible

Actual Authority

Actual authority occurs where the P intended to give the agent authority to affect his/her legal relations, or where the P and A would have reasonable expected the A to have authority

Does not require consideration – A can act gratuitously (hence why not always employee)

TWO TYPES

1.

Express – this is where the P stated the agent’s authority either orally or in writing a.

This includes authority that can be inferred from written or oral words

2.

Implied – the authority the P and A would have reasonable expected/understood the A to have in the circumstances. Courts look to: a.

Customary i.

Determined by looking at what authority agents of this type normally have ii.

Example, stockbrokers are normally allowed to do certain types of things on behalf of their P’s. Bank managers typically allowed to do certain types of things on behalf of the bank. iii.

Would make an argument that agents of this sort customarily have the authority on which the A acted and there is nothing express (careful!) in the express grant of authority that is inconsistent with this b.

Usual i.

What this particular agent with this particular P has been allowed to do in the past ii.

For example, if the A has done certain things in the past that are outside the express authority, but were never objected to, the A may be said to have actual authority

Freeman & Lockyer v. Buckhurst Park Properties (1964, QB)

Facts : Kapoor was acting as though he was the managing director (president) of a company. The board of directors never actually appointed him (no express actual authority). But they were aware of he was acting as such and allowed him to continue to do so.

Issue : Was the Company bound by his actions?

Decision : Actual authority could be implied from the circumstances, by looking at what they had

USUALLY allowed him to do.

Limitation : If the express actual authority clearly prohibits the agent from engaging in particular acts on behalf of the P, then a few ratifications of acts of the agent contrary to the principal will

NOT normally be sufficient to say the agent had implied authority.

Wiltshire v. Sims (1808)

This case deals with Customary Implied Authority

Facts

: Stockbroker sold customer’s shares on credit.

Issue : Was this a violation of agency?

5

Decision : Yes. There was no express authority to sell the shares and no express prohibition to sell shares on credit. HOWEVER although stockbrokers have authority to sell shares for their clients, stockbrokers don’t normally have the authority (so no customary authority) to sell shares on credit .

Duties of Agent to Principal

Agent owed certain fiduciary duties to the P

These duties are implied terms based on the relationship – the P and A are free to vary these terms by express agreement

S. 122 – Statutorily mandated duty of care of officers and directors of corporations

Duty 1 – To perform the tasks that have been assigned to the A according to the terms of the agreement with the P or according to the Instructions of the P

Duty 2 – To act in the best interests of the principal

Duty 3 – To perform the tasks with reasonable care

Note – this duty is NOT from Donoghue v. Stevenson – has been around much longer than this case

The standard of care is said to be the degree of skill and diligence which an agent in his or her position would normally possess or exercise

Duty 4 – The duty not to delegate

There is an exception when the implied term of non-delegation is not reasonable in the circumstances o Or if there is express authority to do so, or if the A can be said to have implied authority to delegate in the circumstances o Ex. Ship carrying perishable goods were rotting in hold. The captain put to shore and engaged an agent to sell the goods. Held that the captain had authority to delegate in the circumstances. He wouldn’t have known the local market where he put in to respond to the emergency. Arguably necessary.

Remedies for delegation – damages for any loss and possibly an injunction against any further delegation

Rationale for this – the P engaged the agent because he had faith in HIM – not someone else to enter into K’s on his behalf

Duty 5 – to avoid conflict of interest between the duty to principal and personal interest

For example, if a P employs an A to buy goods on behalf of the P, the agent cannot buy goods from himself on behalf of the P. There are clear competing interests – the P wants to pay the lowest possible price while the A wants to sell them for the highest possible price

REMEDY – contract is void and the agent is required to account to the P for any profits made in the transactions

Damages would be available to compensate for losses from the conflict of interest, and could get an injunctions against future ones

NOTE – CBCA ALLOWS FOR CONFLICT OF INTEREST SO LONG AS THE CONFLICT

IS KNOWN, PERSON IS NOT INVOLVED IN PARTICULAR DECISION, AND THE

DEAL MADE IS FAIR FOR THE CORPORATION

6

Duty 6 – Not to make secret profits

Common example – purchasing agent who gets some kickback from making a particular purchase from a particular supplier

A loss to the P could occur because the A may not have obtained the lowest possible price for the goods, and has actually made a profit on the side

REMEDY – A would have to account for the amount of the benefit the A received and could be required to pay damages that result from not getting lowest price goods

Example – an A that acts on behalf of competing principal (ie sells goods for two P’s without the other knowing about it)

Thompson v. Meade (1891)

Facts : Stockbroker asked to sell shares for a certain price ($10) but sold them for more ($12) and pocketed the difference

Decision : Stockbroker required to account to the P for the extra profit made.

Duty 7 – To keep proper accounts

If doesn’t, there is an evidentiary presumption against the A

The court will take a view of the amount of profit to the A or loss to the P that is most favorable to the P

Duties of Principal to the Agent

Duty 1 – to pay remuneration

This is frequent, although an A can work for free and the default rule is NO REMUNERATION

Requires an express agreement

HOWEVER even if there is no express agreement, if circumstances indicate that the A would clearly not have been inclined to act gratuitously, the court will award remuneration o Awarded on a quantum meruit basis (ie, what would an agent normally be paid in the circumstances)

HOW TO GET REMUNERATION: o Agent must be performing the obligations required by the agreement o Agent must be the effective cause of the sale/K/etc

Exception – when the A is an exclusive agent (ie where the agent is to be paid whether or not the A is the effective cause)

Requires express agreement to override the implied term

Duty 2 – to pay the expenses of the agent and indemnify the agent against losses

In both these cases, A has to be acting within scope of actual authority

Expenses can’t be incurred by fault of the A

Blair v. Consolidated Enfield

Termination of Agency

By the Act of the parties

If the agency agreement provides for the termination, according to these provisions

When the agreement doesn’t provide for it, it is unilaterally terminable on notice o No requirement for a reasonable notice period

7

o Can be terminated by either party immediately on notice

By Operation of Law

If either the A or the P becomes bankrupt o Rationale if P is bankrupt – A looks to P for payment and thus can’t expect them to continue the relationship without it o Rationale if A is bankrupt – A’s often end up holding money/property for the P and the

A’s creditors can access this (remember above!)

Frustration – the purpose of the agency agreement no longer exists

Death of P or A – the relationship of faith is gone

Third Party Relationships

Third parties are those affected by the acts of A’s on behalf of the P.

