What is program income

advertisement

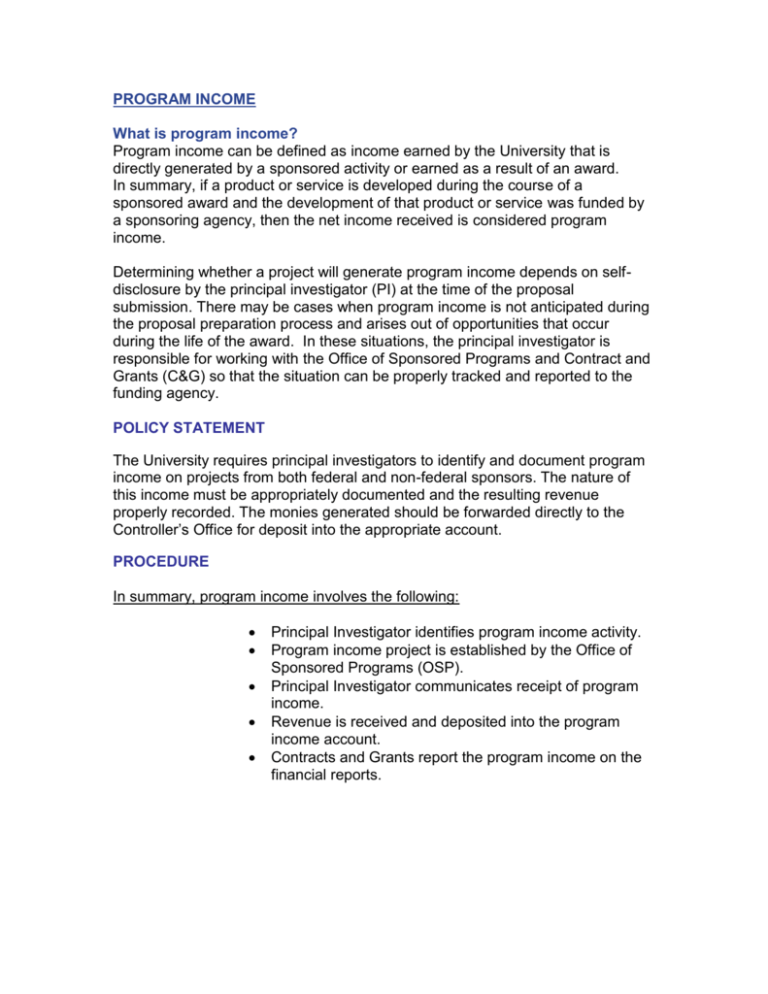

PROGRAM INCOME What is program income? Program income can be defined as income earned by the University that is directly generated by a sponsored activity or earned as a result of an award. In summary, if a product or service is developed during the course of a sponsored award and the development of that product or service was funded by a sponsoring agency, then the net income received is considered program income. Determining whether a project will generate program income depends on selfdisclosure by the principal investigator (PI) at the time of the proposal submission. There may be cases when program income is not anticipated during the proposal preparation process and arises out of opportunities that occur during the life of the award. In these situations, the principal investigator is responsible for working with the Office of Sponsored Programs and Contract and Grants (C&G) so that the situation can be properly tracked and reported to the funding agency. POLICY STATEMENT The University requires principal investigators to identify and document program income on projects from both federal and non-federal sponsors. The nature of this income must be appropriately documented and the resulting revenue properly recorded. The monies generated should be forwarded directly to the Controller’s Office for deposit into the appropriate account. PROCEDURE In summary, program income involves the following: Principal Investigator identifies program income activity. Program income project is established by the Office of Sponsored Programs (OSP). Principal Investigator communicates receipt of program income. Revenue is received and deposited into the program income account. Contracts and Grants report the program income on the financial reports. The procedure below contains detailed steps needed to correctly identify and record program income. Step 1 Identify revenue-generating activities The principal investigator is responsible for identifying actual and potential program income at the proposal stage and contacting the Office of Sponsored Program (OSP) to discuss how the revenue will be used and recorded in the budget. Common types of program income are fees from conferences and the sale of pamphlets or conference materials. Other examples include: o o o o o o o Step 2 Income from fees for services performed such as laboratory tests. Fees from participants attending conferences or symposia. Income generated from the use, sale, or rental of equipment purchased or fabricated with project funds. Proceeds from the sale of excess supplies or equipment purchased or fabricated with project funds. Sale of software, tapes or publications. Income from the sale of research materials such as animal models. Sales of products with an accompanying material transfer agreement. Answer 'yes' to question on Proposal Transmittal Form (Division of Research website) regarding program income If the principal investigator believes that program income will be generated during the project, he or she must answer ‘yes’ to the related question on the proposal transmittal form (PTF). Step 3 Plan for using program income OSP reviews sponsor regulations to determine the appropriate agency requirements. All principal investigators should be aware of how program income will be used and reported due to a possible impact on the scope of work of the award. Program income must be utilized in a manner that is allocable, allowable, and reasonable to the project. Expenses that are unallowable on the main project account are also unallowable on the program income account. Exceptions may be costs incurred that are incidental to the generation of program income. F&A costs will be charged to program income accounts at the same rate applied to the sponsored agreement that generates the income. F&A costs should also be included when determining the registration fee or prices of materials, etc. ***How program income can be used: Program income revenue can be handled in one of four ways, depending on the sponsor’s policies: 1. Matching Method- Program income is used to finance the nonsponsor or non-federal share of the project. 2. Additive Method- Program income is added to the amount allowable for project costs. 3. Deductive Method – Program income is deducted from the amount reimbursed by the sponsor. 