ch7

advertisement

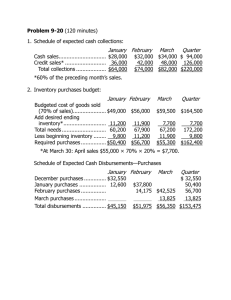

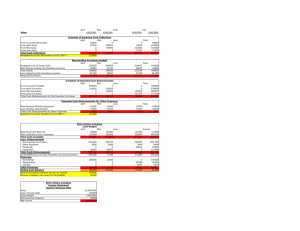

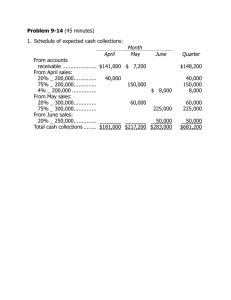

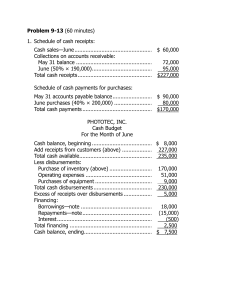

Chapter 7: Introduction to Budgets and Preparing the Master Budget A budget: (reading) A comprehensive financial overview of planned company operations. A formal, quantitative expression of management plans. Advantages of Budgets :( reading) 1. Evaluation of Activities: It provides an opportunity for managers to reevaluate existing activities and evaluate possible new activities. 2. Formalization of Planning: It forces managers to think ahead. 3. Communication and Coordination: It aids managers in communicating objectives to units and coordinating actions across the organization. 4. Performance Evaluation: It provides benchmarks to evaluate subsequent performance. Types of Budgets: 1. 2. 3. 4. 5. Strategic plan Long-range planning Capital budget Master budget Continuous budget Strategic Plan: The most forward-looking budget which sets the overall goals and objectives of the organization. Long-range planning: The strategic plan leads to long-range planning, which produces forecasted financial statements for five- to ten-year periods. Long-range planning includes decisions about the addition or deletion of product lines, design and location of new plants, acquisition of buildings and equipment, and other long-term commitments. Capital budget: Detail the planned expenditures for facilities, equipment, new products, and other long-term investments in coordination with long-range plans. Master budget (Pro Forma Statements): Link both long-range plans and short-term budgets. a detailed and comprehensive analysis of the first year of the long-range plan. 1 It summarizes the planned activities of all subunits of an organization (Sales, Production, Distribution, and Finance). It is a periodic business plan that includes a coordinated set of detailed operating schedules and financial statements. Continuous Budget (Rolling budgets): A common form of master budgets that add a month in the future as the month just ended is dropped. This type of budget forces managers to think specifically about the full next year not just the remained of the current fiscal year. Managers may also prepare daily or weekly task-oriented budgets that help them carry out their particular functions and meet operating and financial goals Components of a Master Budget: The usual master budget for a nonmanufacturing company has the following components: 1. Operating Budget (profit plan): focuses on the income statement and its supporting schedules. a. Sales budget b. Purchases budget c. Cost of goods sold budget d. Operating expenses budget e. Budgeted income statement 2. Financial budget focuses on the effects that the operating budget and other plans (e.g., capital budgets and repayments of debt) will have on cash. 7-26 f. Capital budget g. Cash budget h. Budgeted balance sheet (5 min.) 1. a. Budgeted income statement b. Budgeted balance sheet c. Cash budget 2 d. Capital budget 2. Sales budget (or operating budget) 3. Continuous (rolling) 4. Overall goals of the organization Preparing the master budget: The cooking hut example …p306 The principal steps in preparing the master budget Step 1: Preparing Basic Data: b- cash collection from customers a- sales budget :( basically differentiate between cash and credit sales we made) In preparing it we'll search for the following: 1. Budgeted sales for forthcoming years (total). 2. Selling term: Ex: Cash sales 60%, credit sales 40%& and the credit sales (or accounts receivable) will be collected next month. : (this reflects the cash that I'll collect this month from my customers in return for sales that I made during this month or in prior months) Form the information given above we understand that: In April: we'll collect the following: 1. All April (current month) cash sales. 2. All march (previous month) credit sales. 3 March Sales term April May June July April-July total Schedule a:sales budget Credit sales( 40% sales) + Cash sales(60% sales) ooo xxx ooo xxx ooo xxx ooo xxx ooo xxx Total sales Schedule b: cash collections This month cash sales +previous month credit sales Total collections c- purchases and cog budget d- disbursements for purchases aim to provide a picture of my need of inventory that I'll buy. Purchases = amount of inventory needed – beginning inventory Amount of inventory needed = cog + ending inventory So it can be as following: Purchases = cog + ending inventory – beginning inventory will tell how much money I'll pay this month for the purchases of inventory that I made either in this month or in previous ones. In preparing these schedules, we need information about: 1. Budgeted sales (total)…. And 3 %: 2. Cog% 4 Ex: 70%... and of course