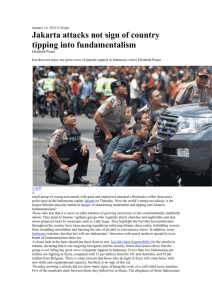

Jakarta

advertisement

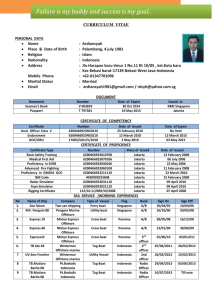

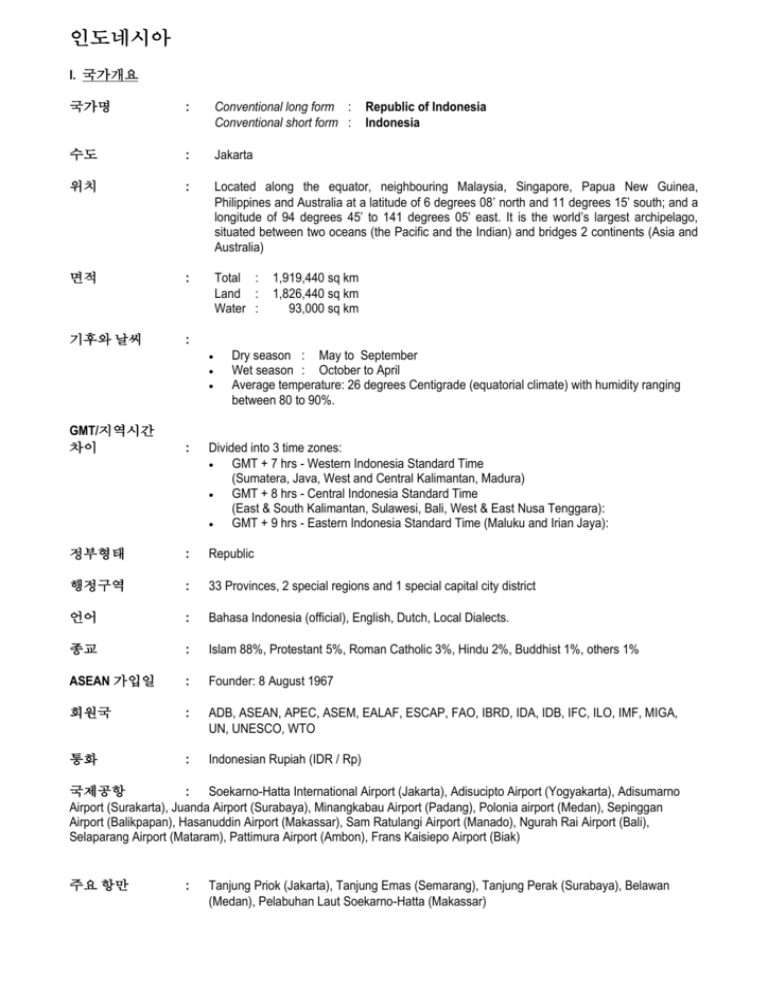

인도네시아 I. 국가개요 국가명 : Conventional long form : Conventional short form : 수도 : Jakarta 위치 : Located along the equator, neighbouring Malaysia, Singapore, Papua New Guinea, Philippines and Australia at a latitude of 6 degrees 08’ north and 11 degrees 15’ south; and a longitude of 94 degrees 45’ to 141 degrees 05’ east. It is the world’s largest archipelago, situated between two oceans (the Pacific and the Indian) and bridges 2 continents (Asia and Australia) 면적 : Total : Land : Water : 기후와 날씨 : Republic of Indonesia Indonesia 1,919,440 sq km 1,826,440 sq km 93,000 sq km Dry season : May to September Wet season : October to April Average temperature: 26 degrees Centigrade (equatorial climate) with humidity ranging between 80 to 90%. GMT/지역시간 차이 : Divided into 3 time zones: GMT + 7 hrs - Western Indonesia Standard Time (Sumatera, Java, West and Central Kalimantan, Madura) GMT + 8 hrs - Central Indonesia Standard Time (East & South Kalimantan, Sulawesi, Bali, West & East Nusa Tenggara): GMT + 9 hrs - Eastern Indonesia Standard Time (Maluku and Irian Jaya): 정부형태 : Republic 행정구역 : 33 Provinces, 2 special regions and 1 special capital city district 언어 : Bahasa Indonesia (official), English, Dutch, Local Dialects. 종교 : Islam 88%, Protestant 5%, Roman Catholic 3%, Hindu 2%, Buddhist 1%, others 1% ASEAN 가입일 : Founder: 8 August 1967 회원국 : ADB, ASEAN, APEC, ASEM, EALAF, ESCAP, FAO, IBRD, IDA, IDB, IFC, ILO, IMF, MIGA, UN, UNESCO, WTO 통화 : Indonesian Rupiah (IDR / Rp) 국제공항 : Soekarno-Hatta International Airport (Jakarta), Adisucipto Airport (Yogyakarta), Adisumarno Airport (Surakarta), Juanda Airport (Surabaya), Minangkabau Airport (Padang), Polonia airport (Medan), Sepinggan Airport (Balikpapan), Hasanuddin Airport (Makassar), Sam Ratulangi Airport (Manado), Ngurah Rai Airport (Bali), Selaparang Airport (Mataram), Pattimura Airport (Ambon), Frans Kaisiepo Airport (Biak) 주요 항만 : Tanjung Priok (Jakarta), Tanjung Emas (Semarang), Tanjung Perak (Surabaya), Belawan (Medan), Pelabuhan Laut Soekarno-Hatta (Makassar) 인도네시아 II. 주요 경제지표와 통계 All relevant indicators could be explored in the ASEAN Secretariat’s Website at www.aseansec.org/13100.htm III. 운용 비용 A. 사업비 1. Industrial Land Cost 위치 Asking Price /sq.m N/A 0.3 (rental) 55 - 65 35 - 40 38 - 42 40 - 60 Jakarta Bogor Bekasi Tangerang Karawang Serang Batam Source SFB Rent US$/sq.m.month 2.50 - 8.00 2.50 - 3.00 2.75 - 8.00 N/A 2.50 - 4.00 2.35 - 3.50 Maintentance Fee/ US$/sq.m/month 0.1 0.06 - 0.10 0.05 - 0.0675 0.04 - 006 0.05 0.05 : Colliers Jardine Indonesia (4Q 2005); Price Water House Cooper (2ndQ 2005) Province Jakarta Region / 위치 South Jakarta North Jakarta West Java Cibitung-Bekasi Lemahabang-Bekasi Cikarang-Bekasi Bekasi Karawang Kalihurip-Karawang Central Java Karawang BaratKarawang Semarang Semarang Cilacap Industrial Estate Abbreviation / Size / Tenants Cilandak Commercial Estate / 11,3 Ha/88 Kawasan Berikan Nusantara/KBN/594Ha/155 (Marunda, Cakung, Tanjung Priok) MM 2100 Industrial TownMM2100 BF / 200Ha / 10 Gobel Industrial Estate-KIG54Ha/n.a East Jakarta Industrial ParkEIJP/320Ha/82 Bekasi International Industrial Estate-BICC/200Ha/111 MM 2100-MMID/1,000Ha/136 Taman Niaga Karawang Prima-TKNP/400Ha/6 Kota Bukit Indah Industrial City-KBI ID/1300Ha/65 Kujang Industrial EstateKIE/140Ha/16 Karawang International Industrial City-KIIC/1,100Ha/64 Candi Industrial EstateCIE/600Ha/33 Taman Industri BSB/600/1 Kawasan Industry Tugu Wijayakusuma-250Ha/32 Price / Rental Land / Standard Factory Building (SFB) / Negotiable Rent: US$ 7.5-16.5 / m2 / month/ negotiable Land: US$ 7.5 / m2 / year SFB: US$ 3.2-3.5 / m2/ month Land: US$ 85/m2 Negotiable SFB: US$ 8/m2/month Negotiable Negotiable Negotiable Land: US$ 65/m2 Land: US$ 2 - 2.5 / m2 / month Negotiable SFB: US$ 1.75 / m2 / month Negotiable Negotiable 인도네시아 Riau Batam East Java Surabaya/Benowo Rungkut & Berbek, Surabaya Mojokerto West Sumatra Padang East Kalimantan Bontang South Sulawesi Makassar Batamindo Industrial ParkBIP/500Ha/81 Bintan Industrial Park-BIP/72/6 Kabil Industrial EstateKIE/180Ha/16 Surabaya Industrial Estate Benowo-SIEB/544Ha/n.a Surabya Industrial Estate Rungkut-SIER/826Ha/475 Ngoro Industrial Persada/400Ha/60 Padang Industrial ParkPIP/200Ha/5 Kaltim Industrial EstateKIE/230Ha/5 Kawasan Industri MakasarKIMA/703Ha/114 SFB: US$ 10-16.5 / m2 / month SFB: US$ 6.5 / m2 / month Negotiable Negotiable Negotiable Negotiable Negotiable Negotiable Negotiable Source: www.ina-industrialestate.com as quoted by BKPM Note : Industrial Estate registered with the association of industrial estate 2. Office Space Cost Type of Office Grade A* Grade B* Grade C** Average Office Lease - Rp base (per sq. m/mth) Average Office Lease - US$ (per sq. m/mth) Prime Area (CBD*** area) Sudirman – Thamrin – Rasuna Said – Gatot Subroto Rp. 123, 989 US$ 18.79 Rp. 42,250 US$ 5.92 Rp. 123, 989 US$ 18.79 Rp. 42,250 US$ 5.92 Rp. 85,000 - - - Outer CBD*** Rp 86,040 - Rp. 32,569 - 위치 Average Service Charge/sq.m/month Rp. US$ Batam Area Source: *Colliers Jardine Indonesia (4Q 2005); **Price Water House Cooper (2ndQ 2005) Other references could obtain in www.regus.com/go/indonesia/?trkid=officeindonesia Note: *** Central Business District 3. 공장 건설비 위치 Sale (average cost in US$) Standard Factory Building Jakarta Bekasi East Java US$ 75-100 US$ 40-80 Lease (per sq.m/mth) (average cost in US$) US$ 2.25 - 3.00 US$ 6 US$ 1.5 Warehouse Jakarta Cikampek - US$ 1.72 US$ 3.5 Type of Factory Source : www.ina-industrialestate.com ; Kawasan Berikat Nusantara 인도네시아 4. 창고 비용 Kawasan Berikat Nusantara Building: US$ 6.00/m2/month Space Only: Rp. 20.000/M2/month Open Space: US$ 7.50/m2/year Warehouse Jl. Nusantara II No. 3 Pelabuhan Tanjung Priok Storage Charges: US$ 750 Source: Kawasan Berikat Nusantara B. 생산비 1. 