Cost Accounting Compliance

advertisement

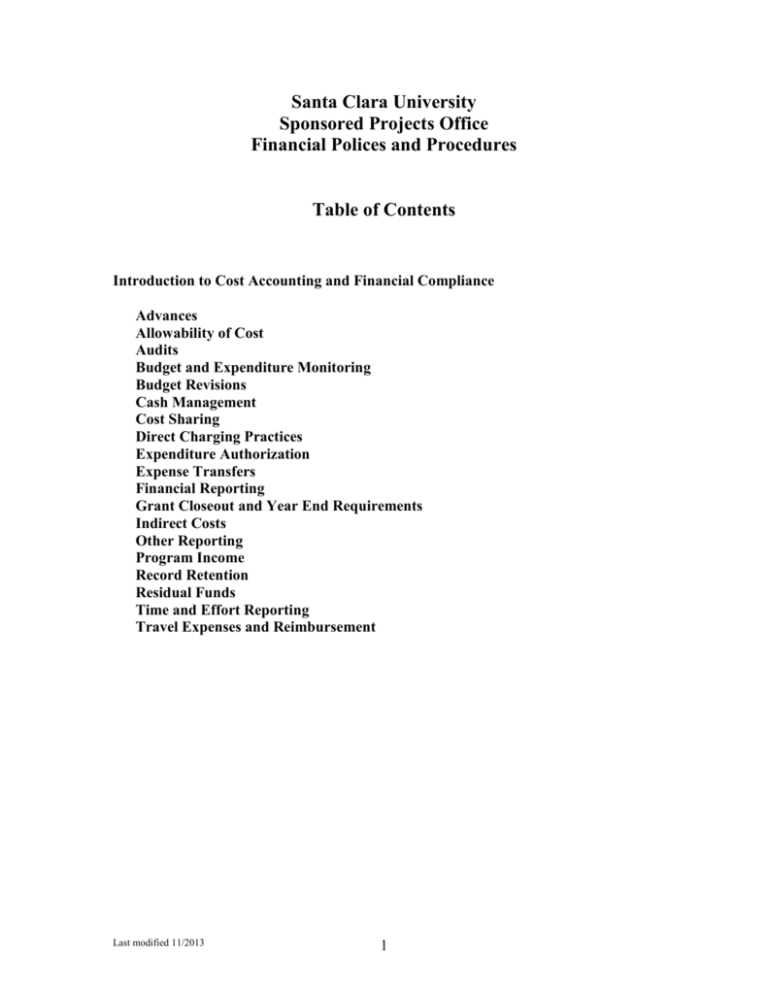

Santa Clara University Sponsored Projects Office Financial Polices and Procedures Table of Contents Introduction to Cost Accounting and Financial Compliance Advances Allowability of Cost Audits Budget and Expenditure Monitoring Budget Revisions Cash Management Cost Sharing Direct Charging Practices Expenditure Authorization Expense Transfers Financial Reporting Grant Closeout and Year End Requirements Indirect Costs Other Reporting Program Income Record Retention Residual Funds Time and Effort Reporting Travel Expenses and Reimbursement Last modified 11/2013 1 Introduction to Cost Accounting and Financial Compliance Cost accounting and financial compliance for sponsored projects at Santa Clara University is dictated by the Code of Federal Regulations (CFR), Part 220, Cost Principles for Educational Institutions; Office of Management and Budget Circular A133, Audits of States, Local Governments, and Non-Profit Organizations; CFR, Part 215, Uniform Administrative Requirements for Grants and Agreements with Institutions of Higher Education, Hospitals, and other Non-Profit Organizations; and other specific sponsor requirements and regulations. Further, policies and procedures of the University must also be followed. Ensuring compliance with the financial terms and conditions of the sponsored award including compliance with federal and agency regulations and requirements is the responsibility of both the Principal Investigator and the Sponsored Projects Office (SPO). The intent of the following policies and procedures are to assist in incorporating the requirements of CFR Part 220 and other federal regulations into the accounting and administration of sponsored awards at the University. Advances SPO follows the University policies and procedures for cash advances. (hyperlink to http://www.scu.edu/finance/forms ) Allowability of Cost Policy. CFR Parts 220 as well as related Cost Accounting Standards require the University to determine whether costs are allowable, allocable, and reasonable on sponsored awards. Determination of allowability, allocability, and reasonableness of a given expense is based on specific sponsor requirements and according to federal cost principles. A primary responsibility of the Sponsored Projects Office is to insure that all costs charged to the sponsored research award are allowable and allocable. 1. Allowability. Expenses charged to a sponsored research award must meet the following allowability criteria: The costs must be reasonable. The cost must be allocable. The costs must be given consistent treatment through application of those generally accepting accounting principles appropriate to the circumstances. The costs must conform to any limitations or exclusions set forth in the sponsored agreement or in the Federal Cost Principles (CFR Part 220). (link to Allowable Costs table on our webpage) 2. Allocability. Once allowability criteria have been met, the cost must be evaluated against the criterion of allocability. That is, the cost has been incurred solely to support or advance the work of a specific sponsored Last modified 11/2013 2 research award. It also means the process of assigning a cost, or a group of costs, to one or more cost objectives, in reasonable and realistic proportion to the benefit provided or other equitable relationship. A cost objective may be a major function of the institution, a particular service or project, or a sponsored agreement. 3. Reasonableness. A cost is reasonable if the nature of the good or service and the amount involved reflect the action of a prudent person. Considerations in determining reasonableness may include if the cost is Necessary for the performance of the sponsored agreement; Determined to be reasonable by arm’s length bargaining of a prudent person; In accordance with the sponsored agreement terms and conditions; and Consistent with established institutional policies and practices. Unallowable Costs. An “unallowable” cost is one that is not eligible for reimbursement by a Federal sponsor, either directly or indirectly (through the F&A rate). Costs that are “unallowable” for reimbursement by Federal sponsors may still be permissible charges against department or institution funds. Examples of “unallowable” costs are: Advertising (some types allowed) Alcoholic beverages Entertainment (including meals with inadequate substantiation of business purpose) Fines and penalties Memorabilia, promotional materials (allowable if used for employee morale) Certain travel costs (i.e., first class) Charitable contributions, donations and gifts Student activity costs Audits Policy and Procedures. Direct cost audits are done either on a random sampling basis or at the request of the sponsoring agency. The aims of the audit are