Actual Authority is more important when assessing the relationship between the P and the A

But some relevance here

If the A is acting within the scope of actual authority to enter a K with another person on behalf of the P, and if it is clear that the agent is acting as an A in its dealings, then the K, if otherwise valid, will be a binding K between the P and that third party

P can enforce the K against the third party and vice versa

NOTE – the A is NOT a party to the K (unless the A was clearly intended to be)

Ostensible Authority

Also important between the P and third parties

Can arise even when no Actual Authority – ie no express or implied authority

If ostensible authority is proven, there will be a valid contract between the third party and the principal, and either can sue for cause in action of breach of contract .

TWO ELEMENTS

1.

Alleged principal must have made or permitted a representation that the alleged agent had authority to act on behalf of the alleged principal a.

Interpretation of “representation” is broad – can be express or implied from the words, conduct, circumstances of the P

2.

The third party relied on the representation to his detriment a.

Reliance suggests the third party wouldn’t have taken the action otherwise b.

Reasonably – the third party should have taken obvious and easy precautions

Freeman & Lockyer v. Buckhurst

The representation operates as an estoppel, preventing the P from asserting he is not bound by the K

Irrelevant whether the A had actual authority to enter the K

The representation most common = conduct of permitting the A to act in some way in the conduct of the P’s business with other persons o Leads to people believing the A has authority to enter K’s on behalf of the P

8

This case is actually decided on this principle – by allowing Kapoor to act the way he was, the fulfilled condition 1 and the Plaintiffs, who relied on that representation suffered a detriment because of it

Rationales for Ostensible Authority

Question - Who should bear the loss?

1. Protection of reliance interest of third party

They reasonably believes the person had authority, and suffered a detriment because of it

Competing interest with this is unfair surprise

BUT where the alleged P could have readily taken steps to avoid reliance by third parties, then the alleged P should not be unfairly surprised

2. Least Cost Avoidance

This is meant to protect broad societal interest

There should be an obligation to avoid the loss on the person who can avoid it at the least cost

This gives the alleged P an incentive to avoid the loss and reduces the cost incurred in avoidance of such losses

The P can: o Check the A’s trustworthiness before engaging him o Monitor the A’s behavior o Dismiss A’s that act beyond their authority o In these cases, not having the P responsible for the A’s authority would defeat the whole purpose of agency

If the responsibility was left on the third party, they would all have to contact the P each and every time to confirm the A’s authority

ON THE OTHER EXTREME – if the alleged agent is a complete fraud, then the third P is probably in the best position to avoid the loss because they have at least had some contact with the fraud

Or if there is suspicious activity by the A

The second requirement of reasonableness allows the courts to find fault with the third party sometimes too

Note – if the third party is successful, the P could then turn and make a claim against the A for going outside their scope of authority AND if the claim against the P fails, the third party can still try and make a claim against the A for breach of warranty of authority

Breach of Warranty of Authority

A BWA is a claim by a third party against an A where the A warranted that she had authority but in fact did not have either actual or ostensible authority .

So, third parties have two options

1.

Claim against the alleged P on the basis that the agent had authority (actual or ostensible)

2.

Claim against the alleged A for BWA

9

THREE ELEMENTS

1.

Agent represents that she has authority

2.

That representation is false

3.

The third party reasonably relies on the representation to his detriment

Remedy – an expectation measure of damages (separated this from tort of negligent misrepresentation, which has reliance based measure of damages)

Ratification

When the A acts beyond his authority, the P may nonetheless choose to accept what the A has done by ratifying the act of the A

A person can ratify a K entered into by an A on their behalf if THREE ELEMENTS satisfied

1.

The A purported to act on behalf of the P who seeks to ratify

2.

The P who seeks to ratify was in existence and was ascertainable at the time the A acted

3.

The P who seeks to ratify must have had the legal capacity to do so both at the time the A acted and at the time of ratification

NOTE – use of P and A is incorrect here – there may not be an agency relationship to start with, as a person can purpose to act on behalf of another person even though they have to authority to do so.

Two requirements for ratification to be effective

1.

P must have done something to ratify (can be express, by conduct, or by acquiescence) a.

Express can be orally or in writing b.

Conduct can be sufficient too – any performance or part performance of the terms of the

K by the P may be sufficient to = ratification c.

P can also be considered to have ratified by simply waiting to see what happens over a period of time (acquiescing)

2.

Ratification must be based on a full knowledge by the P of all important relevant facts a.

P is consenting to a transaction the A had no authority to enter, so the P needs to know the nature of the deal being accepted b.

NOTE – this is likely more about big aspects of the deal – won’t relieve the P of obligations because not informed of relatively minor aspects

Consequences of Ratification

Ratification relates back to time of offer and acceptance b/w A and third party

Now it’s a binding K, so the P can sue the third party and be sued by the third party

The third P can no longer sue for breach of warranty of authority

A no longer liable to P for exceeding authority

And the P will be liable to the A to pay remuneration, expenses, indemnify against loss

Policy Reasons for Ratification

1.

Mutual Benefit a.

At the time of offer and acceptance, there is presumable some benefit from the transaction for the third party b.

When the principal then ratifies, there is presumably some benefit – otherwise why ratify?

10

2.

Unjust enrichment of principal at expense of agent a.

If A acted beyond authority, would be liable for loss to the P b.

The P will benefit if the transaction goes well, but the A will loose out if the transaction goes poorly because will have to compensate the P for it c.

Big potential for upside gain, little or no downside risk d.

Also, protects the A because requires that the P be obliged to pay remuneration etc once it is ratified

3.

Unjust enrichment of principal at expense of third party due to speculation a.

Can’t just allow the P to sit and wait to see if the deal will turn out well for them b.

Say price goes up – the P will ratify the old contract for the better price c.

If price goes down – the P won’t ratify the K because can find for a better price elsewhere d.

Same goes for conduct – cant just let them perform part of the contract that is favorable and then not the rest e.

The requirement that the P be in existence and ascertainable is also important here, because otherwise someone could purport to act on behalf of corp that is not yet incorporated, and then when the corp never comes into existence so it doesn’t have to ratify, there is no way for the third party to enforce the K

4.

Unjust enrichment of third party at expense of P due to speculation by third party a.

If the ratification didn’t go back to time of offer and acceptance and the A was acting beyond actual but with ostensible authority, the third party could speculate. If before the

P ratified the K it turned out to be unfavorable to the third party, it could revoke its offer or acceptance b.

Here, potential upside gain, no downside risk c.

Ex. Sale of goods by 3P to P – price of goods goes down, the 3P revokes the offer on the basis of ostensible authority d.

