fourth quarter, sec quarterly magazine, 2008

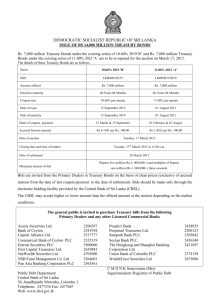

advertisement