to test the effectiveness of the University's internal system for monitoring expenses, and to confirm that expenses were incurred as required by government wide regulations on the allowability of costs and by the specific award provisions. The audit also ensures that the government was charged for the proper portion of the total project costs on projects for which there is a University cost-sharing contribution or those that are partially supported by other sources. A common audit inquiry concerns costs incurred in the latter stages or processed after the termination of an agreement. This includes purchases made from outside vendors as well as transactions within the University. The contention of the auditors is that late purchases do not significantly benefit the project. Large volume purchases or single purchases of a significant amount at the end of a project usually are not allowable since it appears that Last modified 11/2013 3 the intent is to expend remaining funds. Copies of all records should be attached to the initiating documents and also maintained on file in the department until the final audit is completed, even though this may take several years. A useful method of supporting appropriate late purchases on a project is to obtain a nocost extension from the sponsor through SPO. Timeliness or dating problems are then not relevant to the auditors for the extension period. Closing audits normally are completed within one year of the termination of the agreement (although the period may extend to four or five years). The audit agency obtains information on the project available within SPO and other administrative offices. If these offices are unable to provide the necessary information, the principal investigator is contacted for further clarifications. The auditors submit their report to the sponsor, usually with a copy of the draft report to the Director of Sponsored Projects. The sponsor then determines the allowability of items questioned in the auditor's report. If the audit uncovers questionable charges on the agreement, the sponsor submits a letter to the University reiterating the findings and requesting a reply. SPO reviews results of the audit against available records and determines the nature of the University's response to the sponsor. If SPO does not have sufficient information, it contacts the principal investigator and the department for additional explanations to support the charges. After these explanations have been provided for the questioned and/or disallowed costs, SPO presents the University's position and supporting documentation to the sponsor. The contract or grant officer reviews the initial audit with the University's response and determines the total amount allowable on the agreement. Budget and Expenditure Monitoring Policy. The Principal Investigator and Sponsored Projects Office both monitor the budget and expenditures of a project grant. Procedure. Although the SPO will assist the Principal Investigator with the day to day administration of all grants and contracts. The following are the PI requirements for all awards: 1. Monitoring of Funds. The PI is responsible for the ongoing management of award projects, including regular monitoring against the budget. 2. Approval of All Expenditures. Salary, purchasing, travel, etc. all need to be approved as described in the Expenditure Authorization policy and procedure. 3. Monthly Review of Projects Expenditures. Monthly Project Summary reports are prepared by Sponsored Projects Office and sent to the PI for review so the expenditures can be monitored to assure availability of funds and expense transfers can be made in a timely manner if error(s) are detected. Regular monitoring of sponsored project funds helps to: Last modified 11/2013 4 confirm the availability of project funds; ensure that costs are consistent with the project reports and incurred within the period of performance of the project; discover errors in the sponsored project budget, encumbrances, or expenditures; avoid overspending; provide high degree of confidence that the project complies with the sponsor's spending terms and conditions; verify that cost transfers and corrections are processed in a timely manner; and maintain a clear audit trail. Resolving Budget or Expense Issues. After review of the monthly reports, if the PI has questions on the remaining budget, or any expenses that were charged to the grant, the Sponsored Projects Accountant should be contacted. Clearing an Overdraft If an account is in overdraft upon expiration of the project's performance period and additional funds are not available from the sponsor, the principal investigator, in consultation with his or her department and school, must clear the overdraft by transferring charges to an appropriate fund account. The school is responsible for