So part way through, the 3P can ratify which operates back in time before their attempt to revoke

5.

Cures minor defects in the grant of authority a.

Said to reduce litigation over the scope of actual and ostensible authority

Undisclosed Principal

Agency not disclosed, and the 3P thinks entering K with the A (not the P)

The general principle is that the undisclosed principle can disclose the agency relationship and sue the third party on a contract entered into by the A

EXCEPTION – doesn’t apply when the third party was looking to the A alone to perform the K.

Objective test: o The third party will be considered to have been looking to A to perform if: o 1. The terms of the K expressly require that only the A performs the terms of the K agreed to by the agent OR o 2. Circumstances indicate that the 3P clearly intended to contract with the A alone/would not have contracted with the P

Must be corroborating circumstances to prove this is true, cant just accept that if the 3P says it wouldn’t have done it that it wouldn’t

Example Said v. Butt – there was history between them, the P got banned from the theatre, got A to buy the ticket for him, and the court held that clearly there

11

was no K here because it was clear the theatre never would have contracted with him

There are reciprocal rights/protections for the third party o Can sue the P when learn of the agency relationship o Can still sue the agent as a party to the K o In an action by the P against the third party, the third party can use any rights the third P would have against the A and can use any defence that the third party would have had against the A o Ex. Paid $4000 to agent, principal suing for $10,000 – set off the $4000 and just owe principal the $6000 o When sued can use defenses of duress, mistake, or misrepresentation, because these are defenses the 3P might have against the A

Policy Reasons for Law of Undisclosed Principals

1.

Mutual Benefit – if the 3P wasn’t looking to the A to perform the K, then the 3P is still getting the expected benefit of the K when the P performs it

2.

Potential Unjust Enrichment of Third party – P may think she has a binding K with the 3P and proceed to perform the K a.

If the 3P avoids performance of his part on the basis the agency relationship was undisclosed, then the 3P would be unjustly enriched at expense of P

3.

Potential unjust enrichment of the P a.

The 3P can sue the P on the K b.

For example, if the 3P delivers the goods to the A and the A passes the goods on to the undisclosed P. If the P then refuses to pay for them, and the A doesn’t pay, the 3P can sue the P

Liability of P for Torts Committed by Agent

A principal is said to be liable for a tort committed by the principal’s agent if the agent committed the tort while acting within the scope of his or her authority .

Authority is vague – its broader than actual authority

The A just has to be doing the kinds of things that the A would normally do in carrying on her mandate (otherwise difficulties would arise from a P simply saying that he did not and never would authorize an A to commit a tort (DUH!))

Lloyd v. Grace, Smith & Co. (1912)

Facts : A clerk employed at the law firm Grace defrauded a client, Lloyd of her sole remaining assets.

Mr. Sandles, the employee, was in charge of the firm’s conveyancing, and did so unsupervised. He convinced her to sell the cottages and call in the mortgage. He left the room, came back with 2 documents for her to sign. She signed them without reading them over, and it turned out that they were in fact a conveyance to Mr. Sandles himself. He mortgaged them for a bank loan and used the funds to pay off personal debts. Lloyd them sued Smith, the lawyer principal.

Issue : Might be argues that principals like Mr. S don’t give their agents authority to commit frauds.

Decision

: “So narrow a sense would have the effect of enabling principals largely to avail themselves of the frauds of their agents, would be opposed as much to justice as to authority”.

12

From Barwick – “it is true the (master) has not authorized the particular act, but he has put the agent in his place to do that class of acts, and must be answerable for the manner in which that agents has conducted himself in doing the business”

The clerk had authority to receive deeds and carry through sales and conveyances, and the fraud occurred in doing that what he had delegated power and capacity to do

Also confirmed that the P does not have to benefit from the A’s fraud, nor does the A have to intend to benefit the P, in order for the P to be liable

Ernst & Young v. Falconi (1994, Ontario)

Addresses same issue in context of partnership. Partners are agents for each other, liable for the others tortuous conduct.

Facts : Falconi lawyer for KFA, pled guilt to charge under Bankruptcy Act for assisting persons making fraudulent dispositions of their property to avoid paying creditors. His partner had no idea, but the transactions were all done using the legal services of KFA (preparation of documents, documents transferring title, etc).

Issue : Is his partner, Klein also liable? Klien argued that the acts of Falconi could not be considered within the ordinary scope of business of the law firm.

Decision : Judgment against Klien

The court need not find that it is within the ordinary course of business of a law firm for a partner to conspire

Sufficient if that partner used the facilities to perform services normally performed by a law firm in carrying out the transactions as a result of which the creditors of the firm’s clients suffered loss

The activities of Falconi were normal lawyer-like activities – he prepared docs, transferred deeds, prepared corporate minutes, etc – all done using the support staff, trust account, letter head

The fact that the actions were for improper purposes does not take them out of the ordinary course of business of the law firm in that they are the acts normally performed when carrying on its usual business

SO: Principle is the same, partners are agents for each other and are liable for the torts of their fellow partners committed by those partners within the scope of their authority

Policy Reasons for making P liable

1.

Deterrence / Least Cost Avoidance a.

Gives the P incentive to take steps to avoid the harm-causing activity b.

With least cost avoidance, sometimes its possible both persons could have taken steps to avoid the harm – so impose the costs on the person who could have avoided the harm, at least cost c.

For example, in Lloyd v. Grace , Smith & Co .

Smith should have been more careful about who he hired for Mr. Sandles’ position, more carefully monitored the position, and dismissed him when the early signs of fraud occurred d.

The client should have also taken steps – like reading the document, although this isn’t particularly reasonable in the context of a lawyer’s office where it is understood the lawyers are there to look after their clients

2.

Allocation of the loss to the activity causing the loss

13

a.

It will result in an increase in the price of the goods or services to cover for the added cost of harm prevention b.

Price will then more closely reflect the full cost to society of the particular goods or services and demand for the goods or services should adjust in response to the increased price c.

In Lloyd , the cost of law firms exercising better control over their clerks and the cost of compensating victims who suffer losses should come to be reflected in the prices of legal services

3.

Concern for compensation of the victim a.

Judge may have a P that the judge feels is deserving of compensation b.

The D might be the only one with a source for compensation c.

In Lloyd , no question that the little old lady would have been in a horrible position if the court did nothing to help her, as the cottages were her only remaining possessions.

Sandles had debt, no resources to pay, but his principal, who was in a well paying profession and could have obtained insurance, did.

4.

Other – specific to Lloyd , Accessibility of Legal Services a.

