清科周刊 No.0505

advertisement

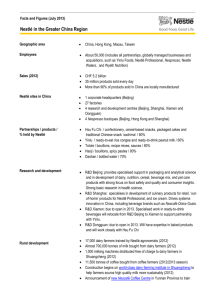

PEdaily E-Magazine No.513 December 9, 2011 ChiNext Delisting Policy Solicits Opinions, Hard to Produce Instant Results 09 December 2011 Gillian Zhang , Zero2IPO Research Center On November 28, 2011, Shenzhen Stock Exchange issued the Scheme for Improving Delisting System of ChiNext (Draft for Soliciting Opinions), which added two more delisting conditions, held no brief for the back-door listing of companies that were suspended for listing, and proposed to set up the delisting & reorganizing board. Moreover, the Scheme specified the long-anticipated ChiNext delisting system and concentrated investors’ attentions on ChiNext that took moves frequently in the recent period. Since Guo Shuqing took the position of Chairman of the CSRC, many ChiNext-related policies have been worked out to improve ChiNext in dividend, refinancing and delisting. 投资改变世界 www.pedaily.cn Alibaba Reportedly Seeks $4B Financing to Buy Yahoo's Stake 09 December 2011 Forbes Alibaba Group is looking for up to $4 billion in debt financing to help fund the repurchase of the 40% stake in the company owned by Yahoo, according to Reuters, which cites "sources familiar with the matter.“ The story says that Rothschild, as adviser to Alibaba, has sent out term sheets to banks seeing underwriting proposals. Alibaba Group declined to comment. The Street for eons has been eager to see Yahoo get rid of its Alibaba stake; a sale of that position - as well as the company's stake in Yahoo Japan - would make the company's decision on what to do with the core business a lot easier to sort out. 投资改变世界 www.pedaily.cn Vancl Raises $230MM 6th Round 08 December 2011 Forbes You probably haven't heard of Vancl, unless you follow the Chinese internet space closely. However, a clothing e-tailer called Vancl is an interesting bellwether for the space. Vancl is - in some ways - trying to be the Gap (GPS) of China - except with no stores, just online only. To grow their brand - like a lot of Chinese e-commerce players like Lashou, Jaiyun (DATE), and Dangdang (DANG) - Vancl is spending a bunch of their revenue coming in each month on marketing their site and for the back-end distribution to deliver their goods. They're also living in the shadow of their e-commerce big brother: Jack Ma's Taobao and T-mall. There has also been rumors that Vancl will IPO fairly soon. However, today's news in Marbridge Daily is that Vancl just raised a 6th round of VC financing giving the company another $230 million. 投资改变世界 www.pedaily.cn Private-Equity Firms' Yuan Funds Soar 08 December 2011 Wall Street Journal Private-equity firms raised more money in China for funds denominated in the country's currency than for those in dollars, according to a report issued on Thursday, as cash-rich Chinese companies and wealthy individuals seek higher returns on their money. Private-equity firms closed 295 yuan funds in China from January to November, raising a total of 19.8 billion yuan ($3.1 billion), according to a report by Zero2IPO Research, a Beijing-based firm that tracks China's private-equity industry. The capital raised accounted for 75% of all the private-equity funds completed in the first 11 months of this year, which totaled 26.5 billion yuan—more than double the money raised in all of 2010. The rest of the funds are denominated in dollars. In the past, dollar-denominated funds dominated China's private-equity industry, as many big Chinese institutions like insurance companies were largely barred from investing in private equity, while overseas investors were eager for a toehold in China. 投资改变世界 www.pedaily.cn China Approves Nestlé $1.7-bn Acquisition of Local Candy Maker Hsu Fu Chi 07 December 2011 Xinhua News Agency China today approved Nestlé proposal to acquire a controlling stake in local snack and candy maker Hsu Fu Chi International, one of the few rare approvals recently passed by Beijing. Singapore-listed Hsu Fu Chi today said that China's commerce ministry had approved Nestlé purchase of a 60-per cent stake in the company. The acquisition is Nestlé biggest deal in China to date. In July, the Vevey, Switzerland-based Nestlé , the world's largest food company, offered to buy 60-per cent of Hsu Fu Chi, for about $1.7 billion in cash. Nestle will then buy 16.48 per cent of the 56.48 per cent held by the Hsu family. The Swiss food giant had secured irrevocable undertakings from the two largest independent shareholders - Arisaig Partners Holdings and subsidiaries of the Baring Asia Private Equity Fund who hold 9 per cent and 16.5 per cent respectively - that they would sell their stakes to the Swiss firm. 