E1-9 Acquisition of Net Assets

advertisement

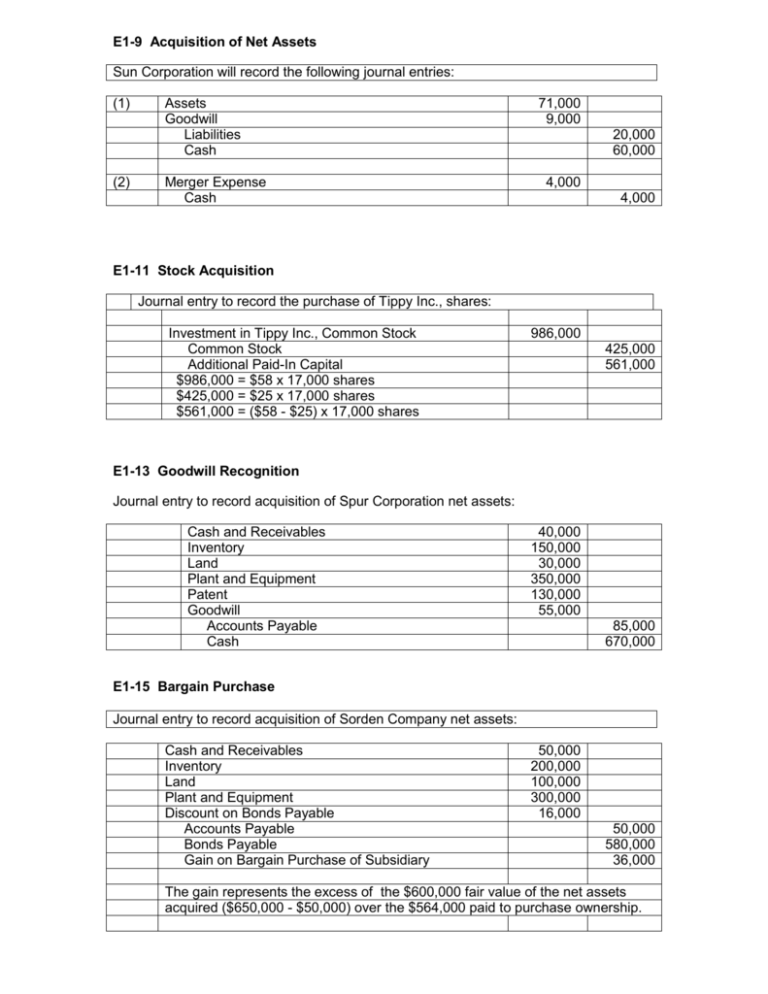

E1-9 Acquisition of Net Assets Sun Corporation will record the following journal entries: (1) (2) Assets Goodwill Liabilities Cash Merger Expense Cash 71,000 9,000 20,000 60,000 4,000 4,000 E1-11 Stock Acquisition Journal entry to record the purchase of Tippy Inc., shares: Investment in Tippy Inc., Common Stock Common Stock Additional Paid-In Capital $986,000 = $58 x 17,000 shares $425,000 = $25 x 17,000 shares $561,000 = ($58 - $25) x 17,000 shares 986,000 425,000 561,000 E1-13 Goodwill Recognition Journal entry to record acquisition of Spur Corporation net assets: Cash and Receivables Inventory Land Plant and Equipment Patent Goodwill Accounts Payable Cash 40,000 150,000 30,000 350,000 130,000 55,000 85,000 670,000 E1-15 Bargain Purchase Journal entry to record acquisition of Sorden Company net assets: Cash and Receivables Inventory Land Plant and Equipment Discount on Bonds Payable Accounts Payable Bonds Payable Gain on Bargain Purchase of Subsidiary 50,000 200,000 100,000 300,000 16,000 50,000 580,000 36,000 The gain represents the excess of the $600,000 fair value of the net assets acquired ($650,000 - $50,000) over the $564,000 paid to purchase ownership. E1-17 Assignment of Goodwill a. No impairment loss will be recognized. The fair value of the reporting unit ($530,000) is greater than the carrying value of the investment ($500,000) and goodwill does not need to be tested for impairment. b. An impairment of goodwill of $15,000 will be recognized. The implied value of goodwill is $45,000 ($485,000 - $440,000), which represents a $15,000 decrease from the original $60,000. c. An impairment of goodwill of $50,000 will be recognized. The implied value of goodwill is $10,000 ($450,000 - $440,000), which represents a $50,000 decrease from the original $60,000. E1-23 Recording a Business Combination Merger Expense Deferred Stock Issue Costs Cash Cash Accounts Receivable Inventory Land Buildings and Equipment Goodwill (1) Accounts Payable Bonds Payable Bond Premium Common Stock Additional Paid-In Capital (2) Deferred Stock Issue Costs 54,000 29,000 83,000 70,000 110,000 200,000 100,000 350,000 30,000 195,000 100,000 5,000 320,000 211,000 29,000 (1) Computation of goodwill: Fair value of Sparse as a whole Fair value of assets acquired Fair value of liabilities assumed Fair value of net assets acquired Goodwill $560,000 $830,000 (300,000) (530,000) $ 30,000 (2) Computation of additional paid-in capital: Market value of shares issued ($14 x 40,000) Par value of shares issued ($8 x 40,000) Additional paid-in capital from issuing shares Stock issue costs Additional paid-in capital recorded $560,000 (320,000) $240,000 (29,000) $211,000 E1-24 Reporting Income 20X2: Net income Earnings per share = = $6,028,000 [$2,500,000 + $3,528,000] $5.48 [$6,028,000 / (1,000,000 + 100,000*)] 20X1: Net income Earnings per share = = $4,460,000 [previously reported] $4.46 [$4,460,000 / 1,000,000] * 100,000 = 200,000 shares x ½ year