DU for Government Loans - July 2012 Release Notes

advertisement

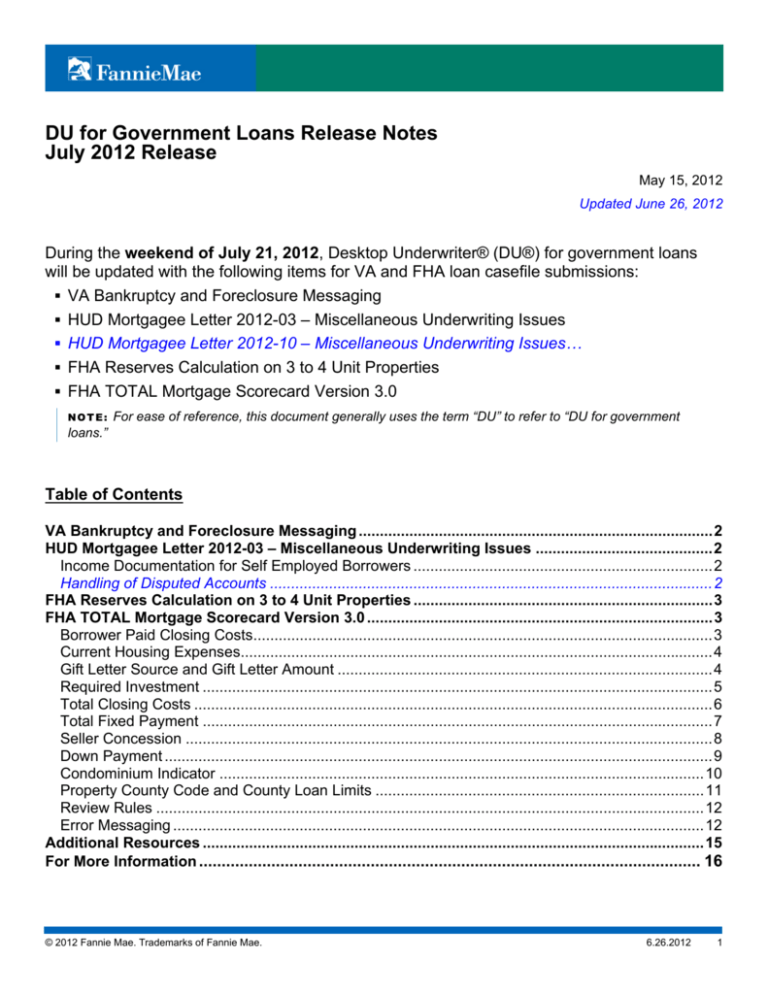

DU for Government Loans Release Notes July 2012 Release May 15, 2012 Updated June 26, 2012 During the weekend of July 21, 2012, Desktop Underwriter® (DU®) for government loans will be updated with the following items for VA and FHA loan casefile submissions: VA Bankruptcy and Foreclosure Messaging HUD Mortgagee Letter 2012-03 – Miscellaneous Underwriting Issues HUD Mortgagee Letter 2012-10 – Miscellaneous Underwriting Issues… FHA Reserves Calculation on 3 to 4 Unit Properties FHA TOTAL Mortgage Scorecard Version 3.0 NOTE: For ease of reference, this document generally uses the term “DU” to refer to “DU for government loans.” Table of Contents VA Bankruptcy and Foreclosure Messaging ....................................................................................2 HUD Mortgagee Letter 2012-03 – Miscellaneous Underwriting Issues ..........................................2 Income Documentation for Self Employed Borrowers .......................................................................2 Handling of Disputed Accounts .........................................................................................................2 FHA Reserves Calculation on 3 to 4 Unit Properties .......................................................................3 FHA TOTAL Mortgage Scorecard Version 3.0 ..................................................................................3 Borrower Paid Closing Costs.............................................................................................................3 Current Housing Expenses................................................................................................................4 Gift Letter Source and Gift Letter Amount .........................................................................................4 Required Investment .........................................................................................................................5 Total Closing Costs ...........................................................................................................................6 Total Fixed Payment .........................................................................................................................7 Seller Concession .............................................................................................................................8 Down Payment ..................................................................................................................................9 Condominium Indicator ...................................................................................................................10 Property County Code and County Loan Limits ..............................................................................11 Review Rules ..................................................................................................................................12 Error Messaging ..............................................................................................................................12 Additional Resources .......................................................................................................................15 For More Information ............................................................................................................... 