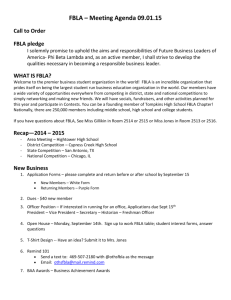

FBLA practice test #1

advertisement

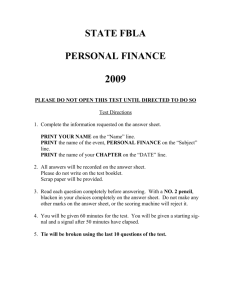

NEW YORK STATE FBLA BUSINESS MATH 2009 PLEASE DO NOT OPEN THIS TEST UNTIL DIRECTED TO DO SO Test Directions 1. Complete the information requested on the answer sheet. PRINT YOUR NAME on the “Name” line. PRINT the name of the event, BUSINESS MATH on the “Subject” line. PRINT the name of your CHAPTER on the “DATE” line. 2. All answers will be recorded on the answer sheet. Please do not write on the test booklet. Scrap paper will be provided. 3. Read each question completely before answering. With a NO. 2 pencil, blacken in your choices completely on the answer sheet. Do not make any other marks on the answer sheet, or the scoring machine will reject it. 4. You will be given 60 minutes for the test. You will be given a starting signal and a signal after 50 minutes have elapsed. 5. Tie will be broken using the last 10 questions of the test. NYS FLBA 2009 BUSINESS MATH 1 1. Marian Abelt likes being a mail clerk. She earns $8.125 per hour and her boss allows her to work flexible hours. Last week she worked 35.525 hours. What was her straighttime pay? A. $288.00 B. $288.64 C. $288.65 D. $289.00 2. Cindy Haskins is paid $8.00 an hour for a regular 35-hour week. Cindy’s overtime rate is 1 ½ times her regular hourly rate. This week Haskins worked her regular hours and 8 hours overtime. What is her total pay? A. $96.00 B. $280.00 C. $344.00 D. $376.00 3. Carol Howard is scheduled to work 7:00 am to 11:00 am and from 12:00 noon and 4:00 pm Monday through Friday. She worked overtime Tuesday and Thursday 5:00 pm to 8:00 pm. Her regular pay is $7.50 per hour with 1 ½ times her regular hourly rate for overtime. What was Carol’s total pay for the week? A. $300.00 B. $333.75 C. $345.00 D. $367.50 4. Jeremy Sullivan delivers newspapers for the Dispatch. He receives 14.2¢ per paper, 6 days a week (for the daily paper), and 50¢ for the Sunday paper. He delivers 124 daily papers each day and 151 Sunday papers each week. What is his total pay for the week? A. $75.50 B. $105.65 C. $176.55 D. $181.16 5. Paul Sellers was paid a biweekly salary of $1,230. Now he’s paid on a semimonthly basis. What will Seller’s semimonthly salary be? A. $1,332.50 B. $1,537.50 C. $2,460.00 D. $5,330.00 NYS FBLA 2009 BUSINESS MATH 2 6. Maude Eggert sells cosmetics for Soft Touch, Inc. She is guaranteed a salary of $790 a month, or 7 percent of her total sales--whichever is greater. What is her gross pay for a month in which her total sales were $10,984? A. $768.88 B. $768.90 C. $790.00 D. $1,558.88 7. Joyce Doyle is a sales trainee. She is paid $1,500 per month plus a commission of 7.5 percent on all sales over a quota of $20,000 per month. What is her total pay for a month in which she has sales totaling $22,650? A. $198.75 B. $1,500.00 C. $1,698.75 D. $3,198.75 8. Erica Matthies is married and earns $28,640 per year as a video editor. The state tax rate in her state is 3.5 percent of taxable income. What amount is withheld yearly for state income tax? A. $862.40 B. $1,002.40 C. $1,015.00 D. $8,182.86 9. The Social Security tax rate is 6.2 percent of the first $90,000 and Medicare tax rate is 1.l45 percent on all income. Oliver Gelfand earns $45,550 a year, paid on a semimonthly basis. How much is the total amount deducted per pay period for Social Security and Medicare? A. $20.06 B. $108.62 C. $128.68 D. $254.25 10. Bill Bernstein’s group medical insurance coverage costs $5,480 a year. The company pays 65 percent of the cost. How much is deducted each month from his paycheck for medical insurance? A. $159.83 B. $167.25 C. $296.83 D. $456.67 NYS FBLA 2009 BUSINESS MATH 11. Brianna Ralph is married and claims 2 allowances. Her gross weekly salary is $450. Each week she pays $52.43 for federal, Social Security, and Medicare taxes, $21.20 for medical insurance, and $5.00 for the credit union. What is her net pay? A. $371.37 B. $397.57 C. $418.77 D. $413.77 12. Sabrina West has been keeping track of her parent’s living expenses. The total monthly expenses for June, July, August, and September were $2,334.09, $2,567.33, $3,451.96, and $1,98l.78, respectively. What were Sabrina’s parent’s average