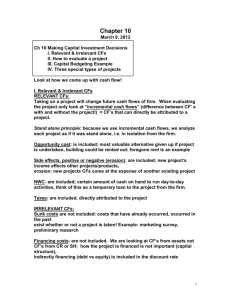

Notes for Chapter 9

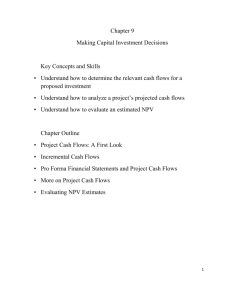

advertisement

Making Capital Investment Decisions Project Analysis FIN 301: Chapter 9 Key Concepts and Skills • Understand how to: –Determine the relevant cash flows for a proposed investment –Analyze a project’s projected cash flows –Evaluate an estimated NPV Barton College 2 Chapter Outline 9.1 Project Cash Flows: A First Look 9.2 Incremental Cash Flows 9.3 Pro Forma Financial Statements and Project Cash Flows 9.4 More on Project Cash Flows 9.5 Evaluating NPV Estimates 9.6 Scenario and Other What-If Analyses 9.7 Additional Considerations in Capital Budgeting Barton College 3 Project Cash Flows • Relevant Cash Flows – Are Incremental cash flows that occur only if the project is accepted – The stand-alone principle allows us to analyze each project in isolation from the firm simply by focusing on incremental cash flows • Stand-Alone Principle – Projects stand alone and have their on cash flows, costs, assets – They are not part of another project (mutually exclusive) to avoid duplicated revenue streams, etc. – Allows the company to manage the projects that are accepted and or rejected, and thus manage overall risk. – “Mini Firms” or a portfolio of projects/firms as stated by the author… – Having “Mini Firms” allows the company to hedge risk by selecting a diversified portfolio of projects. Barton College 4 Repeat Relevant Cash Flows are…. • Cash flows that will occur only if the project is accepted • Incremental cash flows • The stand-alone principle allows us to analyze each project in isolation from the firm simply by focusing on incremental cash flows Barton College 5 Relevant Cash Flows: Incremental Cash Flow for a Project Corporate cash flow with the project Minus Corporate cash flow without the project Barton College 6 Make sure the Cash Flow is Incremental….. • Do not include the cash flow if it would occur without the project, i.e., it must be incremental or in addition to existing firm cash flows. – E.g., Building a new student center may increase enrollment, but how many would come otherwise? • You should always ask yourself “Will this cash flow occur ONLY if we accept the project?” – If the answer is “yes”, it should be included in the analysis because it is incremental – If the answer is “no”, it should not be included in the analysis because it will occur anyway – If the answer is “part of it”, then we should include the part that occurs because of the project • • This may require a forecast or statistical estimate (i.e., forecast of the number of students when the student center is built) Barton College 7 We Want to Consider Only Relevant Cash Flows • “Sunk” Costs ………………………… N • Opportunity Costs …………………... Y • Side Effects/Erosion……..…………… Y • Net Working Capital………………….. Y • Financing Costs….………..…………. N • Tax Effects ………………………..