Slide 1-1

advertisement

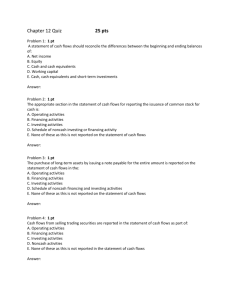

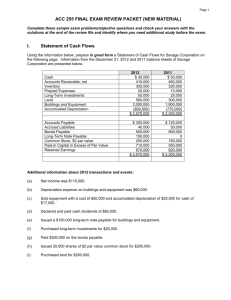

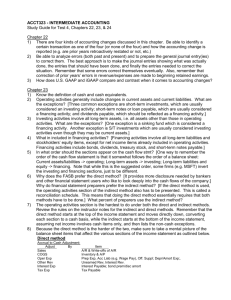

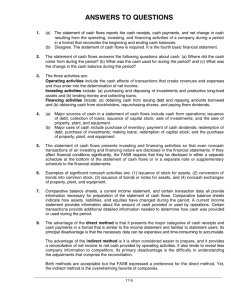

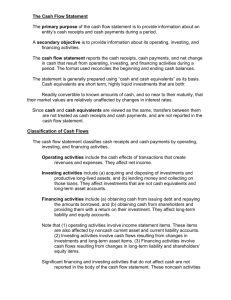

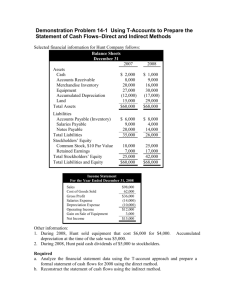

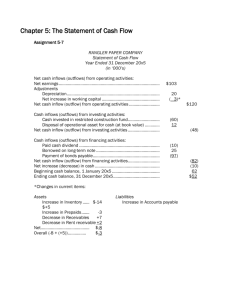

Financial Statement Analysis I: Chapter 4 ©NACM General Chapter Notes A. The Statement of Cash Flows as a Derivative Statement B. FASB 95 Analysis: Cash flows from Operations, Investing, and Financing Slide 4-1 Cash Flows of the Firm Slide 4-2 General Chapter Notes (cont.) C. How to Calculate Cash Flows 1. Net Income 2. Assets a. Increases are uses of cash (negative cash flows) b. Decreases are sources of cash (positive cash flows) 3. Liabilities and Equity a. Increases are sources of cash (positive cash flows) b. Decreases are uses of cash (negative cash flows) 4. Classifying cash flows as Operating, Investing or Financing Slide 4-3 General Chapter Notes (cont.) D. The ABC Corp. Example Problem (balance sheets and income statement are provided as links to this module) Cash Flow Statement - Indirect Method Cash Flows from Operations Net Income $2,500 Depreciation (Change in Accum. Depr.) $1,500 Accounts Receivable ($1,500) Inventory $1,000 Accounts Payable $500 -------CF from Operations $4,000 Slide 4-4 General Chapter Notes (cont.) D. The ABC Corp. Example Cash Flows from Investing Additions to Prop., Plant, and Eq. Cash Flows from Investing Cash Flows from Financing Current LTD LTD Dividends Paid Cash Flows from Financing Total Cash Flow - All Activities Beginning Cash and Mar. Sec. Ending Cash and Mar. Sec. ($4,000) -------($4,000) ($500) $700 ($1,000) -------($800) ($800) $2,000 -------$1,200 Slide 4-5 General Chapter Notes (cont.) E. Analysis of Cash Flow Statement for ABC – What went on during the year CF from Operations CF from Investing CF from Financing Net Cash Flow $4,000 ($4,000) ($800) ----------($800) F. Liquidity and Cash Flow Analysis 1. Cash flow problems in the working capital cycle 2. Cash balance 3. Using cash flow analysis in trade credit decisions Slide 4-6 Notes for Particular Parts of Chapter 4 A. Accrual Accounting for Income versus Cash Flow B. Cash Flows as a Result of the Firm’s Decisions and their Outcomes C. How Interest on Debt is Treated in FASB 95 D. Income Statement Depreciation, Changes in Accumulated Depreciation, and CF from Operations E. Direct and Indirect Methods of Calculating Cash Flows F. Composite Transactions Slide 4-7 Notes for Particular Parts of Chapter 4 (cont.) G. Cash Flow and Trade Credit Granting Decisions H. Profitable but Out of Cash: Nocash Corp. 1. Credit management and inventory management 2. Effects of rapid growth on financing needs I. Analysis of Cash Flows for Sage Corp. J. Summary Analysis of Cash Flows K. Statement Quality and Cash Flow L. Limitations of Cash Flow Analysis Slide 4-8 Dragoon Enterprises Cash Flows From Operations net income $ 1,050 increase in accum. depreciation $ 100 increase in accounts receivable $ (550) decrease in inventory $ 110 increase in accounts payable $ 300 decrease in acc. wages payable $ (100) decrease in interest payable $ (50) increase in taxes payable $ 150 -------- Total Cash Flow From Operations $ 1,010 Slide 4-9 Dragoon Enterprises Cash Flows from Investing increase in gross PP&E $ (700) decrease in long term investments $ 140 Total Cash Flow from Investing $ Total Cash Flow From Operations $ 1,010 Total Cash Flow from Investing $ (560) -------- Total Cash Flow from Financing $ (100) (560) Total Cash Flow (change in cash) $ 350 Beginning Cash $ 850 Total Cash Flow $ 350 Ending Cash $ 1,200 Cash Flows from Financing decrease in bonds payable $ (300) increase in capital stock $ 70 increase in paid in capital $ 330 dividends paid $ (200) -------- Total Cash Flow from Financing $ (100) Slide 4-10 Gerber Scientific Summary Analysis Statement of Cash Flows Year 2010 % 2009 % 2008 % $25,096 19.4% $9,774 7.8% $10,205 3.0% $464 0.4% $705 0.6% $751 0.2% Sale of Net Assets $13,709 10.6% $2,622 2.1% $345 0.1% Debt Proceeds $89,525 69.3% $110,686 88.8% $321,862 95.8% Inflows Cash Flow from Operations Sale of Investments Common Stock Activities Effect of Exchange Rates Total $898 $333 0.3% 0.7% $1,373 0.4% $1,413 0.4% $129,127 100.0% $124,685 100.0% $335,949 100.0% Slide 4-11 Gerber Scientific Summary Analysis Statement of Cash Flows Year 2010 % 2009 % 2008 % $4,489 3.5% $8,187 6.4% $8,589 2.6% $308 0.2% $457 0.4% $753 0.2% Business Acquisitions $3,473 2.7% $34,273 26.7% $4,650 1.4% Inv. in Intangible Assets $1,368 1.1% $828 0.6% $868 0.3% $117,176 91.4% $80,271 62.6% $314,256 95.2% Debt Issuance Costs $494 0.4% $1,174 0.9% Common Stock Activities $486 0.4% Other Financing Activities $341 0.3% $3,074 2.4% Outflows Capital Expenditures Purchases of Investments Debt Repayments Effect of Exchange Rates Total $128,135 100.0% $128,264 Slide 4-12 $993 0.3% 100.0% $330,109 100.0%