4. Add/Deduct Method - The addition method is used up to an agency dollar limit. After that point, the deduction method is used. *****Example: A sponsor awards $100,000 for a project. The project generates an income of $30,000. o Matching Method: If the University were required to supply matching funds, e.g., $50,000, the University would now have to provide $20,000. o Additive Method: The total project cost could be $130,000. o Deductive Method: The sponsor will now only fund $70,000 of the project's costs. o Add/deduct Methods: If the sponsor limit is $25,000, the amount of $25,000 will be added to the total project cost, but $5,000 will be deducted from the sponsor's payment to reduce it to $95,000. The total amount available is $125,000. Step 4 Generate the program income When program income is generated, the PI documents the activity that generated the income (e.g., sales of goods or services, etc.) and instructs the buyer/attendee where to send payments. Appropriate records should be maintained by the PI. Step 5 Invoice for the product or service All monies collected should be forwarded directly to the Controller’s Office for deposit. The PI should maintain documentation that shows evidence of: Step 6 Receipts given to buyers, attendees, etc. Goods or services that generated the income. Number of units sold and unit cost. Information identifying the buyers, attendees, etc. Chartfield combination (DeptID, Fund, Project) to which the funds were deposited. Receive program income Any checks not made payable to Florida A&M University will be returned. If payments are erroneously received by the principal investigator or department, the checks/money orders must be forwarded to the Controller’s Office for deposit. See attached deposit form. ***Receipt of program income: In cases when the program income was not identified at the proposal stage, the PI should notify the Office of Sponsored Programs for the establishment of the program income project. The program income project will be a subproject under the same PeopleSoft award/contact as the sponsored project. OSP will inform the PI of the treatment method to be applied and the chartfield combination (DeptID, Fund, Project) to use when spending the program income funds. The budget for program income should mirror the amount of funds deposited into the program income account. Therefore, an amendment request should be forwarded to OSP for every deposit that is forwarded to the Controller’s Office for processing. The PI should forward copies of checks and an amendment request. The program income budget will only increase upon the processing of amendments by OSP. Step 7 Monitor program income The principal investigator should monitor the receipt and recording of program income. If the Principal Investigator believes that program income has been generated and deposited but is not appearing on the project, he or she should contact OSP or Contracts and Grants to track the revenue and resolve any discrepancies. Step 8 Report program income Contracts and Grants reports program income to the sponsoring agency via the financial reports. ***PROJECT CLOSEOUT: Any residual program income funds are to be handled according to the terms and conditions of the award. Unless the federal awarding agency regulations or the terms and conditions of the award state otherwise, recipients shall have no obligation to the federal government regarding program income earned after the end of the project period. RESPONSIBILITIES Principal Investigator o Identify sources of actual and potential program income at the proposal stage and mark 'yes' to the program income question on the Proposal Transmittal Form. o Develop a plan for using program income. o Complete required program income sections in agency application. o Contact OSP to discuss potential program income and whether it is reportable to the sponsor. o Maintain all documentation related the program income generating activity. o Invoice for product or service. o Deposit all program income related monies into the appropriate project. o Reconcile (verify receipt) with the University’s financial records. o Initiate budget amendments to increase program income budget. o At final project termination, address any outstanding fees or collections. o Request any approvals needed to retain any program income residuals. Department Head Ensure that any activity that could generate program income is correctly identified on the Proposal Transmittal Form. Dean Ensure that any activity that could generate program income is correctly identified on the Proposal Transmittal Form. Office of Technology, Licensing & Commercialization Provide advice on Material Transfer Agreements to principal investigators on the sale of research materials. Office of Sponsored Programs (OSP) Review proposal and RFP for anticipated program income. Determine whether program income is reportable or non-reportable. If necessary, contact sponsor to discuss concerns or questions. Correctly determine use of reportable program income. Establish appropriate program income account/project. Monitor levels of program income and any limits that are set by the sponsor. University Controller’s Office Deposit and record program income payments. Office of Contracts and Grants Monitor spending to ensure program income is expended first. Report program income as required by sponsor. Contact Information: Subject Proposal Preparation Contact Phone Office of Sponsored 599-3531 Programs ______________________________________________________________ Account Information Office of Sponsored 599-3531 Interpretation of Award Terms Programs & Conditions Project Information Amendments/Modifications _______________________________________________________________ Fiscal Reporting Contracts and Grants 412-5067 Award Close-out Time & Effort Reporting