인건비 a. Minium Wage for Worker Position Average Monthly Median Salary 2006 (Rp) Provincial Minimum Wage-As of Jan 2006 (Rp/month) Nagroe Aceh Darussalam North Sumatera West Sumatera Riau Jambi South Sumatera Bangka Belitung Bengkulu Lampung West Java DKI Jakarta Banten Central Java D.I Yogyakarta East Java Bali West Nusa Tenggara East Nusa Tenggara West Kalimantan South Kalimantan Central Kalimantan East Kalimantan Maluku North Maluku Gorontalo North Sulawesi South East Sulawesi Central Sulawesi South Sulawesi Papua Source: Ministry of Manpower and Transmigration, 2006 as quoted by BKPM 820,000 737,794 650,000 637,000 563,000 604,000 640,000 516,000 505,000 447,654 819,100 661,613 450,000 460,000 390,000 510,000 550,000 550,000 512,000 629,000 634,260 684,000 575,000 528,000 527,000 713,500 573,400 575,000 612,000 822,500 인도네시아 b. Basic Wage Rate Position Professional Manager Clerks Selling Clerk Service Clerk Clerk Production staff Others Monthly Median Salary Range (Rp) 1,104,414 2,966,295 1,085,794 637,539 537,658 326,762 644,722 1,364,056 Source: Statistics Indonesia of The Republic of Indonesia (BPS as quoted by BKPM c. Salary Position Finance Account Clerk Payroll Clerk Credit Control Clerk Accounts Assistant Credit Control Officer Account Supervisor Credit Control Manager Financial Analyst Auditor Accounts Payable Manager Accountant Finance Manager Engineering & Technical Sales & Service Engineer Process Engineer Human Resource HR Clerk/Assistant Training Executive HR Officer/Executive Training Manager HR Manager Information Technology Helpdesk Analys Analyst Programmer Web Designer IT Executive System Progrmmer/ Software Engineer IT Administrator Network Administrator Database Administrator System Engineer Network Support Engineer ERP Consultant Account Manager Business Development Manager IT Manager Project Manager Logistic & Warehousing Operations Executive Warehouse/Store Assistant Shipping Assistant Shipping Supervisor Min Salary (Rp) Max. Salary (Rp) 2,000,000 2,000,000 1,800,000 2,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 8,000,000 8,000,000 20,000,000 3,500,000 3,000,000 2,500,000 3,500,000 4,000,000 6,000,000 9,000,000 12,000,000 12,000,000 12,000,000 12,000,000 30,000,000 6,000,000 5,000,000 9,000,000 11,000,000 2,000,000 5,000,000 6,000,000 10,000,000 15,000,000 2,500,000 10,000,000 10,000,000 15,000,000 25,000,000 3,000,000 4,000,000 4,000,000 5,000,000 6,000,000 5,000,000 5,000,000 4,000,000 5,000,000 5,000,000 8,000,000 8,000,000 12,000,000 15,000,000 20,000,000 6,000,000 6,000,000 6,000,000 8,000,000 10,000,000 8,000,000 10,000,000 7,000,000 10,000,000 10,000,000 20,000,000 15,000,000 25,000,000 25,000,000 25,000,000 2,000,000 2,500,000 2,500,000 3,000,000 3,000,000 4,500,000 4,500,000 4,500,000 인도네시아 Warehouse Supervisor Warehouse Manager Distribution Manager Office Support Despatch cum Office Boy Security Officer Personal Driver Data Entry Clerk 행정 Clerk/Coordinator Receptionist/Fron Office Assistant Secretary Executive Secretary Administration/Office Manager Sales, Marketing & Advertising Promote/Retail Assistant Sales Co-ordinator Market Researcher Customer Service Executive Marketing Exevutive Brand/Product Manager Sales Executive Advertising Manager Marketing Manager PR Manager Sales Manager 5,000,000 10,000,000 10,000,000 8,000,000 15,000,000 20,000,000 850,000 1,000,000 1,000,000 1,200,000 1,500,000 1,500,000 3,000,000 5,000,000 6,000,000 1,000,000 1,300,000 1,200,000 1,500,000 2,000,000 2,500,000 6,000,000 8,000,000 12,000,000 1,500,000 2,000,000 2,000,000 2,000,000 2,500,000 10,000,000 2,500,000 6,000,000 15,000,000 15,000,000 15,000,000 2,500,000 2,500,000 3,000,000 2,700,000 3,000,000 15,000,000 3,000,000 8,000,000 25,000,000 25,000,000 25,000,000 Source: Kelly Services d. Wages in Batam Island Position Unskilled Labour Skilled Labour Clerk and Typist Factory Supervisor Senior English Speaking Secretary Factory Manager Senior Accountant, Marketing Manager, Personnel Manager or Production Manager Financial Controller Source : Batam Industrial Development Authority (BIDA) Average Monthly Salary (Rp/month) 510,000 – 685,000 570,000 – 745,000 570,000 – 850,000 970,000 – 2,000,000 970,000 – 2,000,000 1,220,000 – 3,100,000 2,220,000 – 4,100,000 2,220,000 – 4,100,000 인도네시아 2. 공공설비 a. Electricity Cost Tariff Power LImit Category R-1 R-1 R-1 R-1 R-2 R-3 B-1 B-1 B-1 B-1 B-2 B-3 M I-1 I-1 I-1 I-1 I-1 I-2 up to 450 VA 900 VA 1,300 VA 2,200 VA above 2,200 VA up to 6.600 VA above 6.600 VA up to 450 VA 900 VA 1,300 VA 2,200 VA above 2,200 VA up to 200 kVA above 200 kVA up to 450 VA 900 VA 1,300 VA 2,200 VA above 2,200kVA up to 14 kVA above 14 kVa up to 200 kVA Monthly Fee (Rp/kVA/ mth) 12,000 23,000 30,500 30,500 Power Usage (Rp/kWh)* Low Tension Medium Tension (VA) ( VA) 0-30 kWh: 172 20-60 kWh: 380 0-20 kWh: 310 20-60 kWh: 490 0-20 kWh: 395 20-60 kWh: 490 0-20 kWh: 400 20-60 kWh: 490 31,500 34,260 24,500 28,300 29,500 30,500 31,000 29,500 27,000 33,500 33,800 33,800 34,000 35,000 I-3 above 200 kVA 31,300 I-4 Above 30.000 kVA 28,700 High Tension ( KVA) Above 60 kWh: 190 Above 60 kWh: 530 Above 60 kWh: 530 Above 60 kWh: 530 575 0- 30 kWh: 257 0-108 kWh: 440 0-146 kWh: 490 0-264 kWh: 500 First 100 hours: 535 WBP* = K x 475 1,415 0- 30 kWh: 161 0- 72 kWh: 350 0-104 kWh: 475 0-196 kWh: 480 First 80 on hours: 480 WBP = K x 466 621 above 30kWh: 445 above 108kWh: 490 above 146kWh: 493 above 264kWh: 540 The next exceed 100 on hours: 360 LWBP* = 475 above 30kWh: 435 above 72kWh: 465 above 104kWh: 495 above 196kWh: 495 The next exceed 80 on hours: 495 LWBP = 466 First 350 on hours WBP = K x 468 The next 350 on hours, WBP = 468 LWBP = 468 460 over usage = 646 over usage = 738 over usage = 609 over usage = 538 Source : PLN Note: R = Residential; B = Business; I = Industry; M = Multipurpose * WBP = peak hours; ** LWBP = after peak hours b. Water Cost Category Classification I Praying place, and the like Classification II Government Hospital, and the like Classification III A Housing, and the like Classification III B Small industry, and the like Classification IV A Embassies, and the like Classification IV B Stars hotels, and the like Classification V / Special Category LPG BBG (for