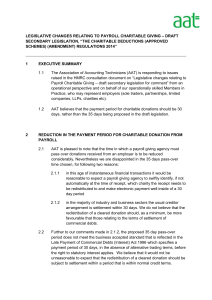

Untitled

advertisement

AAT – delivering finance skills that add value AAT training increases the effectiveness of people at the centre of successful businesses. We work with organisations such as RSM Tenon, KPMG, P&G and the Ministry of Defence to develop skilled finance teams, and we’re ready to help your business too. Founded in 1980, we are the UK’s leading professional accountancy body offering skills-based qualifications in accounting and finance. We are sponsored by chartered accountancy bodies: CIPFA, ICAEW, CIMA and ICAS. Over 65,000 people study AAT qualifications every year, from companies and organisations of all sizes, across all industry sectors. We have built our reputation by offering cost-effective training that works for employers, not just employees. How AAT works for you and your staff We offer practical, vocational training that not only turns employees into experts, but will help you increase staff productivity and motivation. By supporting your staff to train with AAT, you can: • attract, develop and retain the best people • improve the management of cash flow and finance – the lifeblood of your business • s tay one step ahead through continuous professional development • p roject a credible, authoritative image to partners and clients • a chieve all this without disruption to the day to day management of your business. Quick reference guide Find out five ways that we help your business grow on the next page. Find an overview of the skills and knowledge your staff will develop through our qualifications on page 4. Discover what it means to progress to professional membership on page 8. Find out about becoming an AAT accredited employer on page 10. For your next step turn to page 11. 2 Five ways we can help grow your business 1. We deliver expertise where it’s needed most Our qualifications give your staff the skills to manage cash flow, chase debtors more effectively and keep your business on a secure financial footing. This makes a big difference to the core of your business. 2. We help you attract and retain the best talent We all feel more empowered and motivated when we have the chance to develop our skills and move our careers forward. By investing in training, you can increase the value of your workforce and demonstrate your commitment to their career progression. 3. We deliver practical skills that make a difference From their first day of training, AAT students learn techniques and processes that they can apply directly at work – covering not only accountancy, but also important communication and interpersonal skills. They become more rounded, effective and committed team players. 4. We work around you Flexibility is fundamental to AAT because it’s all about helping your staff to study while contributing effectively to your business. This extends to the delivery of our qualifications with part-time and distance learning options offered at over 400 training providers across the UK. 5. We keep you one step ahead Every AAT professional member commits to ensuring their long-term effectiveness through continuing professional development. So you can be sure your employees are up to date in terms of knowledge and skills, giving your company a competitive edge that makes all the difference. “We chose AAT as it’s a great way to provide the relevant skill set for those that work in finance. Our staff have really benefited from their AAT training. It’s given them greater confidence in their abilities to progress to more complex roles and it has also created a great level of teamwork with students supporting each other.” Mark Baldwin Head of Payment Services, BT 3 Our qualifications AAT Access – essentials in business and finance AAT Access, Level 1 Award in Accounting, is an introductory qualification for those who will benefit from learning the basics of accounting and business communications. This short qualification will give your employees a confidence boost and a strong foundation to further develop their finance skills. It’s ideal for new employees as an induction course and existing staff who have financial responsibilities within their job roles. It’s also the perfect foundation for those going on to Level 2 of the AAT Accounting Qualification. AAT Access introduces basic accounting concepts of single-entry bookkeeping and mathematical functions using financial data. Students will develop practical skills in essential accounting procedures, creating business documents, accounting in a professional environment and mathematics for accounting. “AAT is the most practical and useful accounts based qualification out there – I don’t think anything else can beat it.” Lisa Newton MAAT Managing Director, Boogles Ltd 4 The AAT Accounting Qualification The AAT Accounting Qualification will provide your employees with practical accounting and financial knowledge and skills, while also developing their grasp of business. Achieving the qualification will give them a firm grounding in accounting that will make a real difference to your finance team. It’s made up of three levels and each one is a qualification in its own right. This gives you the option to train your staff to the level that you need for your business or support them right through to completion of the full AAT Accounting Qualification. Level 2 Certificate in Accounting* The Level 2 Certificate in