Going Global in Asia: Emerging Trends and Economic Insights of

advertisement

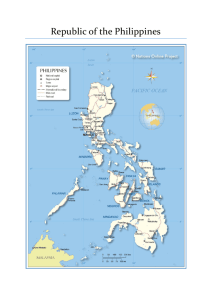

Bank of America Merrill Lynch White Paper Going Global in Asia: Emerging Trends and Economic Insights of Asia Pacific. August 2014 Executive summary Contents Asia has always held a certain fascination with companies looking for new opportunities New insights to consider as you’re considering Asia.. . . . . . . . . . . . 2 abroad. An investment in Asia meant your business was truly ready to expand its global reach and diversify. The same sentiment still rings true today as more U.S. companies are partnering with China, Japan and even emerging players like Indonesia and the Philippines. In this article, we’ll explore Asia’s economic draw from the open markets and unique currencies to the latest economic headlines making waves across Asia and beyond. Summary. . . . . . . . . . . . . . . . . . . 7 GOING GLOBAL IN ASIA: EMERGING TRENDS AND ECONOMIC INSIGHTS OF ASIA PACIFIC | 2 New insights to consider as you’re considering Asia 2014 has become an especially buoyant year for CFOs all across Asia. According to the 2014 Asia CFO Outlook, 76% of Asia’s finance chiefs surveyed expected revenues to grow, which is up from 72% last year.1 It is an endorsement of resounding confidence in Asia’s business outlook, despite macroeconomics and market risk. In Japan, this optimism has even become a notable trend in recent months as “Abenomics” — the economic policy adopted by Prime Minister, Shinzo Abe, continues to foster beliefs of top-line growth and a more unified economy. In Southeast Asia, steps toward economic integration are also being taken to level the playing field between countries. The Association of Southeast Asian Nations (ASEAN) aims to narrow the social and economic development gaps between its member countries by 2015 with the implementation of several policies, including the Initiative for ASEAN Integration (IAI) Work plan. Even as margin pressures build and economic gaps widen between countries, growth rates in Asia remain strong, steady and increasingly competitive. Let’s take a look at some of the key players and new contenders in Asia’s world market, presented in order of GDP (PPP) rankings. China It may be hard to believe, but it wasn’t that long ago that The Peoples Republic of China was a closed-off, decentralized economy with relatively little flow of goods and services between regions. Since the late 1970s, China’s economy has dramatically shifted to a more marketoriented one, boosting its status as one of the world’s largest exporters. In 2013, China was named the second-largest economy in the world after the U.S.,2 and The Economist predicts that it may even overtake America as early as 2019, provided China’s prices rise faster than America’s and its currency, the Chinese yuan, doesn’t fall.3 China at a Glance4 Population: 1,355,692,576 (July 2014 est.) GDP: U.S. $13.39 trillion (2013 est.) Currency: Chinese yuan (CNY) Exchange rates: 6.2 Chinese yuan per U.S. dollar (2013 est.) But before China can even think about eclipsing the U.S.A., it will need to tackle a number of challenges on the home front, including creating higher-wage opportunities for the rising middle-class, reducing corruption and other economic crimes, containing the environmental damage related to the country’s rapid transformation, and decreasing its high domestic savings rates and correspondingly low domestic consumption. One step in the right direction was the bold decision to liberalize China’s cash and liquidity structures. All companies based in China can now lend to non-Chinese parent companies, subsidiaries or affiliates, opening the door to a wider range of opportunities in and outside of China. India Every country deserves their moment in the sun, and for India, 2014 was well worth the wait. India developed quickly in the last decade, but external slowdowns in recent years, including high inflation, rising fiscal and account deficits, capital liquidity problems, and staggering poverty, have kept it from achieving the same growth and economic boom as its Asian neighbors. Exports: $2.21 trillion (2013 est.) Imports: $1.95 trillion (2013 est.) GOING GLOBAL IN ASIA: EMERGING TRENDS AND ECONOMIC INSIGHTS OF ASIA PACIFIC | 3 But even with setbacks, India continues to move forward, meeting the demands of an openmarket economy, improving living standards and growing tremendously in critical sectors, like IT, software and business outsourcing. This year, it has even surpassed Japan as the world’s third-largest economy in terms of Purchasing Power Parity (PPP) behind U.S. and China.5 