Important that people feel comfortable seeking out legal advice b.

Wont feel comfortable if they get screwed by their lawyers office and get no compensation

Sole Proprietorship

Key Elements:

Can form a SP simply by starting to do business (by yourself)

The sole proprietor is the only equity investor

The SP is ultimate decision maker

NOT a legally recognized separate entity o Assets owned directly by sole proprietor o Sole proprietor enters K, and is liable for them o Also liable for torts committed in carrying on the business, because she will have been personally involved, or vicariously liable for agents and employees

Personally liable – creditors can come after both business and personal assets o This works both ways – people who have claims arising out of conduct of business can get assets of business and personal assets to satisfy the claim o In addition, if people have claims arising out of sole proprietor’s activities outside the business, can go after personal AND business assets too

The SP might be able to negotiate limited liability in individual transactions (ie, borrows from creditors and in the agreement it says, can’t touch my personal assets)

Formation

One simply starts carrying on the business

Comply with licensing requirements that may exist (fed, prov, and munic) for carrying on particular types of businesses

Possible need to register name of business

Business Name Registration

14

One can carry on a business as a SP in one’s own name without having to register

Must register name if using other than one’s own name, or a name indicating a plurality of persons

In BC, this requirement is found in s. 88 of the Partnership Act o States that the name must be filed with the registrar IF:

1. It is a business of trading, manufacturing or mining

this phrase is not clear/defined

2. It is not a partnership

Separate part of the act deals with partnerships and their registration, although both end up in the same registry

3. The business name is not the sole proprietor’s own name or the business name consists of a phrase indicating a plurality of persons

ex. Smith and Sons (this would confuse someone into thinking it was a partnership)

s. 89 of Partnership Act – registrar is NOT TO REGISTER the name IF it RESEMBLES the name of a corporation in BC, or if it is likely to confuse or mislead UNLESS o The corporation consents in writing OR the business name was used before the corporation first used its name o This is a curious provision, given it says nothing about two sole proprietorships having the same name – likely to be rectified soon

S. 90 of the Partnership Act – requires the registrar to maintain a register showing the business names on the left side with the names of the persons associated with the business on the right side

Purposes of the Registry : o May help track down who is behind a particular business

Useful for creditors to identify the sole proprietor for credit check purposes

Useful for a person wanting to pursue a legal claim that has arisen out of dealings with the business o Avoid deception of a name indicating a plurality of persons o Allow persons starting a business to avoid a passing off claim against them because they have used a business name that has been used by another person

Funding Sole Proprietorship

Sources of Funds:

Investment by SP

Funds borrowed from one or more lenders – lenders are usually banks o To avoid personal liability, SP might try to get a no-recourse loan meaning liability is limited to business assets o Although more likely that they will want to impose constraints on the business

Trade Credit – buys goods now, pays later

NOTE – all funds other than the SP’s investment could be considered “securities” and thus have to follow provincial securities regulation

Management of Sole Proprietorship

Sole Proprietor has ultimate control over decisions

May delegate some authority to agents or employees

15

So while it starts simple, could get complex – grow to be large, have hierarchy of agents and employees that are managed by several managers, with the apex of the hierarchy being the sole proprietor

As earlier stated, creditors may impost constraints on SP’s control o Want to control degree of risk their investment will be exposed to o Don’t want them to gamble the funds they are loaned on risky business ventures that have a high potential for the SP but huge downside risk for the creditor o Loss of control by the SP is a trade off – the SP gets necessary funds, and the lender will keep the interest rate on the borrowed funds down

Dissolution

The sole proprietor simply stops carrying on the business . No requirement to register a sole proprietorship (other than possibly the business name) and so no requirement to register its dissolution.

SP must eventually pay off the debts (or be petitioned into bankruptcy) but once the assets are sold and the debts paid off, the SP keeps what remains

Sole Proprietorship vs. Corporation

Advantages:

1.

SP is easy to form and very easy to dissolve

2.

Tax advantages of SP (often primary reason for choosing a particular form of business association) a.

Profits in SP are taxed directly in the hands of the SP b.

Income Tax Act requires the tax payer to add up their incomes from various sources and deduct losses from various sources c.

SP taxpayer can deduct losses from business against income from other sources

(business, property, employment) i.

May not be planning on losses, but important to remember lots of businesses incur losses in the start up phase d.

Tax Timing – General principle of tax saving is that it is better to pay a tax later than sooner since you can earn income on the amounts no paid – if the person carries on the business as a SP the person can use the losses of the business immediately against other income to reduce their taxes

3.

In contrast, tax disadvantages for corporation a.

Corporations treated by Income Tax Act as a separate person, so it also adds up its income and can deduct its losses. BUT the shareholders cannot deduct business losses from their other income because the business losses are not their losses – they are the corporation’s losses b.

Double taxation – if business does make a profit it will be taxed in the hands of the corporation as a separate tax payer, and then when the profits paid to shareholder, the shareholder will also pay tax on the profit

Disadvantages

1.

Sole proprietorship has no limited liability a.

Although this may not be so bad, given that when you incorporate the lenders will often still ask you to be personally liable/waive limited for leasing, getting loans

2.

Corporation may have a tax advantage if a small business – may be able to claim small business deduction to lower its tax rate

16

a.

Thus, at some point when the SP starts to turn a profit, may make sense to incorporate

Partnership

Involves more than one equity investor – commonly used business association

A partnership occurs when two or more persons carry on a business with a view to profit.

Origins

Comes from the C/L courts as an extension of contract law and agency

In England, codified in 1890, and virtually copied word for word in BC

The common law and equity origins of partnership are still relevant because the partnership act preserves the rules of equity and common law except to the extent they are inconsistent with the

Act (s. 91 of the Partnership Act)

Uses of Partnership

1.

Professionals a.

Provincial legislation used to prevent professionals from carrying on business as a corporation, so they used partnerships b.

Now, it is common for them to use LLPs

2.

Joint Ventures a.

Two or more corps might engage in a joint venture, and one way for them to do so is by a partnership b.

Corporations = people, so 2 or more together can be a partnership c.

Not uncommon choice in this context because it has a flow through tax feature

3.

Tax Reasons a.

Potential tax advantages for sole proprietorships may also apply to partnerships because the Income Tax Act doesn’t treat it as a separate legal entity b.

A partner can use his/its share of the losses against his/its other sources of income

4.

Default a.

People might be in partnership and not even know it – no formalities to formation

Advantages of Partnership

1.

Corporate form of association has often not been available for several professional businesses

2.

Easy to form

3.

