Australian dollar: riding high

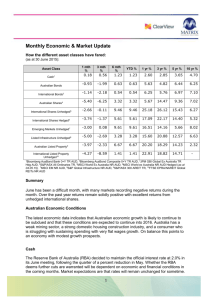

advertisement

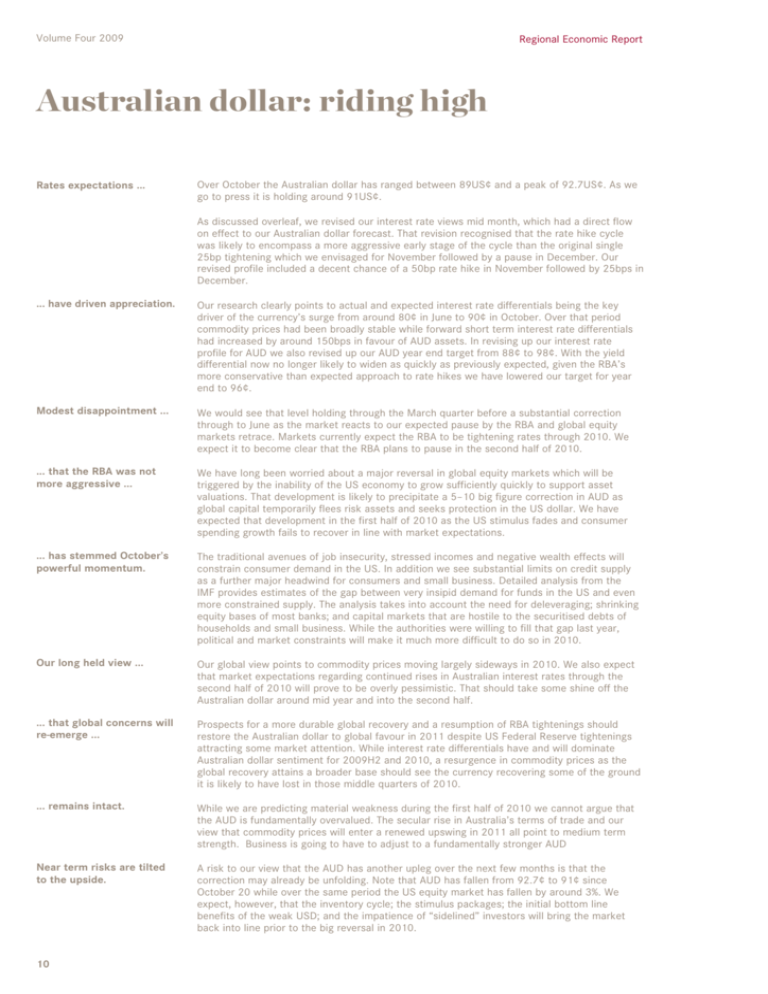

Volume Four 2009 Regional Economic Report Australian dollar: riding high Rates expectations ... Over October the Australian dollar has ranged between 89US¢ and a peak of 92.7US¢. As we go to press it is holding around 91US¢. As discussed overleaf, we revised our interest rate views mid month, which had a direct flow on effect to our Australian dollar forecast. That revision recognised that the rate hike cycle was likely to encompass a more aggressive early stage of the cycle than the original single 25bp tightening which we envisaged for November followed by a pause in December. Our revised profile included a decent chance of a 50bp rate hike in November followed by 25bps in December. ... have driven appreciation. Our research clearly points to actual and expected interest rate differentials being the key driver of the currency’s surge from around 80¢ in June to 90¢ in October. Over that period commodity prices had been broadly stable while forward short term interest rate differentials had increased by around 150bps in favour of AUD assets. In revising up our interest rate profile for AUD we also revised up our AUD year end target from 88¢ to 98¢. With the yield differential now no longer likely to widen as quickly as previously expected, given the RBA’s more conservative than expected approach to rate hikes we have lowered our target for year end to 96¢. Modest disappointment ... We would see that level holding through the March quarter before a substantial correction through to June as the market reacts to our expected pause by the RBA and global equity markets retrace. Markets currently expect the RBA to be tightening rates through 2010. We expect it to become clear that the RBA plans to pause in the second half of 2010. ... that the RBA was not more aggressive ... We have long been worried about a major reversal in global equity markets which will be triggered by the inability of the US economy to grow sufficiently quickly to support asset valuations. That development is likely to precipitate a 5–10 big figure correction in AUD as global capital temporarily flees risk assets and seeks protection in the US dollar. We have expected that development in the first half of 2010 as the US stimulus fades and consumer spending growth fails to recover in line with market expectations. ... has stemmed October’s powerful momentum. The traditional avenues of job insecurity, stressed incomes and negative wealth effects will constrain consumer demand in the US. In addition we see substantial limits on credit supply as a further major headwind for consumers and small business. Detailed analysis from the IMF provides estimates of the gap between very insipid demand for funds in the US and even more constrained supply. The analysis takes into account the need for deleveraging; shrinking equity bases of most banks; and capital markets that are hostile to the securitised debts of households and small business. While the authorities were willing to fill that gap last year, political and market constraints will make it much more difficult to do so in 2010. Our long held view ... Our global view points to commodity