….. Y Barton College 8 • Sunk Costs Issues Impacting Incremental Cash Flows – Costs already incurred and cannot be considered in an investment decision(s). • Opportunity Cost – The forgone opportunity we give up for using a resource for one thing but not another. • Side Effects – Product Erosion (People buy the new Altima instead of the Maxima, etc.) – Product Tie-ins (Wilson Tennis Rackets promotes the Wilson Tennis Balls) – Gillette Razors is a good example (dual blade triple blade quad blade) • Shaving cream – Second Derivatives: Apple iPhone (iPhone cases), Oil (GE Locomotive Engines) • Networking Capital – The short term demands of most projects require an investment in networking capital (inventories, cash, other expenses, etc.) • Financing Cost – Are not considered when looking at incremental cash flow. They are looked at separately and should not be confused with the generation of cash from the asset…. It is already included in the discount rate… • Others… – Always use after tax cash flows See Notes…. 9 – We must always consider the tax implications of cash flow (Tax Shield) Barton College Derivative Businesses Barton College 10 Pro-Forma Statements Barton College 11 Cash Flow Model Cash Flow to Creditors The cash flow identity Cash Flow from Assets = Cash flow to creditors + Cash flow to owners Cash flow to creditors = Interest – net new debt = Interest – (Ending LTD – Beg LTD) 1. Cash Flow of Assets (Firm) Cash flow from Assets = OCF – NCS – change NWC Cash Flow to Stockholders (owners) OCF = EBIT + Depreciation – tax Cash to owners = Dividends – net new equity (includes common stock and paid in capital) NCS = Ending NFA – Beg NFA + Depreciation Change NWC = Ending NWC – Beg NWC Retained Earnings Plowback $ OCF – change NWC True Cash Flow From Operations Barton College $ Assets (Firm) $ NCS Creditors CFFA (Free Cash Flow) Investments & Other non-operating Income Stockholders (Owners) 12 Pro Forma Statements and Cash Flow • Pro Forma Financial Statements – Projects future operations • Operating Cash Flow: OCF = EBIT + Depr – Taxes OCF = NI + Depr if no interest expense • Cash Flow From Assets: CFFA = OCF – NCS –ΔNWC NCS = Net capital spending ΔNWC = Change in networking capital Barton College 13 See Backup Slides Profit = Sales – Total Costs… Barton College 14 Shark Attractant Project P-279 • Estimated sales • Sales Price per can • Cost per can • Estimated life • Fixed costs • Initial equipment cost 50,000 cans $4.00 $2.50 3 years $12,000/year $90,000 • Investment in NWC • Tax rate • Cost of capital $20,000 34% 20% – 100% depreciated over 3 year life Barton College 15 Pro Forma Income Statement Table 9.1 Sales (50,000 units at $4.00/unit) Variable Costs ($2.50/unit) $200,00 0 125,000 Gross profit $ 75,000 Fixed costs 12,000 Depreciation ($90,000 / 3) 30,000 EBIT Taxes (34%) Net Income Barton College $ 33,000 11,220 $ 21,780 16 Projected Capital Requirements Table 9.2 (Book Value) Year 0 NWC 1 2 3 $20,000 $20,000 $20,000 $20,000 90,000 60,000 30,000 0 Total $110,000 Investment $80,000 $50,000 $20,000 Net Fixed Assets NFA declines by the amount of depreciation each year Investment = book or accounting value, not market value Barton College 17 Projected Total Cash Flows Table 9.5 Year 0 OCF $51,780 NWC -$20,000 Capital Spending -$90,000 CFFA -$110,00 Note: 1 2 $51,780 3 $51,780 20,000 $51,780 $51,780 $71,780 Investment in NWC is recovered in final year Equipment cost is a cash outflow in year 0 OCF = EBIT + depreciation – taxes = 33,000 + 30,000 – 11,220 = 51,780; OCF = NI + depreciation = 21,780 + 30,000 = 