With a host of transformative policies in place and India’s newest Prime Minister, Narendra Modi, at the helm, many are speculating that India could be the next China. Since the start of the year, stocks have climbed 25%.6 Foreign investment is back on track. And India’s currency, the Indian rupee, enjoyed a seven-month high in March as foreign investors excited about the new government’s role in India’s economic recovery stepped forward to purchase Indian assets and give its full show of support for India’s continued growth.7 India at a Glance8 Population: 1,236,344,631 (July 2014 est.) GDP: U.S. $4.99 trillion (2013 est.) Currency: Indian rupee (INR) Exchange rates: 58.68 Indian rupees (INR) per U.S. dollar (2013 est.) Exports: $313.2 billion (2013 est.) Imports: $467.5 billion (2013 est.) Japan India may have overtaken Japan as the third-largest economy in terms of Purchasing Power Parity,5 but on almost every other economic level, Japan is still a force to be reckoned with. Thanks to a strong work ethic, superior mastery of high technology and enviable government-industry cooperation, Japan has always been able to land on its feet and stand even taller, despite the obstacles. And since 2000, there have been many — from three recessions back to back to braving the 9.0 magnitude earthquake and ensuing Tsunami, which hit Japan’s manufacturing industry hard. Today, Prime Minister Shinzo Abe is working to end two decades of deflation and tepid growth by creating an economic revitalization agenda of fiscal stimulus, monetary easing and structural reform. Last year, Japan joined the Trans Pacific Partnership (TPP) negotiations, a pact that will open Japan up to increased foreign competition and provide new export opportunities for Japanese businesses. Japan at a Glance10 Population: 127,103,388 (July 2014 est.) GDP: U.S. $4.729 trillion (2013 est.) Currency: Japanese yen (JPY) Exchange rates: 97.44 yen (JPY) per U.S. dollar (2013 est.) Exports: $697 billion (2013 est.) Imports: $766.6 billion (2013 est.) Japan’s outlook over the next few years will largely be determined by the gradual tax increase of 10% by 2015.9 The tax hike will help raise revenue and tackle Japan’s national debt, which is currently exceeding 230% of the GDP.9 South Korea Sixty years ago, the U.S. government considered adding South Korea as another line item to its foreign aid budget. Fifty years ago, the country was poorer than Bolivia and Mozambique.11 Ten years ago, South Korea joined the trillion-dollar club of world economies. And today, it is the world’s 12th largest economy.12 The rags-to-riches story of South Korea has been nothing short of spectacular and puts it in a class of its own. Its impressive track-record of innovation, economic reform, market openness and sound leadership place South Korea well above neighboring Asian countries. Yet it is not technically considered a developed market with exports and imports ($125 trillion/year) exceeding its national income ($1.1 trillion).11 South Korea also faces a rapidly aging population, inflexible labor markets, dominance of large conglomerates (chaebols) and heavy reliance on exports, which make up half of South Korea’s GDP.12 Despite the challenges, GDP rose a remarkable 3.9% at the end of 2013 — the fastest economic growth in three years.13 This upswing is part of South Korea’s and President Park Geun-hye’s three-year plan for economic innovation. The plan aims to revitalize the South Korea at a Glance15 Population: 49,039,986 (July 2014 est.) GDP: U.S. $1.666 trillion (2013 est.) Currency: Korean won (KRW) Exchange rates: 1,107.3 South Korean won (KRW) per U.S. dollar (2013 est.) Exports: $557.3 billion (2013 est.) Imports: $516.6 billion (2013 est.) GOING GLOBAL IN ASIA: EMERGING TRENDS AND ECONOMIC INSIGHTS OF ASIA PACIFIC | 4 Korean economy with a 4% potential growth, 70% employment rate and $40,000 per capita GDP.14 The Korea New Exchange (KONEX) market launched in July of last year will also play a continuing role in the government’s “creative economy” vision by bolstering the growth of start-up companies, reducing stock market barriers and easing dependency on bank loans. Indonesia During the financial crisis, Indonesia outperformed its Asian neighbors and joined the ranks of China and India as the only G20 members to post growth.16 In December 2011, Fitch and Moody’s upgraded Indonesia’s credit rating to investment grade.16 And it is projected to be the fastest growing ASEAN-6 (Malaysia, Philippines, Singapore, Thailand, Vietnam, Indonesia) economy with an average annual growth of 6% from 2014-2018.17 But as its stock continues to rise, so does