ACCT610 SO Ch16

advertisement

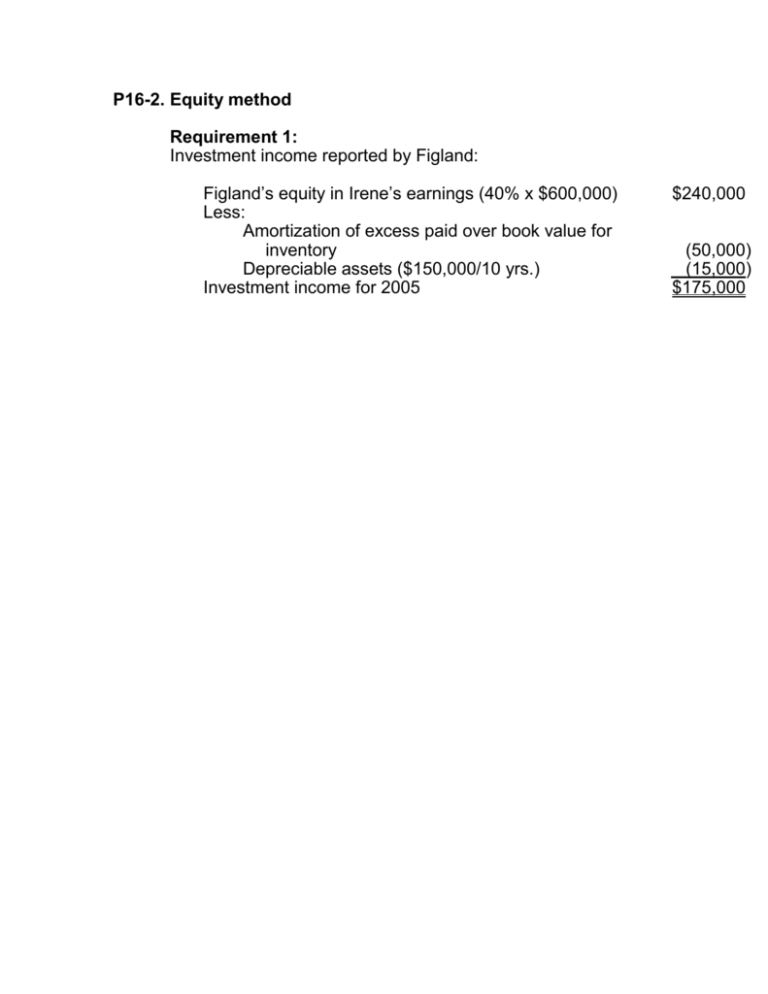

P16-2. Equity method Requirement 1: Investment income reported by Figland: Figland’s equity in Irene’s earnings (40% x $600,000) Less: Amortization of excess paid over book value for inventory Depreciable assets ($150,000/10 yrs.) Investment income for 2005 $240,000 (50,000) (15,000) $175,000 Requirement 2: Balance in investment in Irene Company on 12/31/05: Cost of initial investment Investment income [see requirement (1)] Less: Dividends received (40% x $325,000) Balance in investment account on 12/31/05 $1,800,000 175,000 (130,000) $1,845,000 P16-4. Mark-to-market for trading securities Requirement 1: Journal entry for mark-to-market adjustment on 12/31/04: Desired balance in Market adjustment account Cost $80,000 Market value on 12/31/04 85,000 Previous balance before adjustment Required adjustment to Market adjustment account Entry: DR Market adjustment—trading securities CR Unrealized gain on trading securities $5,000 DR 0 $5,000 DR $5,000 Requirement 2: Entry to record the sale of Company B common stock: DR Cash $14,000 1 DR Market adjustment—trading securities 2,500 CR Trading securities—Co. B common stock (50% of $30,000) CR Realized gain on sale of trading securities $5,000 $15,000 1,500 1 Unrealized loss on Co. B common stock included in mark-to-market adjustment on 12/31/04 was determined as follows: Cost of Co. B common stock $30,000 Market value on 12/31/04 (25,000) Unrealized loss included in 12/31/04 mark-to-market adjustment 5,000 Portion of Co. B shares being sold 50% Market adjustment related to Co. B shares sold $2,500 Requirement 3: Mark-to-market adjustment of 12/31/05. Desired balance in market adjustment account: Co. A Common Co. B Common Co. C Preferred Cost $50,000 15,000 20,000 $85,000 12/31/05 Market $55,000 13,000 25,000 $93,000 $8,000 DR Previous balance after adjusting for Co. B stock sale on 6/30/04 ($5,000 DR + $2,500 DR) Required adjustment to Market adjustment account Entry: DR Market adjustment—trading securities CR Unrealized gain on trading securities 7,500 DR $500 DR $500 $500 Requirement 4: Mark-to-market adjustment for 12/31/06. Desired balance in market adjustment account: 12/31/06 Cost Market Co. A Common $50,000 $58,000 Co. B Common 15,000 10,000 Co. C Preferred 20,000 18,000 Co. D Warranty 10,000 12,000 $95,000 $98,000 Previous balance after 12/31/05 mark-to-market adjustment 8,000 DR Required adjustment to Market adjustment account Entry: DR Unrealized loss on trading securities CR Market adjustment—trading securities $3,000 DR $5,000 CR $5,000 $5,000 Requirement 5: Required entry for Co. B common stock sale if considered an available-for-sale security: DR Cash DR Realized loss on sale of available-for-sale securities CR Available-for-sale Securities—Co. B common stock $14,000 1,000 $15,000 DR Market adjustment—available-for-sale securities(1) $2,500 CR Unrealized market gains/losses—stk. equity $2,500 1Unrealized loss on Co. B common stock included in mark-to-market adjustment on 12/31/04 was determined as follows: Cost of Co. B common