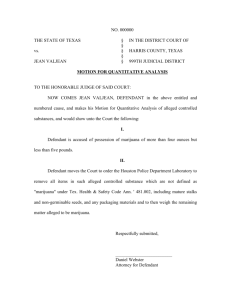

constitutional law

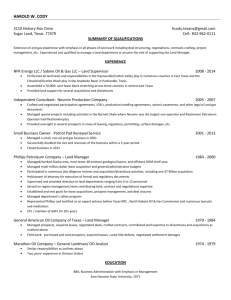

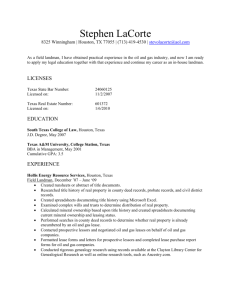

advertisement