clearing of any unfunded expenditures from its departmental resources. Budget Revisions Policy. Sponsor terms and conditions, as well as, University policies and federal regulations are followed for budget revisions. Procedures. The Principal Investigator submits a request for a budget revision to a Sponsored Projects accountant. The SPO accountant reviews the request. The Director of SPO approves all budget revisions even those of low value (<10%) or between two discretionary expense categories. If the revision requires sponsor approval, then the SPO Director seeks such approval before a revision is processed. Cash Management Policy. CFR Part 220, A110, and various agency regulations require the University to follow cash management practices that are explained, documented, consistent, timely and appropriate under the circumstances. Procedure. SPO submits invoices and processes payments. SPO submits a request for reimbursement monthly or quarterly, depending on the terms and conditions of the award, when electronic funds transfer are not used. For Federal grants, funds are drawdown electronically based a cost reimbursable basis monthly or quarterly. For Federal Subcontracts, SPO invoices monthly or quarterly or as specified by the contract. Federal invoices always are based on expenses incurred and, therefore, MUST be reconciled to the University’s financial system, PeopleSoft. Last modified 11/2013 5 Processing Steps for Method of Reimbursement and Requesting Funds. Reimbursement is the preferred method for Santa Clara University and is required for all Federal Awards. The drawdown method and format and reporting intervals follow sponsor terms and conditions. The SPO Accountant notifies the University Finance Office when drawdown requests are submitted so the UFO staff will know which accounting strings should receive the credits when funds are received. Receipt of Funds. Funds are received electronically in Santa Clara University’s Bank of America Concentration account. When received, the UFO makes a journal entry to record the amounts in the PeopleSoft financial system to the accounting strings provided by SPO. Depositing cash. When cash is received, a deposit slip is prepared, listing the current date, the accounting distribution(s) to be used, date of service, and the department name. One copy of the deposit slip is retained by the SPO. The cash and the remaining copies of the deposit slip are personally delivered (not mailed) to the University Cashier. The Cashier records the deposit and returns a validated copy of the deposit slip to SPO for its records. Depositing Checks. All checks should be endorsed "For Deposit Only" as soon as they are received. The Sponsored Projects Office uses a stamp for this purpose. An SPO Accountant completes a deposit slip for each award. The date, accounting distribution(s), date of service, total amount of the deposit and the department name are included on the deposit slip. A copy of the deposit slip is retained by SPO and added to the appropriate award accounting file. The deposit slip and the checks are then hand-delivered by the SPO Accountant to the University Cashier. The Cashier provides a validated copy of the deposit slip to SPO Accountant. Required Forms. Cash deposit slip and check deposit slips are used. Cost Sharing Policy. CFR Part 220, A110, and various agency regulations require University cost sharing to be identified, documented and verifiable to the formal or informal accounting records and auditable by the sponsor. Procedure. Cost sharing, sometimes referred to as “matching,” represents that portion of the total projects costs of a sponsored agreement borne by the University, rather than the sponsor. A spreadsheet may be established to track committed cost sharing. The PI must identify and provide resources to fund the cost-sharing amount. Funds from other federal awards may not be used as the source of cost sharing except as authorized Last modified 11/2013 6 by statute. Funds generally come from unrestricted, gift, endowment income, or designated funds. The signed award document indicates whether the project involves cost sharing. If cost share/matching is absolutely necessary for the awarded project, these steps must be followed. PI needs to track cost share related expenditures as they occur. Payroll related cost share must be identified and provided to Sponsored Projects Office up front (Time and Effort Report - Name and % of effort). Sponsored Projects Accountant will calculate cost sharing amount for each individual. All information must be provided to the Sponsored Projects Office prior to the reporting deadline. The cost-sharing activity is closed at the same time as the related grant or contract closed. Direct Charging Practices Policy. CFR Part 220 and related Cost Accounting Standards require the