INTERMEDIATE ACCOUNTING

advertisement

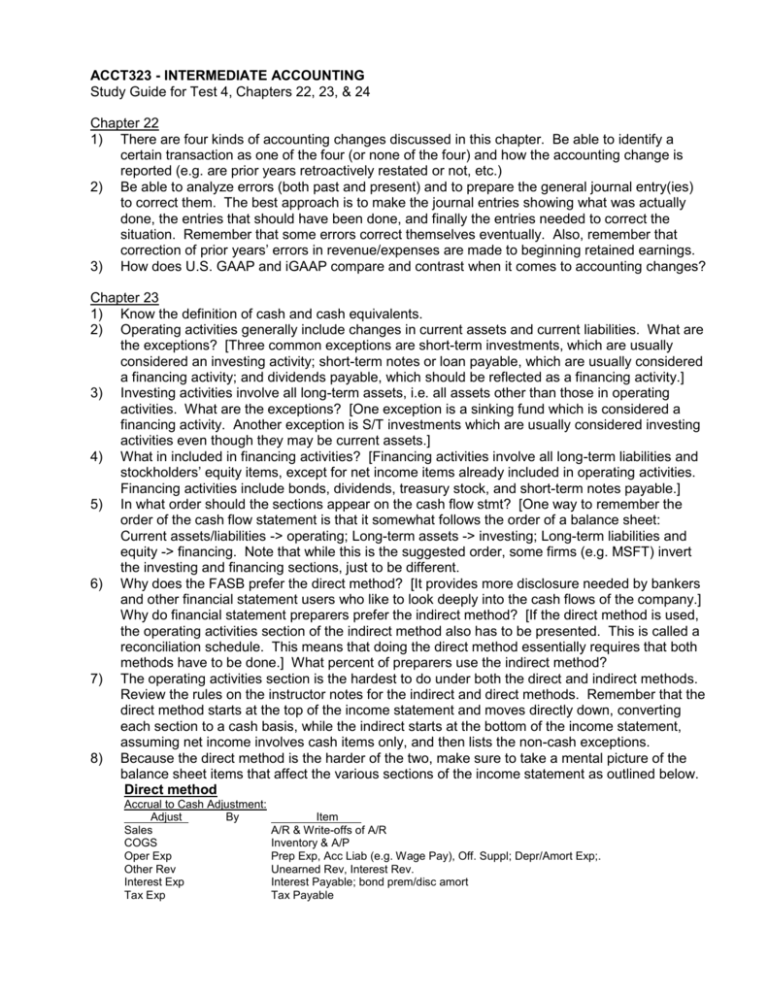

ACCT323 - INTERMEDIATE ACCOUNTING Study Guide for Test 4, Chapters 22, 23, & 24 Chapter 22 1) There are four kinds of accounting changes discussed in this chapter. Be able to identify a certain transaction as one of the four (or none of the four) and how the accounting change is reported (e.g. are prior years retroactively restated or not, etc.) 2) Be able to analyze errors (both past and present) and to prepare the general journal entry(ies) to correct them. The best approach is to make the journal entries showing what was actually done, the entries that should have been done, and finally the entries needed to correct the situation. Remember that some errors correct themselves eventually. Also, remember that correction of prior years’ errors in revenue/expenses are made to beginning retained earnings. 3) How does U.S. GAAP and iGAAP compare and contrast when it comes to accounting changes? Chapter 23 1) Know the definition of cash and cash equivalents. 2) Operating activities generally include changes in current assets and current liabilities. What are the exceptions? [Three common exceptions are short-term investments, which are usually considered an investing activity; short-term notes or loan payable, which are usually considered a financing activity; and dividends payable, which should be reflected as a financing activity.] 3) Investing activities involve all long-term assets, i.e. all assets other than those in operating activities. What are the exceptions? [One exception is a sinking fund which is considered a financing activity. Another exception is S/T investments which are usually considered investing activities even though they may be current assets.] 4) What in included in financing activities? [Financing activities involve all long-term liabilities and stockholders’ equity items, except for net income items already included in operating activities. Financing activities include bonds, dividends, treasury stock, and short-term notes payable.] 5) In what order should the sections appear on the cash flow stmt? [One way to remember the order of the cash flow statement is that it somewhat follows the order of a balance sheet: Current assets/liabilities -> operating; Long-term assets -> investing; Long-term liabilities and equity -> financing. Note that while this is the suggested order, some firms (e.g. MSFT) invert the investing and financing sections, just to be different. 6) Why does the FASB prefer the direct method? [It provides more disclosure needed by bankers and other financial statement users who like to look deeply into the cash flows of the company.] Why do financial statement preparers prefer the indirect method? [If the direct method is used, the operating activities section of the indirect method also has to be presented. This is called a reconciliation schedule. This means that doing the direct method essentially requires that both methods have to be done.] What percent of preparers use the indirect method? 7) The operating activities section is the hardest to do under both the direct and indirect methods. Review the rules on the instructor notes for the indirect and direct methods. Remember that the direct method starts at the top of the income statement and moves directly down, converting each section to a cash basis, while the indirect starts at the bottom of the income statement, assuming net income involves cash items only, and then lists the non-cash exceptions. 