monthly expenditures? A. $2,383.12 B. $2,583.79 C. $2,784.46 D. $10,335.16 13. Olive Baker stops at an ATM location in the lobby of her office building. She has a paycheck for $173.45 and a refund check for $3. She would like to receive $25 in cash and deposit the remaining amount. What is her total deposit? A. $145.45 B. $151.45 C. $176.45 D. $181.45 14. Carole Winter deposits checks for $425.22, $883.99, and $57.05. She has cash consisting of 45 one-dollar bills, 15 five-dollar bills, 12 ten-dollar bills, 28 quarters, 16 dimes, 19 nickels, and 65 pennies. She would like to receive $60 in cash. What is her total deposit? A. $1,366.26 B. $1,426.28 C. $1,556.46 D. $1,676.46 15. Mac Valent had a balance of $209.81 in his checking account. He wrote checks for $47.15, $53.03, and $107.30. What was Mac’s balance? A. $2.32 B. $2.33 C. $207.48 D. $419.62 3 NYS FBLA 2009 BUSINESS MATH 4 16. Keith Jackson wrote a check to Greenstone Electric in the amount of $123.45. What would be the correct way for Keith to write the amount of the check in words on his check? A. One hundred twenty-three and 45/100 B. One twenty-three hundred and 45/100 C. One hundred twenty three and 45 cents D. One hundred and twenty-three dollars and 45 cents 17. Brianna Warren check book register and bank statement showed the following information: Check Register Balance--$4,561.20, Interest--$6.59, Service Charge--$5.05, Statement Balance--$3,987.00, Outstanding Check--$75.74, Outstanding Deposit-$651.48. What is Brianna’s adjusted bank balance? A. $1,313.06 B. $3,411.26 C. $4,559.65 D. $4,562.74 18. Tula Woods uses online banking. Last month Woods had these charges: basic charge of $6.95, seven service charges at $0.50 each, and $5.00 to replace a lost card. Woods also had ATM fees of $4.00 for out-of-network use and a cash advance fee of 2 percent of $200. What are the total fees? A. $17.45 B. $19.45 C. $23.45 D. $223.45 19. Winona Gendron is a street vendor selling souvenirs in front of Comerica Baseball Park. She deposits her sales income directly into a savings account. her deposit today consists of 5 one-hundred-dollar bills, 8 fifty-dollar bills, 25 twenty-dollar bills, 22 fivedollar bills, 8 two-dollar bills, 19 one-dollar bills, 18 half-dollars, 42 quarters, 36 dimes, 28 nickels, and one check for $40.00. What is the total deposit? A. $950.00 B. $1,569.50 C. $1,609.50 D. $1,649.50 20. Darrick Taylor’s previous balance is $2,161.41. On his bank statement there is a record of $20.04 in interest, deposits of $345.00 and $575.80, and withdrawals of $210.00 and $945.00. What is his new balance? A. $1,757.25 B. $1,947.25 C. $2,375.57 D. $3,704.50 NYS FBLA 2009 BUSINESS MATH 5 21. Vernon Taber deposited his $2,000 scholarship money in a savings account at State Home Savings Bank on June 1. At the end of 2 months, interest was computed at an annual interest rate of 6 percent. How much simple interest did his money earn? A. $20.00 B. $43.76 C. $120.00 D. $720.00 22. Ernie Boddy had $3,620 on deposit at Savings Bank on July 1. The money earns interest at a rate of 6.5 percent compounded quarterly. What is the amount in the account on April 1 of the following year if no deposits or withdrawals were made? A. $3,738.61 B. $3,799.36 C. $3,855.30 D. $3,861.10 23. Alfredo Rodriguez purchases a DVD for $29.95, a dictionary for $31.50, a paperback book for $9.25, and a magazine for $5.00. What is the total sales tax if he lives in Acme, Washington, where the state tax is 6.5 percent and the city tax is 1.1 percent? A. $.83 B. $4.92 C. $5.68 D. $5.75 24. At corner Grocery store, Liz Doyle purchases a 22-pound turkey at $1.59 per pound, 6 oranges at 4 for $1.00, a $6.99 box of laundry detergent, a half-gallon of milk for $2.69, a $0.99 frozen pie, and 6 cans of condensed soup at 2 cans for $0.74. The sales tax rate is 4 percent. There is no sales tax charged on food items. What is the total purchase price? A. $49.09 B. $49.37 C. $49.65 D. $51.34 25. Guiseppe Gerken wants to purchase some batteries. A 6-pack costs $4.77. An 8pack costs $5.67. A package of four 4-packs costs $7.95. Which is the best buy? A. 6-pack @ $4.77 B. 8-pack @ $5.67 C. four 4-packs @ $7.95 D. they all cost the same NYS FBLA 2009 BUSINESS