Transport use) Source: *PERTAMINA;**Tempo Interaktif Usage Block and Tariff per m3 (in Rp) 0-10 m3 11-20 m3 > 20 m3 500 500 500 500 500 500 2,250 3,000 3,500 3,250 4,000 5,000 4,750 5,750 6,750 9,100 9,100 9100 11,000 11,000 11,000 Tariff (Rp/unit) 4,250/kg* 2,562/lsp** Source: PDAM Jaya as quoted by BKPM c. Gas Tariff 인도네시아 d) Fuel Cost Category Gasoline (Premium) Kerosene High Speed Diesel: a. Public (subsidized) b. Transport (non subsidized) c. Industry (non subsidized) Marine Diesel Fuel Marine Fuel Oil Pertamax Plus Pertamax Pertamina DEX BioPertamax Tariff (Rp/litre) 4,500.00 2,000.00 4,300.00 5,359.001) 5,126.001) 5,038.001) 3,221.901) 5,850.002) 5,600.002) 5,900.002) 5,600.00 Note: 1) Price in Region I (exclude UPmsVII: Makassar & UPmsVIII: Jayapura and NTT) - The selling price Pertamax, Pertamax Plus, Pertamax DEX and BioPertamax in Upms III (Jabodetabek, Banten and West Java) 2)The selling price will be reviewed and adjusted to the International crude price. Source : PERTAMINA; BKPM 인도네시아 IV. 운송비 A. 육상 운송 1. Air Cargo Rate (from Jakarta City to Other Major World Cities) Weight of Cargoes (US$) 0 – 44 kgs 45 kgs – 99 kgs* 100 kgs – 249 kgs* 250 kgs – 499 kgs* 500 kgs – 999 kgs* Over 1000 kgs* Destination Europe Paris, France London, United Kingdom Amsterdam, Netherlands Geneva, Switzerland Frankfurt, Germany Rome, Italy North America Washington, D.C., USA New York, USA Los Angeles, USA Chicago, USA Ottawa, Canada Ontario, Canada ASEAN Countries Bandar Seri Begawan, Brunei Darussalam Phnom Penh, Cambodia Kuala Lumpur, Malaysia Yangon, Myanmar Manila, Philippines Singapore Bangkok, Thailand Ha Noi, Viet Nam Asia Beijing, China New Delhi, India Tokyo, Japan Hong Kong Seoul, South Korea Islamabad, Pakistan Taipei, Taiwan Australasia Sydney, Australia Canberra, Australia Auckland, New Zealand Wellington, New Zealand Source: BKPM 72.00 72.00 64.00 64.00 64.00 64.00 4.10 4.10 4.10 5.85 4.10 4.10 3.95 3.95 3.95 4.70 3.95 3.95 3.90 3.90 3.90 3.95 3.90 3.90 3.20 3.20 3.20 3.85 3.20 3.20 3.15 3.15 3.15 3.70 3.15 3.15 64.00 64.00 64.00 64.00 4.65 4.65 4.45 4.65 4.45 4.45 4.40 4.45 4.40 4.40 4.05 4.40 3.85 3.85 3.50 3.85 3.75 3.75 3.45 3.75 29.00 2.72 2.27 2.17 1.41 1.41 29.00 0.80 29.00 29.00 0.6 29.00 50.00 3.37 0.70 2.93 3.82 0.55 4.52 5.28 3.37 0.60 2.93 2.30 0.50 2.20 2.65 3.37 0.50 2.93 1.75 0.40 2.20 2.10 2.63 0.42 2.83 1.65 1.45 2.05 2.53 2.78 1.55 1.35 1.95 1.45 34.00 34.00 1.50 34.00 34.00 29.00 1.35 3.30 3.55 1.40 2.65 4.10 2.35 1.25 3.05 3.50 1.30 2.60 3.75 1.90 1.10 2.40 3.45 1.20 2.15 3.75 1.75 1.00 2.30 2.85 1.10 2.00 3.05 1.70 2.15 2.75 1.95 2.85 1.65 1.65 34.00 34.00 34.00 1.55 4.10 3.55 4.10 1.35 3.60 3.55 3.60 1.15 2.85 2.85 2.85 1.00 2.60 2.55 2.60 2.55 2.50 2.55 인도네시아 2. Shipping Cargo Rate (from main seaport in Indonesia: Jakarta, Semarang, Surabaya, Panjang, Palembang, Belawan) Ocean Freight (in US$) Destination 20 GP 40 GP 40 high cube Europe Le Havre, France Southampton, UK Rotterdam, Netherlands Hamburg/Bremerhaven, Germany Antwerp, Belgia North America Vancouver, Canada West Coast, USA Seattle, USA Portland, USA Oakland, USA Los Angeles, USA New York, USA ASEAN Countries Singapore Laem Chabang, Thailand Viet Nam Asia Shanghai, China Tokyo, Japan Hong Kong Busan/Inchon, South Korea Colombo, Srilanka Kaohsiung/Taichung, Taiwan Source: BKPM 1,700 3,150 3,350 2,565 3,360 3,660 250 300 550 400 450 1,100 400 450 1,100 350 350 350 450 1,000 550 550 600 700 1,800 550 550 600 700 1,800 인도네시아 3. Rail Transportation Cost (from Jakarta City to Other Major Cities in Indonesia) Destination Distance Description Rate (Rp/ per unit / ton) (km) 1st Class* 2nd Class* 3rd Class* Bekasi 50 General Cargo 32.400 31.600 30.600 Bandung 195 General Cargo 64.800 63.200 61.200 Cirebon 400 General Cargo 137.700 134.300 130.050 Jogyakarta 600 General Cargo 194.000 189.600 183.600 Semarang 500 General Cargo 162.000 158.000 153.000 Solo 650 General Cargo 210.000 205.400 198.900 Surabaya 800 General Cargo 259.200 252.800 244.800 Source: PT. Kereta Api Indonesia Note : * Classes refer to the good s classification in STB (Requiring/specification, tariff of PT. KA freight transportation). All tariff categories can be possibly negotiated. 4. Inland Truck Transportation Cost Destination (from Tanjung Priok Port) Jakarta - KBN Jakarta - Bekasi Area Jakarta - Bogor Area Jakarta - Tangerang Area Jakarta - Serang Jakarta - Karawang Jakarta - Bandung Jakarta - Semarang Jakarta - Surabaya Source : Iron Bird (Blue Bird Group) 20 Feet (Rp) 1.067.000 1.333.000 1.599.000 1.559.000 1.866.000 1.559.000 2.666.000 11.500.000 14.500.000 40 Feet (Rp) 1.333.000 1.866.000 2.133.000 2.133.000 2.332.000 2.133.000 3.333.000 13.500.000 16.500.000 General Cargo/FT (Rp) 40.000 60.000 70.000 70.000 75.000 70.000 125.000 450.000 550.000 인도네시아 B. PASSENGER TRANSPORTATION 1. Car Rental (with Driver) Source: AVIS Car Type Rental as Year 1 month quoted by BKPM Toyota Kijang LGX/gasoline 2001 645 3,860 5,670 7,350 8,380 Note: Toyota Kijang LGX/Gasoline 2000 595 3,240 4,670 6,030 7,030 Rate Toyota Kijang LGX/Gasoline 1997 N/A 2,765 3,970 5,130 6,150 subject to change Toyota Kijang LSX/Gasoline 1997 455 2,185 3,370 4,630 5,670 without prior Volvo 960 1995 595 3,240 4,670 6,030 7,030 notice. Toyota Crown 1995 595 3,240 4,670 6,030 7,030 Driver usage from Toyota Corona 1995 555 3,015 4,170 5,530 6,560 8.00am to 8.00pm. Additional driver fee is Rp. 7.000,- per hour (between 8pm to 8am). Including car maintenance, replacement of cars in case of engine trouble and accident. Excluding out of town & over time driver fee, gasoline, value added tax (PPN) 10% & income tac (PPH) 23. Car Rental (package car and driver) in Rp 000 Daily 1 week 2 weeks 3 weeks 2. Taxi Fare (Airconditioned Taxis) By Meter Flag fare (for first km) For every additional km Additional Surcharges Toll charges* Airport Surcharge Type of Taxi Fare (Rp) Blue Bird / Silver Bird Blue Bird / Silver Bird 5,000 / 6,000 1,500 / 3,200 Blue Bird Silver Bird 8,000 (from Airport to City) 8,000 – 12,500 8,000 – 12,500 Source: www.bluebirdgroup.com Note: * Toll charges are dependent on destination. 