Very flexible, whereas corporations require compliance with lots of mandatory statutory requirements

4.

Tax advantages

Disadvantages

1.

Partners are personally liable for K’s entered into

Formation

General partnerships = Part 2 of the Act

Limited partnerships = Part 3 of the Act

There are no formal steps to create a general partnership

Just start carrying on business with another person with a view to profit

Although generally good practice to write up and sign a partnership agreement

17

THERE IS a registration requirement for general partnerships, although a general partnership can exist without ever complying with the registration requirement o Consequences for failing to register

Offence so fine

Even if haven’t registered, legal actions can still be brought against all or any one of the partners

S. 81 of Partnership Act – persons in partnership for trading, manufacturing, mining must file registration statement with registrar o This must happen within 3 months after formation o Failure may result in fine, and partners become jointly and severally liable for debts – not just jointly liable o If J & S – the P’s can sue each one separately and individually – if just jointly, the P is barred from suing other partners if already sued one

S. 90 – the Registrar keeps an index showing the name of the partnerships registered along with names of persons who are partners

S. 83 – if change or alteration in the membership of the firm, new registration statement must be filed

Three main situations when the existence of partnership can be significant

1.

What is the relationship between 2 or more people? Is it partnership? a.

The Partnership Act sets out a default agreement for people acting as partners, so need to know if its appropriate to apply those provisions to control their agreement

2.

Liability of a person to third parties on the basis of acts of fellow partners – remember agency!

3.

Tax reasons

S. 2 of the Partnership Act

A Partnership is the relation that subsists between persons carrying on business in common with a view of profit

4 KEY ELEMENTS

1.

Persons

Defined in s. 29 of the Interpretation Act = corporation , partnership or party , and the personal or other legal representatives of a person to whom the context can apply according to law

2.

Carrying on business

Business takes on its ordinary meaning – “a trade, profession, a person’s usual occupation; buying and selling, trade; a commercial firm; a shop”

3.

In common

Must be doing business together in some way

S. 4 provides guidelines

4.

With a view of profit

A non-profit association not treated as a partnership under the Act

It’s a VIEW of profit – no profits actually have to be made (

Backman )

Backman v. Canada (2001, SCC)

Facts : A limited partnership established under the law of Texas – The Commons at Turtle Creek. LP investors were Americans. Acquired land in Dallas, built apartment building on it. Later, the cost of land far exceeded its value. The appellant and 38 other Canadiands sought to take advantage of the loss

18

and deduct it from their Canadian income taxes. They attempted to do this by buying out the interest of the Americans, then selling it right back to the Americans to realize the capital loss.

Issue : They claimed partnership, so that they could deduct their individual losses from their personal incomes. Was it actually a partnership?

Decision : Considered the elemends of partnership, and decided it was NOT a partnership

Carrying on a business – discussed dictionary definition, noted that you don’t have to carry one on for a long period of time, can form a partnership for a single transaction o Gordon v. The Queen

Carrying on a business involves “the occupation of time, attention and labor, the incurring of liabilities to other purposes, and the purpose of livelihood or profit”

In common

– the authority of any partner to bind the partnership is relevant o But just because management of a partnership rests with one partner doesn’t mean that the business was not carried on in common o Also important to consider if they held themselves out to third parties as partners o Consider the contribution of skill, knowledge or assets to a common undertaking, a joint property interest, the sharing of profits and losses, filing of income tax returns as a partnership, joint bank accounts

View of Profit o The tax motivation will not detract from question of partnership – it is a question of intention o Profit shouldn’t be the overriding intention – sufficient if there is ancillary profit-making purpose o Don’t need a net gain over time – can incur losses o Need to weigh relevant factors in the surrounding circumstances

Result :

The apartment never operated

Just acquire and sold

The Canadians never managed the property

The investments were just “window dressing” in an attempt to make it look like a partnership for tax purposes, but no real expectation of or view of proft

*****s. 3 of the Partnership Act

Where the business is carried on through a corporation then the particular corporate statute applies and the Partnership Act DOES NOT APPLY

This doesn’t mean a corporation can’t be a partner – a corporation is a person, so can be in a partnership

But the corporation itself is not a partnership – shareholders are not partners

The Legal Status of Partnership

Re Thorne v. New Brunswick (1962, SCC)

Partners can’t be employees

19

Facts : Thorne and Robichaud were partners in a tree-felling and sawmilling operation. R did felling, T did sawmilling. T injured, sought worker’s compensation. Board refused, saying that T was not a worker., he was a partner.

Issue : Workers Compensation Act defines “workman” as an “employee”. The board argued that partnership was not a legally recognized entity and that meant an employment K in the context of the

T-R business had to be a contract between an employee and T and R as co-employers. For T to be an employee, would have had to make a K with himself. Which is impossible – it takes two to make a contract

Decision : A partnership Not recognized as legally separate

T was NOT an employee but rather a partner, no compensation

Consequences of Partnerships not being separate legal entities

1.

Each partner liable to the full extent of his personal assets

2.

Partners cant be employees of partnership business (note, shareholders CAN be employees of corporation)

3.

Partner cannot be a creditor of the partnership – you can’t enter into a K with yourself

4.

By Rule 7 of the Court Rules, can sue in the name of he partnership firm and serve to the place of business

5.

For income tax purposes – income is allocated between the partners and they are taxed individually – its not the partnership that is taxed

The Partnership Agreement

The PA sets out the default rules for partners (ss. 21-34) that govern the relationship between the partners if they have not either expressly or implicitly agreed otherwise

These rules based on assumption of equality with respect to capital contributions, rights to participate in management, share in profts

Partnership Act s. 21 allows for variation to the default rules

Consent by all the partners – either express or implied from a course of dealing

Ability of partners to create heir own set of rules = very flexible, key advantage of ptshp

Useful to have comprehensive partnership agreement that puts in provisions they want to change as well as those consistent with default position (only have to look at written to determine rights)

The Default Position:

1.

Partnership Property

S. 23(1) – Partnership property must be held and applied in accordance with partnership agreement

S. 6 – Partnership property means property brought into the partnership, property acquired on account of the firm, or property acquired for the purposes of and in the course of the partnership

S. 23(2) – Property that belongs to partnership but in name of one individual = held in trust for the partnership

S. 24 – Property bought with money belonging to the firm is partnership property

20

2.