51,780 Barton College or 18 Shark Attractant Project Year Sales Variable Costs Gross Profit Fixed Costs Depreciation EBIT Taxes Net Income Pro Forma Income Statement 0 1 2 200,000 200,000 125,000 125,000 75,000 75,000 12,000 12,000 30,000 30,000 33,000 33,000 11,220 11,220 21,780 21,780 Operating Cash Flow Changes in NWC Net Capital Spending Cash Flow From Assets Net Present Value IRR Cash Flows 51,780 -20,000 -90,000 -110,000 51,780 3 200,000 125,000 75,000 12,000 30,000 33,000 11,220 21,780 51,780 51,780 20,000 51,780 71,780 $10,647.69 25.76% OCF = EBIT + Depreciation – Taxes Barton College OCF = Net Income + Depreciation (if no interest) 19 Computing NPV for the Project Using the TI BAII+ CF Worksheet Cash Flows: CF0 = -110000 CF1 = 51780 Display You Enter CF, 2nd, CLR WORK C00 -110000 Enter, Down C01 51780 Enter, Down CF2 = 51780 F01 2 CF3 = 71780 C02 71780 Enter, Down F02 1 Enter, NPV I 20 Enter, Down NPV CPT 10647.69 IRR, CPT Barton College 25.76 Enter, Down 20 Making The Decision Operating Cash Flow Changes in NWC Net Capital Spending Cash Flow From Assets Cash Flows 51,780 -20,000 -90,000 -110,000 51,780 Net Present Value IRR $10,647.69 25.76% 51,780 51,780 20,000 51,780 71,780 • Should we accept or reject the project? Barton College 21 The Tax Shield Approach to OCF • OCF = (Sales – costs)(1 – T) + Deprec*TC OCF=(200,000-137,000) x 66% + (30,000 x .34) OCF = 51,780 • Particularly useful when the major incremental cash flows are the purchase of equipment and the associated depreciation tax shield – i.e., choosing between two different machines Barton College 22 Changes in NWC • GAAP requirements: – Sales recorded when made, not when cash is received • Cash in = Sales – ΔAR – Cost of goods sold recorded when the corresponding sales are made, whether suppliers paid yet or not • Cash out = COGS – ΔAP • Buy inventory/materials to support sales before any cash collected Barton College 23 Depreciation & Capital Budgeting • Use the schedule required by the IRS for tax purposes • Depreciation = non-cash expense – Only relevant due to tax affects • Depreciation tax shield = DT – D = depreciation expense – T = marginal tax rate Barton College 24 Computing Depreciation • Straight-line depreciation D = (Initial cost – salvage) / number of years Straight Line Salvage Value • MACRS (Modified accelerated cost recovery system) Depreciate 0 Recovery Period = Class Life 1/2 Year Convention Multiply percentage in table by the initial cost Barton College 25 IRS Depreciation Rules • http://www.irs.gov/publications/p946/ar02.html Barton College 26 After-Tax Salvage • If the salvage value is different from the book value of the asset, then there is a tax effect • Book value = initial cost – accumulated depreciation • After-tax salvage = salvage – T(salvage – book value) Market Value Barton College Effect of depreciation or recapture Costs 27 Tax Effect on Salvage Net Salvage Cash Flow = SP - (SP-BV)(T) Where: SP = Selling Price BV = Book Value T = Corporate tax rate Book = Salvage Net Salvage Value = SP(1-T) Barton College 28 Example: Depreciation and After-tax Salvage • Car purchased for $12,000 • 5-year property • Marginal tax rate = 34%. Depreciation Year 1 2 3 4 5 6 Barton College $ $ $ $ $ $ 