network management and development of new business

advertisement

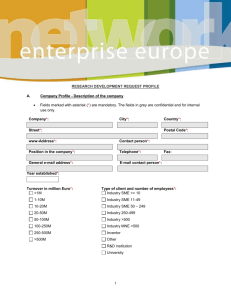

NETWORK MANAGEMENT AND DEVELOPMENT OF NEW BUSINESS OPPORTUNITIES – A CASE STUDY IN FINNISH METAL INDUSTRY NETWORK Tiina Valjakka, Katri Valkokari VTT Industrial Systems P.O. Box 1301, FIN-02044 VTT Email: tiina.valjakka@vtt.fi, katri.valkokari@vtt.fi ABSTRACT This paper describes the development of new business opportunities through a strategic network. The case network is a Finnish metal industry network of seven small and mediumsize enterprises (SMEs). The objective of the research is to recognise and define the mechanisms of how multilateral strategic networks generate new business. The strategic cooperation is seen as a means for SME networks to compete. Network strategy is the tool to create common understanding on strategic issues, e.g. growth strategy, in the network. The Partnet project, within which this research is conducted, consists of three different enterprise networks, each of which has started to evolve towards a strategic network. Juha Lemponen Oy is one of the three core companies and the core of the case network. The network of Juha Lemponen created a vision of the future of the network including agreement on the growth strategy. The network gained a new customer with whom they had a chance to start practising the new way of operating. The researchers actively participated in the development process. The research suggests that the strategic co-operation of an SME network brings along possibilities to create new business opportunities. INTRODUCTION It is widely recognised that the degree to which companies are collaborating to compete is increasing and the co-operation is reaching new and greater forms. Strategic alliances are often seen as a tool for large conglomerates for managing the market and the supply chain. However, strategic bilateral and also multilateral co-operation is diffusing into relatively small companies, too. In Finland, the large globally operating companies have outsourced their functions to a great extent and will continue to do so. There is relatively few middlesized companies capable of providing the larger entities outsourced by the big businesses. One approach suggested as a solution is an SME network where a group of small companies would be responsible for system deliveries (Hyötyläinen et. al, 1999). The potential for system supplying can be seen to depend on the level of network co-operation (Lamming 1993). Turning an SME network into a collaborative system supplier requires several alterations both in the operations of individual companies and in co-operation modes. Close co-operation means that the companies are becoming increasingly involved with each other's strategies. This has brought the concept of strategic enterprise network into discussion. (Jarillo, 1993, Hines et.al 2000, Hyötyläinen 2000) Strategic network co-operation exceeds the bilateral relationship, for there is a shift towards multilateral operations. The aim of the paper is to describe the development of a strategic SME network. The focus is on developing the network's product-market strategy, with an objective of finding new business opportunities. STRATEGIC NETWORK The long-term partnerships of multilateral networks can be seen as strategic enterprise networks. A strategic enterprise network is based on mutual co-operation between companies and has long-term plans and a shared vision of the future. Strategic network may have its own goals, organisational structures or communication mechanisms. (Jarillo 1993, Kuivanen & Hyötyläinen [ed.] 1997, Hyötyläinen, 2000). One of the bases of successful co-operation is that the companies possess complementary competencies and resources (Moss-Kanter, 1994). Close co-operation of companies generates new knowledge of products, technologies and processes. The close and open multilateral cooperation also provides great insider views to companies with different material and technology bases. The new knowledge in networks is one factor that allows visioning new opportunities and facilitates the creation of new business. NETWORK STRATEGY Strategy typically concerns an individual company and states its position among other companies. There are not many studies about making a strategy for a business network, e.g. a supply chain. (Mikkola & Kettunen, 2002) There is a notion of co-operative strategy making as a part of so-called power school of strategy making. Power school views the strategy making as a process of negotiation (Mintzberg et al, 1998). It is noted that the rapidly increasing co-operation such as joint ventures, alliances, and outsourcing in the modern business development may lead to co-operative or collective strategy making becoming a strategy school of its own in the future (Mintzberg et al, 1998) The basis for a strategic network is shared vision of network activity, products, and product development. The networks' operating principles and development visions can be combined into a common network strategy (Hyötyläinen, 2000). Strategy creation and implementation in an enterprise network poses several challenges and complexities. Subcontractors and suppliers have usually multiple customers which may even operate in different businesses. Each company in the network has its own objectives and at the same time they have to see the potential of multilateral strategic co-operation. The traditional Ansoff Matrix (Ansoff, 1965), conventionally used in individual company context (Figure 1), is one tool to utilise in the network strategy process. Existing Products New Products Existing Markets Market Penetration Product Development New Markets Market Development Diversification Figure 1. The Ansoff Matrix. The matrix provides four different product-market strategies for growth. 