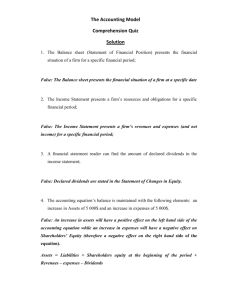

THE CITY UNIVERSITY OF NEW YORK Basic Financial

advertisement