MATH 6 26. Jonnie Marker has a coupon for $1.00 off a jar of bean dip if he buys 2 bags of corn chips. He purchased 2 bags of chips for $3.99 per bag and a jar of bean dip for $2.79. What is the final price? A. $7.98 B. $9.77 C. $10.77 D. $11.77 27. Jeremy Berkowitz purchases a down jacket during an April coat sale at the Ski Shop. All coats are discounted 45 percent. The down jacket regularly sells for $154.50. What is the markdown? A. $69.52 B. $69.53 C. $84.97 D. $84.98 28. The Pizza Shack discounts 15 percent off the regular selling price on the purchase of 3 or more pizzas. What is the total cost of three pizzas that regularly sell for $9.75, $15.75, and $19.75? A. $6.79 B. $38.46 C. $45.25 D. $52.04 29. Joshua Okwy was planning to go camping with his family. He purchased a tent for $199.98, a lantern for $39.50 and an outdoor stove for $59.95. He lives in North Carolina, where the sales tax is 6 percent. What was the total cost of these items? A. $281.46 B. $299.43 C. $317.39 D. $317.40 30. Rolo Stein’s charge account statement showed a previous balance of $658.94, a finance charge of $10.71, new purchases of $54.21, $36.28, and $98.56, a credit of $145.81 and a $100.00 payment. What is the new balance? A. $213.37 B. $812.83 C. $1,104.51 D. $1,139.84 NYS FBLA 2009 BUSINESS MATH 7 31. Hideo Nagata’s account statement showed the following information: previous balance of $948.00, credit of $100.00, payment of $200.00, and new purchases of $72.00 and $88.00. The periodic rate is 1.5 percent. What is Hideo’s new balance? A. $808.00 B. $817.72 C. $820.12 D. $1,008.00 32. Jessie Ardella obtained a single-payment loan of $3,225.00 to pay a repair bill. He agreed to repay the loan in 31 days at an exact interest rate of 11.75 percent. What is the maturity value of his loan? A. $3,257.18 B. $3,257.63 C. $3,263.07 D. $3,603.94 33. Milt Gibson purchased computer equipment for $4,020. He used the store’s credit plan. He made a 20 percent down payment with 20 monthly installments. What amount did he finance? A. $160.80 B. $201.00 C. $3,216.00 D. $4,824.00 34. Scott DuBois took out a simple interest loan of $1,800 for home repairs. The loan is for 12 months at 8 percent interest with a payment of $156.60. After 8 months, the balance is $615.87. If he pays off the loan when the next payment is due, how much is saved by paying the loan off early? A. $4.11 B. $6.42 C. $10.53 D. $12.00 35. Kathleen Dun purchased a laptop computer for $1,200. She made a down payment of $500. She can finance the remainder by agreeing to pay $31.34 per month for 24 months to the computer company. She could also obtain a small business loan at $40.44 per month for 18 months. How much would she save by taking the least expensive plan? A. $9.10 B. $24.24 C. $27.92 D. $52.16 NYS FBLA 2009 BUSINESS MATH 8 36. Levi Lemke wants to purchase a car costing $21,000. He will finance the car with an installment loan from the bank, but would like to finance no more than $14,280. What percent of the total cost of the car should his down payment be? A. 32% B. 47% C. 53% D. 68% 37. Dalton Slade is interested in a sports utility vehicle that has a base price of $31,145. Factory-installed options total $1,245. The destination charge from its assembly plan in River Rouge, Michigan, is $352. If the state sales tax is 7%, what will be the total cost of the vehicle? A. $32,742.00 B. $34,922.15 C. $35,009.30 D. $35,033.94 38. Evander Harris is ordering a luxury coupe convertible built to his specifications. The base price is $81,975 and options total $1,280. There is a destination charge of $890. The dealer’s cost is about 90 percent of the base price and 88 percent of the optional price. The dealer will sell him the car for $200 more than the estimated dealer’s cost plus a 6 percent sales tax. What is the total cost of the car? A. $75,993.90 B. $79,610.13 C. $80,341.53 D. $80,553.53 39. Sue Soto owns a used four-door sedan that she wants to sell so she can purchase a new vehicle. One used-vehicle guide shows that the average retail value for it is $3,900. She adds $50 for having a vinyl top, $125 for a cassette player, $25 for power windows, and $25 for power locks. Soto deducts $175 for having no air-conditioning. She