Other Suggested

advertisement

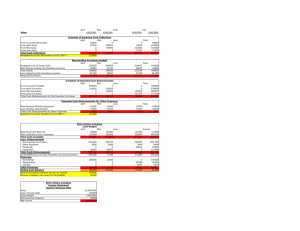

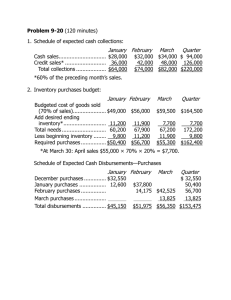

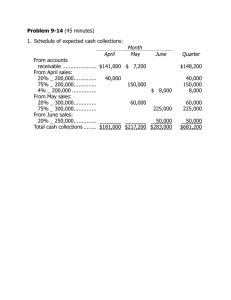

Problem 9-13 (60 minutes) 1. Schedule of cash receipts: Cash sales—June ............................................................ $ 60,000 Collections on accounts receivable: May 31 balance ........................................................... 72,000 June (50% × 190,000) ................................................. 95,000 Total cash receipts .......................................................... $227,000 Schedule of cash payments for purchases: May 31 accounts payable balance .................................... $ 90,000 June purchases (40% × 200,000) ................................... 80,000 Total cash payments ....................................................... $170,000 PHOTOTEC, INC. Cash Budget For the Month of June Cash balance, beginning ................................................. $ 8,000 Add receipts from customers (above) .............................. 227,000 Total cash available......................................................... 235,000 Less disbursements: Purchase of inventory (above) ...................................... 170,000 Operating expenses ..................................................... 51,000 Purchases of equipment ............................................... 9,000 Total cash disbursements ................................................ 230,000 Excess of receipts over disbursements ............................. 5,000 Financing: Borrowings—note ........................................................ 18,000 Repayments—note ....................................................... (15,000) Interest ....................................................................... (500) Total financing ............................................................... 2,500 Cash balance, ending ...................................................... $ 7,500 Problem 9-13 (continued) 2. PHOTOTEC, INC. Budgeted Income Statement For the Month of June Sales .............................................................................$250,000 Cost of goods sold: Beginning inventory ..................................................... $ 30,000 Add purchases ............................................................. 200,000 Goods available for sale ............................................... 230,000 Ending inventory.......................................................... 40,000 Cost of goods sold ....................................................... 190,000 Gross margin ................................................................. 60,000 Operating expenses ($51,000 + $2,000) .......................... 53,000 Net operating income ..................................................... 7,000 Interest expense ............................................................ 500 Net income ....................................................................$ 6,500 3. PHOTOTEC, INC. Budgeted Balance Sheet June 30 Assets Cash ..............................................................................$ 7,500 Accounts receivable (50% × 190,000) ............................. 95,000 Inventory ....................................................................... 40,000 Buildings and equipment, net of depreciation ($500,000 + $9,000 – $2,000) ..................................... 507,000 Total assets ....................................................................$649,500 Liabilities and Equity Accounts payable (60% × 200,000) ................................$120,000 Note payable.................................................................. 18,000 Capital stock .................................................................. 420,000 Retained earnings ($85,000 + $6,500) ............................ 91,500 Total liabilities and equity ................................................$649,500 Problem 9-18 (60 minutes) 1. a. Schedule of expected cash collections: First Year 2 Quarter Second Third Fourth Year 1—Fourth quarter sales: $300,000 × 65% ......................................................... $195,000 Year 2—First quarter sales: $400,000 × 33% ......................................................... 132,000 $400,000 × 65% ......................................................... $260,000 Year 2—Second quarter sales: $500,000 × 33% ......................................................... 165,000 $500,000 × 65% ......................................................... $325,000 Year 2—Third quarter sales: $600,000 × 33% ......................................................... 198,000 $600,000 × 65% ......................................................... $390,000 Year 2—Fourth quarter sales: $480,000 × 33% ......................................................... 158,400 Total cash collections ...................................................... $327,000 $425,000 $523,000 $548,400 Problem 9-18 (continued) b. Schedule of budgeted cash disbursements for merchandise purchases: First Year 2 Quarter Second Third Fourth Year 1—Fourth quarter purchases: $180,000 × 80% ......................................................... $144,000 Year 2—First quarter purchases: $260,000 × 20% ......................................................... 52,000 $260,000 × 80% ......................................................... $208,000 Year 2—Second quarter purchases: $310,000 × 20% ......................................................... 62,000 $310,000 × 80% ......................................................... $248,000 Year 2—Third quarter purchases: $370,000 × 20% ......................................................... 74,000 $370,000 × 80% ......................................................... $296,000 Year 2—Fourth quarter purchases: $240,000 × 20% ......................................................... 48,000 Total cash disbursements ................................................ $196,000 $270,000 $322,000 $344,000 Problem 9-18 (continued) 2. First Year 2 Quarter Second Third Fourth Budgeted sales............................................................... $400,000 $500,000 $600,000 $480,000 Variable expense rate ..................................................... × 12% × 12% × 12% × 12% Variable expenses........................................................... 48,000 60,000 72,000 57,600 Fixed expenses .............................................................. 90,000 90,000 90,000 90,000 Total expenses ............................................................... 138,000 150,000 162,000 147,600 Less depreciation ........................................................... 20,000 20,000 20,000 20,000 Cash disbursements ....................................................... $118,000 $130,000 $142,000 $127,600 Year $1,980, ×1 237, 360, 597, 80, $ 517, Problem 9-18 (continued) 3. Cash budget for Year 2: First Year 2 Quarter Second Third Fourth Cash balance, beginning ................................................... $ 20,000 $ 23,000 $ 18,000 $ 18,500 Add collections from sales ................................................. 327,000 425,000 523,000 548,400 Total cash available ........................................................... 347,000 448,000 541,000 566,900 Less disbursements: Merchandise purchases .................................................. 196,000 270,000 322,000 344,000 Operating expenses ....................................................... 118,000 130,000 142,000 127,600 Dividends ...................................................................... 10,000 10,000 10,000 10,000 Land.............................................................................. 0 80,000 48,500 0 Total disbursements .......................................................... 324,000 490,000 522,500 481,600 Excess (deficiency) of receipts over disbursements ............................................................. 23,000 (42,000) 18,500 85,300 Financing: Borrowings .................................................................... 0 60,000 0 0 Repayments................................................................... 0 0 0 (60,000) Interest* ....................................................................... 0 0 0 (4,500) Total financing .................................................................. 0 60,000 0 (64,500) Cash balance, ending ........................................................ $ 23,000 $ 18,000 $ 18,500 $ 20,800 *60,000 × 10% × 9/12 = $4,500.