3. Bus Fare (Airconditioned Buses) Type Destination DAMRI From Airport to City Centre Fare (Rp) 15,000 PATAS PPD Within the City 4,500 Trans Jakarta I. Blok M - Kota II. Pulogadung - Harmoni III. Harmoni - Kali Deres 3,500 3,500 3,500 Source : DAMRI, Patas PPD (Perusahaan Pengangkutan Djakarta); Tempo Interaktif 인도네시아 4. Toll Fees Fee (Rp) Route Jakarta Jakarta Outer Route Kamal - Cengkareng (airport) Serpong - Pondok Aren Jakarta - Bandung (Cipularang) Jakarta - Bogor (Jagorawi) Jakarta - Cikampek Jakarta - Merak Jakarta - Tangerang Tangerang - Merak Jakarta - Tanggerang Bandung Padalarang - Cileunyi Palimanan - Kanci Surabaya Surabaya - Gempol Surabaya - Gresik Medan Belawan - Medan - Tg Morawa Cars, Jeep, Mini & Medium Bus, Small Truck Big Truck & Big Bus with two gardan Trailers/Large Truck 4,500 2,500 3,000 34,500 4,500 10,000 6,000 3,000 5,500 55,000 6,000 17,000 7,500 3,500 6,500 70,000 8,000 20,000 3,000 15,000 3,500 21,000 4,500 26,000 3,000 3,500 4,500 4,500 1,500 7,500 2,000 9,000 2,000 3,000 6,000 3,000 8,000 3,000 11,500 3,500 6,000 6,500 Notes: References and updates available at Jasa Marga 인도네시아 5. Train Fare Destination Train Name Gambir-Bandung Argo Gede Normal - Parahyangan - Argo Bromo Gumarang Senja Utama/Taksaka - Gambir-Surabaya Gambir-Semarang Gambir-Yogyakarta Fare (Rp) Business 40,000* 45,000** 240.000 200.000 100,000 Executive 70,000* 75,000** 60,000* 65,000** 170,000* 180,000** Source: BKPM; References and updates available at PT. Kereta Api Persero Note : * Monday-Thursday; ** Friday-Sunday 6. Domestic Air Fare (from Jakarta City to Other Major Cities in Indonesia) Destination One Way Fare (Rp) Economy Batam 868,000 Denpasar 971,000 Jayapura 3,050,000 Medan 1,271,000 Makassar 1,289,000 Manado 1,945,000 Padang 960,000 Pakanbaru 967,000 Palembang 560,000 Pontianak 789,000 Semarang 528,000 Solo 602,000 Surabaya 778,000 Timika 2,787,000 Yogyakarta 560,000 Notes: References and updates available at Garuda Indonesia Executive 1,370,000 1,589,000 4,675,000 2,288,000 2,359,000 3,572,000 1,512,000 1,530,000 1,069,000 1,249,000 1,068,000 1,069,000 1,557,000 4,296,000 1,069,000 인도네시아 V. 통신비 A. TELEPHONE CHARGES 1. Local Calls Type Montly Fee (Rp) Distance 0 – 20 km Residential / Personal 32,600 > 20 km 0 – 20 km Business 57,600 > 20 km Time 00.00 - 09.00 09.00 - 15.00 15.00 - 24.00 00.00 - 09.00 09.00 - 15.00 15.00 - 24.00 00.00 - 09.00 09.00 - 15.00 15.00 - 24.00 00.00 - 09.00 09.00 - 15.00 15.00 - 24.00 Duration per pulse 3 mnts 2 mnts 3 mnts 2 mnts 1,5 mnts 2 mnts 3 mnts 2 mnts 3 mnts 2 mnts 1,5 mnts 2 mnts Charges (Rp.) 250 250 250 250 250 250 250 250 250 250 250 250 Notes: References and updates available at PT. Telkom 2. International Calls - 007 IDD Telephone Rates (call from Jakarta City to Other Major World Cities) Destination Standard Rate Premium Rate Reduced Rate (Rp) (Rp) (Rp) Europe Paris, France 10,700 12,840 8,025 London, United Kingdom 9,400 11,280 7,050 Amsterdam, Netherlands 10,700 12,840 8,025 Geneva, Switzerland 10,700 12,840 8,025 Frankfurt, Germany 10,700 12,840 8,025 Rome, Italy 10,700 12,840 8,025 North America Washington, D.C., USA New York, USA Los Angeles, USA 8,300 9,960 6,225 Chicago, USA Ottawa, Canada Ontario, Canada ASEAN Countries BSB, Brunei Darussalam 4,900 5,880 3,675 Phnom Penh, Cambodia 4,900 5,880 3,675 Vientiane, Lao PDR 5,650 5,880 3,675 Kuala Lumpur, Malaysia 5,650 6,780 4,237.50 Yangon, Myanmar 4,900 5,880 3,675 Manila, Philippines 6,250 7,500 4,687.50 Singapore 5,650 5,880 3,675 Bangkok, Thailand 6,250 7,500 4,687.50 Ha Noi, Viet Nam 4,900 5,880 3,675 Asia Beijing, China 10,700 10,700 8,025 New Delhi, India 9,400 11,280 7,050 Tokyo, Japan 9,400 11,280 7,050 Hong Kong 8,300 9,960 6,225 Seoul, South Korea 8,300 9,960 6,225 Reduced 007 Rate (Rp) 9,630 7,520 9,630 9,630 9,630 9,630 6,640 4,410 4,660 4,410 5,620 4,660 5,260 4,410 8,650 7,520 7,520 6,640 7,470 인도네시아 Islamabad, Pakistan Taipei, Taiwan Australasia Sydney, Australia Canberra, Australia Auckland, New Zealand Wellington, New Zealand 6,250 8,300 7,500 9,960 4687.5 6,225 5,620 - 8,300 9,960 6,225 6,640 8,300 9,960 6,225 7,470 Notes: References and updates available at PT. Telkom Note: To activate 007 services, cal 147 or 162. Note: Standard time: 11am – 2pm and 5pm – 3am; Premium time: 2pm – 5pm; Reduce time: 3am – 11am 3. TELKOM Global-017 Destination Australia, Cellular Canada China France, Cellular Malaysia, Cellular Netherlands, Cellular Saudi Arabia Singapore, Cellular United Kingdom, Cellular United States Tarif – 017 (Rp) Discount 40% 4,980 4,980 6,420 6,420 3,390 6,420 5,640 3,390 5,640 4,940 Source: PT. Telkom Note: Telkom Global-17 tarif are 60% less than standard International rate with non time band (flat rate) 4. Fax Charges Zone Local Distance (km) 0 to 20 > 20 Charges (Rp) Time 12pm - 09am 09am - 03am 03am - 12pm 12pm - 09am 09am - 03am 03am - 12pm Duration 3 minutes 2 minutes 3 minutes 2 minutes 1,5 minutes 2 minutes Rate 250 250 Interlocal Zona I > 30 to 200 Zona II > 200 to 500 Zona III > 500 Source: Telkom147 06am - 07am 07am - 08am 08am - 11pm 11pm - 06am 06am - 07am 07am - 08am 08am - 11pm 11pm - 06am 06am - 07am 07am - 08am 08am - 11pm 11pm - 06am 1 minute 645 1,290 645 325 915 1,815 915 460 1,135 2,270 1,135 570 인도네시아 5. Internet Charges DIAL UP connection Services TELKOMNET INSTANT (0809 8 9999) Indosat IM2 (0809 8 8001) Speed Registration /monthly fee Tariff (Rp) 56 Kbps - 150.00* / minute Registration 45,000 Monthly fee 25,000 56 Kbps Dial up Package: Registration 45,000 Montly fee none 100.00** / minute Dial up charge: 2,820/hour Hemat (20 hrs) 55,000 Bronze (38 hrs) 100,000 Silver (71 hrs) 180,000 Gold (283 hrs) 700,000 Source: PT. Telkom; Indosat Note: * Including dial up telephone charge; ** plus dial up charge ADSL (Telkom Speedy) Services Personal Light Medium Heavy Speed Down Stream 384 Kkbps Up stream 64 Kpbps Down Stream 384 Kkbps Up stream 64 Kpbps Down Stream 512 Kkbps Up stream 64 Kpbps Registration Monthly Fee Freee Usage Additional Charge per Mb (Rp) Alt-1 Alt-2 200,000 500,000 300,000 500 Mb 1,200 200,000 500,000 450,000 1 GB 1,200 200,000 500,000 800,000 2 GB 1,200 - 3,800.000 unlimited - Corporate Down Stream 384 Kkbps 2,500.000 Up stream 64 Kpbps Source: PT. Telkom CBN Internet Protocol (IP) Dial Up Type Registration Fee (Rp) Basic 50,000 Plus 50,000 Premium 150,000 Supreme 150,000 (single login) Time of Usage (Hour) 0 (exclude time of usage) 40 200 Unlimited Monthly Fee (Rp) 20,000 110,000 500,000 800,000 Source: CBN Note: Additional fee of usage Rp 50 per minute; rates exclude 10% VAT and could change without notice; rates exclude the phone pulse fee B. POSTAL AND MAILING RATES 1. Airmail Letters (from Jakarta City to Other Major World Cities) Destination Air Letter Air Express Printed Paper (0 – 20 gr) (0 – 250 gr) & Small Packets * Europe Paris, France US$ 24 London, UK US$ 20 Rp 7,500 Rp 5,000 Amsterdam, Netherlands US$ 23 Geneva, Switzerland US$ 19 Frankfurt, Germany US$ 24 Rome, Italy US$ 22 Postcards Rp 4,000 인도네시아 North America Washington, D.C., USA New York, USA Los Angeles, USA Chicago, USA Ottawa, Canada Ontario, Canada ASEAN Countries BSB, Brunei Darussalam Phnom Penh, Cambodia Vientiane, Lao PDR Kuala Lumpur, Malaysia Yangon, Myanmar Manila, Philippines Singapore Bangkok, Thailand Ha Noi, Viet Nam Asia Beijing, China New Delhi, India Tokyo, Japan Hong Kong Seoul, South Korea Islamabad, Pakistan Taipei, Taiwan Australasia Sydney, Australia Canberra, Australia Auckland, New Zealand Wellington, New Zealand Rp. 8,000 US$ 18 Rp 6,000 Rp. 7,000 US$ 23 Rp 5,500 Rp 4,000 Rp 4,000 Rp 4,000 Rp 4,000 Rp 4,000 Rp 4,500 Rp 4,000 Rp 4,000 Rp 4,500 US$ 9 US$ 12 US$ 9 US$ 9.5 US$ 8 US$ 9 US$ 11.5 Rp 3,000 Rp 3,500 Rp 3,000 Rp 3,000 Rp 3,500 Rp 3,500 Rp 3,000 Rp 3,000 Rp 3,500 Rp 2,500 Rp 2,500 Rp 2,500 Rp 2,500 Rp 2,500 Rp 3,000 Rp 2,500 Rp 2,500 Rp 3,000 Rp 4,500 Rp 4,500 Rp 4,000 Rp 4,500 Rp 4,500 Rp 4,000 US$ 16 US$ 12 US$ 9 US$ 12 US$ 12 US$ 11 Rp 3,500 Rp 3,500 Rp 3,500 Rp 3,500 Rp 3,500 Rp 3,500 Rp 3,000 Rp 3,000 Rp 2,500 Rp 2,500 Rp 3,000 Rp 2,500 Rp 4,500 Rp 4,500 Rp 4,500 Rp 4,500 US$ 15 US$ 15 US$ 15 US$ 15 Rp 3,500 Rp 3,500 Rp 2,500 Rp 2,500 Rp 3,000 Rp 3,000 Rp 2,500 Rp 2,500 Rp 3,500 Source: Jakarta Post Office Note: * Printed Papers such as brochures, catalogues, greeting cards etc (unsealed) 3. Courier Service (from Jakarta City to Other Major World Cities) Multiplier Additional Minimum Rates after charges 0.5 kg 20.5kg Destination per 0.5 kg (US $) 20.5- 29.5kg (US $) (US $) Europe 99.91 - 109.97 19.87 - 30.15 33.69 - 40.56 North America 73.19 20.98 26.60 ASEAN Countries 42.48 - 62.55 6.62 - 12.53 12.99 - 22.82 Asia 45.51 - 109.97 11.58 - 30.15 19.14 - 40.56 Australasia 62.55 11.58 22.82 Source: DHL Note: All rates are subject to a 10% VAT and fuel surcharge of 3%. Multiplier Rates after 20.5kg 30- 49.5kg (US $) 29.91 - 37.60 22.94 12.30 - 20.34 17.14 - 37.60 20.34 Multiplier Rates after 20.5kg 50- 69.5kg (US $) 21.52 - 31.09 15.96 10.16 - 16.67 13.59 - 31.09 16.67 인도네시아 VI. 투자법과 절차 A. PROCEDURES OF SETTING UP A BUSINESS B. INVESTMENT LICENCE APPLICATION C. COMPANY REGISTRATION D. INVESTMENT INCENTIVES AND PROMOTION E. PROCESSING TIME FOR FDI APPLICATION F. OTHER RELATED INFORMATION Details as published in the “Guide Book for investing in ASEAN: Update 2004” (ASEAN Secretariat, Jakarta), to view document: Indonesia-GuideBook.pdf VII. 세금 제도 1. Corporate Income Tax : The rate of taxable income is progressive: On the first 50 million rupiah On the next 50 million rupiah over 100 million rupiah 10% 15% 30% Certain gross income is subject to a “final” tax as follows: Rent of land and building Construction contracting services by small enterprise Construction, planning, supervision and consulting Services by small enterprise Sale of share listed on an Indonesian stock exchange Listing of founder shares on an Indonesian stock Exchange Interest on time and saving deposit Interest on bond listed in Indonsian stock exchange 2. Personal Income Tax : 3. Value Added Tax : on the first 25 million rupiah on the next 25 million rupiah on the next 50 million rupiah on the next 100 million rupiah over 200 million rupiah = = = = = 10% 2% 4% 0.1% 0.5% 20% 20% 5% 10% 15% 25% 35% VAT on imports, manufactured goods and most services is 10% Goods that are exempted from VAT : goods from mining or drilling taken directly from the sources; goods being basic necessities for the public; foods and drinks served at hotels, restaurants, stalls and other similar places. Money, gold bars and securites Services that are exempted from VAT: medical health services; social services; government postal services; 인도네시아 banking, insurance and optional leasing services; religion services; education services; art and entertainment services that are subject to entertainment tax; commercial art and entertainment services which are taxed under regional entertainment tax non-advertisement broadcasting services; bradcasting servies for advertising public transport services on land and waters; and international air transport; manpower services; hotel services; government/public services. public services provided by the Government VAT in Batam Except for companies qualifying for a bonded zone status, starting 1 January 2004 VAT and luxury sales goods tax (LST) has been applied as follows: Starting 1 January 2004 VAT shall be imposed on deliveries of automotive, cigarette and liquour products; Starting 1 March 2004 the list of taxable goods shall be extended to include electronic products 5. Withholding Tax (Art. 23/26 ITL): Withholding tax is levied on dividends, royalties, interest, technical, and management fees as well as other certain services; 15% of the gross amount of interest deposits earned by cooperatives (final); 15% of the estimated net income of: o Rental and other income from use of assets; o Compensation in relation to technical service, management service, consultant and other services except than those incomesubject to salary tax. Note: Payment to non-residents is subject to 20% or reduced rate of Tax Treaty of the gross amount. 