adds $450 for having less than the expected mileage. What is the average retail price for her vehicle? A. $3,500 B. $4,375 C. $4,400 D. $4,750 40. J. J. Olmstead drove 11,400 miles in his SUV last year. His variable costs totaled $2,965.89. His fixed costs totaled $2,884.26. What was the cost per mile for him to operate his SUV? A. $0.253 B. $0.260 C. $0.513 D. $1.949 NYS FBLA 2009 BUSINESS MATH 9 41. Teneshia Cooper has an open-end lease for a SUV, which she uses for her fabric store. The lease costs $339 a month for 60 months. She paid a deposit of $2,500, a title fee of $35, and a license fee of $135. At the end of the lease, she can buy the vehicle for its residual value of $9,446. What is the total cost if she buys the vehicle? A. $23,010 B. $29,956 C. $32,421 D. $32,456 42. Sanchez Corado rented a minivan for 4 days at $38.00 a day plus $.50 a mile. He purchased collision waiver insurance for $8.50 a day. He drove 420 miles and paid $89.64 for gasoline. What was the total cost of renting the minivan? A. $275.64 B. $313.64 C. $452.64 D. $485.64 43. Alice Coopersmith is moving to a new home. She can rent a 14-foot truck for $40.00 a day plus $.52 a mile or an 18-foot truck for $55.00 a day plus $.58 a mile. It would take 4 trips to make the move in the 14-foot truck, but only 3 trips in the larger truck. She estimates that gasoline would cost about $85.00 for either truck. A round-trip to her new home is 60 miles. Regardless of the number of trips, she would need the truck for only 1 day. Which truck would be cheaper to rent and by how much? A. The 14-foot truck is cheaper by $5.40 B. The 14-foot truck is cheaper by $25.80 C. The 18-foot truck is cheaper by $5.40 D. The 18-foot truck is cheaper by $25.80 44. The Hashros have purchased a duplex. They would use the rental income from one part of the duplex to helpmeet the mortgage payments. A selling price of $100,800 was agreed upon. What is the amount of the mortgage loan if a down payment of 30 percent is required? A. $30,240 B. $33,600 C. $70,560 D. $97,440 45. The rate of assessment in Foster, Rhode Island, is 50 percent. The tax rate is $40.20 per $1,000 of assessed value. What is the real estate tax on a piece of property that has a market value of $236,000? A. $4,743.60 B. $5,870.65 C. $9,487.20 D. $18,974.40 NYS FBLA 2009 BUSINESS MATH 10 46. Jose and Trudy Engstrom own a home that has a market value of $675,000. They live in Richmond, Virginia, where the rate of assessment is 80 percent and the tax rate is 25.13 mills. What is the annual real estate tax? A. $1,357.02 B. $1,696.28 C. $13,570.20 D. $16,962.75 47. Melvin Hayashi recorded his housing expenses for the month of December: $548.36 for mortgage payment, $29.50 for insurance premium, $122.50 for real estate taxes, $46.75 for refrigerator installment payment, $104.70 for electricity, $34.40 for telephone service, $86.70 for home heating oil, and $21.80 for water. His monthly take-home pay is $2,500. What is his total monthly housing cost? A. $446.36 B. $994.72 C. $1,505.29 D. $3,494.72 48. Boris Heban is single and pays into an HMO. The total cost is $8,190 annually, and the employer pays 90 percent of the total cost. He also pays 50 percent of the optional annual dental premium of $662 and 50 percent of the optional vision premium of $188. How much is deducted each week from his paycheck? A. $23.92 B. $149.92 C. $165.67 D. $173.85 49. Placido Lucero is retired and covered by Medicare Part A & B. His retirement plan covers 67 percent of his Medicare HMO annual premium of $4,200. His retirement plan covers 50 percent of his wife’s Medicare HMO annual premium of $4,200. Also, Lucero has a dependent grandchild who has an HMO annual premium of $1,600, of which 40 percent is covered by his retirement plan. What is the monthly amount deducted from his retirement check for health care? A. $370.50 B. $416.67 C. $462.83 D. $833.33 50. Enice Brudley purchased 3,000 shares of GTI Petroleum at $6.30 per share. The broker’s commission was $19.95 for fewer than 1,000 shares, or $.02 per share for 1,000 or more. What was the total paid? A. $18,900.00 B. $18,919.95 C. $18,920.00 D. $18,960.00 NYS FBLA 2009 BUSINESS MATH 11 51. Joyce Kronecki bought 350 shares of