Accounting is the first level of the qualification and is suitable for people new to finance or looking to brush up on their foundation knowledge and skills. It covers a range of basic accounting practices and techniques, from costing and double-entry bookkeeping to computerised accounting. Level 3 Diploma in Accounting* This level introduces more complex accounting tasks, like maintaining cost accounting records and the preparation of reports and returns. On completion of this level, your staff will be able to prepare balance sheets, and profit and loss accounts. They’ll be taught professionalism in the workplace meaning that they’ll be able to confidently work with and advise internal and external clients. Complemented with the understanding of how to treat VAT and complete VAT returns, you’ll have a skilled member of staff ready to take their training to the next level. Level 4 Diploma in Accounting* Level 4 will allow your staff to become proficient in delivering high level accounting tasks. They’ll receive training in drafting financial statements, managing budgets and evaluating financial performance. They'll also have the opportunity to specialise in areas from tax to auditing and credit control. On completion of this level, your staff will be perfectly placed to become an AAT professional member and gain the designatory letters MAAT after their name, and even continue their studies to chartered accountancy. View the full syllabus online at aat.org.uk/qualifications *Levels 2, 3 and 4 equate to Levels 5, 6 and 8 in Scotland. 5 AAT apprenticeships Apprentices benefit from an invaluable mix of theoretical learning and practical training – a combination unmatched by any other scheme and of great benefit in the workplace. The AAT Accounting Qualification fits perfectly on the apprenticeship framework. Apprenticeships provide formal, nationally recognised training programmes for ambitious individuals, and the opportunity to achieve a qualification while developing hands-on skills and experience in the workplace. Apprenticeships are proving popular with employers – 92% of employers have found their apprenticeship scheme has produced more motivated staff and a higher level of job satisfaction (Learning and Skills Council, February 2009). Through apprenticeships you will nurture loyal employees who, on completion of their AAT apprenticeship, can fast-track to chartered accountancy. Funding is available across all three levels of the qualification providing a cost effective way of attracting, developing and retaining productive and highly skilled employees. Taking on an apprentice is straight forward. You won't be bombarded with forms and paperwork – your employee’s training provider will do most of the administration for you. You will need to commit to supporting your apprentice’s time spent out of the office, and provide a mentor for them at work. The diagram below shows how the AAT Accounting Qualification fits on to the apprenticeship framework for England and Wales*. Apprenticeship framework AAT Accounting Qualification Competence Technical skills and knowledge Employment rights and responsibilities On and off the job learning Transferable skills Employment Maths, English and ICT For example, trainee accountant *For apprenticeship framework information for Scotland visit Skills Development Scotland at skillsdevelopmentscotland.co.uk and for Northern Ireland visit the Department for Employment and Learning at delni.gov.uk 6 “We see huge benefits from our apprentices as they’re able to apply their AAT training to their job from day one. We also see a lot of agility with our apprentices – we’re able to flow them between departments to leverage what they’ve learnt through their training, which is great for the business.” Joanne Evans Finance Manager, P&G Cost-effective and flexible training Flexibility to suit any work schedule Fees Flexibility is key to AAT – our course structures help your staff to develop their skills while contributing effectively to your business. We know that implementing training requires a commitment in terms of finance and time, and we’re confident your investment will be a worthwhile one. All assessments are computer based and can be scheduled at any time, allowing you to manage time and resource depending on workload, staff absence and availability. What’s more, you might be eligible for government funding to support the cost of training. We also have a network of over 400 training providers across the UK, offering part-time and distance learning options to suit you and your staff. *Fees vary Costs are broken down into two main categories: • training provider fees* – paid to the training provider to cover tuition and sometimes course materials • A AT fees – paid to AAT and includes admission, membership and assessment fees. More information on fees and funding can be found on our website. 