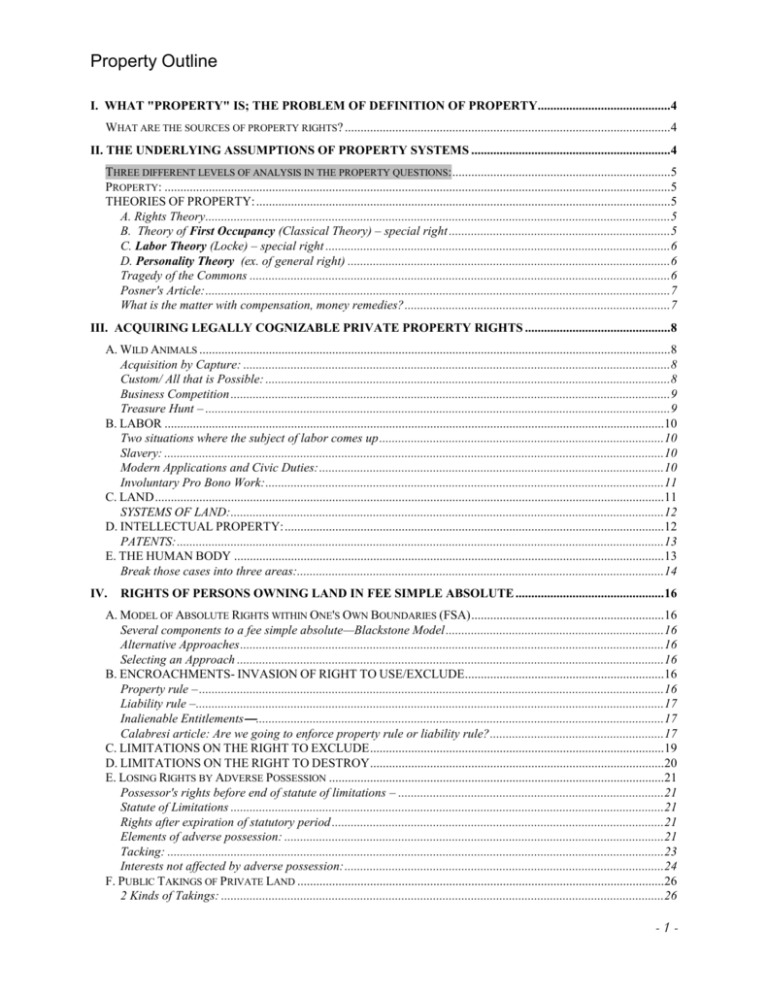

property outline

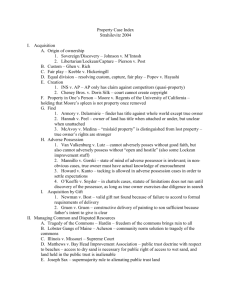

advertisement