Monthly Economic & Market Update

advertisement

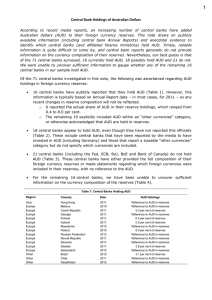

Monthly Economic & Market Update How the different asset classes have fared: (as at 30 June 2015): Asset Class Cash1 Australian Bonds International Bonds3 Australian Shares4 International Shares Unhedged5 International Shares Hedged6 Emerging Markets Unhedged7 Listed Infrastructure Unhedged8 Australian Listed Property9 International Listed Property Unhedged10 1 mth % 3 mth % 6 mth % YTD % 1 yr % 3 yr % 5 yr % 10 yr % 0.18 0.56 1.23 1.23 2.60 2.85 3.65 4.70 -0.93 -1.99 0.63 0.63 5.63 4.82 6.44 6.25 -1.14 -2.18 0.54 0.54 6.25 5.76 6.97 7.10 -5.40 -6.25 3.32 3.32 5.67 14.47 9.36 7.02 -2.66 -0.11 9.46 9.46 25.18 26.12 15.43 6.27 -3.74 -1.37 5.61 5.61 17.09 22.17 14.40 5.32 -3.00 0.08 9.61 9.61 16.51 14.16 5.66 8.02 -5.00 -2.69 3.28 3.28 15.60 20.88 12.57 6.63 -3.97 -2.33 6.67 6.67 20.20 18.29 14.23 2.32 -4.27 -8.59 1.41 1.41 22.91 18.82 14.71 1 Bloomberg AusBond Bank 0+Y TR AUD, 2Bloomberg AusBond Composite 0+Y TR AUD, 3JPM GBI Global Ex Australia TR Hdg AUD, 4S&P/ASX All Ordinaries TR, 5MSCI World Ex Australia NR AUD, 6MSCI World ex Australia NR AUD Hedged (as at 04.05.15), 7MSCI EM NR AUD, 8S&P Global Infrastructure NR AUD, 9S&P/ASX 300 AREIT TR, 10FTSE EPRA/NAREIT Global REITs NR AUD Summary June has been a difficult month, with many markets recording negative returns during the month. Over the past year returns remain solidly positive with excellent returns from unhedged international shares. Australian Economic Conditions The latest economic data indicates that Australian economic growth is likely to continue to be subdued and that these conditions are expected to continue into 2016. Australia has a weak mining sector, a strong domestic housing construction industry, and a consumer who is struggling with sustaining spending with very flat wages growth. On balance this points to an economy with modest growth prospects. Cash The Reserve Bank of Australia (RBA) decided to maintain the official interest rate at 2.0% in its June meeting, following the quarter of a percent reduction in May. Whether the RBA deems further cuts are warranted will be dependent on economic and financial conditions in the coming months. Market expectations are that rates will remain unchanged for sometime. 1 - The bank is caught between concerns about the risks of fuelling the property bubble if rates are cut further, and concerns about a weakening mining sector if they are not cut again soon. Australian Bonds There has been a continuation of rising local bond yields with the rate at around 3% at the end of June. Australian long bond yields generally follow global bond markets which have been moving off ultra low levels in recent weeks. Rising bond yields push down bond values, and bonds fell in value over the past month. Australian Equities The Australian share market has had a good run and now seems to be taking a breather. Earnings growth is forecast to be fairly flat over the next 2 years. The market is at the upper end of its normal valuation range. This suggests that with fairly modest expectations for economic growth, that the Australian share market will likely deliver modest returns in the coming year. There is some possibility of stronger returns if interest rates are cut aggressively, similarly a much weaker than expected Chinese economy could, if it comes to pass; push the market lower. International Economic Conditions The US economy continues to improve and offers the brightest prospects for growth in 2015. In Europe there are a few green shoots emerging but structural problems remain and the Greek economic and political crisis continues to introduce an unpredictable element into any forecasting. China is slowing to a more manageable and sustainable model of economic growth as its economy matures. International Shares International shares have been boosted by the falling value of the A$, a trend we think is likely to continue. US shares are very expensive on a wide range of valuation measures, and this market is at some risk of a correction. Other international share markets offer more reasonable valuations. Selectively then opportunities remain in international equities. We believe that active management is best positioned to identify these opportunities whilst reducing the impact of the risks. Emerging Markets We remain cautiously optimistic about emerging markets shares. In China, equity markets suffered a correction at the end of June, following strong growth earlier in the year. While Chinese shares may have gotten ahead of themselves, valuations in the broader range of EM markets seem quite attractive. 2