Gains and Losses on Sale or Exchange-Basis

advertisement

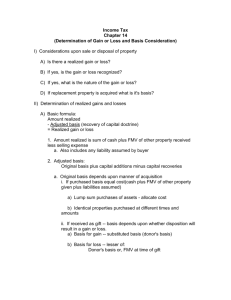

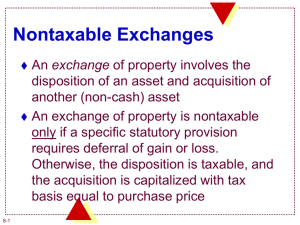

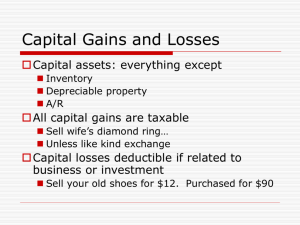

106766273. Page 1 of 2 Principles Regarding Gains and Losses on Exchange 1. The tax law requires you to report all income except where the law provides an exception. 2. Gains and losses on sale or exchanges of assets are included in income. The gains or losses may be ordinary or capital gains and losses. 3. As a general rule, gains are recognized on disposal of all assets whether they were held for personal reasons, or profit motive, i.e. business or investment. 4. As a general rule, losses are only recognized on disposal of assets held with a profit motive. There is an exception for casualty losses of personal use property. 5. Gain or loss is measured by the following formula Total value of all consideration received Less: Basis of all assets given up Equals: Gain realized 6. In a nontaxable like-kind exchange, you recognize gain up to the amount of boot received. You do not recognize loss in a like-kind exchange. 7. When you dispose of property subject to a mortgage, and the other party assumes your mortgage or takes your property subject to the mortgage, you are treated as having received boot (equal to the amount of the mortgage on your old property). Do you know 2 exceptions to this rule? (Installment Sale, Transfer to Corporation) 8. In a fully taxable exchange, your basis in the new property is equal to its FMV on the date of the exchange. 9. If part of the realized gain is deferred, your basis in the new property will be less than its FMV on the date of the exchange. If a loss is realized, but not recognized, in a like-kind exchange, your basis in the new property will be more than its FMV on the date of the exchange. 10. There are two basic ways to compute basis of new asset: Basis of Old Asset FMV of Asset Received + Boot Given - Boot Received - Gain realized, but deferred + Gain Recognized - Loss Recognized + Loss realized, but deferred = Basis of New Asset = Basis of Asset Received 106766273. Page 2 of 2 Basis alternatives, based on method of acquisition 1. Purchase the property 2. Inherit the property 3. Receive the property as a gift 4. Convert "personal use property" to business or rental use 5. Acquire the property in a basket purchase 6. Acquire the property in a bargain purchase 7. Acquire the property by separation from other property, such as stock dividend, etc. 8. Purchase the property from a related party in a disallowed loss transaction 9. Trade other property that you own for this property, in a transaction in which gain or loss is not recognized. 10. Acquire the property after having a disallowed loss on a wash sale of identical property. Events that affect the basis in property: 1. Additional investment (addition of room to house, etc.) 2. Write-off that provides tax deduction, such as depreciation or casualty loss 3. Sell part of the property and use FIFO or Average, etc. 4. Receive gift of property and donor pays gift tax 5. Pay legal fees or other expenses to acquire property 6. Buy property on which there are past-due taxes