投资改变世界 www.pedaily.cn KKR to Invest $60 Million in China Outfitters IPO 07 December 2011 Reuters Global private equity firm KKR & Co L.P. (KKR.N) said on Monday that it would invest $60 million as a cornerstone investor in the Hong Kong initial public offering of China men's casual wear retailer China Outfitters Holdings Ltd 1146.HK. "The menswear market in China has enormous growth potential. Market leaders such as China Outfitters have significant room to increase market share," David Liu, CEO of KKR Greater China said. Private equity firms are increasingly providing pre-IPO financing, an area hedge funds previously dominated in Asia prior to the 2008 financial crisis. China Outfitters designs, makes and sells menswear in China. Its foreign brands include JEEP, Santa Barbara, Polo & Racquet Club and London Fog. The company has over 1,000 stores nationwide. 投资改变世界 www.pedaily.cn Shanghai Aims to Expand Financing to Tech Firms 07 December 2011 Reuters The Shanghai municipal government unveiled a plan on Wednesday that will create incentives for foreign private equity and venture capital funds to invest in early-stage technology companies in the city. One element of the plan is a $1.5 billion quota under which foreign funds can invest in the equity of high tech companies in the city. The People's Bank of China and the State Administration of Foreign Exchange have already approved the quota. The plan also calls for other unspecified incentives to attract "famous" private equity and venture capital funds to invest in China. A related element of the plan is the approval of a joint venture between U.S.-based Silicon Valley Bank Ltd and Shanghai-based Pudong Development Bank. The bank, which received formal approval in October, will formally open for business sometime in the first half of 2012, said Jiang Mingsheng, vice president of Pudong Development , at a news conference in Shanghai. 投资改变世界 www.pedaily.cn China's New Foray Westward for Deals 06 December 2011 Wall Street Journal China Development Bank Corp, which funded a wave of Chinese investment into Africa and the developing world, is teaming up with some of the West's biggest privateequity players in a new venture aimed at driving investment into and out of China. Its newly formed CDB International Holdings Ltd. on Tuesday signed agreements with Permira, Kohlberg Kravis Roberts & Co. and TPG to seek opportunities for co-investing. Parent company China Development Bank holds a small stake in TPG. Zhang Xuguang, the chairman of Hong Kong-based CDB International, said in written answers to questions from the Wall Street Journal that it would concentrate on "companies and projects that can benefit from and promote China's development.""The globalization of Chinese firms has been getting faster and its scale bigger, giving CDB International broad scope to develop," he said. 投资改变世界 www.pedaily.cn Blackstone Asia Head Eyes Growth in China, Southeast Asia 06 December 2011 Reuters Blackstone Group L.P. (BX.N) sees China and Southeast Asia as top destinations for Asia investments next year as it aims to benefit from buoyant consumer markets there, the Asia-Pacific head of the private equity firm said on Tuesday. "Certainly China will remain a core focus for us. We are long-term very bullish about China," Michael Chae told the 2012 Reuters Investment Outlook Summit in Hong Kong. "Southeast Asia, and Indonesia in particular, we also think is quite interesting." But Chae, a former senior partner with Blackstone in New York, was quick to caution that Asia has not decoupled from the West, and that volatility in Asia and global markets is affecting investment decisions now and into 2012. "There's an above-average level of uncertainty around macro conditions in this region and globally, which makes it a really intellectually interesting time to be alive and to be investing," he said. 投资改变世界 www.pedaily.cn Subscription RSS: http://tag.pedaily.cn/rss/rss-s52.xml E-Mail: http://tag.pedaily.cn/mail/subscription.aspx