it'll be lower than 100% as it reflect that I buy the goods at a price lower that S.P by 60%= gross margin % 3. Minimum inventory policy Ex: 20,000 + 80% of next month cog….it means that the company has a policy to finish the month with inventory at its warehouses of 20000 and 80% of the following month purchases… and t do this because it frightened that the supplier delaying in providing the good it want to sell… Purchasing policy Ex: 50% will be paid during the month of purchase and 50%at the following month… so on April we 'll pay : Part of the current month purchases (50%) + part of purchases not paid on previous month and we will pay it during this month ( accounts payable of previous month). March April Schedule c: purchases budget Budgeted cog( 70% this month sales) + desired ending inventory[20000+80%next month cog--- (70% of next month sales)] -Beg inventory (ending of prior month) xxx purchases * 50% Given purchase terms Schedule d: cash disbursement for purchases 50% of previous month purchases +50% of this month purchases *50% Ooo xxx 5 May June July April-July total Disbursements for purchases e- operating expense budget f- disbursemnets of operating expenses Operating expenses schedule details: Variable costs: commissions and miscellaneous expenses. Fixed costs: Cash expenses: amounts of wages, rent.. Noncash expenses: insurance and depreciation expenses for each month. ---- won't be included on schedule (f), disbursements of operating expenses March Schedule e:operating expenses budget Wages ( fixed) + Commissions( 15% of current's month sales) April xxx Total wages and commissions Miscellaneous expense (5% of current sales) Rent Insurance fixed Depreciation *50% Total operating expense Schedule f: cash collections Wages and commissions Miscellaneous expense rent Total disbursements 6 May June July April-July total Step 2: Preparing the Operating Budget totals Sales -cog =gross margin -operating expenses =income from operations -interest expense Net income Cash budget Step 3: Preparation of Financial Budget (We will focus only on the cash budget) Cash Budget: The cash budget is constructed using three major sections: First: the available cash balance = beg. Cash balance – min cash balance desired Second: net cash receipts and disbursements: 1. Expected cash receipts (Schedule b) 2. cash disbursements for purchases (Schedule d), 3. disbursements for operating expenses (Schedule f), 4. and other disbursements include outlays for fixed costs, long term investments, dividends and the like. third: An excess or deficiency of cash is computed as the difference between the cash available and the total cash needed in order to determine whether the company needs to borrow funds or if prior borrowings and interest may be paid off. 7 The available cash balance + net cash receipts and disbursements= -ve----- cash deficiency Borrowing is necessary +ve….loan repayment (for both together) (Watch if he said borrow in multiplies if 1000) principal Interest: part of p repaid * %*no of months this part remain with me \ 12) So cash budget shows the patterns of short-term, (self-liquidating) financing. The resulting loan is (self-liquidating) –as the company uses borrowed money to acquire merchandise for sale, and uses the proceeds from sale to repay the loan .this (working capital cycle) moves from cash to inventory to receivables and back to cash. April Beginning cash balance ( ending for prior periods) - Minimum cash balance desired (fixed, given) Available cash balance(x) Cash receipts and disbursements: 1. Collections to customers (Schedule b) 2. cash disbursements for purchases (Schedule d), 3. disbursements for operating expenses (Schedule f), 4. and other disbursements include outlays for fixed costs, long term investments, dividends and the like( given) Net cash receipts and disbursements(y) Excess (deficiency) of cash before financing x+y Financing: deficit : Borrowing --- ( at the beginning of the month) 8 May June July excess : Repayments --- ( at the end of the month) Interest payments Total cash increase ( decrease) from financing Ending cash balance (beginning balance +y +x) Another form of the cash budget (simpler way): Beginning cash balance + cash receipts from customers -cash disbursements for purchases -cash disbursements for operating expenses -any other cash disbursements The cash we have - minimum cash we need = Ending cash balance If the ending number was negative this means that we 'll borrow to cover this deficit, so 'll add extra section: + Finance / borrowing / loan = Ending cash balance And on the next month we have positive ending balance we 'll add extra items to cash disbursements representing in repayment loan interest paid = part of loan that we repay during current month * no of months passed since we take loan /12 * % 9