Accounting 2300 - Robert Ricketts

advertisement

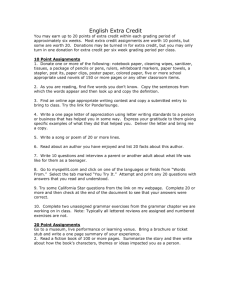

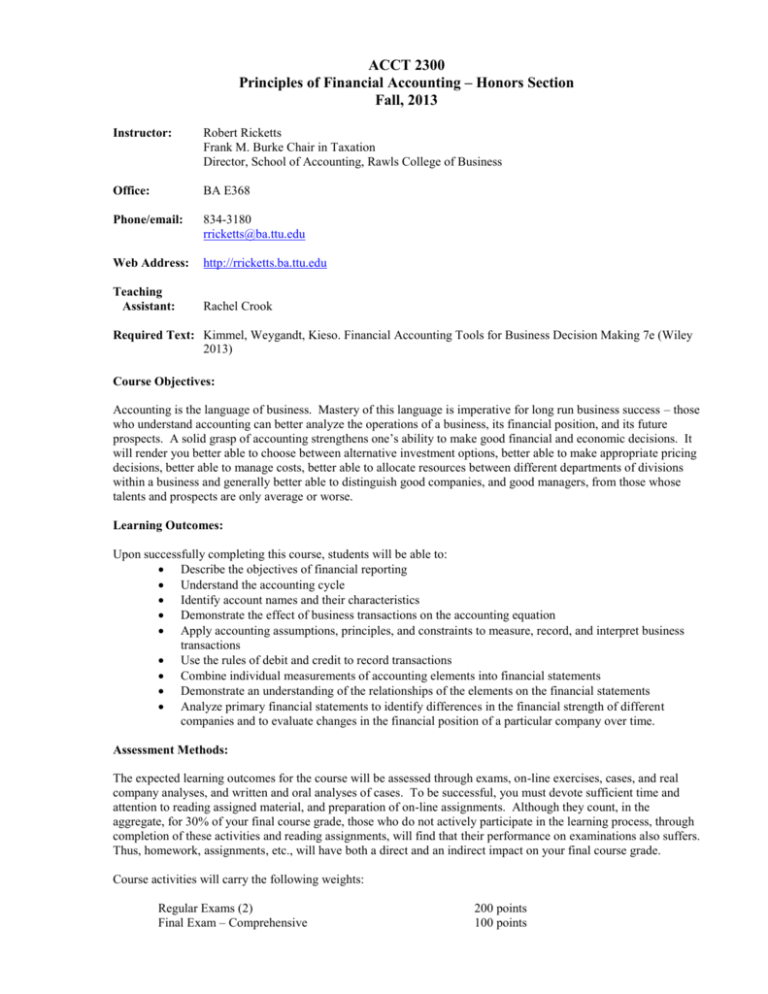

ACCT 2300 Principles of Financial Accounting – Honors Section Fall, 2013 Instructor: Robert Ricketts Frank M. Burke Chair in Taxation Director, School of Accounting, Rawls College of Business Office: BA E368 Phone/email: 834-3180 rricketts@ba.ttu.edu Web Address: http://rricketts.ba.ttu.edu Teaching Assistant: Rachel Crook Required Text: Kimmel, Weygandt, Kieso. Financial Accounting Tools for Business Decision Making 7e (Wiley 2013) Course Objectives: Accounting is the language of business. Mastery of this language is imperative for long run business success – those who understand accounting can better analyze the operations of a business, its financial position, and its future prospects. A solid grasp of accounting strengthens one’s ability to make good financial and economic decisions. It will render you better able to choose between alternative investment options, better able to make appropriate pricing decisions, better able to manage costs, better able to allocate resources between different departments of divisions within a business and generally better able to distinguish good companies, and good managers, from those whose talents and prospects are only average or worse. Learning Outcomes: Upon successfully completing this course, students will be able to: Describe the objectives of financial reporting Understand the accounting cycle Identify account names and their characteristics Demonstrate the effect of business transactions on the accounting equation Apply accounting assumptions, principles, and constraints to measure, record, and interpret business transactions Use the rules of debit and credit to record transactions Combine individual measurements of accounting elements into financial statements Demonstrate an understanding of the relationships of the elements on the financial statements Analyze primary financial statements to identify differences in the financial strength of different companies and to evaluate changes in the financial position of a particular company over time. Assessment Methods: The expected learning outcomes for the course will be assessed through exams, on-line exercises, cases, and real company analyses, and written and oral analyses of cases. To be successful, you must devote sufficient time and attention to reading assigned material, and preparation of on-line assignments. Although they count, in the aggregate, for 30% of your final course grade, those who do not actively participate in the learning process, through completion of these activities and reading assignments, will find that their performance on examinations also suffers. Thus, homework, assignments, etc., will have both a direct and an indirect impact on your final course grade. Course activities will carry the following weights: Regular Exams (2) Final Exam – Comprehensive 200 points 100 points Online Assignments Written and oral case analyses Total 75 points 75 points 450 points To receive an A, you must accumulate 405 points; for a B, you must accumulate 360 points, 315 for a C and 270 for a D. Please note that the grading process is a mathematical calculation of the components listed above. Extra credit is not available. All students will be graded equally and fairly. Academic Honesty: Integrity is the cornerstone of the practice