PNC Money Market Funds

QUARTERLY FUND HIGHLIGHTS

PNC Money Market Funds

MONEY MARKET FUNDS

12/31/15

FUND OBJECTIVES

PNC Money Market Funds seek to provide current income and liquidity while maintaining a stable $1.00 share price. In pursuit of this goal, the Fund’s managers:

• Invest only in high-quality, short-term securities with remaining maturities of 397 days or less.

• Maintain a dollar-weighted average maturity of 60 days or less.

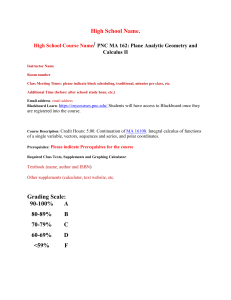

Government Money Market

Class I

Money Market

Class I

Treasury Money Market

Class I

Tax Exempt Money Market

Class I

CUSIP Number 69351J157

NASDAQ Symbol PKIXX

69351J181

PCIXX

69351J215

PDIXX

69351J132

PXIXX

Total Net Assets $1,797.29M $1,490.46M $532.75M $589.23M

Assets $1,369.31M $1,345.95M $380.85M $315.20M

Net Asset Value $1.00

Inception Date 3/3/87

Dividend Frequency

Gross Expense Ratio

Daily

0.25%

$1.00

9/3/86

$1.00

6/16/94

$1.00

7/20/88

Daily

0.30%

Net Expense Ratio 0.07%

Weighted Average Maturity

0.11% 0.02% 0.05%

0.07% 0.11% 0.02% 0.05%

Weighted Average Life 23 days

Daily

0.35%

29 days

Daily

0.37%

41 days 29 days

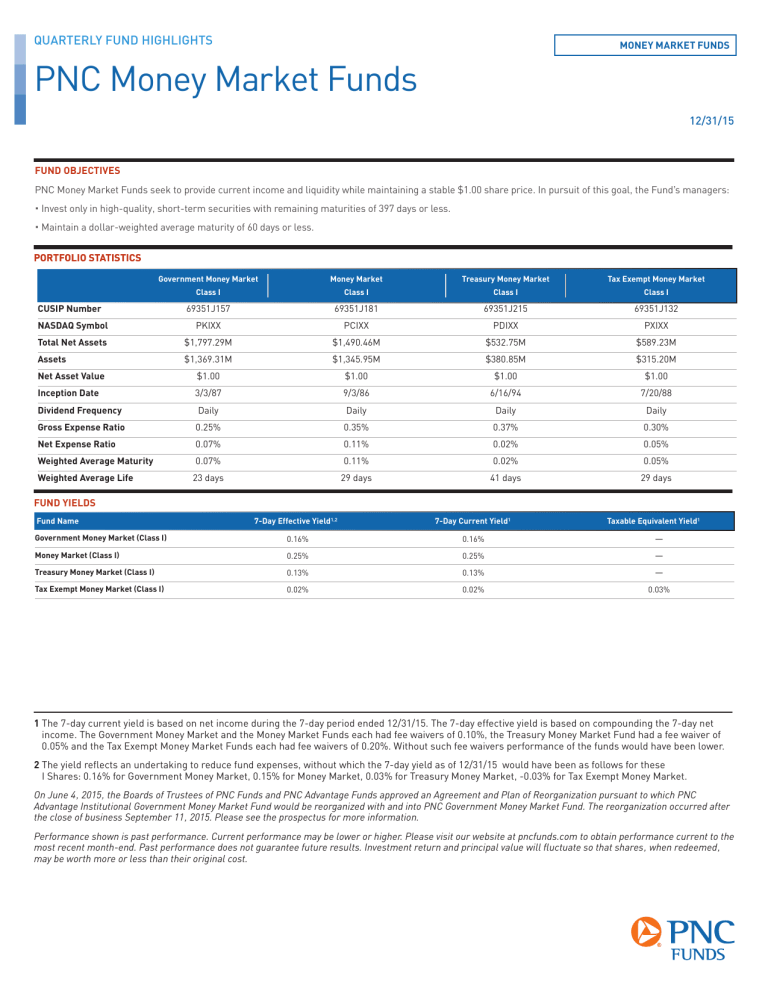

FUND YIELDS

Fund Name

Government Money Market (Class I)

Money Market (Class I)

Treasury Money Market (Class I)

Tax Exempt Money Market (Class I)

7-Day Effective Yield 1,2

0.16%

0.25%

0.13%

0.02%

7-Day Current Yield 1

0.16%

0.25%

0.13%

0.02%

Taxable Equivalent Yield 1

—

—

—

0.03%

1 The 7-day current yield is based on net income during the 7-day period ended 12/31/15. The 7-day effective yield is based on compounding the 7-day net income. The Government Money Market and the Money Market Funds each had fee waivers of 0.10%, the Treasury Money Market Fund had a fee waiver of

0.05% and the Tax Exempt Money Market Funds each had fee waivers of 0.20%. Without such fee waivers performance of the funds would have been lower.

2 The yield reflects an undertaking to reduce fund expenses, without which the 7-day yield as of 12/31/15 would have been as follows for these

I Shares: 0.16% for Government Money Market, 0.15% for Money Market, 0.03% for Treasury Money Market, -0.03% for Tax Exempt Money Market.

