Formula sheet Princ of Finance

advertisement

Summary of Formulas - Exam III

Principles of Finance

I. Bond Valuation

1

1

(1 r ) t

F

Bond value = C

+

r

(1 r ) t

where C=coupon payment; F=face value; r = yield to maturity; t = time to maturity

II. Stock valuation

1. no growth case:

D

P=

r

2. constant growth case: “Dividend Growth Model”:

D (1 g ) Dt 1

D

Pt = t

(r can be written as r= t 1 g )

rg

rg

Pt

3. constant growth “after a certain time” case:

D1

D2

Dt

Pt

Po =

....

1

2

t

(1 r )

(1 r )

(1 r )

(1 r ) t

where Pt

Dt 1

rg

III. Capital Budgeting

Cash flow from assets = operating cash flow (OCF)

- additions to capital spending

- additions to net working capital (NWC)

where OCF = earnings before interest and taxes (EBIT)+ depreciation - taxes

CF1

CF2

CF3

CFn

NPV= - Initial Investment +

...

1

2

3

(1 r )

(1 r )

(1 r )

(1 r ) n

IV. Returns

Dollar return=dividend + change in market value

Percentage return=(dividend/beginning market value) + (change in market

value/beginning market value)

Past Return Statistics:

Average return = R

( R1 .... RT )

T

Standard deviation = SD = VAR

( R1 R) 2 ( R2 R) 2 ... ( RT R) 2

T 1

where T = number of observations

Range of returns = R +/- z(SD)

1

Future Return Statistics:

E(RA) = (RA 1) P1 + (RA 2) P2+ ... + (RAT)PT

VAR (RA) = {RA 1- E(RA)} 2 P1 + {RA 2 - E(RA)} 2 P2 + ... + {RAT - E(RA)} 2 PT

SD(RA )= VAR( RA )

VARP = {RP 1- E(RP)} 2 P1 + {RP 2 - E(RP)} 2 P2 + ... + {RPT - E(RP)} 2 x PT

where E (R P)

1,2.... T

P

= expected portfolio return

= states of the economy

= probability of state of economy occurring

IV. Capital Asset Pricing Model (CAPM)

E(Ri) = Rf + i [E(RM ) – Rf]

Where E(Ri) = expected return of security i

Rf = risk-free rate

E(RM ) = expected return of the market

i = security i ’s beta

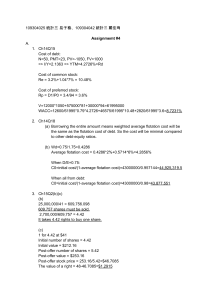

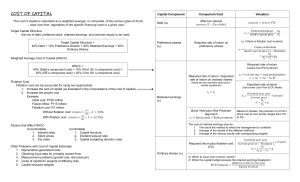

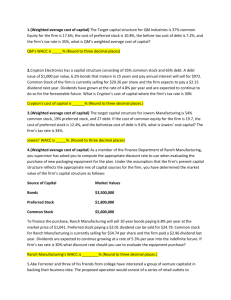

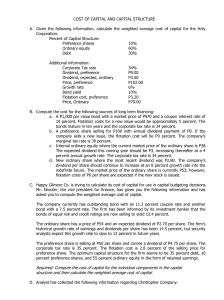

V. Weighted Average Costs of Capital (WACC)

WACC = (E/V) ( R E ) + (D/V) ( R D ) (1 - T) + (P/V) ( RP )

where R E = cost of equity, E/V=wE = % of firm value financed by equity

R D = cost of debt, D/V = wD = % of firm value financed by debt

R P = cost of preferred stock, P/V= wP= % of firm value financed by pref. stock

T= corporate tax rate

VI. Weighted Average Flotation Cost (f)

f=(E/V) f E + (D/V) fD + (P/V) f P

where f E = flotation costs of equity

fD = flotation costs of debt

f P = flotation costs of preferred stock

cost of project with flotation costs = cost of project without flotation costs / (1- f)

VII. Firm Value (V) with Taxes

VL = V U + (DxT)

VL = [(EBIT x (1-T))/ R U + (DxT)

where L = leveraged, U = unleveraged

VIII. Break-Even EBIT

EPSno debt = EPSwith debt

EBIT/# of sharesno debt = (EBIT-interest)/# of shareswith debt

2