Day to Day running of the business – set out in S. 27

Sets out how to run business, “subject to agreement express or implied by partners”

27(a) – Partners share squally in capital, profits, and losses o Miles v. Clark – Photographer (P) and person F set up business together under oral agreement the F bought lots of equipment for the P to use. Dispute arose, P sued F for half the assets based on 27(a) o Decision: 27(a) didn’t apply – inconsistent with oral agreement

27(b) – Firm must indemnify every partner for liabilities in the ordinary and proper conduct of the business (similar to agency, where P indemnifies the A)

27(c) – P who makes advance of capital over contribution agreed on entitled to interest

27(d) – A partner not entitled to interest on the capital subscribed by the partner

27(e) – Every partner may take part in managements of business

27(f) – Partners don’t get remuneration for working in the business

27(g) – Can’t add new partners without consent of all the partners

27(h) – Decisions on ordinary business matters are made by majority of partners o this doesn’t apply to changes in the NATURE of the partnership

27(i) – Partnership books kept at principal place of business, every partner has access

3.

No Majority of the partners can expel another partner

S. 28 – can’t expel unless a power to do so has been conferred by express agreement

This is a default rule that can’t be altered by implication

4.

Any partner can dissolve the partnership at ANY TIME – s. 29 and 35(c)

Assignment of Partnership Interest

S. 34 – A Partnership interest can be assigned, but this only means an assignee of a partner is entitled to a share of the profits and a share of the partnership assets on dissolution – does not mean the assignee becomes a partner, so has no say in management or administration

Rationale – don’t want to be in business with a partner you haven’t chosen

Fiduciary Duties Between Partners

Must have duties b/w partners because they are treated as agents for each other.

1.

General Fiduciary Duty a.

S. 22 – “a partner must act with the utmost fairness and good faith towards the other members of the firm in the business of the firm”

2.

Specific Fiduciary Duties a.

S. 31 – Partners bound to render accounts and full info of all things affecting the partnership b.

S. 32 (1) – Must account for any benefits derived without consent of other partners from any transaction concerning the partnership, or form any use by the partner of the partnership property, name, or business connection i.

S. 32(2) – this applies to transactions made after partnership dissolved by death of partner before the affairs are wound up c.

S. 33 – Must account for profits made engaging in competing businesses

Rochweg v. Truster (2002, OCA)

21

Facts : R was a chartered accountant and a partner of RTZ. Left firm and partnership dissolved (July

1996). R became director of Teklogix Inc (July 1995) – clients of RTZ – entitled to shares and stock options – earned fee for being director, accounted for fee to RTZ but never accounded for shares/stock options. Note – Tecklogix had been his client since 1967 so he was the primary contact between them and RTZ.

Issues : Were the other partners of RTX entitled to an account for the shares and stock options?

Decision : Note, this is Ont decision, so this story is told using the appropriate BC provisions

NO written partnership agreement – so governed by the act, and there has been no change to s.

31-33

An obligation to account arises under s. 32 without proof of a competing activity o Versus under s. 33 where need proof of competition

At all times R was a partner of RTZ, he had duties to his partners

He did not have a conflict of interest giving rise to account under s. 33

BUT the shares and stock options were compensatory benefits in a matter affecting and concerning the partnership which he had an obligation to disclose under s. 31, and for which he must account under s. 32(1)

McKnight v. Hutchinson (2002, BCSC)

Facts : Law firm partnership that ended when M learned H had received earnings from part ownership in a private company. They had a partnership agreement that said in article 2.8 they were allowed to conduct business other than law, and get paid for it, if they told the other and as long as the activities wouldn’t compromise the practice of law within the partnership.

Decision : Article 2. 8 reinforced the duty to disclose in s. 31 of the Act. There was no notice given by

H about his matters. In fact, some of them were even law firm related services. It is possible they also put him in a conflict of interest.

Funding

Similar to SP – usually some trade credit, bank loan

Partners are the equity investors – maybe cash contributions, property or services

Usually the partners share profits in proportion to relative contributions, but not necessarily – if nothing said, default of 27(a) to share equally

Dissolution

By Act of the Partners

1.

35(a): set a fixed term for the partnership – at the expiry, partnership ends unless the partners agree otherwise

2.

35(b): agree to dissolve at end of a particular venture

3.

29, 35(c): If no a or b, the partnership may be dissolved by notice of intention to dissolve and the dissolution will take effect from the date of the notice or the date specified in the notice

Death, Bankruptcy or Dissolution of a partner

1.

Dissolved automatically in any of these situations

2.

Why? On death, no longer the same partnership, and upon bankruptcy, don’t want to have to cover losses of your partner

22

3.

Remaining partners can re-constitute

4.

Is a term often expressly varied by agreement so that death, bankruptcy or dissolution does not result in automatic end to partnership a.

Often frustrating to have to go through process all over again b.

BC Partnership Act s. 36 reflects this – default provision - when there are two or more partners, these things only dissolve the partnership with the deceased, bankrupt or dissolved partner and the remaining partners, so that the remaining partners stay in partnership

Liability of Partnerships

It is frequent for third parties, like creditors or contractors, to argue that particular persons are liable on the basis that they are partners

SECTIONS 7-11 of PARTNERSHIP ACT APPLY TO VOLUNTARY RELATIONSHIPS

BETWEEN PARTNERS AND THIRD PARTIES

Section 7 – apparent authority of partners

(1) Every partner is an agent of the firm and other partners for the purposes of the partnership business

(2) Where partner does act for “carrying on in the usually way of business of the kind carried on by the firm” it binds the firm and partners unless: o partner had no authority to act for firm in the particular matter; and o third party either knew the person had no authority or did not know or believe the person was a partner

Parallels ostensible authority – reliance of the 3P must be reasonable

Section 8 – actual authority of agent or partner

An act or instrument (document);

Relating to the business of the firm;

Done/executed in the firm name , or in any manner showing an intent to bind the firm;

By any person authorized to do so (whether partner or not)

is binding on the firm and ALL the partners

Does not limit actual authority – appears to cover both actual and ostensible

Section 9 – If no ostensible authority, partners not bound unless particular partner had actual authority

If a partner pledges credit of the firm and does so for a purpose not connected with the firm’s ordinary course of business, then the firm not bound unless the person was specially authorized by the other partners o No way the 3P has reason to believe the person has authority

Section 10 – Third Party notice of restriction on Authority of Partner

3P has notice of restriction of power of partner, partner’s actions in contravention of restriction don’t bind firm

Section 11 – Joint Liability for debts of partnership – all partners jointly liable as long as partner

On death, estate is severally liable subject to prior payment of partner’s separate debts

Section 19 – Liability of New partners and Retired Partners

(1) Person who joins existing partnership not liable to creditors of debts that arose before

(2) Person does not cease to be a party to K’s just because have left partnership

23

(3) If creditor agrees to relieve retiring partner from further liability, agreement binding

Liability of Partners in Tort

Section 12 – Firm liable for wrongful acts or omissions with loss/injury caused to any person where a partner acted with the authority of co-partners OR acted in the ordinary course of business

Section 14 – Liability under s. 12 is joint and several

Ernst & Young v. Falconi

Demonstrates Scope of s. 12

Facts – above – lawyer helping bankrupt peeps get rid of their props.