KOW Inc. at $42.50 per share. Last year the company paid annual dividends of $.58 per share. What were her annual dividends? A. $43.08 B. $203.00 C. $14,875.00 D. $15,078.00 52. Duane Hartley owns 2,000 shares of Heban Oil stock, which he purchased for $28.40 each. Recently he read that the average selling price of his stock was $37.90. The company paid annual dividends of $1.80 per share last year. What is the annual yield on his stock? A. 4.75% B. 6.34% C. 7.49% D. 7.50% 53. Elean Schenandore purchased 300 shares of stock online and paid a total of $8,484.95. She sold the stock at $39.94 per share and paid a $29.95 sales commission. What was the profit or loss from the sale? A. $3,457.10 profit B. $3,527.00 profit C. $3,476.10 loss D. $3,527.00 loss 54. Alfredo Gutierrez bought 2,000 share of a phone company’s stock at $36.50 a share. He sold his stock at $48.25 per share. Each transaction paid a sales commission of $49.95 plus $.02 per share. What was the net amount of the sale? A. $23,320.10 B. $73,089.95 C. $96,410.05 D. $96,500.00 55. Tony Sanchez owned 180 shares of an architecture company’s stock, for which he paid $13.50 per share plus a 2 percent commission on the principal. He sold at $31.50 and paid a 3 percent sales commission on the principal. What was the profit from the sale? A. $3,021.30 B. $3,118.50 C. $3,240.00 D. $3,361.50 NYS FBLA 2009 BUSINESS MATH 12 56. Sandy and Morry Doran purchased a $50,000 bond at a quoted price of 94 3/8. The bond pays annual interest at a rate of 3 percent. What is the annual interest earned? A. $1,415.63 B. $1,415.70 C. $1,500.00 D. $1,594.38 57. A manufacturing company recruits a data processing manager. The costs included: advertising cost-$1,475.00, interviewing cost-$861.79, and hiring cost-$3,791.86. What is the total recruiting cost? A. $1,455.07 B. $4,405.07 C. $6,128.00 D. $6,128.65 58. Novi Discount Brokers hired Wall Street Search Service to locate candidates for the position of manager, investment bonds. The agency’s fee is 25 percent of the first year’s salary if one of its candidates is hired. Novi also ran several advertisements at a total cost of $2,816.40. Novi interviewed three people. Hakeem Golden applied through the agency. His travel costs were $948.75. Nancy Cooper answered the advertisement. Her travel costs were $516.40. Henry Little applied through the agency. His travel costs were $671.80. Novi hired Henry Little at an annual salary of $94.760. Novi paid his moving expenses of $1,419.20 and his real estate broker’s fee of 7 percent to sell his $249,000 home. What was the recruiting cost including the costs for the two candidates not hired? A. $28,802.55 B. $30,067.55 C. $44,676.15 D. $47,492.55 59. Nick Antonelli sells for Discount Appliance, Inc. His weekly based salary is $400 plus 5 percent of all his sales. One week he had $9,860 in sales. If he received a 6 percent merit increase on his base salary, what would his gross pay be for the week? A. $917.00 B. $918.20 C. $922.58 D. $946.58 60. A stock clerk’s annual salary is $21,860. Benefits include: Vacation and holidays$840.77, Health insurance-$1,275.00, Unemployment insurance-$1,005.56, Social Security (FICA)-$1,355.32, Medicare-$316.97, and Compensation insurance-$486.26. What are the total benefits? A. $4,792.65 B. $5,279.88 C. $19,130.12 D. $27,139.88 NYS FBLA 2009 BUSINESS MATH 13 61. Cho Wan Sey, a sales representative for Curry Corporation, flew to New York City to make a sales presentation. Airfare Was $515. She rented a car for 3 days for $51.40 a day plus $.52 a mile. She drove a total of 70 miles. Her hotel bill was $184.50 a night for 2 nights. Her meals cost $11.90, $24.85, $9.76, $14.91, $37.80, $9.80, and $14.90. What were Sey’s total travel expenses? A. $874.82 B. $977.62 C. $1,014.02 D. $1,198.52 62. The tax department of National Brokerage, Inc. is sending 8 tax advisors to a 2-day seminar on the new Economic Growth and Tax Relief Reconciliation Act. Three of the advisors earn $252 a day, while the other 5 earn $360 per day. Registration costs $350 per person. Materials cost $125 per person. What will the 2-day seminar cost National Brokerage, Inc.? A. $1,087 B. $2,174 C. $6356 D. $8,912 63. Adelphia Brokers, a full