Finding Growth in the Beverage Industry

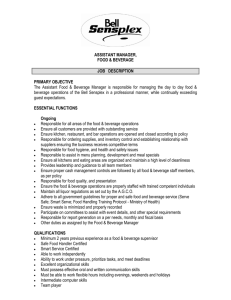

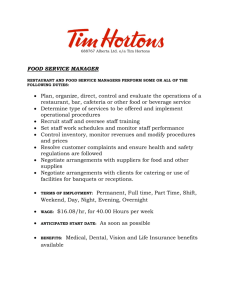

advertisement

Finding Growth in the Beverage Industry 1/6/2016 3:03:51 PM By Brian Reed The beverage industry has seen many changes during the past few years, as up-andcoming trends push companies to find new ways to drive sales. In the past year, the refreshment beverage industry as a whole has seen a volume sales increase of 3 percent. However, this growth trend doesn’t represent the entire category, as many segments within it have seen sales decline. Carbonated soft drinks (CSD) and refrigerated orange juice, for instance, have both endured negative compounded annual growth rates (CAGR) for the past five years, down by 3 percent and 4 percent, respectively. Given that these and other big players in the beverage market have seen their sales decrease, it forces us to ask, what is driving the growth? Let’s look at the data. Traditional Out, Alternative In Like many industries, the beverage industry has recently seen an upward trend of health and wellness products. While sales of traditional drinks continue to decline, alternative products, including natural and organic beverages, continue to see sales growth. In fact, even though natural refreshment drinks (as defined by our partner SPINS) account for only 6.6 percent of the beverage category, they are driving 31 percent of dollar growth. After seeing these impressive trends, one of my SPINS colleagues and I were intrigued to dig deeper. We found some interesting dynamics around current innovation in beverages. In the past year, the average amount spent per buyer on refreshment beverages was $217. However, the natural refreshment buyer spent $30 more throughout the year – a difference of 14 percent. Innovation and distinguishable package design have helped increase sales of natural beverages, leading consumers to spend nearly $2 billion in this high growth area. Innovative products ranging from new types of drinks like Kombucha or fermented items, to new twists on old standards such as ‘matcha’ tea or ‘cold-brewed’ coffee, are winning over natural refreshment buyers and are driving most of the category growth. Innovation Creates Opportunity for Growth Although alternative drink sales are booming, due to the decline of traditional beverage sales, manufacturers have had to be inventive to encourage consumer spending. Packaging diversification has allowed CSD manufacturers to be creative with their product packaging and sizing in order to combat declining sales. For instance, instead of offering a 12 pack of 12-oz cans, manufacturers now also offer an 8 pack of 8-oz cans – and sell it at a premium per ounce rate compared to the heavily promotion-driven 12pack. Even though the 8-pack has a lower overall volume, consumers are willing to pay more per ounce because of the lure of the new packaging design. In addition to re-invigorating their product design, manufacturers and retailers should analyze not only which categories are driving growth, but also who is in these categories. If natural refreshment beverages are leading sales, who is buying them? In general, natural beverage buyers are more likely to be: Young – under 35, singles and couples Multi-cultural Educated – diverse, non-Caucasian – college graduates or higher Along with generally being young, multi-cultural and educated, the natural beverage buyer is also more likely to buy more and to be more experimental in what he or she buys. These characteristics have led alternative beverage products to be the agent for growth within the beverage industry; they are turning today’s alternative beverages into tomorrow’s mainstream buys. Although natural beverage buyers typically fit the above description, they are not exclusive to these groups. In fact, significant dollar sales come from groups outside the marketing target for these items and should not be overlooked. Retailer Strategy Since non-traditional segments such as natural/organics are responsible for driving beverage sales, retailers can apply this information to extend growth in the aisle in three key ways: Think nontraditionally about the CSD aisle. Retailers should planogram for base volume and use surge areas for promotional products. Recognize that natural beverages are driving growth in the aisle and not just the perimeter of the store. Plan adjacencies thoughtfully. Cross-purchasing opportunities are vast and retailers should act to use these to their advantage. Make the experimenting ‘stickier.’ High ring trial buys are great, but repeat buys are even better. Before attacking promotional pricing, retailers should explore everyday pricing and make sure it is appropriate. By using these strategies, retailers can expand beverage industry growth opportunities well beyond the health and wellness categories. I recently presented this information at the BevNet Live Winter Conference with Kathryn Peters from SPINS. If you have any questions on key beverage trends and growth opportunities, contact me at Brian.Reed@IRIworldwide.com.