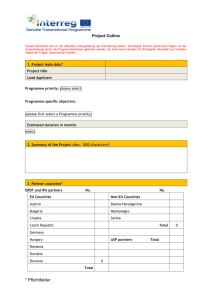

An Introduction to Monitoring an ERDF Project

advertisement