5-year Asset Beg BV 12,000.00 9,600.00 5,760.00 3,456.00 2,073.60 691.20 Depr % 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 100.00% $ $ $ $ $ $ $ Deprec 2,400.00 3,840.00 2,304.00 1,382.40 1,382.40 691.20 12,000.00 End BV $ 9,600.00 $ 5,760.00 $ 3,456.00 $ 2,073.60 $ 691.20 $ - 29 Salvage Value & Tax Effects Depreciation Year 1 2 3 4 5 6 $ $ $ $ $ $ 5-year Asset Beg BV 12,000.00 9,600.00 5,760.00 3,456.00 2,073.60 691.20 Depr % 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 100.00% $ $ $ $ $ $ $ Deprec 2,400.00 3,840.00 2,304.00 1,382.40 1,382.40 691.20 12,000.00 $ $ $ $ $ $ End BV 9,600.00 5,760.00 3,456.00 2,073.60 691.20 - Net Salvage Cash Flow = SP - (SP-BV)(T) If sold at EOY 5 for $3,000: NSCF = 3,000 - (3000 - 691.20)(.34) = $2,215.01 = $3,000 – 784.99 = $2,215.01 If sold at EOY 2 for $4,000: NSCF = 4,000 - (4000 - 5,760)(.34) = $4,598.40 Barton College = $4,000 – (-598.40) = $4,598.40 Too much Depreciation Too little Depreciation 30 Some Modeling Rules 1. Don’t make your model too complex…….GIGO…… 2. Create a common location for making input assumptions a. - Variable Costs, Price, Units Sold, Discount Rate, etc. 3. Create a common location for showing outputs of the model a. NPV, IRR, PI, Payback, ROI, etc. 4. As numbers 1-3 become more expansive, numbers 1-3 become even more important; (use relative and absolute referencing between pages and within sheets to compartmentalize your work 5. Remember, others may need to understand your “numbers” and how you derived the assumptions. Barton College 31 Majestic Mulch & Compost Co Barton College 32 Majestic Mulch & Compost Co Majestic Mulch and Compost Company (MMCC) YEAR Background Data: Unit Sales Estimates Variable Cost /unit Fixed Costs per year Sale Price per unit Tax Rate Required Return on Project Yr 0 NWC NWC % of sales Equipment cost - installed Salvage Value in year 8 Depreciation Calculations: Equipment Depreciable Base MACRS % (Eqpt-7 yr) Recovery Allowance Book Value 0 $ $ $ $ $ 1 3,000 60.00 25,000.00 120.00 $ 120.00 $ 34.0% 15.0% 20,000.00 15% 800,000 20% of equipment cost 2 5,000 120.00 $ 3 6,000 120.00 $ 4 6,500 110.00 $ 5 6,000 110.00 $ 6 5,000 110.00 $ 7 4,000 8 3,000 110.00 $ 110.00 800,000 After-Tax Salvage Value Salvage Value Book Value (Year 8) Capital Gain/Loss Taxes Net SV (SV-Taxes) 20% 14.29% 114,320 685,680 24.49% 195,920 489,760 17.49% 139,920 349,840 12.49% 99,920 249,920 8.92% 71,360 178,560 8.93% 71,440 107,120 8.93% 71,440 35,680 4.46% 35,680 0 54,000 90,000 108,000 107,250 99,000 82,500 66,000 49,500 160,000 0 160,000 54,400 105,600 Required Net Working Capital Investment 20,000 Given Data and Projected Revenues – Table 9.9 Barton College 33 Majestic Mulch & Compost Co Majestic Mulch and Compost Company (MMCC) YEAR Background Data: Unit Sales Estimates Variable Cost /unit Fixed Costs per year Sale Price per unit Tax Rate Required Return on Project Yr 0 NWC NWC % of sales Equipment cost - installed Salvage Value in year 8 0 1 3,000 60.00 25,000.00 120.00 $ 120.00 34.0% 15.0% 20,000.00 15% 800,000 20% of equipment cost $ $ $ $ $ Depreciation Calculations: Equipment Depreciable Base MACRS % (Eqpt-7 yr) Recovery Allowance Book Value 2 3 5,000 $ 120.00 4 6,000 $ 120.00 5 6,500 $ 110.00 6 