Indonesia’s struggle with poverty, unemployment and lingering corruption. The winner of this year’s presidential election will also need to boost investment, growth and corporate profits, as Indonesia is heavily dependent on foreign direct investment for development. Foreign portfolio inflows are also helping to fund the country’s current deficit (2% of GDP) and refinance the government’s foreign debt.18 Indonesia at a Glance19 Population: 253,609,642 (July 2014 est.) GDP: U.S. $1.285 trillion (2013 est.) Currency: Indonesian rupiah (IDR) Exchange rates: 10,341.6 Indonesian rupiah (IDR) per U.S. dollar (2013 est.) Exports: $178.9 billion (2013 est.) Imports: $178.6 billion (2013 est.) The hope is that Indonesia’s new president will usher in a new era of economic reform and confidence. Prior to July’s vote, the benchmark stock index and its currency, the Indonesian rupiah, climbed roughly 2.5%, for a total increase of 17% in stocks so far this year and a 4.7% for the rupiah.18 Australia The global financial crisis affected countless countries around the world. So how did Australia escape relatively unscathed and emerge even stronger? For starters, Australia boasts an open market with minimal restrictions on imports of goods and services. Australia also had one other big resource on its side: China and its growing appetite for iron ore, wheat and other commodities that largely kept Australia safe from the financial crisis.20 China is also Australia’s largest trading partner, and Australia is China’s sixth largest trading partner.21 Needless to say, this two-way investment relationship has served both countries well for more than four decades. Recently, Australia’s economy has begun to move away from mining to service sectors like healthcare and finance. With this shift comes a change in the way Australia does business, or in this case, who Australia does business with. In the beginning of July, Japanese President Shinzo Abe made the first visit to Australia since 2002 to sign agreements over security and commerce. This trade liberalism between both China and Japan, Australia maintains, will provide more jobs, better infrastructure, freer trade and greater cooperation — all while building the foundation for a stronger economy. Australia at a Glance22 Population: 22,507,617 (July 2014 est.) GDP: U.S. $998.3 billion (2013 est.) Currency: Australian dollar (AUD) Exchange rates: 1.031 Australian dollars (AUD) per U.S. dollar (2013 est.) Exports: $251.7 billion (2013 est.) Imports: $245.8 billion (2013 est.) GOING GLOBAL IN ASIA: EMERGING TRENDS AND ECONOMIC INSIGHTS OF ASIA PACIFIC | 5 Taiwan The Island of Taiwan may seem small compared to its burgeoning neighbors, China and Japan. But what it lacks in size, Taiwan is definitely making up for in exports and domestic spending. The export-dependent economy grew 3% in the first quarter, the biggest increase rate in more than a year.23 Domestic private consumption also grew 2.94%, boosted by rising stock prices and an influx of Chinese tourists visiting Taipei’s new crop of hotels, shops and restaurants.23 As more opportunities trickle down from China, Taiwan is quickly realizing its potential as an offshore currency hub for the Renminbi (RMB). It’s the second major market after Hong Kong to clear transactions in the yuan. Direct access to clearing means less transaction costs, reduced FX volatility and greater opportunities to develop yuan-denominated products on Taiwan soil. Taiwan at a Glance25 Population: 23,359,928 (July 2014 est.) GDP: U.S. $926.4 billion (2013 est.) Currency: New Taiwan dollars (TWD) Exchange rates: 29.77 New Taiwan dollars (TWD) per U.S. dollar (2013 est.) Exports: $305.8 billion (2013 est.) Imports: $268.5 billion (2013 est.) In the years to come, Taiwan will also have to decide for itself how economically dependent it wants to be on China, as many political differences remain unresolved. Since 2009, Taiwan has gradually decreased government rules regarding Chinese investments in Taiwan and secured greater market access for investors in mainland China. In July 2013, Taiwan signed a free trade deal with New Zealand and with Singapore in November, further signifying its role as an emerging market to watch in the next few years.24 Thailand Thailand’s economy has braved some difficult storms in recent years. The economic recession greatly affected Thailand’s exports, and in 2011, flooding in Bangkok and surrounding provinces devastated the country’s manufacturing sector. As the economy slowly begins to right itself, significant declines in labor freedom, uncontrolled government spending and wide-spread corruption will also