Turnaround Management Association 2010 Distressed Investing

advertisement

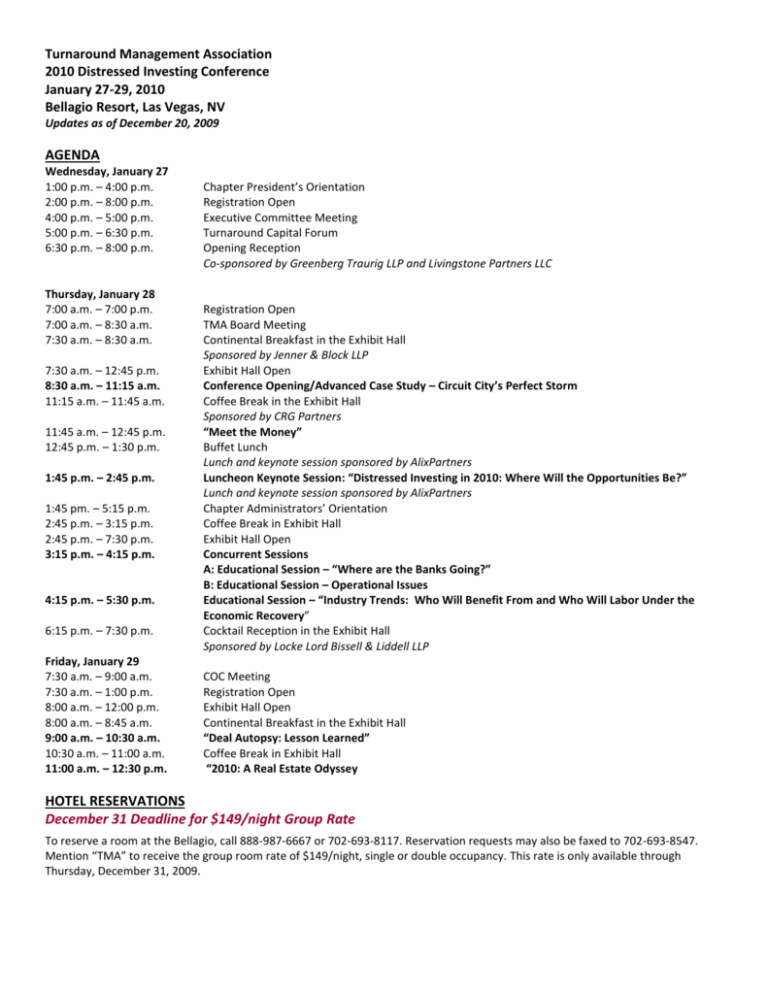

Turnaround Management Association 2010 Distressed Investing Conference January 27-29, 2010 Bellagio Resort, Las Vegas, NV Updates as of December 20, 2009 AGENDA Wednesday, January 27 1:00 p.m. – 4:00 p.m. 2:00 p.m. – 8:00 p.m. 4:00 p.m. – 5:00 p.m. 5:00 p.m. – 6:30 p.m. 6:30 p.m. – 8:00 p.m. Thursday, January 28 7:00 a.m. – 7:00 p.m. 7:00 a.m. – 8:30 a.m. 7:30 a.m. – 8:30 a.m. 7:30 a.m. – 12:45 p.m. 8:30 a.m. – 11:15 a.m. 11:15 a.m. – 11:45 a.m. 11:45 a.m. – 12:45 p.m. 12:45 p.m. – 1:30 p.m. 1:45 p.m. – 2:45 p.m. 1:45 pm. – 5:15 p.m. 2:45 p.m. – 3:15 p.m. 2:45 p.m. – 7:30 p.m. 3:15 p.m. – 4:15 p.m. 4:15 p.m. – 5:30 p.m. 6:15 p.m. – 7:30 p.m. Friday, January 29 7:30 a.m. – 9:00 a.m. 7:30 a.m. – 1:00 p.m. 8:00 a.m. – 12:00 p.m. 8:00 a.m. – 8:45 a.m. 9:00 a.m. – 10:30 a.m. 10:30 a.m. – 11:00 a.m. 11:00 a.m. – 12:30 p.m. Chapter President’s Orientation Registration Open Executive Committee Meeting Turnaround Capital Forum Opening Reception Co-sponsored by Greenberg Traurig LLP and Livingstone Partners LLC Registration Open TMA Board Meeting Continental Breakfast in the Exhibit Hall Sponsored by Jenner & Block LLP Exhibit Hall Open Conference Opening/Advanced Case Study – Circuit City’s Perfect Storm Coffee Break in the Exhibit Hall Sponsored by CRG Partners “Meet the Money” Buffet Lunch Lunch and keynote session sponsored by AlixPartners Luncheon Keynote Session: “Distressed Investing in 2010: Where Will the Opportunities Be?” Lunch and keynote session sponsored by AlixPartners Chapter Administrators’ Orientation Coffee Break in Exhibit Hall Exhibit Hall Open Concurrent Sessions A: Educational Session – “Where are the Banks Going?” B: Educational Session – Operational Issues Educational Session – “Industry Trends: Who Will Benefit From and Who Will Labor Under the Economic Recovery” Cocktail Reception in the Exhibit Hall Sponsored by Locke Lord Bissell & Liddell LLP COC Meeting Registration Open Exhibit Hall Open Continental Breakfast in the Exhibit Hall “Deal Autopsy: Lesson Learned” Coffee Break in Exhibit Hall “2010: A Real Estate Odyssey HOTEL RESERVATIONS December 31 Deadline for $149/night Group Rate To reserve a room at the Bellagio, call 888-987-6667 or 702-693-8117. Reservation requests may also be faxed to 702-693-8547. Mention “TMA” to receive the group room rate of $149/night, single or double occupancy. This rate is only available through Thursday, December 31, 2009. Turnaround Management Association 2010 Distressed Investing Conference January 27-29, 2010 Bellagio Resort, Las Vegas, NV Updates as of December 20, 2009 EDUCATIONAL PROGRAM (IN FORMATION) Thursday, January 28, 2010, 8:30 a.m. – 11:15 a.m. “Circuit City’s Perfect Storm” Presenters: Robert J. Duffy, FTI Consulting, Inc.; Gregg M. Galardi, Skadden, Arps, Slate, Meagher & Flom LLP; Lawrence E. Klaff, GB Merchant Partners; Edward R. Morrison, Columbia Law School; Richard M. Pachulski, Pachulski Stang Ziehl & Jones LLP As Circuit City entered Chapter 11 in November 2008, the company faced collapsing sales, suppliers demanding more stringent repayment terms and banks tightening credit supply and demanding a stranglehold over operations. It also faced an amended Bankruptcy Code that siphons away available cash to pay recent trade debts, demands quick decisions about continuing or terminating real estate leases and shortens the time during which the firm has an exclusive right to propose a reorganization plan. Together, these forces upended the company’s plans for reorganization. Instead of jockeying to control the reorganization process, bank lenders used the DIP loan to dictate a liquidation and direct Circuit City to use particular liquidators, who would later become bidders at its own auctions. This session will explore the legal, financial and operational issues that preceded Circuit City’s hemorrhage in Chapter 11.During the first half of