of accounting, and accounting students in the Rawls College of Business do not cheat, nor do they tolerate cheating by their classmates. Any student found cheating on any assignment in this class will receive an F for the course. In egregious circumstances, I will pursue more substantial sanctions, up to and including expulsion from the Honors College, the Rawls College of Business, and/or the University. Do not test this policy. If you are unsure whether a particular behavior may be construed as inappropriate, contact me before engaging in it. Integrity is a minimum requirement for all students participating in accounting courses in the College of Business. Those who lack it should not plan to enroll in subsequent accounting courses. Disabling Conditions: Any student who, because of a disabling condition, may require special arrangements in order to meet course requirements should contact the instructor the first week of classes to make necessary accommodations. Civility in the classroom The Texas Tech University Provost has asked that the following statement be included in this syllabus: “Students are expected to assist in maintaining a classroom environment which is conducive to learning. In order to assure that all students have an opportunity to gain from time spent in class, unless otherwise approved by the instructor, students are prohibited from using electronic devices, challenging instructor’s authority, eating or drinking in class, coming in late or leaving early, making offensive remarks, reading newspapers, sleeping or engaging in any other form of distraction. Inappropriate behavior in the classroom shall result in, minimally, a request to leave class.” Religious Holidays A student who is absent due to a religious holy day will be allowed to take an exam or complete an assignment missed on that day. Changes I reserve the right to make changes in the syllabus, including changes in the number or dates of assignments and exams. In particular, I reserve the right not to count scores on assignments or exams in the event that the integrity of the assignment or exam is, or may have been, compromised. Any changes in assignments or due dates will be announced in class. It is the responsibility of each student to attend class and become aware of such changes. Course Schedule (subject to change) Date Aug 27 Aug 29 Sep 3 Sep 5 Sep 10 Sep 12 Sep 17 Sep 19 Sep 24 Sep 26 Oct 1 Oct 3 Oct 8 Oct 10 Oct 15 Oct 17 Oct 22 Oct 24 Oct 29 Oct 31 Nov 5 Nov 7 Nov 12 Nov 14 Nov 19 Nov 21 Nov 26 Nov 28 Dec 3 Topic Assignment Introduction to Financial Statements A Further Look at Financial Statements The Accounting Information System Demo on software Chapter 2 exercises Chapter 3 exercises Accrual Accounting Concepts Chapter 4 exercises Case 1 EXAM 1 Merchandising Operations & the Multiple Step Income Statement Reporting and Analyzing Inventory Chapter 5 exercises Fraud, Internal Control and Cash Chapter 7 exercises Case 2 Reporting & Analyzing Receivables Reporting & Analyzing Long-Lived Assets Chapter 8 exercises Chapter 6 exercises Chapter 9 exercises EXAM 2 Reporting & Analyzing Liabilities Reporting & Analyzing Liabilities (cont) Chapter 10 exercises Reporting & Analyzing Stockholders’ Equity Chapter 11 exercises Statement of Cash Flows Case 3 Financial Analysis: The Big Picture Thanksgiving Financial Analysis: The Big Picture FINAL EXAM Chapter 12 exercises Chapter 13 exercises