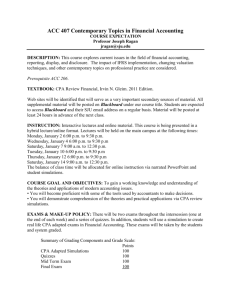

prepared for

AC C O U N T I N G

C PA E X A M R E V I E W

prepared for

revolutionary changes

The CPA exam is transforming in 2011 to ensure the skills candidates

acquire match the needs of today’s changing accounting environment.

These changes are the most significant since the exam became

computerized in 2004. Beginning in 2011, the Uniform CPA Examination

will feature a new structure, format and content, along with enhanced

technology to improve the exam experience for all candidates.

•New Content and Skill Specifications (CSOs/SSOs)

New content and changes in the scope of knowledge and skills

reflect the responsibilities of today’s entry-level CPAs.

•International Standards

International standards, including International Financial Reporting

Standards (IFRS) and International Standards on Auditing, will now be

covered in three of the four exam parts: Financial (FAR), Audit (AUD) and

Business (BEC).

•Task-Based Simulations (TBS)

TBS will now be included in Financial (FAR), Audit (AUD) and Regulation

(REG). Depending on the section, six or seven TBS will be presented in

one testlet. A new research task format will also be included based on the

FASB Accounting Standards Codification™ in Financial (FAR).

•Written Communication Tasks

Three written communication tasks will now be included in Business (BEC).

These changes will pave the way for faster score reporting,

giving candidates results in a timelier manner.

Learn more

about each

exam section

Financial

Audit

Regulation

Business

FI NANCIAL

financial accounting

& reporting (far)

2011 Exam Structure

Exam Time: 4 Hours

exam structure

• FAR contains 90 multiple choice

questions and seven task-based

Testlet 1: Multiple Choice

simulations.

• 60% of your overall score is on

60%

Testlet 2: Multiple Choice

multiple choice questions and 40%

is on task-based simulations.

Testlet 3: Multiple Choice

• No written communication tasks will

be included.

• A new research task format will be

40%

Testlet 4: Seven TaskBased Simulations

included.

• A new release of authoritative

literature, with FASB Codification™

will be introduced.

2011 CSOs

Area I

Conceptual Framework, Standards, Standard

Setting and Presentation of Financial Statements,

(First-time adoption of IFRS) (17–23%)

Area II

Financial Statement Accounts: Recognition,

Measurement, Valuation, Calculation, Presentation

and Disclosures (27–33%)

Area III

Specific Transactions, Events and Disclosures:

Recognition, Measurement, Valuation, Calculation,

Presentation and Disclosures (27–33%)

Area IV

exam content

In 2011, FAR covers two primary

topics: Financial Statements

and Government & Not-for-Profit

Accounting. Candidates often

find this section the most difficult

because of the sheer amount of

information covered.

Governmental Accounting and Reporting (8–12%)

The Impact of International

Area V

Not-for-Profit (Nongovernmental) Accounting

and Reporting (8–12%)

Standards

In FAR, questions on International

Financial Reporting Standards

(IFRS) will focus on identifying and

understanding the difference between

financial statements prepared on

the basis of U.S. GAAP and those

prepared on the basis of IFRS.

AU D I T

auditing

& attestation (aud)

2011 Exam Structure

Exam Time: 4 Hours

exam structure

• AUD contains 90 multiple choice

questions and seven task-based

Testlet 1: Multiple Choice

simulations.

• 60% of your overall score is on

60%

Testlet 2: Multiple Choice

multiple choice questions and 40%

is on task-based simulations.

Testlet 3: Multiple Choice

• No written communication tasks will

be included.

• A new research task format will be

40%

Testlet 4: Seven TaskBased Simulations

included.

2011 CSOs

exam content

Area I

Engagement Acceptance and Understanding

the Assignment (12–16%)

Area II

Understanding the Entity and Its Environment

(including Internal Control) (16–20%)

approximately the same.

Area III

Performing Audit Procedures and Evaluating

Evidence (16–20%)

The Impact of International

Area IV

Evaluating Audit Findings, Communications

and Reporting (16–20%)

Area V

Accounting and Review Service Engagements

(12–16%)

Area VI

Professional Responsibilities (including Ethics

and Independence) (16–20%)

In 2011, AUD includes a review of

six major areas and all are weighted

Standards

In AUD, you will need to be familiar

with the International Auditing and

Assurance Board (IAASB) and its role

in establishing International Standards

on Auditing (ISAs).

R E G U L AT I O N

regulation (reg)

2011 Exam Structure

Exam Time: 3 Hours

exam structure

• REG contains 72 multiple choice

questions and six task-based

Testlet 1: Multiple Choice

simulations.

• 6

0% of your overall score is on

60%

Testlet 2: Multiple Choice

multiple choice questions and 40% is

on task-based simulations.

Testlet 3: Multiple Choice

• N

o written communication tasks

will be included.

• A

new research task format will be

40%

Testlet 4: Six TaskBased Simulations

included.

2011 CSOs

Area I

Ethics, Professional and Legal Responsibilities

(15–19%)

exam content

In 2011, REG will have an emphasis

on three major areas: Federal Taxation,

Area II

Business Law (17–21%)

Area III

Federal Tax Process, Procedures, Accounting and

Planning (11–15%)

Area IV

Federal Taxation of Property Transactions (12–16%)

Area V

Federal Taxation of Individuals (13–19%)

Area VI

Federal Taxation of Entities (18–24%)

Business Law and Ethics.

BUSINESS

business environment

& concepts (bec)

2011 Exam Structure

Exam Time: 3 Hours

exam structure

• BEC contains 72 multiple choice

questions and three written

Testlet 1: Multiple Choice

communication tasks.

