Vince Bonato, et al. v. Yahoo! Inc., et al. 11-CV-02732

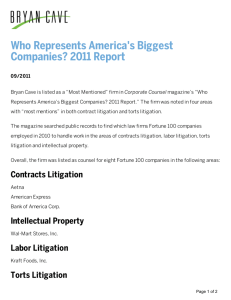

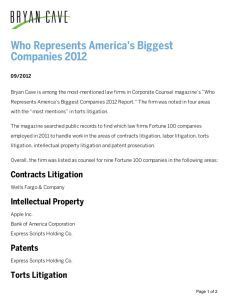

advertisement