6. Land/Property Tax: The effective rates are nominal, typically not more than one tenth of one percent per annum (0,1 %) of the value of property Land and Building tax is levied on the owner or tenant of : Land, the effective rate is 0.5% X the tax calculation Base (20%-100%) X the Selling Value of the Tax Object, Building, the effective rate is 0.5% X the tax calculation base (20%-100% X (the Selling Value of the Tax Object – Non-taxable Selling Value). Note: Land and Building tax in estate, forestry, and mining sectors are calculated separately 7. Duty on acquisition of rights to land and building: Acquisition of rights to land and building from transfer, sales, exchange, bequest, gift, and inheritance is subject to 5% duty upon transfer value. 8. Real Property Gains Tax: 5% 9. Estate Duty: There is no estate duty in Indonesia. Transfer of properties from bequest and inheritance is not taxable under certain conditionare tax free. 10. Excise Duty: Excise tax is levied on domestic consumption of specific goods, that are: Etil alcohol or ethanol; Alcoholic drinks; Tobaccos including cigarette, cigar, cloves or other tobacco products Rate: For domestic products maximum 250% of factory price or maximum 55% of retail price. For Import products maximum 250% of the sum of import price and import duty or maximum 55% of retail price. 인도네시아 (please refer to the customs department for further information). 11. Stamp Duty: Money valued stated in the document is more than Rp 1 million = Rp 6,000 rate of stamp duty Money valued stated in the document is between Rp 500,000 and Rp 1 million = Rp 3,000 rate of stamp duty Money valued stated in the document is below Rp 500,000 is not subject to to stamp duty For claques the rate is Rp 3,000 regardless of money value stated. 12. Import Duty: Every imported goods subjected to import duty with rate maximum of 40%, with exemption on Farm products import and different tariffs rate on: Certain goods on the exclusive schedule XXI-Indonesian List; Certain imported goods based on international agreement or treaties; Passenger goods through aircraft or shipping, post office or other similar services. (please refer to the Customs Department for further information). All foreign direct investment companies are given customs tariff reduction as fiscal incentive (See V.2 and V.3) that can be found in The Indonesian Custom Tariff Book (Buku Tarif Bea Masuk Indonesia/BTBM). The contract address for detail information: Deputy Chairman for Investment Servicing and Facilities, The Investment Coordinating Board (BKPM) Jln. Gatot Subroto No. 44, Jakarta 12190, Indonesia PO.BOX 3186, Telp. (62-21) 5252008, Fax: 5254945, 5202050, or Directorate General of Customs Jln. Jenderal A. Yani No. 108, Jakarta 13220, Indonesia Tel. (62-21) 4890308, 4897511, Fax. (62-21) 4890871 13. Export Duty: (please refer to the Ministry of Trade and Industry). 14. Other Taxes: Luxury tax from 10% to 75% Tax Facilities for Promoting Inbound Investment: 1. Income Tax: o Investment allowance, up to 30% of total realized investment (within 6 years, each 5%) o Accelerated depreciation and amortization (double than normal rate) 2. VAT: Enterpreneurs of inside bonded area in certain Integrated Economic Development Areas (KAPET) are exempted from VAT for: o Importation of capital goods and other equipments related to production process o Importation of raw material o Purchasing of raw material or semi finished product from inside or outside bonded area entrepreneurs for futher process or for subcontracting purposes o Delivering of raw material or semi finished products to other entrepreneurs of inside bonded area o Redelivering of taxable goods from the subcontractor who is entrepreneur of inside or outside bonded area 3. Import Duty: Entrepreneurs of inside bonded area in certain Integrated Economic Development Areas (KAPET) may be granted facilities in the form of deferred import duty on importation of: o Capital goods or equipment for development/construction/extention and office equipments o Capital goods and factory equipments which are directly related to production activities o Goods and or material for futher process Entrepreneurs of certain industries which support development and extention of industries in KAPET as determined by the Ministry of Finance Decree may be granted other import duty facilities. (please refer to the custom department for further information) 인도네시아 인도네시아 15. Double taxation Agreements (DTA): Country Algeria Australia Austria Belgium Re-negotiation Brunei Darussalam Bulgaria Canada Re-negotiation Czech China Denmark Egypt Finland France Germany Hungary India Italy Japan Jordan Korea, Rep. Of Korea, Democratic People’s Repupblic of Kuwait Luxemburg Malaysia Mexico Mongolia Netherlands Re-negotiation Re-negotiation II Valid From 01-01-2001 01-07-1993 01-01-1989 01-01-1975 01-01-2002 01-01-2003 01-01-1993 01-01-1980 01-01-1999 01-01-1997 01-01-2004 01-01-1987 01-01-2003 01-01-1990 01-01-1981 01-01-1992 01-01-1994 01-01-1988 01-01-1996 01-01-1983 01-01-1999 01-01-1990 01-01-2005 01-01-1999 01-01-1994 01-01-1987 01-01-2005 01-01-2001 01-01-1971 01-06-1994 01-01-2004 Country New Zealand Norway Pakistan Philippines Poland Romania Russia Saudi Arabia Seychelles Singapore Slovak South Africa Spain Sri Lanka Sudan Sweden Switzerland Syria Taipei Thailand Tunisia Turkey U.A.E Ukraine United Kingdom Re-negotiation United States Re-negotiation Uzbekistan Venezuela Vietnam Valid From 01-01-1989 01-01-1991 01-01-1991 01-01-1983 01-01-1994 01-01-2000 01-01-2003 01-01-1989 01-01-2001 01-01-1992 01-01-2001 01-01-1999 01-01-2000 01-01-1995 01-01-2001 01-01-1990 01-01-1990 01-01-1999 01-01-1996 01-01-1983 01-01-1994 01-01-2001 01-01-2000 01-01-1999 01-01-1976 01-01-1995 01-02-1991 01-02-1997 01-01-1999 01-01-2001 01-01-2000 Source: BKPM; Price Water House Special rate/Presumptive Income Tax: Income tax on interest from time deposits and other savings: o 20% for domestic taxpayer (final), o 20% or reduced rate of Tax Treaty for