• 85% of your overall score is on

85%

Testlet 2: Multiple Choice

multiple choice questions and 15%

is on written communication tasks.

Testlet 3: Multiple Choice

15%

Testlet 4: Three Written

Communication Tasks

2011 CSOs

exam content

Area I

Corporate Governance (16–20%)

In 2011, BEC includes a review of

six major areas and all are weighted

Area II

Economic Concepts and Analysis (16–20%)

Area III

Financial Management (19–23%)

Area IV

Information Systems and Communication (15–19%)

approximately the same.

The Impact of International

Standards

In BEC, questions pertaining to

international standards will test your

grasp of globalization in the business

Area V

Strategic Planning (10–14%)

Area VI

Operations Management (12–16%)

environment.

positioned for success.

Being prepared requires foresight and agility. Becker Professional

Education has both. For candidates preparing with our CPA Exam

Review for the 2011 exam, that translates into a review program that

has been redesigned and updated to mirror the new exam. We’ve

“Your review course offers so much

and mirrors the CPA Exam to a ‘T’!

Thank you so much for making my

life easier.”

— Kristin Alongi

Becker alum

retooled all our course components to ensure they mirror the content,

structure and functionally of the 2011 exam in every way. We met the

challenge when the exam went computer-based in 2004, and we’re

poised to do it again.

With stellar marks from our previous candidates and peer groups,

“I passed all four sections on the

Becker has reached the pinnacle of the exam review industry. And

first try using Becker. Recipe for

we’re not going anywhere. Our subject matter specialists and exam

success: buy Becker, study, pass.”

experts continually update the content of our CPA review program to

— Jon Bell

ensure that outdated material is eliminated and that our candidates

only study what is most likely to appear on the exam.

count on becker to

prepare you to pass.

Why choose Becker Professional Education to prepare for the

CPA Exam? It works. No other review program comes close to

matching Becker.

•Highest Pass Rates—Students who prepare with Becker pass

at double the rate of non-Becker candidates.*

•Greater Success—Over 400,000 candidates have successfully

passed the exam using Becker, more than any other review provider.

•World-Class Review Course—Becker offers a completely

integrated program that maximizes your study time and replicates

the exam in every way, giving you the greatest chance of passing.

•Greater Experience—Becker Professional Education has been

helping prepare students for the CPA Exam for more than 50 years.

We know what works.

*B ecker Professional Education students pass at twice the rate of all CPA Exam candidates

who did not take a Becker review course, based on averages of AICPA-published pass rates.

Data verified by an independent, third-party firm.

Becker alum

comprehensive. integrated. proven.

Becker Professional Education’s learning approach allows you to deepen your understanding, sharpen your

test-taking skills, and build your confidence for exam day. Each component aligns directly with one of the four

essential elements of effective preparation: Understand. Apply. Practice. Review.

This approach is grounded in a highly structured methodology, and it’s designed, updated and taught by

CPAs and exam experts. The result? You progress seamlessly and efficiently through your review course

without overlap in information or redundant effort and are ready for success on exam day.

apply

understand

• Textbooks

• Expert Instruction

practice

• PassMaster™ Interactive

Comprehensive and exceptionally

Over 100 hours of instruction from

Software

easy to use. Include hundreds of

the best-of-the-best subject matter

Mirrors exam interface with over

past exam questions.

specialists and exam experts.

6,000 multiple choice questions—

more than other review providers.

Questions link directly to the

ADDITIONAL RESOURCES:

• Convenient Lecture Review and Make Up

Complete access to our lecture library from Becker’s expert national instructors.

• Unlimited Academic Support

Unlimited access to online academic and personalized support that provides

highly targeted answers to your specific questions.

applicable pages in electronic

textbooks and lectures.

• Complete Simulations

Only Becker provides complete

simulations that mirror those

found on the CPA Exam. There

are over 100 individual tasks

available for practice.

review

• Final Exam and Simulation

Software

Mirrors functionality and content of the

actual CPA Exam so you can become

familiar with the Computer-Based Test

(CBT) environment. Includes two final

practice exams per part.

Other Review Materials:

•Flashcards (optional)

Over 1,000 cards to help you

commit to memory the most

important principles. Available in

traditional or mobile app formats.

•Final Review (optional)

the becker promise.®

We are so convinced that our CPA Exam Review will prepare

you to succeed on the exam that we offer The Becker Promise.

If you utilize Becker but do not pass the CPA Exam, you may

repeat our course at no additional tuition charge if you satisfy

our requirements. We’re that committed to your success.

The only on-demand product

of its kind for intensive,

last-minute preparation.

Visit becker.com/2011 to learn more about the 2011 CPA Exam.

THREE FLEXIBLE FORMATS

LIVE

Engaging, knowledgeable

instructors and dynamic

technology that create

an unrivaled CPA Exam

Review experience.

ONLINE

The structure of a weekly

class and regular interaction

with your instructor and

peers, but with the flexibility

to attend anytime, anywhere

via the Internet—or to

review course materials and

software offline anytime.

SELF-STUDY

Freedom to study at a

self-determined pace,

whenever and wherever

it’s convenient.

®

becker.com/cpa

877.CPA.EXAM

(877.272.3926)

Visit becker.com/2011 to learn more

about the 2011 CPA Exam and how Becker

can help you pass. Also be sure to register

ACCOUNTING | FINANCE | PROJECT MANAGEMENT

Content and Skill Specification Outlines (CSOs/SSOs) that detail the specific testable content

on each of the exam parts are available through the AICPA. Visit cpa-exam.org.

©2010 DeVry/Becker Educational Development Corp. All rights reserved.

A:10-982:02:10M:8/10

for our automatic 2011 update alerts.

AC C O U N T I N G

ONE GREAT COURSE