8) Because the direct method is the harder of the two, make sure to take a mental picture of the balance sheet items that affect the various sections of the income statement as outlined below. Direct method Accrual to Cash Adjustment: Adjust By Sales COGS Oper Exp Other Rev Interest Exp Tax Exp Item A/R & Write-offs of A/R Inventory & A/P Prep Exp, Acc Liab (e.g. Wage Pay), Off. Suppl; Depr/Amort Exp;. Unearned Rev, Interest Rev. Interest Payable; bond prem/disc amort Tax Payable 9) 10) 11) 12) 13) 14) If the indirect method is used, what two additional items must be disclosed? [Interest paid and income taxes paid must be disclosed elsewhere, either at the bottom of the cash flow stmt or in the notes. If the direct method is used, this information should be in the operating activities section of the cash flow statement.] Certain significant noncash transactions must be disclosed at the bottom of the cash flow statement. Learn the key types listed in your text. What significant noncash transactions do not have to be disclosed on the cash flow statement? Review how A/R and allowance for doubtful accounts are handled under the indirect and direct methods. How does U.S. GAAP and iGAAP compare and contrast when it comes to the statement of cash flows? Review how to calculate and interpret the following: free cash flow, current cash debt coverage ratio, cash debt coverage ratio. Can you prepare a cash flow statement in good form? You can? Excellent. Chapter 24 1. What are the major parts of a typical annual report? 2. Be able to determine whether a subsequent event requires adjustment of financial statements (Type 1), disclosure in the notes (Type 2), or no action at all. 3. Understand how to determine which segments of a business must be reported separately. Also understand how to determine what disclosures are necessary about products, geographical areas, and customers. 4. How do the discrete and integral views on interim financial reporting differ? How should the following be reported in interim financial statements: Advertising? Bad debts? Income taxes? EPS? Which view is to be followed for most revenues and expenses? 5. Know the four possible types of auditor reports and when they are to be used. [Note that “unmodified” is the new name for what was formerly called “unqualified.” 6. What is the difference between a financial forecast and a projection? Are these reports required information? What is the SEC’s Safe Harbor Rule? Is it effective in making companies feel safe about disclosing future estimates? 7. Understand the three general approaches to financial statements analysis: ratio, vertical (common-size), and horizontal (trend or base-year) analyses. The only ratios you will be expected to calculate are the current cash debt coverage ratio, the cash debt coverage ratio, and the free cash flow. 8. What is the purpose of the FASB Codification Project? What are its benefits? What are its drawbacks? (see notes) 9. How does U.S. GAAP and iGAAP compare and contrast when it comes to the information in this chapter? You may bring a 3” by 5" (index size card) with both sides crammed with as much info as possible. Better yet, bring a brain crammed full of lots of relevant data. It has been scientifically proven (through careful instructor observation) that if you have to make frequent reference to your cheat sheet, you will not only have difficulty finishing the test on time but your test score will also suffer. Conclusion: the better you know the material, the faster you can do it with fewer errors. Good luck!