service brokerage house, brought in Williams N. Thomas, a specialist in financial stock, to meet with their 15 brokers. Mr. Thomas charged a fee of $2,500 for the 4-hour session. The average hourly rate for the 15 brokers was $50.00 per hour. Lunch for the 15 brokers and Mr. Thomas was $14.50 per person. What was the total cost for the 4-hour financial stock training session? A. $3,482.00 B. $5,717.50 C. $5,732.00 D. $6,805.00 64. Eduardo Diaz is a molding machine operator at US Accessories, Inc. He molds 130 tinted license plate holders from one container of molding plastic. Each container costs $5.85. Eduardo is able to mold 1 holder every 3 seconds. The direct labor cost is $18.95 per hour. What is the prime cost of manufacturing 1 tinted license plate holder? A. $.045 B. $.061 C. $.101 D. $.361 NYS FBLA 2009 BUSINESS MATH 14 65. Harry Cooke operates an engraving machine at Noonan Metals. From one sheet of metal, 120 nameplates can be made. Each sheet costs $24.75. He can engrave one every 3 seconds. The direct labor cost is $18.50 per hour. What is the prime cost of engraving one nameplate? A. $.052 B. $.206 C. $.222 D. $.360 66. Solo Circuits manufactures calculators. They plan to manufacture scientific calculators to be sold at $10.99 each. The fixed costs are estimated to be $605,225. Variable costs are $8.89 per unit. How many calculators must be sold for Solo Circuits to break even? A. 30,444 B. 55,071 C. 68,079 D. 288,202 67. True Bounce basketballs are manufactured by General Sports. They have total fixed costs of $3,110,400. The variable cost per basketball is $18.47. The selling price per basketball is $24.95. What is the break-even price in number of basketballs? A. 71,635 B. 124,665 C. 168,403 D. 480,000 68. Alice McHenry is a quality control inspector for Nu-Age Cassettes. The process is in control if 6 percent or less of each sample is defective. McHenry checked a sample of 50 cassettes and found 4 defective cassettes. What percent of the sample is defective and is the process in or out of control? A. 8%, In Control B. 8%, Out of Control C. 14%, In Control D. 14%, Out of Control 69. General Appliance did a time study of Phil Jacobs’ job as a metal fabricator. Jacobs’ times per item, in seconds, were recorded as follows: 42.5, 44.1, 42.8, 45.9, 45.6, and 43.7. If he gets a ten-minute break each hour, how many items can he make per hour? A. 9 B. 11 C. 44 D. 68 NYS FBLA 2009 BUSINESS MATH 15 70. Chandra Lane, a carton packer for Grandma’s James, fills cartons 2.5 hours per day. She works 8 total hours per day. What percent of her day is spent filling cartons? A. 31.25% B. 37.5% C. 62.5% D. 68.75% 71. A carton contains 6 packages, each 10 inches wide next to each other. Each end is ¾ inch cardboard. How wide is the carton? A. 61 ½ inches B. 63 ¾ inches C. 65 ¼ inches D. 69 inches 72. Mayo Electronics shows a $19.99 list price in its catalog for a surge protector. The net price to the retailer is $13.00. What is the trade-discount rate? A. 32% B. 35% C. 65% D. 68% 73. A catalytic converter is manufactured and sold to a jobber for $180.90, then sold to a wholesaler for $241.20, then sold to a retailer for $360.00, who places a retail price of $600.00 on the converter. Find the trade discount each time it is sold. A. 25%, 33%, 40% B. 30%, 40%, 60% C. 30%, 50%, 75% D. 33%, 49%, 67% 74. Wholesale Supply Company offers chain discounts of 35 percent less 20 percent less 15 percent to sell out a discontinued item. Find the final net price for a $1,460 order. A. $438.00 B. $645.32 C. $1,022.00 D. $1,444.67 75. An invoice from gentlemen’s Clothiers to Champion Tux Rentals shows a net price of $761.87. The terms are 5/15 EOM, n/30 EOM. The invoice is dated August 14. The invoice is paid September 15. How much is paid on September 15? A. $533.31 B. $647.59 C. $723.78 D. $761.87 NYS FBLA 2009 BUSINESS MATH 16 76. Theresa Oakley operates a mini-engine repair shop. Recently she bought an older lawn mower for $20.00 at a local auction. She repaired the lawn mower at a cost of $9.17 in parts. She painted and polished the lawn mower at a cost of $6.43. When the lawn mower was finished, Oakley sold it for $75.00. What was the markup on the lawn mower? A. $35.60 B. $39.40 