foreign taxpayer (final); Income tax on gain from transactions of shares listed in the stock exchange: o 0.1% of transaction value (final); Income tax on interest/discount and gain from bonds listed in the stock exchange: o 15% on interest/discount for domestic taxpayer (final) Banks, pension funds, and mutual funds are exempted from income tax on bond interest. o 20% on interest/discount or reduced rate of Tax Treaty for foreign taxpayer (final); o 0.03% on gain from transaction value (final). Income tax on gain from transfer of land and building o 5% of transaction value (final for individual, other than real estate and non-final for corporate); Income tax on rent of land and building: o 6% for corporate (final); 인도네시아 10% for individual (final). o Income tax on income from construction services (small scale firm): o 4% on construction planning and supervision services (final); o 2% on construction work services (final). Income tax on income from sea and air transportation services: o 1.2% of transaction value for domestic sea transportation services (final); o 1.8% of transaction value for domestic air transportation services (non-final); o 2.64% of transaction value for international sea and air transportation services (final) Source: Information provided by BKPM. References and updates could refer to www.bkpm.go.id VIII. 교육 제도 A. Employment Act Description Normal Work Hours The basic weekly hours in not more than 40 hours. Normally, working hours is either 8 (eight) hours per day from Monday to Friday, or 7 (seven) hours per day from Monday to Friday plus 5 (five) hours on Saturday Paid Annual Leave An employer is required to allow an employee the following paid leave benefits: - Annual leave of at least two weeks per annum - Sick leave for a period of up to twelve months Paid Maternity 3 months Monday to Saturday: 1.5 to 2 times of normal/weekdays’ rates. Sunday and public holidays: 3 to 4 times of weekdays’ rates for overtime. The standard /basic calculation of overtime wage is 100% of monthly salary. The rate of working per hour is 1/173 of montly salary* Payment of Overtime Severance Payment Entitlement For workers, usually one month of severance payment for each completed year of service. B. Employment of Expatriate Rules and Regulations See Compendium of Investment Policies and Measures in ASEAN, second edition. Source: BKPM; * Decree of Ministry of Manpower and Transmigration No. 102/MEN/VI/2004 as quoted by BKPM 인도네시아 IX. 생활비 A. Visa and Entry/Exit Permits 1. Cost of Visa Application a) Type of Visas and Cost Transit Visa on Arrival US$ 30.00/request; For Batam Island, Tanjung Uban and Tanjung Balai Karimun: US $20 Validity of Transit Permit on Arrival: 14 days from the date of admission in Indonesia Visit Visa US$ 35.00/person for the Visit Visa Validity of Visit Visa: 90 days from the date of issuance Validity of Visit Permit: 60 days from the date admission to Indonesia Visit Visa on Arrival US$ 50.00/person for the Visit Visa on Arrival; For Batam Island, Tanjung Uban and Tanjung Balai Karimun: US $15/request Multiple-Journey Business Visa US$ 75.00/person for the Multiple-Journey Business Visa Validity of Multiple-Journey Business Visa: one year from the date of issuance Validity of Multiple-Journey Business Permit: 60 days each visit to Indonesia, for a period of one year from the first admission in Indonesia using said visa Limited Stay Visa US$ 60/person for Limited Stay Visa Validity of Limited Stay Visa: 90 days for Limited Stay Visa Validity of Limited Stay Permit: for a maximum of one year, from the date of admission in Indonesia, and extendible for a maximum of 5 times continuously b) Re-entry Visa for single Re-entry Permit: Rp 150,000.00/case for Multiple Permit: Rp 400,000.00/case 2. Airport Tax : International : Rp. 100.000,Domestic : Rp. 30.000,3. Exit/Fiscal Tax : Rp 1,000,000 Source: Directorate General of Immigration Source: Information provided by BKPM. References and updates could refer to www.bkpm.go.id B. ACCOMMODATION RATES 1. Housing Rental 위치: Pondok Indah, Kemang/Cipete, Menteng, Lebak Bulus, Cinere Average Rental/month: US$ 1,500 - US$ 4,500 Facilities: 3 to 5 bedrooms, swimming pool, garden Source: The Jakarta Post 2. Apartment and Condo Rental 인도네시아 위치 Type of Rooms Approx. Floor Area (sq.m) Average monthly rents /month** Non Services Serviced Prime Areas1): CBD** Non CBD Other Mangga Besar (Batavia) 1 bedroom 2 bedroom 3 bedroom 72 128 182 1 bedroom 2 bedroom 3 bedroom 55 94 118 US$ 15.00/sq.m US$ 19.00/sq.m US$ 11.00/sq.m US$ 18.00/sq.m Areas1): Type of Rooms Four Seasong-Regent Residence 2) Seasson Terrace Penthouse Bedrooms /m2 3 3 4 US$ 1,600 US$ 1,800 US$ 2,200 US$ 2,900 US$ 2,700 US$ 3,300 Year Lease 1-Year 2-Year US$ 4,530 US$ 4,290 US$ 5,525 US$ 5,230 Price on Price on application application US$ 1,325 US$ 1,700 US$ 2,100 - 1bedroom/ 101m2 2bedroom/ 159m2 3bedroom/212m2 1) 2) Source : Colliers Jardine Indonesia; Batavia Apartment; Four Seassons as quoted by BKPM Note : * CDB = Central Business District Apartment Setiabudi Type B Type C Type E The quoted gross rent includes Base Rent and Service Charges. The above rate excludes electricity, water, telephone and cable TV charges (these services will be billed separately); the rate quoted above does not include 10% VAT ** Apartment rates subject to 15.25% government tax and service charge C. MISCELLANEOUS COSTS Translation Cost (Rp.) English Newspaper Monthly Subscription (Rp) Specification Sworn: (/vice versa) Chinese-Indonesia English-Indonesia Japanese-Indonesia French-Indonesia German-Indonesia Asian Wall Street Journal AsiaWeek Asian Business Forbes Fortune Newsweek Asian Diver Reader’s Digest Description Daily Weekly Monthly Bi-weekly Bi-monthly Monthly Household Help (Rp) : a) Maid b) Private Driver c) Gardener d) Cook e) Security Top Guards Source: ISCI; US Embassy; The Indoprom Newsletter Standard Service Annual Fee 90,000,- / 250,000,20,000,- / 60,000,90,000,- / 250,000,80,000,- / 95,000,80,000,449,800 / 3 months 823,800 / 6 months 1,750,000 / year 228,800 / year 54,000 / 6 months 101,000 / year 540,020 / year 534,400 / year 570,000 / 54 weeks 43,100 / 6 months 81,850 / year 135,000 / 6 months Rp 500,000- 750,000/mth Rp 800,000-1,000,000/mth Rp 400,000- 500,000/mth Rp 600,000- 800,000/mth Rp 850,000/month 인도네시아 X. 