6,000 $ 110.00 7 5,000 $ 110.00 8 4,000 $ 110.00 3,000 $ 110.00 800,000 After-Tax Salvage Value Salvage Value Book Value (Year 8) Capital Gain/Loss Taxes Net SV (SV-Taxes) 20% 14.29% 114,320 685,680 24.49% 195,920 489,760 17.49% 139,920 349,840 12.49% 99,920 249,920 8.92% 71,360 178,560 8.93% 71,440 107,120 8.93% 71,440 35,680 4.46% 35,680 0 54,000 90,000 108,000 107,250 99,000 82,500 66,000 49,500 160,000 0 160,000 54,400 105,600 Required Net Working Capital Investment 20,000 Barton College Depreciation and After-Tax Salvage - Table 9.10 34 Majestic Mulch & Compost Co Majestic Mulch and Compost Company (MMCC) YEAR Background Data: Unit Sales Estimates Variable Cost /unit Fixed Costs per year Sale Price per unit Tax Rate Required Return on Project Yr 0 NWC NWC % of sales Equipment cost - installed Salvage Value in year 8 0 $ $ $ $ $ Depreciation Calculations: Equipment Depreciable Base MACRS % (Eqpt-7 yr) Recovery Allowance Book Value After-Tax Salvage Value Salvage Value Book Value (Year 8) Capital Gain/Loss Taxes Net SV (SV-Taxes) 1 3,000 60.00 25,000.00 120.00 $ 120.00 34.0% 15.0% 20,000.00 15% 800,000 20% of equipment cost 2 3 5,000 $ 120.00 4 6,000 $ 120.00 5 6,500 $ 110.00 6 6,000 $ 110.00 7 5,000 $ 110.00 8 4,000 $ 110.00 3,000 $ 110.00 800,000 20% 14.29% 114,320 685,680 24.49% 195,920 489,760 17.49% 139,920 349,840 12.49% 99,920 249,920 8.92% 71,360 178,560 8.93% 71,440 107,120 8.93% 71,440 35,680 4.46% 35,680 0 54,000 90,000 108,000 107,250 99,000 82,500 66,000 49,500 160,000 0 160,000 54,400 105,600 Required Net Working Capital Investment 20,000 Net Working Capital – Table 9.12 Barton College 35 Majestic Mulch & Compost Co YEAR Initial Investment Equipment Cost Sales Variable Costs Fixed Costs Depreciation (Eqpt)) 0 1 2 3 4 5 6 7 8 (800,000) EBT Taxes Net Operating Income 360,000 180,000 25,000 114,320 40,680 13,831 26,849 600,000 300,000 25,000 195,920 79,080 26,887 52,193 720,000 360,000 25,000 139,920 195,080 66,327 128,753 715,000 390,000 25,000 99,920 200,080 68,027 132,053 660,000 360,000 25,000 71,360 203,640 69,238 134,402 550,000 300,000 25,000 71,440 153,560 52,210 101,350 440,000 240,000 25,000 71,440 103,560 35,210 68,350 330,000 180,000 25,000 35,680 89,320 30,369 58,951 195,920 248,113 (36,000) 139,920 268,673 (18,000) 99,920 231,973 750 71,360 205,762 8,250 71,440 172,790 16,500 71,440 139,790 16,500 Add back Depreciation CASH FLOW from Operations NWC investment & Recovery Salvage Value TOTAL PROJECTED CF (20,000) 114,320 141,169 (34,000) (820,000) 107,169 212,113 250,673 232,723 214,012 189,290 156,290 35,680 94,631 66,000 105,600 266,231 Discounted Cash Flows (820,000) 93,190 160,388 164,821 133,060 106,402 81,835 58,755 87,031 Cumulative Cash flows (820,000) (712,831) (500,718) (250,046) (17,323) 196,690 385,979 542,269 808,500 NPV IRR Payback $65,483 17.24% 4.08 MMC Pro Forma Income Statements Barton College 36 Majestic Mulch & Compost Co YEAR Initial Investment Equipment Cost Sales Variable Costs Fixed Costs Depreciation (Eqpt)) 0 1 2 3 4 5 6 7 8 (800,000) EBT Taxes Net Operating Income 360,000 180,000 25,000 114,320 40,680 13,831 26,849 600,000 300,000 25,000 195,920 79,080 26,887 52,193 720,000 360,000 25,000 139,920 195,080 66,327 128,753 715,000 390,000 