prices moving largely sideways in 2010. We also expect that market expectations regarding continued rises in Australian interest rates through the second half of 2010 will prove to be overly pessimistic. That should take some shine off the Australian dollar around mid year and into the second half. ... that global concerns will re-emerge ... Prospects for a more durable global recovery and a resumption of RBA tightenings should restore the Australian dollar to global favour in 2011 despite US Federal Reserve tightenings attracting some market attention. While interest rate differentials have and will dominate Australian dollar sentiment for 2009H2 and 2010, a resurgence in commodity prices as the global recovery attains a broader base should see the currency recovering some of the ground it is likely to have lost in those middle quarters of 2010. ... remains intact. While we are predicting material weakness during the first half of 2010 we cannot argue that the AUD is fundamentally overvalued. The secular rise in Australia’s terms of trade and our view that commodity prices will enter a renewed upswing in 2011 all point to medium term strength. Business is going to have to adjust to a fundamentally stronger AUD Near term risks are tilted to the upside. A risk to our view that the AUD has another upleg over the next few months is that the correction may already be unfolding. Note that AUD has fallen from 92.7¢ to 91¢ since October 20 while over the same period the US equity market has fallen by around 3%. We expect, however, that the inventory cycle; the stimulus packages; the initial bottom line benefits of the weak USD; and the impatience of “sidelined” investors will bring the market back into line prior to the big reversal in 2010. 10 Volume Four 2009 Regional Economic Report Australian dollar: riding high Chart 1. Chart 2. AUD/EUR & AUD/NZD AUD/USD & AUD/JPY 1.05 JPY USD 110 0.70 EUR NZD 1.3 Source: Factset Source: Factset 0.95 100 0.85 90 0.65 1.2 0.60 0.75 80 0.65 70 0.55 AUD/USD (lhs) AUD/JPY (rhs) 0.55 60 1.1 AUD/EUR (lhs) 0.50 AUD/NZD (rhs) 0.45 Jan-07 May-07 Oct-07 Feb-08 Jul-08 Dec-08 Apr-09 Sep-09 50 Chart 3. 0.45 Jan-07 May-07 Oct-07 Feb-08 Jul-08 Dec-08 Apr-09 Sep-09 Chart 4. AUD has led changes in relative rates 1.0 1.0 USD The Australian dollar & 2yr swap spreads bps Sources: Bloomberg, Westpac Economics 550 80 %pa index 4 AUD TWI 500 Composite spread of US, UK, CA, NZ 0.9 450 0.8 400 AUD 350 RBA cash spread to Fed 0.7 3 70 2 60 1 300 Sources: Factset, RBA, Westpac 0.6 Jan-08 250 May-08 Oct-08 Feb-09 Jul-09 Chart 5. 50 Jan-08 Sep-08 Jan-09 May-09 Sep-09 Chart 6. The Australian dollar: actual versus fitted 1.00 0 May-08 USD USD Broad nominal USD trade weighted index 1.00 100 index index Fair value band AUD/USD actual Source: Westpac Economics 0.90 95 0.80 0.80 90 0.70 0.70 85 0.60 0.60 80 0.50 75 0.40 70 Feb-02 0.90 AUD/USD forecast 0.50 index based at February 2002 -8.7% -4.2% -6.8% -7.2% +21% -11% Source: Westpac Economics 0.40 Jan-91 Jan-95 Jan-99 Jan-03 Jan-07 Feb-04 Feb-06 Feb-08 Feb-10 Past performance is not a reliable indicator of future performance. The forecasts given above are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The results ultimately achieved may differ substantially from these forecasts. 11