University to consistently account for direct and indirect costs across all sponsors. Clarification is sometimes necessary to ensure certain costs are recovered consistently as either direct or indirect costs, but not both. Expenditure Authorization Policy. To provide appropriate levels of management and oversight for all expenditures on externally sponsored projects, the following signature approvals are required. Procedure. The Principal Investigator and the Sponsored Projects Director or Sponsored Projects accountants must approve all expenditures. For expenditures $10,000 or more, the approval of an Associate or Assistant Dean is required. For expenditures $100,000 or more, the approval of a Dean is required. For expenditures $250,000 or more, the approval of an Associate or Assistant Provost or and Associate or Assistant Vice President is required. For expenditures of $500,000 or more, the approval of a Vice President is required. For expenditures of $1,000,000 or more, the approval of the President is required. The Principal Investigator is responsible for securing approval up to the Dean level. All approval signatures should be on purchasing documents provided to Sponsored Projects. Sponsored Projects will work with the Associate Provost for Research and Faculty Affairs to seek higher level approval as needed. Last modified 11/2013 7 Expense Transfers Policy. CFR Part 220, A110 and various agency regulations require the University to ensure expense transfers are explained, documented, consistent, timely and appropriate under the circumstances. Procedures. Expense transfers, sometimes called cost transfers, refer to the shifting of expenses between fund accounts. The federal guidelines for cost transfers state, in part, "any costs allocable to a particular sponsored agreement may not be shifted to other sponsored agreements in order to meet deficiencies caused by overruns, to avoid restrictions, or for other reasons of convenience." To assure that timely corrections are made when expenses are mistakenly or inadvertently charged to the wrong fund account, principal investigators are responsible for reviewing their budget statements monthly. Expense transfers should be prepared and submitted to SPO as soon as the need for the transfer is identified, but under most circumstances, not later than 90 days from the original transaction date. Adequate Documentation. An expense/revenue transfer form must be completely filled out by the principal investigator. The debit and credit section on the form must have the accounting string, along with description of the charge being transferred and why the cost is being transferred. In addition, there must be sufficient back-up documentation which includes but not limited to: Receipts Actual Transaction Detail report showing the original transaction of the request. Project Summary report showing the available funding. Approval. Expense transfers involving sponsored research projects that are processed within 90 days of the original transaction require approval signatures from the principal investigator and SPO accountant. Only in the case of exceptional circumstances will expense transfers be permitted more than 90 days after the original charge. The reasons for an expense transfer over 90 days after the original charge must be documented in detail and will require the signature of the principal investigator(s), the departmental chair, the associate/assistant dean, and the SPO Director. In all cases, the PI must sign the “debit” side of the expense revenue transfer request form. Financial Reporting Policy. The Sponsored Projects Office prepares financial reports for submission to funding agencies, submits invoices, and processes payments. In addition, this office reviews charges to sponsored accounts to determine compliance with both the University and agency regulations. Furthermore, this office is responsible for reporting on sponsored activity at the University and for the coordination of audit activity on sponsored accounts. Last modified 11/2013 8 Procedures. The Sponsored Projects Accountant reconciles the general ledger accounts and reviews expense activity monthly to provide reasonable assurance that the financial records are not misleading or contain material errors. Sources of financial information. The Sponsored Projects Office maintains the financial records of the Project. Each financial transaction is recorded in the accounting system by date, description, account, and dollar amount. This information, available online, is used to prepare monthly, quarterly, semi-annual, and annual financial reports. Responsibility for financial reporting for Federal Contracts and Grants. The Sponsored Projects Accountant prepares and timely submits the Federal Financial Reports. Grant Closeout and Year End Requirements Policy and