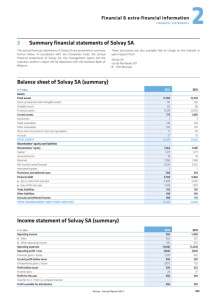

J Sainsbury plc - Annual Report and Financial Statements 2010

advertisement