C. $55.00 D. $70.60 77. Peter Kraemer is a buyer for a mattress store. He purchases twin-size box springs for $86.74 each. The Sleep Store sells them for $167.49 each. What is the markup rate based on the selling price? A. 6.9% B. 48.2% C. 51.8% D. 93.1% 78. Hardware Company purchases door hardware sets for $29.86 each. It charges customers $49.99 for the hardware and installation. The labor and other overhead total $11.75 for each set installed. What is the net profit per set? A. $8.38 B. $14.25 C. $20.13 D. $31.88 79. Custom Comp, assemblers of customized professional central processing units, delivered a system to Universal Delivery for a selling price of $1,078,450. The cost of the unit to Custom Comp was $416,785. The system design, programming, installation, and other overhead expenses were estimated to be 38.5 percent of the selling price. What net profit did Custom Comp make on the sale? A. $246,461.75 B. $254,741.02 C. $406,923.98 D. $415,203.25 80. A deli purchases apple butter for $1.03 a jar. It sells the apple butter for $1.79 a jar. The deli estimates the overhead at 35 percent of the selling price. What is the net-profit rate on each jar of apple butter? A. 7.3% B. 7.5% C. 12.6% D. 22.3% NYS FBLA 2009 BUSINESS MATH 17 81. Paperback Paupers marks up paperback books 35 percent of the selling price. A paperback book costs Paupers $4.52. What is the selling price of the book? A. $6.10 B. $6.95 C. $7.46 D. $17.43 82. Craig Nielson works at his parents’ outdoor market. He sells tomatoes for $1.99 a pound. The tomatoes cost $0.89 a pound. What is the markup rate based on cost? A. 44.7% B. 55.3% C. 80.9% D. 123.6% 83. Surface Combustion, Inc. calculates the cost of manufacturing a particular open-pit furnace as $1,214.78. Surface marks up each furnace 120 percent based on cost. What is the selling price? A. $1,457.74 B. $2,672.52 C. $6,073.90 D. $7,288.68 84. A reciprocating saw is on sale for $59.99, a savings of $30.00 over the regular price. Find the markdown rate. A. 25% B. 33.3% C. 50% D. 66.7% 85. Dishwashing detergent is tested by 1,000 people. Eighty-seven said they would buy it. The estimated market size is 4,500,000. The company estimated that each person would buy the detergent 12 times a year. What is the annual sales potential? A. 3,915,000 B. 4,698,000 C. 5,400,000 D. 7,830,000 86. A tire company sells approximately 4,000,000 automobile tires per year. There are approximately 44,000,000 automobile tires sold per year in the entire market. What is the company’s market share? A. 9.0% B. 9.1% C. 9.4% D. 10.0% NYS FBLA 2009 BUSINESS MATH 18 87. The year enrollment at Silverado Central University (SCU) accounted for 55 percent of all university students in the greater metropolitan area. Next year the total university enrollment in the greater metropolitan area is expected to be about 34,000 students. What enrollment figures can SCU project for next year? A. 6,182 B. 7,556 C. 15,300 D. 18,700 88. Pacific New Car Sales is interested in sponsoring the sports coverage on the local television station. The rate per 30-second commercial is $1,475. Commercials less than 30 seconds are 50 percent of the 30-second rate. Pacific New Car Sales has contracts for ten 30-second advertisements, five 10-second advertisements, and five 60-second advertisements. What is the total cost for these advertisements? A. $31,958.33 B. $32,450.00 C. $33,187.50 D. $36,875.00 89. Study lamps are packed 2 in a carton. The dimensions of the carton are 2.5 feet by 1.25 feet by 1.75 feet. The Supply Store wants to order 200 pairs of lamps. How many cubic feet of storage space will the Supply Store need to store the lamps? A. 547 B. 1,094 C. 1,100 D. 2,188 90. An inventory record for Sunrise Wholesale Pool Supply shows a receipt of 100 folding canvas lounge chairs on April 1. Another shipment of 125 arrived on April 15. On May 10, 110 chairs were shipped out. On June 2, 50 arrived and on June 17, 75 were shipped out. Find the balance as of June 17. A. 90 B. 110 C. 150 D. 360 91. The Flower Shoppe is opening a store in the warehouse district. The rent is $8.75 per square foot per year plus 5 percent of the store’s gross sales. The area of the store is 2,000 square feet. If The Flower