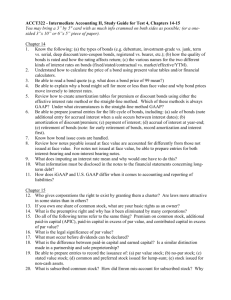

Bridger Bike Corp. manufactures mountain bikes and distributes

advertisement

Bridger Bike Corp. manufactures mountain bikes and distributes them through retail outlets in Montana, Idaho, Oregon, and Washington. Bridger Bike Corp. has declared the following annual dividends over a six-year period ending December 31 of each year: 2005, $5,000; 2006, $18,000; 2007, $45,000; 2008, $45,000; 2009, $60,000; and 2010, $67,000. During the entire period, the outstanding stock of the company was composed of 10,000 shares of 2% cumulative preferred stock, $100 par, and 25,000 shares of common stock, $1 par. Instructions 1. Determine the total dividends and the per-share dividends declared on each class of stock for each of the six years. There were no dividends in arrears on January 1, 2005. Summarize the data in tabular form, using the following column headings: Year 2005 2006 2007 2008 2009 2010 Dividends $ 5,000 18,000 45,000 45,000 60,000 67,000 Total Dividends P/S Total Dividends C/S 2. Determine the average annual dividend per share for each class of stock for the sixyear period. 3. Assuming a market price of $125 for the preferred stock and $8 for the common stock, calculate the average annual percentage return on initial shareholders’ investment, based on the average annual dividend per share (a) for preferred stock and (b) for common stock. SOAL II Krisch Enterprises Inc. produces aeronautical navigation equipment. The stockholders’ equity accounts of Krisch Enterprises Inc., with balances on January 1, 2010, are as follows: Common Stock, $20 stated value (250,000 shares authorized, 175,000 shares issued) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Paid-In Capital in Excess of Stated Value . . . . . . . . . . . . . . . . . . Retained Earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Treasury Stock (40,000 shares, at cost) . . . . . . . . . . . . . . . . . . . . $3,500,000 1,750,000 4,600,000 1,000,000 The following selected transactions occurred during the year: Jan. 6. Paid cash dividends of $0.40 per share on the common stock. The dividend had been properly recorded when declared on November 29 of the preceding fiscal year for $54,000. Mar. 9. Sold all of the treasury stock for $1,350,000. Apr. 3. Issued 50,000 shares of common stock for $1,700,000. July 30. Declared a 2% stock dividend on common stock, to be capitalized at the market price of the stock, which is $36 per share. Aug. 30. Issued the certificates for the dividend declared on July 30. Nov. 7. Purchased 25,000 shares of treasury stock for $800,000. Dec. 30. Declared a $0.45-per-share dividend on common stock. 31. Closed the credit balance of the income summary account, $400,000. 31. Closed the two dividends accounts to Retained Earnings. Instructions 1. Enter the January 1 balances in T accounts for the stockholders’ equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions, and post to the eight selected accounts. 3. Prepare a retained earnings statement for the year ended December 31, 2010. 4. Prepare the Stockholders’ Equity section of the December 31, 2010, balance sheet. SOAL III Three different plans for financing a $10,000,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate is estimated at 40% of income. Plan 1 10% bonds $ 5,000,000; Preferred 10% stock, $40 par $ 5,000,000; Common stock, $10 par $ 2,500,000; Plan 2 $$5,000,000 $5,000,000 Plan 3 $$$10,000,000 Instructions 1. Determine for each plan the earnings per share of common stock, assuming that the income before bond interest and income tax is $2,000,000. 2. Determine for each plan the earnings per share of common stock, assuming that the income before bond interest and income tax is $950,000. 3. Discuss the advantages and disadvantages of each plan. SOAL IV On July 1, 2010, Brower Industries Inc. issued $32,000,000 of 5-year, 12% bonds at an effective interest rate of 13%. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Instructions 1. Journalize the entry to record the amount of cash proceeds from the sale of the bonds. 2. Journalize the entries to record the following: a. The first semiannual interest payment on December 31, 2010, and the amortization of the bond discount, using the Effective Interest Rate Method. (Round to the nearest dollar.) b. The interest payment on June 30, 2011, and the amortization of the bond discount, using the Effective Interest Rate Method. (Round to the nearest dollar.) 3. Determine the total interest expense for 2010. SOAL V The following transactions were completed by Hobson Inc., whose fiscal year is the calendar year: 2010 July 1. Oct. 1. Dec. 31. 31. 31. 31. Issued $18,000,000 of five-year, 10% callable bonds dated July 1, 2010, at an effective rate of 12%, receiving cash of $16,675,184. Interest is payable semiannually on December 31 and June 30. Borrowed $400,000 as a 10-year, 7% installment note from Marble Bank. The note requires annual payments of $56,951, with the first payment occurring on September 30, 2011. Accrued $7,000 of interest on the installment note. The interest is payable on the date of the next installment note payment. Paid the semiannual interest on the bonds. Recorded bond discount amortization of $132,482, which was determined using the straight-line method. Closed the interest expense account. 2011 June 30. Paid the semiannual interest on the bonds. Sept. 30. Paid the annual payment on the note, which consisted of interest of $28,000 and principal of $28,951. Dec. 31. Accrued $6,493 of interest on the installment note. The interest is payable on the date of the next installment note payment. 31. Paid the semiannual interest on the bonds. 31. Recorded bond discount amortization of $264,964, which was determined using the straight-line method. 31. Closed the interest expense account. 2012 June 30. Recorded the redemption of the bonds, which were called at 97. Sept. 30. Paid the second annual payment on the note, which consisted of interest of $25,973 and principal of $30,978. Dec. 31 Recorded interest payable on the installment note 2013 Sept. 30. Paid the third annual payment on the note Instructions 1. Journalize the entries to record the foregoing transactions. 2. Indicate the amount of the interest expense in (a) 2010 and (b) 2011. 3. Determine the carrying amount of the bonds as of December 31, 2011.