international journal of research and analysis volume 2 issue 6

advertisement

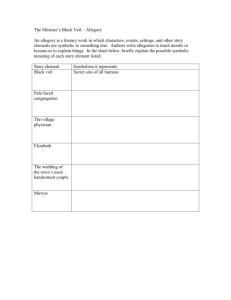

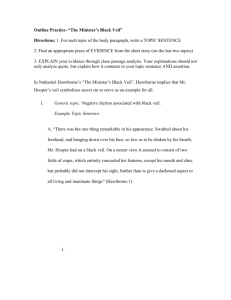

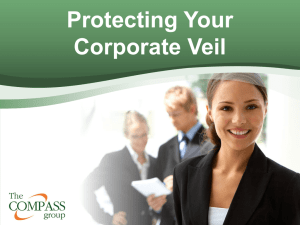

INTERNATIONAL JOURNAL OF RESEARCH AND ANALYSIS VOLUME 2 ISSUE 6 2015 LIFTING OF CORPORATE VEIL FOR TAX REVENUE AND ANALYSIS OF THE PROS AND CONS OF LIFTING OF CORPORATE VEIL * SWECHHA MALIK Introduction: In Solomon vs Solomon &Co., it was observed by the Court that existence of company is distinct and separate from its members. 1 Another main benefit of company is the principle of limited liability which means the liability of members is limited up to the nominal value of shares or amount guaranteed by them. 2 But there are certain situations like fraud, for benefit of revenue, agency etc. where the Court will lift the veil of incorporation in order to examine the realities which lay behind 3.So, the corporate veil is said to be lifted when the Court ignores the separate legal entity and limited liability of the Company and concerns itself directly with managers or members. This paper deals with lifting of corporate veil for protection of tax revenue and analyses the pros and cons of lifting of corporate veil. Lifting of Corporate Veil for Tax Revenue: At times tax legislations warrant the lifting of the corporate veil and the courts disregard the separate legal personality of companies in case of tax evasions or liberal schemes of tax avoidance without any necessary legislative authority.4 In the Dinshaw Maneckjee Petit, Re5 the Court ordered the lifting of corporate veil since the company was formed by the assessee purely as a means for avoiding super tax and the company was nothing more than the assessee himself. In Life Insurance Corporation of India v Escorts Ltd., the Supreme Court observed that: “the corporate veil may be lifted where a taxing statute or a beneficent statute is sought to be evaded or where associated companies are inextricably connected as to be in reality, part of one concern and also for the protection of public interest.”6 In Juggilal Kamlapt v. CIT, the Supreme Court held that it is well established that the Income Tax authorities are allowed to lift the veil of corporate entity and look at the reality of the transaction. 7 The Court has the power to disregard the corporate entity if it is used for tax evasion or to circumvent tax obligation or to 1 Solomon v Solomon &Co., [1897] AC 22. AVTAR SINGH,COMPANY LAW 7 (2007). 3 John P.Lowry,Lifting the Corporate Veil,Journal of Business Law 41(1993).. 4 Harshit Saxena, Lifting the Corporate Veil, available at <http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1725433> 5 Dinshaw Maneckjee Petit, Re,(1927) 29 BOMLR 447. 6 Life Insurance Corporation of India v Escorts Ltd, 1986 AIR 1370, 1985 SCR Supl. (3) 909. 7 Juggilal Kamlapt v. CIT, (1969) 73 ITR 702 (SC) 2 280 INTERNATIONAL JOURNAL OF RESEARCH AND ANALYSIS VOLUME 2 ISSUE 6 2015 perpetrate fraud. However, the court also observed that the doctrine of lifting the corporate veil ought to be applied only in exceptional circumstances and not as routine matter8. Then, in Jindal v CIT, the Calcutta High Court pierced the corporate veil and found that there was an attempt to avoid the taxation of deemed dividend and refused to give effect to the separate legal identity.9 The author CS Nivedita Shankar feels that, “while English courts are moving towards a principled approach whereby mere apprehension of deceit or mis-representation shall not suffice, Indian courts are still emphasizing on larger public interest for lifting of corporate veil which has led to an exhaustible list of circumstances, when the corporate veil can be pierced.”10 In my opinion, tax authorities are demanding the lifting of corporate veil as a routine matter now and they are justifying their action on the basis of tax revenue and compelling public interest which is contrary to the judgment of Juggilal Kamlapt case. Analysis of Recent Cases involving Piercing of Corporate Veil: In Vodafone International Holdings B.V vs. Union of India, Supreme Court denied the lifting of corporate veil and held that the tax Authority may invoke the ‘piercing the corporate veil’ test only after it is able to establish that the impugned transaction is sham or tax avoidant. 