資料2

advertisement

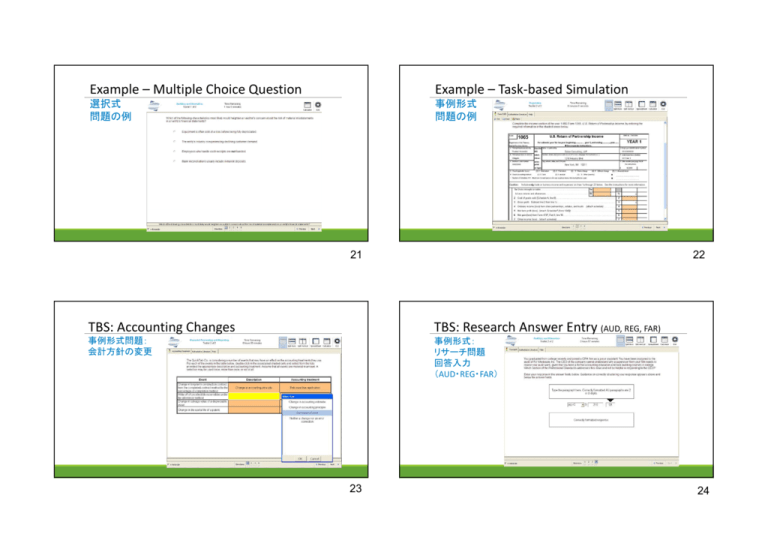

Example – Multiple Choice Question Example – Task-based Simulation 選択式 問題の例 事例形式 問題の例 21 22 TBS: Accounting Changes TBS: Research Answer Entry (AUD, REG, FAR) 事例形式問題: 会計方針の変更 事例形式: リサーチ問題 回答入力 (AUD・REG・FAR) -C 23 24 TBS: Research Search Function (AUD, REG, FAR) Written Communication (BEC Exam) 事例形式: リサーチ問題 検索機能 記述式問題 (BEC試験) (AUD・REG・FAR) 25 Exam Day Time Strategy CPA Exam 2017 Overview 試験当日の時間の使い方 FAR 4 Hour Exam AUD 4 Hour Exam Testlet 1 45 min Testlet 1 4:00 – 3:15 Testlet 2 45 min Testlet 2 3:15 – 2:30 Testlet 3 45 min Testlet 3 2:30 – 1:45 TBS (7) 1hr 45 min TBS (7) 1:45 – 0:00 26 • Most likely, 4 sections will remain as is with minor changes: • Increased number of simulations • Each section of exam will include assessment of higher order skills (analysis or evaluation level) • Written communication will still be tested in BEC only • BEC could see TBS in future REG 3 Hour Exam BEC 3 Hour Exam Testlet 1 35 min Testlet 1 45 min Testlet 2 35 min Testlet 2 45 min Testlet 3 35 min Testlet 3 45 min TBS (6) 1hr 15 min WC (3) 45 min • May increase length of exam from 14 hours up to as long as 16 hours • Allow retesting of failed section in same window • Extend testing a few days into each blackout month • Exam prices will likely increase 27 28 Testing Windows 試験期間 受験可能 Study Strategies 受験不可 試験に向けての勉強 AICPA Recommends 300 – 400 Hours minimum of preparation time FAR REG AUD BEC Lecture Time 41 hours 28 hours 25 hours 17 hours Study Time 123 hours 84 hours 75 hours 51 hours Total (min.) 164 hours 112 hours 100 hours 68 hours 29 Prometric Testing Centers 30 Materials Provided on Exam Day プロメトリック試験会場 試験当日に支給されるもの • Tokyo and Osaka • Monday-Friday and some Saturdays/Sundays • Schedule using Prometric’s web tools Calculator with tape function provided on your screen ウェブで予約 • Copy of NTS and 2 Forms of ID 受験票と2通りの身分証明書 • Arrive Early 早めに到着 White board for handwritten calculations – no pencil and paper! 31 32 Once you pass one part of the exam, you have 18 months to pass the rest! 1科目で合格してから18ヶ月以内に全科目合格しなければならない 1科目で合格してから ヶ月以内に全科目合格しなければならない Skills needed to SIT for US CPA Exam US CPA受験に必要なスキル • NOT an IQ Test, test of Discipline 知能テストではなく、自制心のテスト • Need NOT be Fluent in English 完璧な英語は必要ない • NO Accounting experience required in order to Study or Take Exam 勉強や受験に会計の経験は不要 33 Popular International Candidate Jurisdictions: Educational Requirements 海外の受験生に人気のある出願州の教育要件 34 Popular International Candidate Jurisdictions: Educational Requirements 海外の受験生に人気のある出願州の教育要件 Washington Alaska • Bachelor’s degree from accredited university • Bachelor’s Degree and Accounting which includes: • a completed bachelor’s degree, or its equivalent, conferred by a regionally accredited • 150/225 to take exam • 24+ semester