Word - AEI Capital Corporation

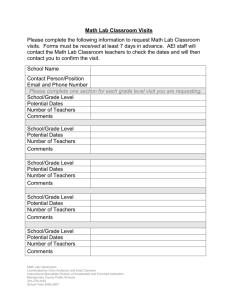

advertisement