1. Market penetration: expanding sales from existing products in existing markets. 2. Market development: entering new markets with existing products. 3. Product development: launching new products for existing markets 4. Product diversification: launching new products for new markets. An SME network can use the matrix for systematic definition of the common growth targets and strategies. It can also be used as a tool in more informal discussions on potential new markets and customers, and possible new products or services that can be created by combing the competencies of the network. THE PARTNET RESEARCH PROJECT The Partnet project consists of three different enterprise networks, each of which has started to evolve towards a strategic network. Juha Lemponen Oy is one of the three core companies. The seven companies in the network of Juha Lemponen Oy are all situated in Southern Ostrobothnia, well-known in Finland for its entrepreneurship, and where there is a great number of SME's. The main customers of the network are large global companies in the transportation and electrotechnical industry. Short description of the companies in the network is shown in table 1. Table 1. Companies in the network of Juha Lemponen Oy. Company Subcontracting area Juha Lemponen Oy Company A Company B Company C Company D Company E Company F Medium-heavy welding assemblies Structural Steel (Wholesaler) Laser and plasma cutting Robot welding Powder Coating Machining and welding Cutting and bending Size of the company (Personnel) 50 35 (total in Finland 370) 6 5 12 20 12 (total of 40) The Partnet project was launched at the beginning of 2002 and will end in autumn 2004. The main objective of the project is to improve and develop the network as a system supplier towards strategic partnerships with the main customers. The four sub-objectives of the project are: 1) achieve deeper and more efficient co-operation in the system supplier network 2) build new models and methods to improve the network operations with the client companies 3) standardize the operations and co-operation modes 4) create new business opportunities via network co-operation Each network also has additional and specific objectives. RESEARCH OBJECTIVES AND METHODS The approach of VTT in development of enterprise networks is experimental development study (e.g. Hyötyläinen 2000), which is grounded on the following principles: wide participation in the companies, development work grounded on real-life problems and development needs in the companies, systematic development process, and transferring the development phase operative models into standard practice. The action research approach is used, the research team actively participating in the analysis and development carried out in the enterprise network. The development process has three main phases which form the basic guideline for systematic progress in the project: Basic analysis, planning and experimentation, and finally consolidation of new ways of action. The basic analysis phase can be seen as the collective strategy making for the network. The main purpose of our long-term research is to recognise and define the mechanisms of how the multilateral strategic networks generate new business. The research question is based on the hypothesis that the creation of new business opportunities in strategic enterprise networks can be a result of different development paths. The aim of the case description is to address how one system supplier network composes and implements its network strategy as a means to find new business opportunities. At the beginning of the project, the researchers interviewed the key persons in each company, total of over 20 persons. A strategy process group of representatives of all seven companies was founded and it held six meetings in the spring of 2002 and now continues its work as a customer process group. The researchers actively participated in the strategy process group and documented the meetings. The companies' own documents and material have also been available for the researchers. This paper is based on material up to March 2003. CASE DESCRIPTION Juha Lemponen Oy is a subcontractor of medium-heavy welding assemblies. It was founded in 1989 and both the turnover and personnel have significantly grown over last five years. At the beginning of 2002 the network of Juha Lemponen Oy was a rather loose SME network in which the core company acted as a system supplier towards the customers. At the beginning of the Partnet project a strategy process group was founded. The group had various objectives, starting from simply learning to know better the representatives and resources of each company, to building trust and discuss the network from a wide and long term perspective. The eventual purpose of the discussions was to build a mutual vision and strategy that every company in the network could agree on. The discussion covered the possible changes in the operational environment: main customers, the final customers, competitors, legislation, changes in the workforce, production and information technology etc. Additionally, the