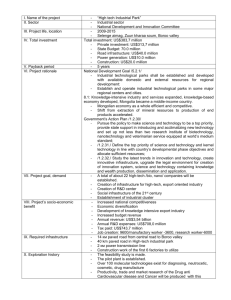

Technology Works - Bay Area Council

advertisement