11 So, lifting of corporate veil is permissible only if the controlling foreign enterprise makes an indirect transfer through abuse of organization form without any reasonable business purpose resulting in tax avoidance or avoidance of withholding tax. 12 Further, the tax authority must apply the ‘look at’ principle wherein the entire transaction as a whole needs to be looked at, without dissecting it.13 While deciding whether or not to lift the corporate veil, following factors need to be considered: a) Participation in investment b) Duration of time period for which the holding structure exists c) The period of business operation in India d) Generation of taxable revenues in India e) Timing of exit and continuity of business. 14 In my opinion, the Supreme Court has rightly supported the ‘holistic approach’ for looking the transaction as a whole instead of looking it in parts to ascertain the lifting of corporate veil. Moreover, the 8 Id M.D Jindal v CIT, 1987 164 ITR 28 Cal. 10 CS Nivedita Shankar, Piercing corporate veil- moving towards a principled approach, available at https://indiafinancing.com/piercing_corporate_veil_moving_towards_a_principled_approach.pdf (June 20, 2013). 11 Vodafone International Holdings B.V vs. Union of India,[2012] 107 CLA 63 (SC) 12 Id 13 Id 14 Id 9 281 INTERNATIONAL JOURNAL OF RESEARCH AND ANALYSIS VOLUME 2 ISSUE 6 2015 judgment is in consonance with Creasey v. Breachwood Motors Limited, where the reason for the denial of the piercing of veil was the timing of incorporation of the company and since the company was carrying business for so many years, fraud exception was rejected. It was observed that, “the Vodafone judgment re‐ignited the substance vs. form debate because Vodafone argued that the business arrangement did not result in a sham transaction and was perfectly legal in form whereas revenue authorities contended that the structure put into place by Vodafone was calculated to avoid tax liability.”15 The corporate veil was lifted in the recent case of Richter Holdings Ltd. v The Assistant Director of Income Tax, where Karnataka High Court observed: “It may be necessary for the fact finding authority to lift the corporate veil to look into the real nature of transaction to ascertain virtual facts.”16 According to Advocate Raj Kumar, “the Karnataka High Court appears to have readily permitted lifting the corporate veil without at all alluding to the jurisprudence on the subject-matter and the Court wrongly provides an additional ground to the tax authorities to lift corporate veil to ascertain facts and tax indirect transfer.17 I agree with the opinion of author because the Court is interpreting this doctrine very widely and thereby causing more uncertainty and doubts in the minds of general public by adding more grounds to this doctrine. In a recent case of Kotak Mahindra Bank Limited v Subhiksha Trading Services Limited,18 Kotak Mahindra Bank was asking for winding up of Subhiksha after it failed to repay a loan of Rs 35 crore with interest. Since Subhiksha failed to prove how it suffered losses of Rs 800 crores due to the global financial crunch, Kotak's counsel, Mr. H. Karthik Seshadri, submitted that, the conduct of Mr. R. Subramanian (Managing Director of Subhiksha) required a detailed investigation by lifting the corporate veil as there was a reasonable grounds to believe that he has “willfully” transferred the company's assets to entities such as Cash and Carry Wholesale Traders Pvt. Ltd., Custodial Services India, Pentagon Trading Services, Shevaroy Holiday Resorts and Triad Trading Services, which are controlled by Mr. Subramanian(59%) along with 15 Adhitya Srinivasan & Vipul Agrawal, Taxing International Transactions By Lifting The Corporate Veil, available at http://www.itatonline.org/articles_new/index.php/taxing-international-transactions-by-lifting-the-corporate-veil/ 16 Richter Holdings Ltd v The Assistant Director of Income Tax, (High Court of Karnataka, 24 March 2011). 17 Raj Kumar(Associate Singhania and Partners),A view point on Richter Holdings Ltd. v The Assistant Director of Income Tax, available at http://www.singhania.net/wp-content/uploads/15-RICHTER-HOLDINGS-LTD-vs.ASSISTANT-DIRECTOR-OF-INCOME-TAX.pdf 18 Kotak Mahindra Bank Limited v Subhiksha Trading Services Limited, (Madras High Court,29 February 2012). 282 INTERNATIONAL JOURNAL OF RESEARCH AND ANALYSIS VOLUME 2 ISSUE 6 2015 a few others.19 The Court in this case rightly upheld the winding up request made by Kodak and in my opinion; it is a fit case of lifting of corporate veil because of fraudulent conduct of Mr.Subramaniam which was deliberately done with knowledge with an intention to defraud creditors by not paying borrowings and loans. Lifting of Corporate veil-Boon or Bane? While there are occasions where the courts will “pierce the corporate veil," those occasions are still the exception and not the rule. 20 So, the Judiciary is unwilling to lift the corporate veil of companies and it will do so only in exceptional circumstances. It can be argued that lifting of corporate veil is rightly described as “incoherent and unprincipled concept” because it depends on the judges concerned and they exercise strong discretion in such cases which only triggers lack of predictability. 