7 Progressing to AAT professional membership Upon completion of the AAT Accounting Qualification, students can apply to become professional members. When your staff member becomes an AAT professional member, they commit to lifelong learning through our continued professional development (CPD) framework. They'll keep their skills up to date and their knowledge fresh for the workplace, giving your company a competitive edge. Your organisation’s effectiveness depends on the capabilities of your staff and it’s crucial they keep their skills up to date so they can deal with new challenges. AAT professional members use MAAT after their name, giving them the professional status that reflects the skills they’ve gained. It also shows their dedication to maintaining and developing their competence. After five years of senior and managerial work experience, your staff can apply for fellow membership (FMAAT). We provide a wealth of exclusive support for our members’ CPD – from free or discounted training events, to technical and ethical helplines, podcasts and email updates. AAT membership journey AAT professional membership FMAAT / MIP* MAAT / MIP* AAT affiliate membership AAT student membership Level 4 Diploma in Accounting Level 3 Diploma in Accounting Level 2 Certificate in Accounting Work experience Levels 2, 3 and 4 equate to Levels 5, 6 and 8 in Scotland. *MIP: AAT members registered or licensed on AAT’s scheme for members in practice. 8 “I can see for myself the progress of AAT students within our organisation who have been placed in new roles as a result of their advancement and growing knowledge. The commitment to study for AAT membership shows a desire to be seen as an achiever, which is a great thing for any employer.” David Stephenson FMAAT Financial Accountant, Morrisons Supermarkets Options after qualifying Fast-track to chartered accountancy Progression to university The AAT Accounting Qualification is the perfect foundation for further training, and our qualifications provide generous exemptions to further study with all of the UK chartered and certified accountancy bodies. Once your staff have qualified they can continue their training on a graduate programme. With degree-pathways at over 30 UK universities, the AAT Accounting Qualification provides excellent exemptions on a range of accounting and finance-related degrees. AAT is the fast-track, non-graduate route into chartered accountancy. In fact, it's the only professional qualification that gives your staff a quicker route to chartered status. 9 AAT employer accreditation AAT's accredited employer scheme recognises the significant role that employers have in the professional development of AAT student and professional members through ongoing training and support. As an AAT accredited employer – a sign of excellence – you are recognised for your provision of valuable training and development for your AAT members. This enables you to demonstrate your commitment to the development of your workforce and send out the right signals as an employer. The scheme is free to join and open to everyone who employs one or more AAT students or professional members, from small and medium businesses to large multinational organisations. An additional benefit to being an accredited employer is that your AAT professional members will automatically meet their mandatory CPD requirements for maintaining their MAAT/FMAAT status, simply by following your internal training and development processes. Hear from leading employers Watch our short videos from AAT accredited employers who we work closely with, including RSM Tenon, to see how our training has added value to their business. Visit aat.org.uk/training 10 “We benefit from having AAT student and professional members because we can rely on these people. And AAT is seen as the gold standard within the finance industry.” Joanne Watts Head of Accountancy Services Hertfordshire County Council Your next step I want to develop an AAT training programme for my business 1. Visit aat.org.uk/mybusiness to find information on AAT training for your business. 2. Call our Account Management team on 0845 863 0795 to arrange a consultation to discuss the training options to suit your business needs. I’m ready to upskill my finance team and register them as an AAT student member 1. Ask your staff to complete the AAT Skillcheck at aatskillcheck.org This will provide guidance on the recommended level for your staff member to begin their training, based on their skills and knowledge. 2. Select a training provider, you can start your search at aat.org.uk/trainingproviders 3. Register your staff as an AAT student member at aat.org.uk/getregistered I want to recruit a new finance staff member and start them on AAT training 1. Advertise your trainee vacancies on AAT Jobs – visit our dedicated finance and recruitment site at aat-jobs.co.uk 2. Select a training provider, you can start your search at aat.org.uk/trainingproviders 3. Register your staff as an AAT student member at aat.org.uk/getregistered And if you’re taking on an apprentice 4. Find more information from the relevant organisation for your region: - for England visit the National Apprenticeship Service at apprenticeships.org.uk - for Wales visit the Welsh Government at wales.gov.uk - for Scotland visit Skills Development Scotland at skillsdevelopmentscotland.co.uk - for Northern Ireland visit the Department for Employment and Learning at delni.gov.uk Information in this brochure was correct at time of printing, June 2012. 11 Any questions? Contact us today to find out more about AAT and our qualifications from our Account Management team. Association of Accounting Technicians 140 Aldersgate Street London EC1A 4HY Registered charity no. 1050724 38790612 – 5,000 Call us on 0845 863 0795. Lines are open 09.00 to 17.00, Monday to Friday. Email us at employer@aat.org.uk or visit aat.org.uk/mybusiness