Issue

: Klien, Falconi’s partner, argued that the acts of F could not be considered in ordinary scope of business of the law firm.

Decision : He was doing things like writing documents, writing title transfers, using the firms letterhead, support staff, etc.

“It is sufficient if the partner used the facilities of the law firm to perform services normally performed by a law firm”

Not necessary for a partner to conspire with others to defeat creditors

When a partner is found liable, he is liable for the full amount . Tort victims contracting with the partnership business can claim full compensation from any one or more of the partners.

This is independent of a right to seek indemnification/contribution from other partners

If a partner has to pay, can seek to have fellow partners contribute according to terms of the partnership agreement

If person sues A, A is 100% liable for full amount

Then up to partner to seek indemnification from partners B, C, D

More on the existence of partnership (context of 3P relationships)

Section 4 – guidance to carrying on a business “in common”

(a) Common ownership of property does not in itself make co-owners partners

If other aspects exist too, then might be considered (ie share profits, have some involvement in mgmt of property)

Finding of co-ownership vs. partnership has significant implications o Co-owners are not agents for each other (partners are) o Co-owners can deal with their own interests in the property w/out consent of the others

Partners cant transfer interest w/o consent on others

(b ) Sharing of gross returns (gross returns are revenues before the deduction of expenses) does not of itself create a partnership (ex. Traveling play company performing in theatre operated by theatre owner) o Not carrying on business in common o Just a presumption – something more may indicate partnership

(c) Creates an assumption – the receipt by a person of a share of the profits on the business is proof in the absence of evidence to the contrary that he is a partner in the business o Cox v. Hickman clarifies that this is a rebuttable presumption of partnership

24

o Qualifications under 4(c)

Receipt of a share or payment contingent on or varying with the profits does not of itself make a person a partner

ad agency and client example

4(c)(i)- Payment of a debt or liquidated amount by installments out of profits does not of itself make a partner (creditor temporarily taking % of profits)

If creditor presses and sues for assets, might cause bankruptcy so this is an arrangement to ensure business stays open

4(c)(ii) - A contract for remuneration of an employee or agent by a share of the profits does not of itself make a person a partner (ex. Articling student gets Xmas bonus set at a % of yearly profits)

4(c)(iii) - Spouse of a child of a deceased partner who receives an annuity out of the profits is not a partner merely because of the receipt of profits

4(c)(iv) - Profit sharing loans – money advanced by loan to person engaging in business on a K between the person and lender, where the K is in writing and signed by or on behalf of all the parties, and where the lender gets a rate of interest varying with profits does not of itself make the lender a partner

CONTROVERSIAL – because makes it possible to have a person with an investment that is pretty much a pure equity claim and yet the person might not be considered a partner

Presumably the difference is that when the firm ends, they would only get investment back, whereas partners entitled to what’s left after liabilities paid

But would get money along with other creditors, before partners get anything back

This was introduced in England by Bovill’s Act

Justifications: Mechanism for funding businesses in temporary difficult positions,

Ex. A struggling SP (motel) will have a hard time attracting new equity investors (their funds could be completely lost if business doesn’t pick up) or fixed rate investors (if it does turn around, all these investors get back is principle plus fixed rate, nothing more)

S.4(c)(iv) allows investors to share in the upside gain through a share in the profits while allowing them a degree of downside risk protection in that they don’t become partners and liable for all other debts

Don’t want to force the company into bankruptcy, and better for existing creditors that it not do so

Example – Martin v. Peyton

4(c)(v) – A person receiving payment for goodwill out of profits is not a partner merely because of receipt of profits

“goodwill” = value of business that is not fully reflected in the market value of individual assets of a business

Buyer agrees to pay addition amount for goodwill out of subsequent profits after only paying face value for business o Section 16 – a person who represents himself to be a partner (orally, written, conduct) or who knowingly allows himself to be represented as a partner, will be liable to anyone who had given credit on the faith of the representation

Ex. Person w/ good credit allows person to use his name to get credit

25

Pooley v. Driver and Martin v. Peyton

Must weight the factors that are consistent with partnership with those than aren’t to decide if a partnership exists

Policy and Underlying Values

1.

Direct Reasonable reliance on a known participant in the business a.

See below for A.E. Lepage v. Kamex, Cox v. Hickman, Pooley v. Driver b.

3p’s may reasonable assume that people involved in management are in business together, and reasonable rely they are jointly liable c.

Hence , those who act in common or represent themselves as partners, are generally considered to be partners d.

This rationale alone not sufficient, as persons are held to be partners even if are

“ dormant partners

” with no involvement in management

2.

Indirect Reasonable reliance on a person not known to the third party a.

See below for Cox v. Hickman, Pooley v. Driver b.

Parties may rely on “silent partners” c.

Highly unlikely a business is all or almost all debt financed (lenders wouldn’t go for it) d.

If person sees a business has lots of assets, can reasonable assume that there are persons who have substantial assets in the business and are personally liable on it e.

So, third party pay advance credit to business on the assumption there is someone who has funds to pay the debt

3.

Avoid unjust enrichment a.

See below for A.E. Lepage v. Kamex, Cox v. Hickman, Pooley v. Driver b.

A person sharing in the profits of the business is getting the benefit of the credit advanced i.

Say profit shared between 2. Person 1 then becomes insolvent, and when supplier comes looking to get the money, if the other person can say they are not a partner, then they get a benefit at the expense of the supplier c.

So, those sharing in profits are generally considered to be partners d.

Also, share in gross returns alone does not mean partner i.

if creditor priced goods or services and set terms of credit based on the persons in the business he was aware of, then being able to make a claim against a person he was not aware of is itself a windfall

4.

Least cost avoidance a.

See below for A.E. Lepage v. Kamex, Cox v. Hickman, Pooley v. Driver b.

Ask, who can best assess the risks , and who can best control the risks c.

Those involved in the business on some level of management or have a share of the profits are usually in a better position to assess the risk and control for it than most 3P creditors d.

If put the risk of business failure on the persons involved and sharing profits lowers the overall cost of credit, because they know how to assess the risk e.