16 © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 1 VA Bankruptcy and Foreclosure Messaging The text of the messages that are issued when DU detects a bankruptcy or foreclosure in the credit report data will be updated in this release; however, the logic for the messages will remain unchanged. The updated text for the bankruptcy message is as follows: This loan casefile has been referred due to the presence of a bankruptcy on the credit report which appears to have occurred within the last 2 years. The lender must review the credit report and bankruptcy documentation to verify that the loan meets VA requirements. The updated text for the foreclosure message is as follows: This loan casefile has been referred due to the presence of a foreclosure on the credit report which appears to have occurred within the last 2 years. The lender must review the credit report and foreclosure documentation to verify that the loan meets VA requirements. HUD Mortgagee Letter 2012-03 – Miscellaneous Underwriting Issues This Mortgagee Letter (ML) was issued by HUD on February 28, 2012, and is effective for all FHA Agency Case Numbers assigned on or after April 1, 2012. The messages in DU will be updated for this ML with this release. DU is unable to determine the date of the FHA Agency Case Number assignment. Submissions made prior to the weekend of July 21 will receive the old messaging; loan casefiles submitted after the weekend of July 21 will receive the updated messaging outlined in these release notes. Lenders are responsible for ensuring the correct documentation and guidelines are applied based on the date of the FHA Agency Case Number assignment. Income Documentation for Self Employed Borrowers Prior to the issuance of this ML, the documentation requirements for year-to-date (YTD) profit & loss (P&L) statements and balance sheets varied based on whether the loan casefile submission received an Approve or Refer recommendation. With this ML, HUD updated its documentation requirements to be the same for all recommendations. DU will be updated with this release to issue the following message on both Approve and Refer recommendations: <Borrower’s Name> is self-employed. Profit and Loss (P&L) Statements and Balance Sheets are required if more than one calendar quarter has elapsed since the filing date of the most recent tax return. Additionally, if income used to qualify the borrower exceeds that of the two-year average based on tax returns, an audited P&L statement or signed quarterly tax returns obtained from the IRS are required to support the greater income stream. Handling of Disputed Accounts The guidance on handling disputed accounts, which is outlined in ML 2012-03, was rescinded with ML 201210. Therefore, the disputed account message in DU will not be updated in this release. The text of the disputed account message in DU also will be updated in this release as follows: If the credit report reveals that the borrower is disputing any tradelines (accounts or collections), the mortgage loan application must be referred to a DE underwriter for review and the file must be documented according to current FHA guidelines, unless the following two conditions have been met: 1) the total outstanding balance of all disputed tradelines (accounts and collections) is less than $1000; and 2) the disputed tradelines (accounts and collections) are aged at least two years from date of last activity as indicated in the credit report. © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 2 FHA Reserves Calculation on 3 to 4 Unit Properties Section 2.B.4.d of HUD Handbook 4155.1 specifies that gift funds cannot be counted towards reserves on 3 to 4 unit properties. DU will be updated in this release to no longer include any gift funds entered in the Assets section of the loan application in the reserves listed in the Underwriting Analysis section of the DU Underwriting Findings Report on 3 to 4 unit properties. Also, DU will no longer include gift funds entered in the Assets section in the Reserves data element sent to the FHA TOTAL Mortgage Scorecard on 3 to 4 unit properties. NOTE: The gift funds amount should be entered in both the Source of Downpayment and Assets sections of the loan application to ensure calculations are performed correctly by DU, and correct information is sent to the FHA TOTAL Mortgage Scorecard. FHA TOTAL Mortgage Scorecard Version 3.0 Certain data elements that are currently optional will become required data element inputs to the FHA TOTAL Mortgage Scorecard the weekend of July 21. These data elements are outlined in the FHA TOTAL Mortgage Scorecard AUS Developer’s Guide, Version 