Shoppe had $180,000 in gross sales the first year, what monthly rent will it pay? A. $750.00 B. $1,458.33 C. $2,208.33 D. $2,333.33 NYS FBLA 2009 BUSINESS MATH 19 92. Scott’s Supermarket hired 5 people to refinish its floor. The regular hourly rate for each person was $7.25. Because the floor was refinished on Sunday, each worker was paid double time. The job took 5 hours to complete. The materials charge was $571.85. What was the total charge? A. $934.35 B. $644.35 C. $753.10 D. $934.35 93. The list price of a personal computer system is $2,248. The monthly rental charge is 10 percent of the list price. There is a 5 percent usage tax. What is the total rental charge for 1 year? A. $2,697.60 B. $2,710.98 C. $2,810.00 D. $2,832.48 94. The Pantry Supermarket used 21,400 kilowatt hours of electricity last month. The peak load for the month was 120 kilowatts. The demand charge is $5.91 per kilowatt. The energy charge per kilowatt hour is $0.0675 for the first 10,000 kilowatt hours and $0.0455 per kilowatt hour for more than 10,000 kilowatt hours. The fuel adjustment charge is $0.015 per hour. What is the total cost of electricity for Pantry Supermarket for last month? A. $1,785.98 B. $2,153.70 C. $2,223.90 D. $2,568.65 95. Super Food Mart has installed automated checkout equipment in its six stores. It hired Robert Case to consult on its installation. Case charge 6 percent of the installment cost. It also hired Marilyn Lee to instruct its employees on the use of the equipment. Lee conducted six 4-hour sessions at $125 per session. The cost of the installation totaled $68,970. What was the total cost for professional services? A. $4,138.20 B. $4,638.20 C. $4,888.20 D. $7,138.20 96. Candies & More occupies 50 feet by 78 feet in a mall with 45,000 square feet. The monthly security expenses are $18,500. The mall apportions this cost based on the square footage of its stores. What does Candies & More pay for security? A. $526.21 B. $1,603.33 C. $2,087.62 D. $2,220.00 NYS FBLA 2009 BUSINESS MATH 20 97. Third National Bank recently purchased 6 new laptop computers. Each computer cost $2,245. The estimated life of each computer is 5 years. The trade-in value of each computer is expected to be $125 at the end of the 5 years. What is the annual depreciation for all six computers? A. $1,944.00 B. $2,120.00 C. $2,140.83 D. $2,544.00 98. Wholesale Grocer Supply Company assets are cash-$2,417,600, accounts receivable$53,591,500, inventory-$48,478,600, property-$75,750,000, investments-$475,000 and other assets-$18,791,500. Liabilities are accounts payable-$84,640,000, notes payable $56,119,400, income taxes-$975,450, and other liabilities-$864,560. What is Wholesale Grocer Supply Company’s owner’s equity? A. $56,832,790 B. $142,599,410 C. $199,432,200 D. $342,031,610 99. Bits & Bytes, Inc. started the month with an inventory of computer hardware and software valued at $68,395.65. During the month, Bits & Bytes bought 16 scanners at a cost of $47.84 each, 24 CD burners at a cost of $37.75 each, and 48 software programs at a cost of $14.95 each. Bits & Byte’s ending inventory of computer hardware and software was valued at $52,936.89. What was the cost of the goods sold? A. $2,389.04 B. $13,069.72 C. $17,847.80 D. 483,854.41 100. During the past quarter, Henri’s Clothes Company had total sales of $27,418 and returns of $220. The cost of goods sold amounted to $9,193. Operating expenses for the quarter included salaries and wages of $2,000, a real estate loan payment of $1,210, advertising at $190, utilities and supplies of $195, a bank loan payment of $350, and other operating expenses of $375. What is Henri’s Clothes Company’s net income? A. $13,685 B. $13,905 C. $14,320 D. $15,685 NYS FBLA 2009 BUSINESS MATH 21 ANSWER KEY 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. B D D D A C C B C A A B B C B A D C C B A B D C C 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. B B B D B B A C B B A D D C C D D C C A C B A A D 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. 75. B B A C A C D D A B D D C B C D D B B A A B A B C 76. 77. 78. 79. 80. 81. 82. 83. 84. 85. 86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99. 100. B B A A A B D B B B B D C B A C D D C C B D A C A