Market value of 12/31/04 Unrealized loss included in 12/31/04 mark-tomarket adjustment Portion of Co. B shares being sold Market adjustment related to Co. B shares sold $30,000 (25,000) 5,000 50% $2,500 P16-7. Purchase method with goodwill Requirement 1: Delta would make the following entry on January 1, 2005 to record the acquisition of Sigma: DR Investment in Sigma CR Cash $80,000 $80,000 Requirement 2: Cost of purchase $80,000 Fair value of net assets acquired (without goodwill) Cash $ 8,000 Accounts receivable 9,000 Inventory 43,000 Land 12,000 Plant and equipment 51,000 Accounts Payable (35,000) Long-term debt (15,000) Goodwill 73,000 $ 7,000 Requirement 3: Delta would make the following elimination entry to prepare the consolidated balance sheet: DR DR DR DR DR DR DR Common stock (Sigma) Additional paid-in-capital (Sigma) Retained earnings (Sigma) Land Plant and equipment, net Inventory Goodwill CR Accounts receivable CR Investment in Sigma $2,000 12,000 30,000 7,000 16,000 12,000 7,000 $ 6,000 80,000 Requirement 4: Following is Delta Inc’s balance sheet immediately after the acquisition of Sigma Company: ($ in thousands) Delta Sigma Eliminations Consolidated Cash Accounts receivable Inventory Investment in Sigma Land Plant and equipment Goodwill $11,000 19,000 47,000 80,000 12,000 66,000 -0$235,000 $ 8,000 15,000 31,000 5,000 35,000 -0$94,000 Accounts payable Long-term debt Common stock Add. paid in cap. Retained earnings $52,000 66,000 5,000 30,000 82,000 $235,000 $35,000 15,000 2,000 12,000 30,000 $94,000 ($ 6,000) 12,000 (80,000) 7,000 16,000 7,000 2,000 12,000 30,000 -0- P16-9. Consolidation at acquisition Purchase price of Sprite’s stock Book value of Sprite’s net assets $25,000) Purchase price differential $30,000 23,750 (95% x $ 6,250 The purchase price differential is allocated: Inventory $3,750 (60% x $6,250) Goodwill 2,500 (40% x $6,250) $6,250 Requirement 1: Total consolidated current assets would be: Prince’s reported current assets $30,000* Sprite’s reported current assets 15,000 Allocation to inventory 3,750 Total $48,750 $ 19,000 28,000 90,000 -024,000 117,000 7,000 $285,000 $87,000 81,000 5,000 30,000 82,000 $285,000 *Note that Prince’s current assets remain at $30,000 after the acquisition. The $30,000 received from the debt issuance was used to buy Sprite’s common stock. Requirement 2: Total consolidated noncurrent assets would be: Prince’s reported noncurrent assets $55,000 Sprite’s reported noncurrent assets 25,000 Allocation to goodwill 2,500 Total $82,500 Requirement 3: Total current liabilities would be: Prince’s reported current liabilities Sprite’s reported current liabilities Total $20,000 10,000 $30,000 Requirement 4: Total noncurrent liabilities would be: Prince’s reported noncurrent liabilities Debt issued in the acquisition Sprite’s reported noncurrent liabilities Minority interest Total $20,000 30,000 5,000 1,250** $56,250 **Minority interest equals 5% x $25,000 Sprite equity. Requirement 5: Total stockholders’ equity would be the $45,000 reported by Prince. All of Sprite’s equity is eliminated in the consolidation process.