3.0, and also in these release notes. Since DU is using existing data elements within its Residential Loan Data (RLD) Format 1003 Version 3.2 and MISMO Automated Underwriting Specification (AUS) Version 2.3.1 file formats to populate these data elements on submissions to the FHA TOTAL Mortgage Scorecard, no changes are needed to customers’ systems with this release. Borrower Paid Closing Costs This data element is defined by HUD as the resulting amount of line f. Estimated Closing Costs minus the amount from line k. Closing Costs Paid by Seller from the Details of Transaction screen (shown below). This information is currently being collected in the Residential Loan Data (RLD) Format 1003 Version 3.2 and MISMO Automated Underwriting Specification (AUS) Version 2.3.1 file formats. Please note, DU currently performs the calculation to send this data element to the FHA TOTAL Mortgage Scorecard and will continue to do so. © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 3 Current Housing Expenses This data element is defined by HUD as the sum of the borrowers’ current monthly housing expenses such as rent or mortgage payments, insurance, taxes, etc. This data is generally taken from the Combined Monthly Housing Expense section of the Income and Housing screen (shown below). This information is currently being collected in the Residential Loan Data (RLD) Format 1003 Version 3.2 and MISMO Automated Underwriting Specification (AUS) Version 2.3.1 file formats. Please note, DU currently performs the calculation to send this data element to the FHA TOTAL Mortgage Scorecard and will continue to do so. Gift Letter Source and Gift Letter Amount DU was updated in September 2009 along with the Residential Loan Data (RLD) Format 1003 Version 3.2 and MISMO Automated Underwriting Specification (AUS) Version 2.3.1 file formats to be able to collect the FHA Gift Letter Source and Gift Letter Amount. This information is entered in the Types, Terms and Property screen (shown below). DU currently sends this to the FHA TOTAL Mortgage Scorecard and will continue to do so. © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 4 The FHA TOTAL Mortgage Scorecard is currently able to receive only one Gift Source and Gift Amount per submission. Because it is possible to enter multiple Gift Sources in the available Source of Downpayment fields, DU will send the Gift Letter Source to the FHA TOTAL Mortgage Scorecard that corresponds with the highest Gift Letter Amount entered. If multiple Gift Letter Sources have the same dollar amount, DU will apply the hierarchy detailed below to determine which Gift Source to send to the FHA TOTAL Mortgage Scorecard: 1. 2. 3. 4. 5. 6. Nonprofit/Religious/Community - Seller Funded Nonprofit/Religious/Community - Non-Seller Funded Relative Employer Government Assistance N/A (includes “Gift Funds” option) In a scenario where multiple Gift Sources are entered, but some do not have a corresponding dollar amount entered, only the Gift Sources with a dollar amount greater than $0 will be used in determining which Gift Source will be sent to the FHA TOTAL Mortgage Scorecard. DU will total the dollar amounts for all Gift Sources (including Seller Funded gifts) and provide this amount (rounded up to the nearest whole dollar) to the FHA TOTAL Mortgage Scorecard as the Gift Letter Amount. The “Gift Funds” option will still be available in the Source of Downpayment field. If this option is selected, DU will send a Gift Source of “N/A” to the FHA TOTAL Mortgage Scorecard. The Gift Source of N/A will also be provided to the FHA TOTAL Mortgage Scorecard when no other Gift Source with a corresponding dollar amount greater than $0 is entered in the loan application. Required Investment This data element is defined by HUD as the amount from line p. Cash From/To Borrower from the Details of Transaction screen (shown below). DU calculates this amount based on existing fields in the Residential Loan Data (RLD) Format 1003 Version 3.2 and MISMO Automated Underwriting Specification (AUS) Version 