21 The author Stephen M. Bainbridge is in favor of abolishing the doctrine of piercing of veil because it is vague and it functions as a tax on entrepreneurs because shareholders with competent counsel will spend time, effort, and resources to ensure that their business is conducted in ways that limit veil piercing risk and it will increase their business costs.22 Further it can be argued that the nominal tests used by Courts while lifting Corporate Veil-whether a corporation has a "separate mind of its own," whether it is a "mere instrumentality," and so forth-are singularly unhelpful and arbitrary. 23 Since the tests applied by the Courts are arbitrary, this raises serious questions on the utility of piercing of corporate veil. Louis Velaphi Mthembu also criticizes the doctrine of lifting of corporate veil due to lack of clarity since the courts would only pierce the corporate veil where it is convenient to do so and secondly overlapping between certain categories is only aggravating the problem 24. On the other hand it can be argued that it is possible to make sense out of the area of piercing by carefully integrating broad policy concerns with specific grounds for piercing. 25 It can also be argued that an individualist society with developed market needs lifting the corporate veil to 19 Id Larry S. Bryant, Piercing the Corporate Veil, 87 Com. L.J. 302 (1982). 21 Shweta Sahu,Piercing the Corporate Veil: A Necessity today in India and abroad, available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2352489 22 Stephen M. Bainbridge, Abolishing Veil Piercing, 26 J. Corp. L. 535 (2001). 23 Frank H. Easterbrookt &Daniel R. Fischeltt, Limited Liability and the Corporation, 52 U. Chi. L. Rev. 109 (1985). 24 Louis Velaphi Mthembu ,To lift or not to lift the corporate veil - the unfinished story, available at http://researchspace.ukzn.ac.za/xmlui/bitstream/handle/10413/5302/Mthembu_Velaphi_Louis_2002.pdf?sequence= 1 25 Franklin A. Gevurtz,Piercing Piercing: An Attempt to Lift the Veil of Confusion Surrounding the Doctrine of Piercing the Corporate Veil, 76 Or. L. Rev.907 (1997). 20 283 INTERNATIONAL JOURNAL OF RESEARCH AND ANALYSIS VOLUME 2 ISSUE 6 2015 control economic relations; it allows them to restrain illegal and dishonest use of limited liability principle working for legal entities 26.Moreover, in the absence of piercing of corporate veil business owners with dishonest reasons, shall have advantage over other market players by using immunity principle for limited liability of a legal entity and this is in clear violation of the principle of equity. According to Marion A. Hecht, “a corporation can avoid the lifting of corporate veil by maintaining an active board of directors; documenting and maintaining the board of directors minutes; ensuring active, functioning, and responsible officers; consistently filing all required state paperwork associated with being incorporated, by producing an annual report and by holding an annual meeting, complete with documented votes.”27 Conclusion Supreme Court has rightly denied the lifting of corporate veil in Vodafone case by observing that the tax Authority may invoke the ‘piercing the corporate veil’ test only after it is able to establish that the impugned transaction is sham or tax avoidant.28 The doctrine of lifting of Corporate Veil which is based on principle of equity is required to control economic relations and to restrain illegal and dishonest use of limited liability principle working for legal entities. However there is need for reform in this doctrine to remove the arbitrariness of nominal tests, to remove lack of predictability and to prevent the unnecessary costs incurred by the shareholders to minimize the risk of lifting of Corporate Veil. Further, Courts should not interpret this doctrine too widely to ensure clarity in the l 26 Dmitry Kafanov, Lifting the Corporate Veil is Necessary for a Developed Market, available at http://www.inmarlegal.ru/en/filemanager/download/486 27 Marion A. Hecht, Piercing the Corporate Veil, AIRA Journal Vol 25 No. 5, 14(2012). 28 Vodafone International Holdings B.V vs. Union of India,[2012] 107 CLA 63 (SC) 284