the session, Professor Morrison will lay out the issues. During the second half, a panel of experts, each with a direct connection to the case, will engage the audience. Attendees will be able to: Determine whether Circuit City’s liquidation was the produce of a rare but perfect storm – a depressed economy, stressed bank lenders and a hostile Bankruptcy Code Identify if the company’s experience points to patterns that we will continue to see – and that will continue to imperil retailers – in the coming year(s) Discuss what this implies for companies, boards of directors, investors, creditors and service professionals going forward Thursday, January 28, 2010, 11:45 a.m. – 12:45 p.m. Meet the Money” Moderator: Jonathan Rosenthal, Saybrook Capital LLC Panel: Steve Hinrichs, Bank of America Business Capital; E. Gerald O’Brien II, CarVal Investors; Peter Spasov, Marlin Equity Partners LLC Thursday, January 28, 2010, 1:45 p.m. – 2:45 p.m. Keynote Session: “Distressed Investing in 2010: Where Will the Opportunities Be?” Moderator: Mark Shapiro, Barclays Capital Panel: David Matlin, MatlinPatterson Global Advisers LLC This panel of accomplished investors will discuss their views of the market and how they approach distressed investing. Don’t miss this rare opportunity to gain insight from some of the industry’s leading professionals. From this session, attendees will learn: What the top professionals think the outlook will be for distressed investors in 2010 How to think about real estate, financial institutions and other sectors that will be distressed in 2010 What some of the trends were in 2009 for distressed investors and will they apply in 2010? CONCURRENT SESSION THURSDAY, JANUARY 28, 2010, 3:15 P.M. – 4:15 P.M. “Where are the Banks Going?” Moderator: Joseph S. Berry Jr., Keefe, Bruyette & Woods Panel: Joseph A. Jiampietro, FDIC; Gregg H. Smith, Conway MacKenzie Inc. More than a year after the government recapitalized the banking industry through TARP, bank balance sheets are still clogged with distressed commercial borrowers. Over 125 banks have been placed into receivership by the FDIC. Many experts are predicting continued headwinds. A multidisciplinary panel will address the current bank environment, including capital, operating issues and regulatory environment for the banking industry. Attendees will be able to: Learn about issues banks are facing regarding distressed loans, capital adequacy, and options available to address these issues Analyze current FDIC Loss Share Structures – is traditional M&A dead? Turnaround Management Association 2010 Distressed Investing Conference January 27-29, 2010 Bellagio Resort, Las Vegas, NV Updates as of December 20, 2009 Evaluate lending in the current environment – is there a new standard? “Operational Issues” Moderator: William K. Snyder, CTP, CRG Partners Group LLC Panel: Carrianne Basler, AlixPartners; Thomas R. Califano, DLA Piper LLP (US); William R. Quinn, Versa Capital Management Inc. Thursday, January 28, 2010, 4:00 p.m. – 5:30 p.m. “Industry Trends: Who Will Benefit From and Who Will Labor Under the Economic Recovery” Moderator: Ronald F. Greenspan, FTI Consulting, Inc. Panel: Frank A. Merola, Jefferies & Company Inc.; Kevin Otus, Emerald Technology Valuations LLC The nascent economic recovery will not treat everyone equally. A panel of experts will explore this idea further by highlighting the evolving prospects for the following industries: technology, retail, commodities, durable goods, travel and hospitality and media and entertainment. Attendees will learn how to: Identify which industries are expected to see a quick boost Determine which industries will see their prospects warm only after sustained economic improvement Recognize which industries may actually see their margins shrink and competitive pressures erode their bottom line and cash flow Friday, January 29, 2010, 9:00 a.m. – 10:30 a.m. “Deal Autopsy: Lessons Learned” Moderator: Howard Brod Brownstein, CTP, NachmanHaysBrownstein