2.3.1. DU does not currently send this data element to the FHA TOTAL Mortgage Scorecard, but will do so starting with this release. © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 5 Total Closing Costs This data element is defined by HUD as line f. Estimated Closing Costs from the Details of Transaction (shown below). This information is currently collected in an existing field in the Residential Loan Data (RLD) Format 1003 Version 3.2 and MISMO Automated Underwriting Specification (AUS) Version 2.3.1. Please note, DU currently sends this data element to the FHA TOTAL Mortgage Scorecard and will continue to do so. © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 6 Total Fixed Payment This data element is defined by HUD as the sum of the borrowers’ total fixed monthly expenses such as the mortgage payment, insurance, taxes, fees, and other recurring charges, including all monthly payment debts and housing debts. DU calculates this amount based on existing fields in the Residential Loan Data (RLD) Format 1003 Version 3.2 and MISMO Automated Underwriting Specification (AUS) Version 2.3.1. Please note, DU currently sends this data element to the FHA TOTAL Mortgage Scorecard and will continue to do so. The amount sent to the FHA TOTAL Mortgage Scorecard for this data element should align with the Total Expense Payment shown in the Underwriting Analysis Report section of the DU Underwriting Findings. © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 7 Seller Concession This data element is defined by HUD as the amount the seller and/or interested third party contributes toward the buyer’s closing costs, prepaid expenses, discount points, Upfront Mortgage Insurance Premium (UFMIP), and interest rate buydowns. There is an existing field in the Residential Loan Data (RLD) Format 1003 Version 3.2 and MISMO Automated Underwriting Specification (AUS) Version 2.3.1 that captures the seller concessions. However, based on FHA’s definition of the data element, DU for government loans will add together the amounts from line k. Closing Costs Paid By Seller on the Details of Transaction; All Seller Credits entered in the Other Credit section of the Details of Transaction; and any amount entered in the Seller Concessions field in the Government Information screen (shown in the following two screenshots). DU does not currently send this data element to the FHA TOTAL Mortgage Scorecard, but will do so after this release. © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 8 Down Payment This data element is defined by HUD as line a. Purchase Price from the Details of Transaction screen (shown below) minus line m. Loan Amount (Exclude PMI, MIP, Funding Fee). DU calculates this amount based on existing fields in the Residential Loan Data (RLD) Format 1003 Version 3.2 and MISMO Automated Underwriting Specification (AUS) Version 2.3.1. DU currently sends this data element to the FHA TOTAL Mortgage Scorecard and will continue to do so. NOTE: DU automatically populates line m. Loan Amount (Exclude PMI, MIP, Funding Fee) in the Details of Transaction screen with the amount entered in the Loan Amount field on the Types, Terms and Property screen (shown below). © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 9 Condominium Indicator If Condominium, Detached Condo, or High Rise Condo is selected as the Subject Property Type in the Additional Data section (shown below), then DU will send a “Y” to the FHA TOTAL Mortgage Scorecard to indicate the property is a condominium. For all other property types, DU will send an “N” to the FHA TOTAL Mortgage Scorecard to indicate the property is not a condominium. DU for government loans does not currently send this data element to the FHA TOTAL Mortgage Scorecard, but will do so starting with this release. © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 10 Property County Code and County Loan Limits With this release, DU will start sending the Property County Code to the FHA TOTAL Mortgage Scorecard and start receiving the County Loan Limit information in