hours in Accounting (15+ in upper level, Master’s weighted more), college or university; and 24+ semester hours in Business • fifteen semester hours in Accounting. •Guam • Can sit within 18 credits of receiving your bachelor’s degree • Bachelor’s Degree to sit for the exam • Minimum age: 19 • Must include: • 24+ semester hours in upper division Accounting, • Financial Accounting, Auditing, Taxation, Management, or Cost Accounting (3 units each) 24+ semester hours in Business • • Economics (6 units), Finance, and Business Law (3 units each) *Neither state above requires U.S. citizenship or legal state residency, and accept international applicants for licensure. All jurisdictions mentioned here require international transcript evaluation. 35 36 Requirements of Licensure ライセンス要件 • Pass the CPA Exam WHY MOST PASS WITH THE ROGER METHOD™ CPA試験合格 ROGER METHOD • 1-2 years of work experience depending on state の合格率が高い理由 We’ve mastered the art of helping students make important connections, retain information, and apply what they have learned all with the support of a team dedicated to their success. 州により、1~2年の実務経験 • Usually under supervision of a licensed CPA CPAのもとでの実務 This methodology includes three fundamental components: Learn, Practice and Support. When integrated together, these components create the perfect trio, providing students with all of the essential elements they need (and more!) to • 150 total semester/225 total quarter units, including Bachelor’s degree and all units completed prior to, during, or after passing the CPA Exam (depends on your jurisdiction) pass the U.S. CPA Exam with confidence. 総単位150と4年生大学卒(州により、CPA試験中や合格後でも可) • Check out rogerCPAreview.com for exact licensure info for your state 各州の詳しい要件についてはrogerCPAreview.comを参照 37 Plan Your Studies 勉強の計画 38 Watch the Lectures 3, 6, 9 and 12 month study plans 講義の視聴 Closed captioning available for all lectures Takes the planning process out of the equation, allowing you to focus on studying the material Highlight directly in eBook Take notes within the lecture 39 40 Practice what you’ve Learned Practice what you’ve Learned 演習 Apply what you’ve learned with Interactive Practice Questions 演習 Multiple Choice Questions Course is broken down by chapter & topic 41 Practice what you’ve Learned 演習 42 Unsurpassed Support 受験のサポート Task Based Simulations • Customizable Study Planners カスタマイズ可能な勉強プランナー • Course Diagnostics コース診断 • 24/7 Homework Help Center 毎日24時間週7日の 宿題ヘルプセンター • Excellent Customer Service & Support Team 優秀な顧客サービスとサポートチーム 43 44 Thank you “If you study, you will pass.” www.rogerCPAreview.com 「勉強すれば、合格します」 “Thanks to your knowledge and awesome teaching abilities I was able to score very high on the exam...FARE 90, REG 92, AUD 94!” – Scott E., Ernst & Young - Roger Philipp, CPA, CGMA 45 46