The Challenges Facing Today`s Mortgage Market

advertisement

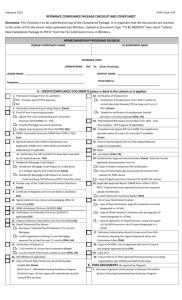

The Challenges Facing Today’s Mortgage Market Presented by Lori Stillwell Presentation Overview Yesterday Today Qualification Changes “New” Products Relocation Policy and Procedure Yesterday… Strong appetite for investors to buy mortgage backed securities Low down payments Low credit score options Limited documentation; even on high balance loans Speculators: Lenders and consumers jumped into the real estate market Today… Private securities still not selling; investors continue to consider (this makes conventional jumbo loans difficult to originate) Significantly tightened underwriting standards Transactions more complex for lenders and consumers Government business consists of 13% (YTD 2008) vs. 3% (2007) of originations in overall mortgage market New FHA guidelines as well as Freddie & Fannie Conforming loan limits Mortgage companies and brokers continue to exit the market Lenders working with consumers to avoid foreclosure Increased loss on sale; reluctance to move Great market for first time home buyers Qualification Changes General Tightening of Underwriting Guidelines Increased minimum FICO Score Increased down payment requirements Increased documentation requirements Enhanced Appraisal Review What is “new”…again? Fixed Rate Products FHA Financing – increased loan limits Fannie Mae/Freddie Mac – conforming loan limit increases VA Financing Private Mortgage Insurance (PMI) FHA Financing increased loan limits FHA created in 1934 – became part of HUD in 1965 Go to www.hud.gov for more information on FHA FHA often viewed as a first time homeowner program – it’s more than that! FHA loan limit increases available through 12/31/2008 $271,050 - $729,750 – varies based on location (higher for multi-unit dwellings) Lenders acceptance will vary and will likely overlay their policies into FHA guidelines FHA now a solid alternative to subprime FHA still allows low down payment options Down Payment can be gifted from family, government source or a non-profit agency Lenders are beginning to leverage FHA flexibility in order to serve customer needs Currently, LTV is not impacted by declining markets VA Loans Home financing for: Active and previously active military personnel Reservists & Surviving spouses Certificate of eligibility required for each customer 100% financing available VA funding fee can be rolled into the mortgage VA funding fee waived for disabled veteran VA appraisal requires an in-depth property inspection with work orders to be completed by the seller prior to closing Expanded maximum loan amount to $417,000 ($625,500 in designated high cost areas) Seller concessions allowed up to 4% of the appraised value PMI and Lender Paid Mortgage Insurance Required when customer’s down payment is less than 20% Utilization dropped as a result of increase in blended loans (80-10-10, etc.) Blended loan guidelines have tightened across industry Home equity has reduced due to declining property values resulting in smaller down payments Borrower paid PMI Low upfront paid at closing = higher monthly PMI cost High upfront paid at closing = lower monthly PMI cost Moderate upfront paid at closing = moderate monthly PMI Lender paid PMI – lender covers cost of PMI through increased interest rate No upfront cost Relocation Policy and Procedure Tighten policy language around reimbursement of VA funding fee Tighten policy language around PMI up-front fee reimbursement Down Payment Assistance Wells Fargo Recommendation: Consider Corporate Second Guarantee Program Overcoming Payment Challenges