return. This update will mean that there will be less of a lag time for the correct amounts to be reflected in DU when adjustments are made to the FHA county loan limits. To make this possible, customers will need to enter both the Property State and Zip Code on the Types, Terms and Property screen (shown below) for all FHA submissions to allow the Property GeoCoder to determine the correct county. If the Zip Code is not entered, or the Property GeoCoder is not able to determine a county, the statutory state minimum will be used in DU. NOTE: If for any reason the County Loan Limit displayed in DU is inaccurate, the customer should document the file by printing out the correct loan limit information from the FHA Mortgage Limits lookup tool, which is located at the following URL: https://entp.hud.gov/idapp/html/hicostlook.cfm © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 11 With this release, the County field located in the FHA Government Information screen (shown below) will no longer be used by DU to determine the county. The field will be removed from the user interface in a future release of DU. Review Rules Review Rules are codes sent to DU to note the reason the loan casefile submission received a Refer recommendation from the FHA TOTAL Mortgage Scorecard. HUD is incorporating four new Review Rules in the FHA TOTAL Mortgage Scorecard. DU is adding two new corresponding messages as well as updating two existing messages. The following two messages are new with this release: This loan casefile has been referred because the current housing expense is greater than the total monthly income. This loan casefile has been referred because the amount being contributed by the seller exceeds 6 percent of the sales price. The following two messages are being updated with this release: This loan casefile has been referred due to the presence of one or more 30-day late mortgage payments showing on the credit report that occurred within the last 12 months, and the transaction type is a cash-out refinance. This loan casefile has been referred because at least one borrower does not have a credit score. Error Messaging The handling of Error Codes returned from the FHA TOTAL Mortgage Scorecard to DU will be updated in this release. After the release implementation over the weekend of July 21, if DU does not recognize an error code returned by the FHA TOTAL Mortgage Scorecard, the numeric code will be passed to the customer in the following new error message: © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 12 The following error codes were returned from the FHA TOTAL Mortgage Scorecard, but aren't recognized by Desktop Underwriter. Please refer to the current version of the FHA TOTAL Mortgage Scorecard AUS Developer's Guide available on HUD's Web site for additional details. The list of error codes and corresponding messages will also be updated in this release to incorporate two new error messages, update the text of one error message, and remove three existing error messages. The updated error code list is below. The current list of error codes and messages can be found in Appendix B of the FHA TOTAL Mortgage Scorecard AUS Developer’s Guide located at the following URL: http://www.hud.gov/pub/chums/aus-developers-guide.pdf Code Type of Error Message Message Text 001 FHA TOTAL Mortgage Scorecard The FHA TOTAL Mortgage Scorecard server was not set up correctly. 004 FHA TOTAL Mortgage Scorecard One SSN must be entered. 005 FHA TOTAL Mortgage Scorecard SSN1 is not valid. 006 FHA TOTAL Mortgage Scorecard SSN2 is not valid. 007 FHA TOTAL Mortgage Scorecard SSN3 is not valid. 008 FHA TOTAL Mortgage Scorecard SSN4 is not valid. 009 FHA TOTAL Mortgage Scorecard SSN5 is not valid. 010 FHA TOTAL Mortgage Scorecard SSN2 is required. 011 FHA TOTAL Mortgage Scorecard SSN3 is required. 012 FHA TOTAL Mortgage Scorecard SSN4 is required. 290 FHA TOTAL Mortgage Scorecard Invalid FHA Case Number. 300 FHA TOTAL Mortgage Scorecard Applicant(s) combined monthly income must be greater than 0. 