resources, consisting of machinery and skills and including growth strategy of each individual company were thoroughly assessed. The result of the work of the strategy process group was a vision of the future of the network (Figure 2). The vision model includes several noteworthy dimensions: - Strategic partnerships with the main customers. The core company towards the customers is in most cases Juha Lemponen Oy. - Network strategy, which includes common objectives and rules concerning eg. policy on pricing and profit sharing. - Network organisation, the core being a management team of one representative from each company in the network. - The network operations will be agile and flexible. - The order-to-delivery –process will be gradually automated as soon as the usability and price range of information technology solutions are suitable for SMEs. One clear target of the network of Juha Lemponen is growth. The Ansoff Matrix (Figure 1) was used to find the common understanding of the growth strategy. The companies agreed that existing products and existing markets (Market development strategy) would be the natural and safe start. Since the network is a subcontractor network with neither own products nor much experience in product development, the next step was to gain new customers with the existing know-how (Market penetration strategy). CUSTOMERS CUSTOMERS CUSTOMERS Strategic partnerships Network Strategy Juha Lemponen Oy System supplier Assemblies Company A Steel Deliveries Company F Steel Structures Strategic Network Network Organization Company B Laser cutting Company E Machined Parts Network Operations Company D Powder Coating Company C Robot Welding Figure 2. The vision model of the Juha Lemponen Oy network. In September 2002 the network got a chance to offer a new large assembly to a customer that had previously ordered some occasional work. This was accomplished through several discussions with the customer the same year. The request for offer was brought to a strategy group meeting where every company of the network was informed at the same time, and the representative of Juha Lemponen Oy asked the commitment, resources, and willingness to accept the new big challenge. This was a totally new way of operating in the network. This offer was seen as a potential start of long term co-operation with the new customer and at the same time as a chance to develop and test the business model of the strategic network. The network won the deal. CONCLUSIONS AND DISCUSSION Strategic network co-operation brings along several benefits. The possibility to strengthen the business by growing is one of them. Our case study of the network of Juha Lemponen Oy shows that the growth strategy as a result of a joint network strategy process brings along chances to create new business opportunities. The natural start of the growth path of a SME system supplier network is to increase the market share with the existing customers. The next step is to find new customers that could utilise the existing combination of the know-how in the network The challenges of a strategic SME network are various, e.g., how to maintain the strategic cooperation, when not every company in the network is involved in each customer product or project. Our research will continue in the Partnet project and will follow how the network of Juha Lemponen Oy and its operations evolve in practise during the project, and by what means it achieves growth and conquers the inevitable disagreements and difficulties. There is a complementary research going on with another network in the Partnet project where a strategic network is pursuing totally new markets with new and innovative ways to combine their technology and know-how. REFERENCES Ansoff, H. I. 1965. Corporate Strategy. An analytic approach to business policy for growth and expansion. New York, McGraw-Hill. Hines, P., Lamming, R., Jones, D., Cousins, P., & Rich, N. 2000. Value Stream Management. Strategy and Excellence in Supply Chain. Harlow: Financial Times-Prentice Hall. Hyötyläinen, R. 2000. Development Mechanisms of Strategic Enterprise Networks. Learning and Innovation in Networks. Espoo: VTT Publications 417. Hyötyläinen, R., Smolander, A., Valjakka, T., & Räsänen, P. 1999. From a Group Businesses to a System Supplier. In: Alasoini, T. & Halme, P. (Eds.), Learning Organizations, Learning Society. Helsinki: Edita, Ministry of labour, Finnish National Workplace Development Programme, Yearbook 1999, reports 8. pp 83-116. Jarillo, J. Strategic Networks. Creating Borderless Organization. oxford: ButterworthHeinemann. Kuivanen, R. & Hyötyläinen, R. 1997. Kohti uudenlaisia yritysverkostoja. Monenkeskisen verkostoyhteistyön kehittäminen. Espoo: VTT, Tiedotteita 1830. (In Finnish.) Lamming, R. 1993. Beyond Partnership. Strategies for Innovation and Lean Supply. New. York: Prentice Hall. Mintzberg, H., Ahlstrand, B. & Lampel, J. 1998. Strategy Safari. London: Prentice Hall. Mikkola M, Kettunen J. 2002. Creating a technology strategy for a supplier network: a case of mobile communications equipment manufacturing. In: Integrating supply chains and internal operations through ebusiness. Proceedings of the 7th International Symposium on Logistics and the 2nd International Symposium on Operations Strategy. Melbourne, 14-17 July 2002. Monash and Victoria universities. Moss Kanter, R.1994. Collaborative advantage: the art of alliances. Harvard Business Review, 72 (July-August), pp. 96-108.