Inc. Panel: Leon V. Komkov, Longroad Asset Management LLC; Lewis J. Schoenwetter, Bayside Capital; James B. Shein, Northwestern University Kellogg School of Management; John P. Tatum, Prophet Equity The most brilliantly conceived transactions can sometimes go off the rails for reasons that are unanticipated, as well as for reasons that might have been predicted. Hear from this panel of experts as they share their experiences of rim shots, air balls, and victories that almost were. Attendees will be able to: Learn from real-world lessons pulled from the ‘deal morgue’ Determine what makes deals go awry Friday, January 29, 2010, 11:00 a.m. – 12:30 a.m. “2010: A Real Estate Odyssey” Moderator: Matthew Bordwin, KPMG Corporate Finance Inc. Panel: Neil Aaronson, Hilco Real Estate LLC; Marc Blum, Next Realty, L.L.C.; Teddy Kaplan, Angelo, Gordon & Co.; Matthew B. Schwab, Karlin Real Estate The turmoil in the real estate markets over the last 18 months has changed the underlying fundamentals of the way investors, lenders, landlords and lessees approach a real estate transaction. With unprecedented retail closings, lack of financing available for transactions and staggering amounts of real estate debt coming due, 2010 and beyond will be an extremely interesting time for those in the real estate world. The impact of how the market shakes out will have a far reaching effect on not only the real estate market but the overall economic climate. Attendees will hear from and participate in an open discussion on how to: Forecast expectations as to how the market will evolve over the next year Understand strategies retailers and other tenants can undertake to help survive Invest strategically in real estate Gauge what lenders are looking for to invest in real estate transactions REGISTRATION FEES Register Online Today! Unless otherwise indicated, registration fees include educational sessions, meals and social functions. Events are not prorated. To attend any portion of the conference, you must register for the entire conference at the appropriate registration fee. The registration fee allows admission for one individual only. Registrations may not be shared. Each Turnaround Management Association 2010 Distressed Investing Conference January 27-29, 2010 Bellagio Resort, Las Vegas, NV Updates as of December 20, 2009 registered attendee will receive a name badge at the conference that must be worn for admittance into all educational sessions, meals and social functions. Category TMA Member Nonmember Full-time Academic/Government Employee Fee $1,195 $1,395 $600 Registration Categories The member registration fee is for current, active TMA members only. Please note that TMA membership is on an individual basis. Unless otherwise appropriate as defined below, all other attendees will be charged the nonmember fee. If an individual registers for the member fee, but TMA has no membership record, the individual will be charged the nonmember fee unless s/he can produce proof of membership. The full-time academic/government employee rate defines a full-time academic as a student enrolled in at least 12 credit hours per term at an accredited university or an instructor employed on a full-time basis by an accredited university. Please submit appropriate documentation with your registration form. Registration received after January 20, 2009, will be subject to an on-site registration surcharge of $50 fee, as detailed further below. CONFERENCE SPONSORS Platinum Sponsors Conway MacKenzie Gold Sponsors DLA Piper US LLP Event Sponsors AlixPartners BDO Consulting CRG Partners Getzler Henrich & Associates LLC Greenberg Traurig LLP Hilco Real Estate, LLC Jenner & Block LLP Livingstone Partners LLC Locke Lord Bisselll & Liddell LLP Skadden, Arps, Slate, Meagher & Flom LLP Display Table Sponsors EPIQ Systems Industrial Auctioneers Association Insight Equity Melville Capital, LLC Prophet Equity Reefpoint LLC Windham Professionals Inc. Wingate Partners