25,000 99,920 200,080 68,027 132,053 660,000 360,000 25,000 71,360 203,640 69,238 134,402 550,000 300,000 25,000 71,440 153,560 52,210 101,350 440,000 240,000 25,000 71,440 103,560 35,210 68,350 330,000 180,000 25,000 35,680 89,320 30,369 58,951 195,920 248,113 (36,000) 139,920 268,673 (18,000) 99,920 231,973 750 71,360 205,762 8,250 71,440 172,790 16,500 71,440 139,790 16,500 Add back Depreciation CASH FLOW from Operations NWC investment & Recovery Salvage Value TOTAL PROJECTED CF (20,000) 114,320 141,169 (34,000) (820,000) 107,169 212,113 250,673 232,723 214,012 189,290 156,290 35,680 94,631 66,000 105,600 266,231 Discounted Cash Flows (820,000) 93,190 160,388 164,821 133,060 106,402 81,835 58,755 87,031 Cumulative Cash flows (820,000) (712,831) (500,718) (250,046) (17,323) 196,690 385,979 542,269 808,500 NPV IRR Payback $65,483 17.24% 4.08 MMC Projected Cash Flows – Table 9.14 Barton College 37 Evaluating NPV Estimates • NPV estimates are only estimates • Forecasting risk: –Sensitivity of NPV to changes in cash flow estimates • The more sensitive, the greater the forecasting risk • Sources of value • Barton College Be able to articulate why this project creates value 38 Scenario Analysis • Examines several possible situations: –Worst case –Base case or most likely case –Best case • Provides a range of possible outcomes Barton College 39 Scenario Analysis Example Units Price/unit Variable cost/unit Fixed cost/year $ $ $ Base 6,000 80.00 $ 60.00 $ 50,000 $ BASE Lower 5,500 75.00 $ 58.00 $ 45,000 $ BEST Upper 6,500 85.00 62.00 55,000 WORST Initial investment $ 200,000 Depreciated to salvage value of 0 over 5 years Deprec/yr $ 40,000 Project Life 5 years Tax rate 34% Required return 12% Note: “Lower” ≠ Worst Barton College “Upper” ≠ Best 40 Scenario Analysis Example Units Price/unit Variable cost/unit Fixed Cost Sales Variable Cost Fixed Cost Depreciation EBIT Taxes Net Income + Deprec $ 480,000 360,000 50,000 40,000 30,000 10,200 19,800 40,000 $ WORST 5,500 75.00 $ 62.00 $ 55,000 $ 412,500 $ 341,000 55,000 40,000 (23,500) (7,990) (15,510) 40,000 BEST 6,500 85.00 58.00 45,000 552,500 377,000 45,000 40,000 90,500 30,770 59,730 40,000 TOTAL CF 59,800 24,490 99,730 NPV 15,566 (111,719) 159,504 IRR Barton College $ $ $ BASE 6,000 80.00 $ 60.00 $ 50,000 $ 15.1% -14.4% 40.9% 41 Problems with Scenario Analysis • Considers only a few possible out-comes • Assumes perfectly correlated inputs – All “bad” values occur together and all “good” values occur together • Focuses on stand-alone risk, although subjective adjustments can be made Barton College 42 Sensitivity Analysis • Shows how changes in an input variable affect NPV or IRR • Each variable is fixed except one – Change one variable to see the effect on NPV or IRR • Answers “what if” questions Barton College 43 Sensitivity Analysis: Units Price/unit Variable cost/unit Fixed cost/year Unit Sales $ $ $ Base 6,000 80 60 50,000 Units 5,500 80 60 50,000 Units 6,500 80 60 50,000 Initial investment $ 200,000 Depreciated to salvage value of 0 over 5 years Deprec/yr $ 40,000 Unit Sales Sensitivity 50,000.00 40,000.00 34% 12% Units Price/unit Variable cost/unit Fixed cost BASE 6,000 80 $ 60 $ 50,000 $ $39,357 30,000.00 NPV 20,000.00 $15,566 10,000.00 