305 FHA TOTAL Mortgage Scorecard Appraised Value must be between $9,000 and $9,999,999. Otherwise, it must be 0. 310 FHA TOTAL Mortgage Scorecard Loan amount including MIP must be greater than 0. 315 FHA TOTAL Mortgage Scorecard Monthly payment, including Principal, Interest, Taxes and Insurance, must be greater than 0. 320 FHA TOTAL Mortgage Scorecard Mortgage Insurance Premium cannot be less than 0. 325 FHA TOTAL Mortgage Scorecard Mortgage term in months must be between 48 and 360. 330 FHA TOTAL Mortgage Scorecard Sales price must be between $9,000 and $9,999,999. 335 FHA TOTAL Mortgage Scorecard Either Appraised Value or Sales price is required. 340 FHA TOTAL Mortgage Scorecard Total number of applicants must be between 1 and 5. 345 FHA TOTAL Mortgage Scorecard Total number of applicants does not match number of SSNs entered. 350 FHA TOTAL Mortgage Scorecard Unique identification for AUS must be entered 355 FHA TOTAL Mortgage Scorecard Unique identification for loan application assigned by AUS must be entered 360 FHA TOTAL Mortgage Scorecard Loan To Value Ratio must be between 11 and 125. 365 FHA TOTAL Mortgage Scorecard Front End Ratio must be greater than 0 and less than or equal to 100. 370 FHA TOTAL Mortgage Scorecard Back End Ratio must be greater than 0 and less than or equal to 100. 372 FHA TOTAL Mortgage Scorecard Back End Ratio must be greater than or equal to Front End Ratio. 375 FHA TOTAL Mortgage Scorecard Underwriting P & I must be greater than 0 and less than $15,000. 380 FHA TOTAL Mortgage Scorecard Underwriting Interest must be greater than 0. 385 FHA TOTAL Mortgage Scorecard Either Lender ID or Sponsored Originator EIN is required. 386 FHA TOTAL Mortgage Scorecard Both Lender ID and Sponsored Originator EIN not allowed. Please submit either © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 13 Code Type of Error Message Message Text Lender ID or Sponsored Originator EIN. 387 FHA TOTAL Mortgage Scorecard Sponsored Originator EIN is invalid. Sponsored Originator EIN must be nine numeric digits. 388 FHA TOTAL Mortgage Scorecard Sponsored Originator EIN is invalid. Sponsored Originator EIN must be in the CHUMS Sponsored Originator list. 390 FHA TOTAL Mortgage Scorecard Lender ID must contain 10 digits. 391 FHA TOTAL Mortgage Scorecard Invalid Lender ID. Please ensure lender ID is entered correctly. If it is entered correctly, please contact Lender Approval Division at (202)708-3976. 392 FHA TOTAL Mortgage Scorecard Lender ID is not active. 393 FHA TOTAL Mortgage Scorecard Sponsor ID is required. 394 FHA TOTAL Mortgage Scorecard Sponsor ID must contain 10 digits. 395 FHA TOTAL Mortgage Scorecard Invalid Sponsor ID. 396 FHA TOTAL Mortgage Scorecard Sponsor ID is not active. 397 FHA TOTAL Mortgage Scorecard Both Lender ID and Sponsor ID cannot be mortgagee type 4. 398 FHA TOTAL Mortgage Scorecard Lender ID is not certified through FHA Connection Certification Screen. 399 FHA TOTAL Mortgage Scorecard Sponsor ID is not certified through FHA Connection Certification Screen. 400 FHA TOTAL Mortgage Scorecard Credit report is required. 405 FHA TOTAL Mortgage Scorecard Each Credit Report must include a Credit Report Type and Credit Report Data. 415 FHA TOTAL Mortgage Scorecard First Time Home Buyer must by “Y” or “N”. 420 FHA TOTAL Mortgage Scorecard Counsel Type is not valid. 425 FHA TOTAL Mortgage Scorecard Current Housing Expense must be between $0 and $99,999.99. 430 FHA TOTAL Mortgage Scorecard Gift Letter Amount must be between $0 and $999,999. 435 FHA TOTAL Mortgage Scorecard Gift Letter Source must be “00”, “01”, “03”, “06”, or “15”. 440 FHA TOTAL Mortgage Scorecard Required Investment must be greater than the Negative Loan Amount. 445 FHA TOTAL Mortgage Scorecard For a refinance, Required Investment must be less than or equal to $999,999. For a purchase, Required Investment must be less than: 120 percent (Sale Price) Mortgage Amount. 450 FHA TOTAL Mortgage Scorecard Down Payment is required. 465 FHA TOTAL Mortgage Scorecard Total Fixed Payment must be between $0 and Monthly Income. 