Deflation and the effect on benefit plan limits

advertisement

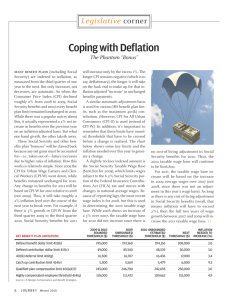

Insight November 12, 2009 Deflation and the effect on benefit plan limits By Brian Donohue, Senior Vice President, Aon Consulting Most 2010 IRS benefit plan limits and Social Security benefits and thresholds remained unchanged from 2009 despite a roughly 2% decrease in the CPI. In this article we look at the implications of this unusual occurrence beyond 2010. Social Security and many benefit plan limits are indexed to inflation, as measured from the third quarter of one year to the next. In anticipation of a drop in the Consumer Price Index (CPI) from 2008 to 2009, questions were stirring about how the various amounts would be affected. When the official numbers confirmed a decline of roughly 2%, we soon learned, for 2010, Social Security benefits and most every benefit plan limit would remain unchanged. But looking beyond 2010, what does this mean? Inflation indexing Let’s start with Social Security. Retiree benefits are adjusted based on the change the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which dropped 2.1% from third quarter 2008 to third quarter 2009. But only increases, not decreases are automatic. Thus, Social Security benefits will not be adjusted for inflation in 2010 (in contrast, benefits had risen 5.8% for 2009). Looking ahead to 2011, this negative change in CPI lingers. Since 2009 CPI-W went down while benefits remained unchanged for 2010, any change in benefits for 2011 will be based on CPI-W for 2010 relative to 2008 (not 2009). Thus, it will take roughly a 2% inflation level for this next year to break even. For example, if there is a 3% growth in CPI-W from third quarter 2009 to third quarter 2010, Social Security benefits for 2011 will reflect an inflationadjustment of just the excess 1%. A similar automatic adjustment basis is used for various IRS benefit plan limits, such as the maximum 401(k) contribution, except CPI for All Urban Consumers (CPI-U) is used instead of CPI-W. In addition, these limits have rounded thresholds that have to be crossed before a change is realized. The chart below shows some key limits and the inflation needed over this next year to generate a change, given the 1.6% drop in CPI-U over the last year. Key benefit plan limitations 2009 2010 Next threshold $ 195,000 $ 195,000 $ 200,000 197,360 194,156 Inflation needed to increase Defined benefit dollar limit [415(b)] Rounded threshold Unrounded (estimated for 2010) November 2009 3.0% page 1 Insight Deflation and the effect on benefit plan limits Key benefit plan limitations 2009 Next threshold 2010 Inflation needed to increase Defined contribution dollar limit [415(c)] Rounded threshold 49,000 49,000 Unrounded (estimated for 2010) 49,340 48,539 Rounded threshold 16,500 16,500 Unrounded (estimated for 2010) 16,707 16,436 Rounded threshold 5,500 5,500 Unrounded (estimated for 2010) 5,569 5,479 50,000 3.0% 17,000 3.4% 6,000 9.5% 250,000 3.0% 115,000 4.9% 401(k) deferral limit [402(g)] Catch up contribution limit [414(v)] Qualified plan compensation limit [401(a)(17)] Rounded threshold 245,000 245,000 Unrounded (estimated for 2010) 246,700 242,695 Highly compensated employee threshold [414(q)] Rounded threshold 110,000 110,000 Unrounded (estimated for 2010) 111,472 109,662 Wage indexing Apart from the inflation-indexing discussed above, many elements of the Social Security formula are adjusted for increases in the “national average wage” as calculated by the Bureau of Labor Statistics (BLS). There is a two-year lag between changes in the “national average wage” and adjustments to Social Security benefits, since the 2008 national average wage ($41,334.97, a 2.3% increase over the 2007 figure of $40,405.48) only recently became available. The 2.3% increase will be reflected in the “wage-indexed” components of the Social Security benefit formula for 2010 (e.g., the “bend points”), increasing benefit amounts for those reaching age 62, dying, or becoming disabled in 2010. However, on the financing side, the Social Security taxable wage base is also indexed to the national average wage, but includes an override of no increase in the event of no inflation adjustment of Social Security benefits. So, that amount ($106,800 for 2009) will remain unchanged in 2010. Looking ahead to 2011, as long as there is any inflation adjustment of November 2009 page 2 Insight Deflation and the effect on benefit plan limits Social Security benefits (recall, that means inflation will have to exceed 2%), then the full two years of wage growth between 2007 and 2009 will increase the 2011 taxable wage base. Finally, various Pension Benefit Guaranty Corporation (PBGC) amounts are also tied to wage indexation, with some interesting results. On one hand, the PBGC maximum guaranteed benefit remains at $4,500 per month for 2010 because it is directly linked to changes in the Social Security taxable wage base. In contrast, the PBGC’s per-participant flat-rate premium, $34 for 2009, will increase to $35 for 2010 because it is tied to increases (not decreases) in national average wages. If national average wages were to decrease, the premium rate would remain level until subsequent increases in average wages were sufficient to warrant an increase in the premium rate. ##### For more strategies on retirement programs, contact Brian Donohue at 312.732.2164 or brian.donohue@aon.com. November 2009 page 3