0.00 5,500 -10,000.00 Tax rate Required Return 6,000 $(8,226) -20,000.00 Unit Sales 6,500 Sales Variable Cost Fixed Cost Depreciation EBIT Taxes Net Income + Deprec $ $ $ $ TOTAL CF NPV Barton College 480,000 360,000 50,000 40,000 30,000 10,200 19,800 40,000 $ 59,800 $ 15,566 $ UNITS 5,500 80 $ 60 $ 50,000 $ 440,000 330,000 50,000 40,000 20,000 6,800 13,200 40,000 $ UNITS 6,500 80 60 50,000 520,000 390,000 50,000 40,000 40,000 13,600 26,400 40,000 53,200 66,400 (8,226) $ 39,357 44 Sensitivity Analysis: Units Price/unit Variable cost/unit Fixed cost/year Fixed Costs Initial investment $ 200,000 Depreciated to salvage value of 0 over 5 years Deprec/yr $ 40,000 Fixed Cost Sensitivity $ $ $ Base Fixed Cost Fixed Cost 6,000 6,000 6,000 80 80 80 60 60 60 50,000 55,000 45,000 Tax rate Required Return 34% 12% Units Price/unit Variable cost/unit Fixed cost $ $ $ BASE 6,000 80 $ 60 $ 50,000 $ Sales Variable Cost Fixed Cost Depreciation EBIT Taxes Net Income + Deprec $ 480,000 360,000 50,000 40,000 30,000 10,200 19,800 40,000 $ 480,000 360,000 55,000 40,000 25,000 8,500 16,500 40,000 $ 480,000 360,000 45,000 40,000 35,000 11,900 23,100 40,000 59,800 56,500 63,100 30,000.00 $27,461 25,000.00 NPV 20,000.00 FC 6,000 80 60 45,000 $15,566 15,000.00 10,000.00 5,000.00 $3,670 0.00 $45,000 $50,000 Fixed Cost $55,000 TOTAL CF NPV Barton College FC 6,000 80 $ 60 $ 55,000 $ $ 15,566 $ 3,670 $ 45 27,461 Sensitivity Analysis: • Strengths – Provides indication of stand-alone risk. – Identifies dangerous variables. – Gives some breakeven information. • Weaknesses – Does not reflect diversification. – Says nothing about the likelihood of change in a variable. – Ignores relationships among variables. Barton College 46 Disadvantages of Sensitivity and Scenario Analysis • Neither provides a decision rule. –No indication whether a project’s expected return is sufficient to compensate for its risk. • Ignores diversification. –Measures only stand-alone risk, which may not be the most relevant risk in capital budgeting. Barton College 47 Managerial Options • Contingency planning • Option to expand – Expansion of existing product line – New products – New geographic markets • Option to abandon – Contraction – Temporary suspension • Option to wait • Strategic options Barton College 48 Capital Rationing • Capital rationing occurs when a firm or division has limited resources – Soft rationing – the limited resources are temporary, often selfimposed – Hard rationing – capital will never be available for this project • The profitability index (PI) is a useful tool when faced with soft rationing Barton College 49 END 9-50 Review A few Relationships • Variable Cost = VC = Q * V – V = cost per unit – Q = number of units • FC = Fixed Cost • Total Cost = TC = FC + VC • Sales (S) = Revenue = P * Q – P = Price per unit • Operating Profit = Sales – TC • Depreciation = D • Operating Profit = EBIT • Operational Cash Flow = OCF = EBIT + D - Taxes • We know that: – – – – OCF = EBIT + D – Tax OCF = (S - VC - FC) - D) + D – Tax OCF = S – VC – FC – Tax OCF = (PxQ) – (VxQ) – FC - Tax Barton College Marketing & Sales Manufacturing, Control & Supply Chain 51 2nd Version of Majestic Mulch Barton College 52 More Complex Barton College 53