Procedure. Closeout is the administrative process whereby sponsors determine whether all technical and administrative requirements of the grant or contract have been completed. Projects are considered completed or “closed out” only after the sponsor receives and approves all technical, financial, invention and property reports as required by the terms and conditions of the award and notifies the University of its acceptance and signoff. PIs are responsible for overseeing the proper closeout of sponsored projects, including the timely submission of all required reports (including final technical reports). PIs must assure that such documentation is adequate and readily available. In addition, some financial reports may require the PI's signature. Reporting requirements vary among agencies as to type, content, and timing. At the close of a grant or contract, the PI is accountable for ensuring that all expenses recorded are complete, allowable, allocable, and without overdrafts. Care must be taken to ensure that charges are not made to a grant or contract beyond the close date. SPO prepares the final financial reports and performs a review. If an account is in overdraft upon expiration of the project's performance period and additional funds are not available from the sponsor, the principal investigator, in consultation with his or her department and school, must clear the overdraft by transferring charges to an appropriate fund account. The school is responsible for effecting the clearance of any such unfunded expenditures from within its resources. Indirect Costs Policy. Indirect costs are charged to all sponsored projects unless prohibited in writing by the funding agency. The University's indirect cost rate for Federal grants is negotiated with the U.S. Department of Health and Human Services. Indirect costs are expenses that cannot be identified specifically with a particular project or activity because these costs generally benefit many activities. Examples include: general administration expense (accounting and payroll services, etc.), research administration, Last modified 11/2013 9 plant operation (including maintenance and utilities), library expenses, and depreciation. The indirect cost rate is negotiated with the University's cognizant agency every three years. This negotiated rate is the result of a complex calculation process utilizing historical information and removing costs specifically disallowed by the Federal government. Other Reporting Procedures. Responsibilities and procedures for various types of reports are described below. Progress Reports. Principal Investigators must submit technical/programmatic progress reports in a timely fashion to the sponsor as required by the terms and conditions of the award. Final Reports. Most sponsors require a fiscal and/or technical reporting of the project. The detail of those reports varies from sponsor to sponsor, but generally the reports are due within 90 days from the expiration date shown on the award document. Failure to submit reports in a timely and acceptable form can block favorable consideration and award of pending proposals and cause final payment to be withheld. Technical Reports. Technical reports are the responsibility of the principal investigator. Many award documents either include the report information or incorporate, by reference, the document that contains the information. Copies of the final technical report usually are forwarded directly to the technical/project monitor (named on the award document). However, SPO should be provided with a copy of the letter transmitting the final technical report to the sponsor. This will assist SPO in closing out the account and is helpful in tracking down reports allegedly not submitted. Some sponsors require the submission of the final technical report along with the final fiscal report. Questions regarding technical report requirements can be answered by the agency project monitor. Financial Reports. See Financial Reporting section. Equipment Inventory Reports. Equipment inventory reports, if required, are submitted to the sponsor by SPO. However, the principal investigator and his or her department should assist in the preparation of the report to determine the final disposition of property acquired under the agreement. Program Income Policy. Program income is defined in OMB Circular A-110 as “gross income earned by the recipient that is directly generated by a supported activity or earned as a result of an award.” Examples of program income include the following: Last modified 11/2013 10 Fees for services performed, such as laboratory tests, Money received from the use, sale, or rental of equipment purchased with projects funds, Sale of software, tapes, or publications, Sale of research materials such as animal models or reagents, Fees from participants at a