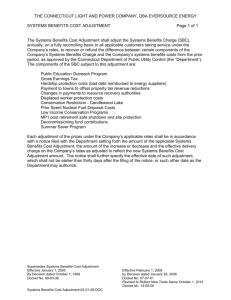

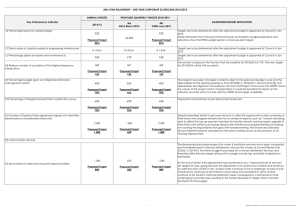

Chapter 8 Rate and Tariff Adjustment Mechanisms

advertisement

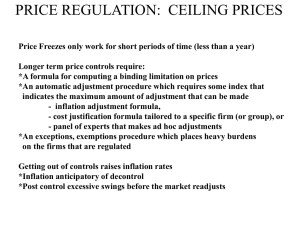

Chapter 8 Rate and Tariff Adjustment Mechanisms 8.2 Inflation Adjustments • RPI-X Adjustment (most common) RPI--- retail (consumer) price inflation index X---efficiency factor, to encourage firms to improve productivity efficiency • Drawbacks: consumer retail price index may not accurately estimate changes to industry factor costs. • Comparison: producer-specific measures of inflation 1. 2. More accurate than retail price measures. Subject to greater volatility contravene the goal of rate stability; hard to optimize production Therefore, RPI is more commonly used. 8.4 An Alphabet Soup of Adjustment Factors The Productivity (X) Factor: ---the expected change in industry productivity that will be passed through to consumers in prices. • Why is X factors positive in practice? ---improved productivity results in lower prices to consumers. ---regulators ensure that firms cannot raise prices more than inflation rate. • Productivity trend should be based on the relevant industry, rather than specific company itself. • Accurate and objective measures of underlying productivity growth in the subject industry are crucial to developing effective incentive regulation plans • Formula containing X factor provides short-term incentives. But setting X must incorporate long-term incentives. • 1. Setting X should: Use publicly available data that are expected to be available at subsequent reviews 2. Use an understandable and transparent methodology that will not be continually challenged or changed 3. Ensure that any judgmental adjustments are consistent with defined principles or productivity measurement 4. Provide a reasonably reliable measure of likely future productivity growth of the industry compared to the productivity of the economy as a whole. 1) Methods to Calculate the X Factor: most popular: TFP (total factor productivity) ---historical induces for the major inputs into the production process are analyzed in precise ways. 2) Forecasting ---X factor is used together with a base price (P0), to ensure that a price cap will allow an NPV earning. Problem: use one model to determine both initial prices and X factor not reasonable in basic algebra. Subjective Add-Ons to the X Factor: ---regulators made X factors slightly larger than the TFP productivity factor alone. Rationale: industry productivity should grow at a faster rate in future. Typically add a “stretch factor” or a “consumer dividend” to the productivity offset. The Investment (K) Factor Rationale: the cost of investments that cannot be made under existing tariffs, can be incorporated into the rate base by increasing the current tariff by the K factor. ---rolling the costs associated with a larger rate base into tariffs. The Service Quality (Q) Factor ----A solution to regulated companies reducing costs by reducing product or service quality. Two questions: How to monitor quality of service? What is required to ensure that quality of service is preserved? • First question: ---service quality can be compared to benchmarks established in advance rewarded where appropriate and penalized where inadequate. • Second question: ---more a policy matter to establish measurable service standards. • Q factor has been applied under both price-cap and revenue-cap schemes. • Mostly rely on multiple indicators, which are mostly technical. • Standards of indicators are set using historical data, projected improvement, negotiation, and values from other jurisdictions and/or companies. The Exclusion (Z) factor ---exogenous adjustment factor ---specific items that are wholly or partly excluded from price and revenue adjustment formulae. • Z factor isolates the risk from the regulated company and passed through the incurred costs to ratepayers. • Exogenous cost changes represent any changes in the company’s costs that are beyond the company’s control. • 1) 2) Changes in these costs should: Be passed directly through to customers (what would occur in a competitive industry) Be passed through to customers w/o affecting the company’s incentive to reduce costs. • Exogenous events that adversely affect just the regulated firm, are good candidates for Z factors. • Z are established: types of events; set of criteria