Creditors will charge more if they are bearing the risk

5.

Other concerns a.

“

Distributional concerns

” – may be inconsistent with other policy concerns and override them, but this is unique by case b.

For example, in Cox v. Hickman , court wanted to avoid discouraging useful arrangements being set up to help a struggling business

26

Case Law on Partnership

Notes:

If it’s a dispute between 2 people about the terms of their agreement, if the K says they are not partners, court will agree

But if it’s a dispute with a 3P, the court will WEIGH the factors

A.E. Lepage v. Kamex Developments (1977)

Must weight the factors – what looks like partnership vs. what doesn’t

Facts : Group of persons form a syndicate to buy a property. Kamex was incorporated to hold the property in trust on their behalf. Persons in group entered an agreement (profits/expenses to be shared in proportion to their interest, selling needed majority vote, must offer your interest to other co-owners before selling it). Parties met monthly to discuss operation and sale of the property. March (co-owner) listed property exclusively with A.E. LePage (should have been open listing) when they approached him. Sold by another company but LePage wanted commission based on exclusivity. Trustee for the syndicate refused to pay.

Issue : A.E. LePage sued, saying it was a partnership and that M’s acts as a partner were binding.

Decision : Arrangement was an ownership in common, NOT a partnership

Inconsistent w/ partnership for co-owners to have ability to deal w/ individual property interests

Right of first refusal (common in partnership) not inconsistent with the right of the members to deal with their own interests in the property

Also, they treated their interests separately for tax purposes , not as a partnership

Some things did look like partnership – sharing of deficiencies, requirement of majority vote

Policy:

Reliance – no indication M had been held out as having authority and not clear LePage relied on the other members as partners (he should have gone to Kamex)

Unjust enrichment – Lepage would have been paid even though didn’t actually sell the property

Least Cost Avoidance – Syndicate members had limited control over management – LePage could have checked with officers of Kamex before approaching March

Cox v. Hickman (1860, HL)

Before partnership Act – this decision is codified in s. 4(c)(i)

Facts : Iron business owned by Smith $ Sons operated under name Stanton Iron Works. Developed financial problems. Instead of forcing bankruptcy, creditors agreed to an arrangement whereby Smith

& Sons would transfer assets of business to trustees, who would run the business. Creditors had rights under trust – access to books, power to elect/replace trustees, and make rules for conduct of business.

Someone supplied goods to the business on credit while the trustee was operating the business under the arrangement. Invoice marked accepted by agents for trustees, which converted the invoice into a negotiable instrument. Endorsed by Hickman who paid a sum of money for the endorsement. Invoice not paid, Hickman sued on it.

27

Issue : Business insolvent – who could pay H? He argues the creditors were partners because they were sharing profits, so they could be liable to him.

Decision : Close 8-7 NOT partners

Sharing of profits is strong evidence of partnership – but it is a rebuttable presumption o Overrules Grace v. Smith

Dormant partners are liable for the acts of other partners in carrying on the business

The TEST of whether a partnership exists is a question of whether the persons carrying on the business were acting as agents of the person alleged to be a partner

Policy :

Reliance – direct reliance can’t be the only concern – H probably didn’t even know who Cox was since they never acted in the capacity of trustees and so never conducted the business o Can’t have directly relied on the creditors as partners o MAY have indirectly relied – he might have seen substantial assets in the business and assumed that there were investors who would be personally liable

Unjust Enrichment – could have been factor since the creditors benefited from the goods at the expense of H – clearly not an overriding factor given H lose

Least Cost Avoidance – this factor also seems to favor H – the creditors probably didn’t carefully assess the risk of business failure, and although they would have had minimal control over the business, it’s arguable more than H

Promoting Useful Arrangements – if case went against creditors, would have discouraged future C’s to take on similar arrangements

Pooley v. Driver (1876)

Deals w/ provisions similar to 4(c)(iv). Weigh factors that indicate partnership vs. those that don’t

Just because parties say in an agreement that they were not to be considered partners is not determinative of whether they were partners!

Facts : B and H enter partnership agreement for business of making grease, pitch, manure. Capital divided into 60 parts, profits distributed in accordance with # of parts attributed to each person. B got

17, H got 23. Remaining 20 given to people who advanced funds. B and H didn’t actually invest any money, all funds came from lenders. Drivers advanced money to B and H, and this agreement was incorporated into the partnership agreement. Pooley held several bills owed by partnership, ended up suing the Drivers claiming they were partners. Drivers defended themselves using

Bovill’s Act.

Issue : Were the Drivers partners b/c they shared in the profits?

Decision : It is partnership

Weighed factors in favor vs. not of partnership

Factors that indicated partnership

1.

Had an interest in the capital of the partnership

2.

Ability of lenders to enforce partnership agreement looked like participation in and control of the business

3.

Having the return on the lender’s investment vary with contribution (uncommon for lenders)

4.

The loan agreement terminated in lender went bankrupt (uncommon for lenders)

5.

Term of loan agreement (14 years) was same as partnership agreement

Policy :

28

1.

Reliance – no direct reliance, because Pooley admitted he wasn’t aware of the connection of

Drivers to business – but of course may be indirect, like in Cox

2.

Unjust enrichment – Drivers would benefit from advance of goods on credit and a share of the profits

3.

Least Cost Avoidance a.

Evidence suggest the Drivers were in position to assess and control risk b.

Aware of capital structure of the business, would have known if it was able to pay debts c.

Once the loan agreement incorporated into partnership agreement, they had ability to enforce the terms and control selling, borrowing, dissolution, etc

4.

Broader Policy – didn’t want to allow this kind of relationship w/o partnership a.

Would give the Drivers limited liability that was ranked with creditors b.

Creditors would not be aware of the main contributions of capital to the business were made by persons who effectively had limited liability. Everyone would set up in business this way, to get the benefit of lower cost credit by having person dealing with the firm believe that the liability of the persons sharing the profits was not limited when in fact the investors sharing the profits would have limited liability. Eventually persons advancing credit would figure this out. They would charge higher amounts for credit and reverse the hypothetical preferred bargain the creditors and equity investors would probably have agreed on ahead of time is one in which the equity investors would bear the risk by agreeing to personal liability since they could control the risk at lower cost c.

Law deals with this by having Limited Liability structure – but must be explicit

Martin v. Peyton (1927 NYCA)

US case but shows the weighing of factors. An example of how a provision like 4(c)(iv) might be justified as a means to allow financing of a business that is experiencing some temporary financial difficulties.