470 FHA TOTAL Mortgage Scorecard Condo Indicator must be “Y” or “N”. 475 FHA TOTAL Mortgage Scorecard Total Closing Costs cannot exceed 20 percent of Sale Price on a purchase. Total Closing Costs cannot exceed 20 percent of Appraised Value on a refinance. 480 FHA TOTAL Mortgage Scorecard Seller Concession Amount must be between $0 and 20 percent of Sales Price. 485 FHA TOTAL Mortgage Scorecard Borrower Closing Costs cannot exceed 20 percent of Sale Price on a purchase. Borrower Closing Costs cannot exceed 20 percent of Appraised Value on a refinance. 490 FHA TOTAL Mortgage Scorecard Gift Letter Amount must be greater than zero when Gift Letter Source is not “N/A”. 495 FHA TOTAL Mortgage Scorecard Gift Letter Source cannot be “N/A” when Gift Letter Amount is greater than zero. 999 FHA TOTAL Mortgage Scorecard The FHA TOTAL Mortgage Scorecard experienced an unexpected error while processing. 9010 DU for Government Loans Invalid property type. 9013 DU for Government Loans GPM is not a valid amortization type for automated underwriting. 9014 DU for Government Loans Other is not a valid amortization type for automated underwriting. 9018 DU for Government Loans Scheduled Amortization is not a valid repayment type for Government Loans. © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 14 Code Type of Error Message Message Text 9019 DU for Government Loans Interest Only is not a valid repayment type for Government Loans. 9020 DU for Government Loans Possible Negative Amortization is not a valid repayment type for Government Loans. 9021 DU for Government Loans Scheduled Negative Amortization is not a valid repayment type for Government Loans. 9022 DU for Government Loans Bi-weekly repayment type is not valid for Government Loans. 9023 DU for Government Loans Second Mortgage is not a valid lien type for Government Loans. 9024 DU for Government Loans Other Mortgage is not a valid lien type for Government Loans. 9990 DU for Government Loans HUD Scorecard output error, resubmit 9991 DU for Government Loans No longer eligible for FTS. 9995 DU for Government Loans Internet server err, resubmit 9996 DU for Government Loans Credential Svc. err, resubmit 9997 DU for Government Loans A failure has occurred while connecting to the FHA TOTAL Mortgage Scorecard. Please resubmit your case. 9998 DU for Government Loans HUD Proxy Server error, resubmit Additional Resources For additional information, please reference the documents and Web sites listed in the table below. Document URL HUD Handbook 4155.1, Mortgage Credit Analysis for Mortgage Insurance http://portal.hud.gov/hudportal/HUD?src=/program_offices/a dministration/hudclips/handbooks/hsgh HUD Mortgagee Letters http://www.hud.gov/offices/adm/hudclips/letters/mortgagee/ FHA Mortgage Limits Lookup Tool https://entp.hud.gov/idapp/html/hicostlook.cfm HUD CHUMS Data Files Page (Loan Limit Files) http://www.hud.gov/pub/chums/file_layouts.html FHA Resource Center: Contact Information and FAQs http://www.hud.gov/offices/hsg/sfh/fharesourcectr.cfm FHA TOTAL Mortgage Scorecard AUS Developer’s Guide http://www.hud.gov/pub/chums/aus-developers-guide.pdf VA Lenders Handbook http://www.benefits.va.gov/warms/pam26_7.asp VA Circulars http://www.benefits.va.gov/homeloans/new.asp VA Regional Loan Centers: Contact Information http://www.benefits.va.gov/homeloans/rlcweb.asp VA Loan Limit Page http://www.benefits.va.gov/homeloans/loan_limits.asp © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 15 For More Information More information can be found in the Help Center located within the User Interface of Desktop Originator® DO®/DU. Additionally, lenders may contact their Fannie Mae Account Team, and mortgage brokers should contact their DO sponsoring wholesale lender. For questions regarding HUD policies and guidelines, lenders and mortgage brokers should contact HUD at 1-800-CALL-FHA (1-800-225-5342). For questions regarding VA policies and guidelines, lenders and mortgage brokers should contact their VA Regional Loan Center. © 2012 Fannie Mae. Trademarks of Fannie Mae. 6.26.2012 16