Credit Laws and Terms

advertisement

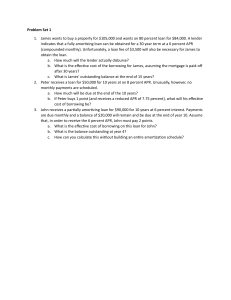

Credit Rights/Laws and Bankruptcy Section 6.2, 6.3, 6.4 Act or Law Purpose and Function Truth in Lending Act Equal Credit Opportunity Act Fair Credit Reporting Act Consumer Credit Reporting Reform Fair Debt Collections Practices (together) What is the difference between closed-end credit (installment credit) and open-ended credit (revolving credit)? Define Secured Loan Define Collateral Define APR (Annual Percent Rate) Define Grace Period According to the Consumer Credit Protection Act, how much are you legally required to pay if someone uses your credit card illegally? How will you plan to stay out of debt? Think through the process of obtaining a loan. As you read through Chapter 6, many factors affect how much a loan will cost you. Some of these factors are listed below. For each factor, determine whether it would drive the overall cost of loan up or down. Put those items which will make a loan expensive on the “Up” arrow and those factors which are would make a loan less expensive on the “Down” arrow. Place the follow items next to the appropriate arrow. borrowing from family member borrowing from credit union high APR collateral large down payment shorter term simple interest on declining balance making minimum monthly payments borrowing from retail stores borrowing from finance companies low APR add-on interest minimal down payment longer term simple interest