conference or symposia. The use of program income is defined in the award agreement. If a research project is being performed, program income is additive meaning any program income is treated as additional funding available for the conduct of the research project. Other agreements may indicate that program income is to be treated as deductive where the amount of program income earned is subtracted from the federal obligation which leaves the funding the same but from two sources. Finally, project income can be stipulated as being used to meet any matching or cost-sharing requirements. Procedure. When program income is either anticipated as part of the project or begins to be earned as part of the project, a separate fund account is established to receive the income. The program income budget period will coincide with the total approved project award period. Project income may only be used for allocable project costs in accordance with the costing regulations of the sponsor. The amount and disposition of the program income will be reported in the final financial report of the parent award to the sponsor. Final disposition of unexpended program income will be made upon termination of the related sponsored project. Record Retention Policy. The University attempts to maintain fiscal records that will satisfy the record keeping requirements of all agencies. Since the University maintains only fiscal records, the principal investigator must be aware that he or she needs to keep records of the technical operations of the project for possible future reference. Retention periods usually are identified in the award document or in a document incorporated by reference in the award. Residual Funds Policy. A proper system of internal accounting control dictates that the University must comply with the terms and conditions of individual sponsored projects, as well as various governmental agency regulations, with respect to the disposition of residual funds that can result on cost reimbursable and other sponsored projects. Procedures. Residual funds are managed by SPO as determined by the award terms and conditions. Last modified 11/2013 11 Time and Effort Reporting Policy. CFR Part 220 and various agency regulations establish requirements for effort reporting of direct and indirect salary and wage expenses on the financial accounting records of the University. Procedures. All faculty and exempt staff whose salary is charged, in whole or in part, to a grant or is used to meet cost sharing or matching requirements on a grant must complete Time and Effort Reports. For non-exempt staff, time sheets provide the necessary documentation. The University is required by the Federal government to document effort that is charged to sponsored projects. It is the responsibility of each department chair and dean to see that a system is in place to ensure that the PIs in their areas fulfill the requirements for review and certification of salaries, and to assure that salaries charged to sponsored projects correspond to effort expended on those projects, within the appropriate limitation for the school. Reporting Period and Submission. These reports must be completed on a monthly basis during the academic year and once in the summer months and should be signed by the employee and the project director. His or her supervisory official should sign the project director’s report. These reports must be forwarded to the Sponsored Projects Office on a monthly basis during the academic year and once in the summer months. SPO will review these reports for timely submission. In addition, SPO will make any necessary adjustments for the actual expenses charged to the grant. Responsibility for Verification and Review. Government sponsors expect to pay only for those portions of employee effort that are actually devoted to their projects. Periodically, auditors review payroll charges to verify that the percentage of an employee's salary charged to a sponsored project account reasonably approximates the actual proportion of the employee's FTE effort that was devoted to that project. As a general rule, exempt employees should understand how their salary charges are being distributed, and should verify for themselves that there is a reasonably close relationship between the allocation and the actual proportion of their effort devoted to the functions and programs being charged. For research assistants and support staff, the PI, who is assumed to be most knowledgeable about the relationship between effort devoted and benefit received, often makes these allocation decisions. Travel Expenses and Reimbursement Policy. Travel expenses and reimbursement must comply with CFR Part 220 as well as the University Travel & Reimbursement Policies & Procedures (hyperlink to http://www.scu.edu/finance/forms) Last modified 11/2013 12