On June 4, 2015, the Boards of Trustees of PNC Funds and PNC Advantage Funds approved an Agreement and Plan of Reorganization pursuant to which PNC

Advantage Institutional Government Money Market Fund would be reorganized with and into PNC Government Money Market Fund. The reorganization occurred after the close of business September 11, 2015. Please see the prospectus for more information.

Performance shown is past performance. Current performance may be lower or higher. Please visit our website at pncfunds.com to obtain performance current to the most recent month-end. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

PNC MONEY MARKET FUNDS | Quarterly fund highlights • Period ending 12/31/15 MONEY MARKET FUNDS

INVESTMENT STRATEGIES

S&P Credit Rating: AAAm 4 and NAIC Level 1 Credit Rating 5

PNC Money Market Fund

PNC Money Market Fund seeks as high a level of current income as is consistent with stability of principal by investing primarily in high-quality, short-term securities such as CDs, commercial paper,

U.S. government obligations and repurchase agreements.

PNC Government Money Market Fund

PNC Government Money Market Fund seeks as high a level of current income as is consistent with stability of principal by investing primarily in obligations issued or guaranteed by the U.S. Government, its agencies or instrumentalities and repurchase agreements.

PNC Treasury Money Market Fund

PNC Treasury Money Market Fund seeks as high a level of current income as is consistent with stability of principal by investing primarily in bills, notes and obligations of the U.S. Treasury.

PNC Tax Exempt Money Market Fund

PNC Tax Exempt Money Market Fund strives to provide a high level of federally tax-exempt current interest income, as is consistent with liquidity and stability of principal.

For some investors, income may be subject to state and/or local taxes, and certain investors may be subject to the federal Alternative Minimum Tax (AMT).

An investment in the money market funds is not insured or guaranteed by the Federal Deposit Insurance

Corporation or any other government agency. Although the Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the funds.

The Funds are not guaranteed or insured by PNC Bank, N.A.

TAXABLE MONEY MARKET

MANAGEMENT TEAM

Richard J. Stevenson

Portfolio Manager

20 years industry experience

Kelley K. Peel, CFA

Portfolio Manager

17 years industry experience

Keith L. Erwin

Portfolio Manager

19 years industry experience

TAX EXEMPT MONEY MARKET

MANAGEMENT TEAM

Adam Mackey

Portfolio Manager

19 years industry experience

Marques Glaze

Portfolio Manager

11 years industry experience

INVESTMENT RISKS

The dividend yield paid by PNC Money Market Funds will vary with changes in short-term interest rates.

With respect to the PNC Money Market and Government Money Market Funds, the value of debt securities within each Fund’s portfolio may be affected by the ability of the issuer to make principal and interest payments. The PNC Government Money Market Fund is subject to counterparty risk, which is the risk that another party in a repurchase agreement may not fulfill its obligations under the agreement.

AS A COMPLEMENT TO:

A Portfolio of Fluctuating NAV Mutual Funds

Individual Securities

Certificates of Deposit or Treasury Bills

PNC MONEY MARKET FUNDS OFFER:

• Easy dollar-in, dollar-out accounting

• Protection against principal fluctuation

• Convenience

• Diversification

• Professional management

• Check writing

• Quality/rating checks

• Dividend reinvestment

• Affordability

• Greater liquidity

• Competitive earnings

• No sales or penalty charges

• Tax-exempt income

4 Credit quality ratings are primarily sourced by the Nationally Recognized Statistical Organization (NRSRO) including Fitch, Moody’s, and S&P, or unrated and determined by the Adviser to be of comparable quality. The ratings represent their (S&P, Moody’s and Fitch) opinions as to the quality of the securities they rate and not the shares of the fund. Ratings are relative and subjective, are not absolute standards of quality, not recommendations to purchase, sell, or hold a security and are based on current unaudited financial information furnished to the rating agencies by the Fund.

Standard and Poors’ ratings are measured on a scale that ranges from A-1+ (highest quality) to D (lowest) for short term credit issuer debt securities and

AAAm (highest) to Dm (lowest) for the principal stability fund (“money market fund”) rating.

5 National Association of Insurance Commissioners (NAIC) is a U.S. organization of insurance regulators. NAIC Designations are used by the NAIC Securities

Valuation Office to denote a category of credit quality, ranging from NAIC level 1 (highest quality) to NAIC level 6 (lowest quality). NAIC 1 is assigned to obligations exhibiting the highest quality with credit risk at its lowest and the issuer’s credit profile is stable. The NAIC designations are not an endorsement and should not be considered by non-members in their investment decisions. For more information on the methodology visit www.naic.org.

You should consider the investment objectives, risks, charges, and expenses of PNC Funds carefully before investing. A prospectus or summary prospectus with this and other information may be obtained at 800-622-FUND (3863) or pncfunds.com. The prospectus should be read carefully before investing.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

PNC Capital Advisors, LLC, a subsidiary of The PNC Financial Services Group, Inc., serves as investment adviser and co-administrator to PNC Funds and receives fees for its services. PNC Funds are distributed by PNC Funds Distributor, LLC, which is not affiliated with the adviser and is not a bank.

© The PNC Financial Services Group, Inc. All rights reserved. QR-25I-1215