유용한 정보 1. Office Business Hours Name a) Government Sector b) Private Sector c) Banks d) Shopping Centre Day Monday – Friday Monday – Friday (provinces) Monday – Friday Saturday (some) Monday – Friday Everyday Time 8.00am to 4.30pm 8.00am to 3.00pm 8.00am to 4.00pm or 9.00 to 5.00pm (half day) 8.00/8.30am to 2.00/3.00pm 8.00am to 8.00/10.00 pm 2. List of Selected Freight Forwarding Companies Cardig Air : e-mail: head@ptjas.co.id DHL (PT.Biro Semesta) : www.dhl.co.id Fin Cargo : e-mail: info@finlogistics.co.id Maersk Line : www.maersk.com Titipan Kilat CV : www.tikinet.co.id; e-mail: tiki@tikinet.co.id United Parcel Services : www.ups.com; siregar@ups.com Sucofindo PT (Persero) : scihums@indosat.net.id 3. List of Selected Hotels and Apartments Allson Residence: www.allsonresidence.jkt.com Ambhara Hotel: www.ambhara.co.id, E-mail: reservation@ambhara.co.id Atlet Century Park: www.century.com Batavia Apartments: www.bataviaapartments.co.id; E-mail: Batavia@cbn.net.id Bona Vista Apartment: www.bonavista.com Casablanca Apartment: www.apartemen-casablanca.co.id Grand Mahakam: www.grandmahakam.com Grand Kemang: www.grandkemang.com Plaza Senayan Apartment: www.plaza-senayan.com Sahid Apartment: E-mail: sahidhtl@cbn.net.id Source: www.jakarta.go.id; www.apartmentsjakarta.com 인도네시아 XI. 다른 유용한 기관 주소 Investment Coordinating Board (BKPM) 44, Jl. Jend. Gatot Subroto, Jakarta 12190 Tel: (62-21) 525 2008 / 525 2649; Fax: (62-21) 525 4945 E-mail: contacus@bkpm.go.id; Website: www.bkpm.go.id Batam Industrial Development Authority (BIDA) BIDA Building, Batam Center, Batam 29400 Tel: (62-778) 462 047 / 48; Fax: (62-778) 462 456 E-mail: inquiry@batam.go.id; Website: www.batam.go.id Rep. Office: Jl. DI. Panjaitan Kav 24, Jakarta 13410 Tel: (62-21) 858 0009; Fax: (62-21) 858 0038 Ministry of Finance Jl. Lapangan Banteng Timur 2-4, Jakarta 10710 Tel: (62-21) 344 9230 / 384 9605; Fax: (62-21) 384 5724 E-mail: helpdesk@depkeu.go.id; Website: www.depkeu.go.id Ministry of Justice and Human Rights Jl. HR Rasuna Said Kav. C1 Tel: (62-21) 252 1344 / 252 6153; Fax: (62-21) 252 2915 Website: www.ham.go.id Directorate General Immigration Jl. Rasuna Said Kav 8-9, Kuningan, Jakarta Selatan Tel: (62-21) 522 4658 / 522 5030; Fax: (62-21) 522 5037 E-mail: humas@imigrasi.go.id; Website: www.imigrasi.go.id Directorate General of Intellectual Property Right Jl. Daan Mogot Km. 24,Tangerang 15119 Tel: (62-21) 552 5388; Fax: (62-21) 525 5366; E-mail: djhaki@indosat.net.id Ministry of Manpower Jl. Jend. Gatot Subroto Kav. 51 Tel: (62-21) 525 5733; Website: www.nakertrans.go.id Ministry of Post & Telecommuncation Jl. Medan Merdeka Barat No. 9, Jakarta Pusat E-mail: info@depkomifo.go.id; Website: www.depkominfo.go.id Directorate General Post and Telecommunication Gedung Sapta Pesona, Jl. Medan Merdeka Barat No. 17, Jakarta 10110 Tel: (62-21) 383 5955 / 383 5849; Fax: (62-21) 386 0754 / 386 0781 인도네시아 E-mail: admin@postel.gol.id; Website: www.postel.go.id Ministry of Tourism Sapta Pesona Building, Jl. Merdeka Barat 17 Tel: (62-21) 345 6703; Fax: (62-21) 384 9715; Website: www.budpar.go.id Ministry of Public Works Jl. Patimura No. 20, Kebayoran Baru, Jakarta 12110 Tel: (62-21) 739 2262; Website: www.pu.go.id Department of Industry Jl. Gatot Subroto Kav 52-53 Tel: (62-21) 525 2194; Fax: (62-21) 526 1086; Website: www.dprind.go.id Department of Trade Jl. M.I .Ridwan Rais No. 5, Blok I, LT.III, Jakarta Pusat Tel: (62-21) 384 8667 / 645 6318; Fax: (62-21) 384 6106 E-mail: medag@depdag.go.id; Website: www.depdag.go.id Chamber of Commerce and Industry of Indonesia (KADIN) 29th Floor, Menara KADIN Indonesia, Jl. HR Rasuna Said X-5 Kav. 2-3, Jakarta Selatan Tel: (62-21) 916 5535; Fax: (62-21) 527 4485 E-mail: tpm@kadin.net.id; Website: www.kadin.or.id American Chamber of Commerce World Trade Center, 11th Floor, Jl. Jend. Sudirman Kav. 29-31, Jakarta 12920 Tel: (62-21) 526 2860; Fax: (62-21) 526 2861 E-mail: info@amcham.or.id; Web: www.amcham.or.id British Chamber of Commerce in Indonesia World Trade Center, 8th floor, Jl. Jend. Sudirman Kav. 29-31, Jakarta 12920 Tel: (62-21) 522 9453; Fax: (62-21) 527 9135; E-mail: bisnis@britcham.or.id Indonesia Canada Chamber of Commerce World Trade Center, Jl. Jend. Sudirman Kav. 29-31, Jakarta 12920 Tel: (62-21) 2550 7859; Fax: (62-21) 2550 7812 E-mail: iccc@cbn.net.id; Website: www.iccc.or.id Indonesia French Chamber of Commerce and Industry Jl. Wijaya II No. 36, Kebayoran Baru, Jakarta 12160 Tel: (62-21) 739 7161; Fax: (62-21) 739 7168 E-mail: contacts@ifcci.com; Website: www.ifcci.com German Indonesian Chamber of Commerce and Industry (EKONID) Jl. H. Agus Salim No. 115; Jkt 10310, PO Box 3151 Jakarta 10031 Tel: (62-21) 315 4685; Fax: (62-21) 315 5276 E-mail: info@ekonid.or.id; Website: www.ekonid.com 인도네시아 Indonesia Industrial Estate Association (HKII) Wisma Agro Manunggal 12th Floor, Jl. Jend. Gatot Subroto Kav. 22, Jakarta 12930 Tel: (62-21) 520 7442; Fax: (62-21) 520 7462 E-mail: hkipusat@ina-industrialestate.com; Website: www.ina-industrialestate.com Source: The Directorate General of Immigration and Department of Culture and Tourism cited in Welcome to Indonesia Guide Book; BKPM. 인도네시아 XII. 유용한 웹사이트 리스트 www.indonesia.go.id www.ri.go.id www.indonesianews.net www.expat.or.id/info/overview.html www.indonesiamatters.com/974/doing-business www.deplu.go.id www.gksoft.com/govt/en/id.html www.state.gov/r/pa/ei/bgn/2748.htm www.nationsonline.org/oneworld/indonesia.htm www.buyusa.gov/indonesia/en/doingbusinessinindonesia.html www.doingbusiness.org/ExploreEconomies/?economyid=90 XIII. 국가 휴일 1 Jan 19 Mar 31 Mar 6 Apr 17 May 1 Jun 11 Aug 17 Aug 25 Dec New Year’s Day Hindu Day of Silence Prophet Muhammad’s Birthday Good Friday Ascension Day of Jesus Christ Waicak Isra Mi’raj Independence Day Christmas Day