need to be resolved. To get the economy back on track and competitive, government agencies have collaborated to promote friendlier business practices from reducing corporate profit taxes to cutting down the number of procedures needed to register a company in Thailand. Thailand at a Glance26 Population: 67,741,401 (July 2014 est.) GDP: U.S. $673 billion (2013 est.) Currency: Thai baht (THB) Exchange rates: 30.59 Thai baht (THB) per U.S. dollar (2013 est.) Exports: $225.4 billion (2013 est.) Imports: $219 billion (2013 est.) Even better news for Thailand — the nationwide 10 p.m. to 5 a.m. curfew was lifted in June of this year, allowing many businesses to resume operations and the national economy to resume its ascent. Malaysia With a total area slightly larger than New Mexico, Malaysia’s multi-sector economy is aiming high and gaining remarkable momentum. One of the main economic goals: achieve highincome status by 2020 and move up the value-added production chain with investments in Islamic finance, high-tech industries and even biotechnology. The results of Malaysia’s tenacity can be seen today with the incredible reduction of Malaysia’s poverty levels from more than 50% in the 1960s to less than 2% currently.27 Under the directive of Prime Minister Najib Razak, this upper-middle income, highly open economy is expected to grow 5.4% this year and 4.6% in 2015 from the rise in exports.28 Greater regulatory efficiencies and financial sector overhauls have also been implemented in recent years to stabilize and boost Malaysia’s business climate. It now takes three Malaysia at a Glance29 Population: 30,073,353 (July 2014 est.) GDP: U.S. $525 billion (2013 est.) Currency: Malaysian ringgit (MYR) Exchange rates: 3.174 Malaysian ringgits (MYR) per U.S. dollar (2013 est.) Exports: $230.7 billion (2013 est.) Imports: $192.9 billion (2013 est.) GOING GLOBAL IN ASIA: EMERGING TRENDS AND ECONOMIC INSIGHTS OF ASIA PACIFIC | 6 procedures and an average of six days to incorporate a business. No minimum capital is required. And a wide variety of financial services from microfinance to special loans for farmers and small to medium enterprises are helping to build a unique sense of shared prosperity all across Malaysia. The Philippines If any country can weather natural disasters and financial downturns to emerge economically sound, it is the Philippines. Late last year, GDP grew by 6.5%, bringing 2013 growth to 7.2%, a staggering leap from the 4.7% averages recorded from 2008 – 2012.30 Today, international reserves are at record highs, the banking system is stable, and for the first time in history, several credit rating upgrades have boosted the Philippines to investment grade and above.31 With GDP projected to top $1 trillion by 2030, many are even calling the Philippines the next Asian Tiger economy.32 As impressive as the achievements are, a more careful look reveals high income inequality, an absence of effective regulation and high levels of corruption, which President Benigno Aquino III has personally campaigned to end. His administration is also working to transfer the recent economic gains into substantial benefits that reduce poverty, create more jobs and help victims recover from the impact of last year’s earthquake and typhoon. The Philippines at a Glance33 Population: 107,668,231 (July 2014 est.) GDP: U.S. $454.3 billion (2013 est.) Currency: Philippine peso (PHP) Exchange rates: 42.69 Philippine pesos (PHP) per U.S. dollar (2013 est.) Exports: $47.45 billion (2013 est.) Imports: $63.91 billion (2013 est.) Hong Kong Trade freedom. Investment freedom. Financial freedom. Market openness. You name it, Hong Kong has it. Its economic freedom score is 90.1, making it the top-rated economy of the Index of Economic Freedom for the 20th consecutive year.34 But Hong Kong doesn’t carry its title as the world’s freest economy lightly. Everything this former British colony does is with business formation and innovation in mind. That’s why no minimum capital is required for launching a business in Hong Kong. There are no tariffs on imported goods, no restrictions on foreign banks and few restrictions to foreign investment.34 In 2013, Hong Kong signed the Closer Economic Partnership Agreement (CEPA) with China to forge closer ties with its parent country as well as gain preferential access to the Chinese markets. And with Hong Kong’s shift from manufacturing to the service sector, it is well poised to help companies from China, the U.S and other countries enter international markets and flourish. Hong Kong at a Glance35 Population: 7,112,688 (July 2014 est.) GDP: U.S. $381.3 billion (2013 est.) Currency: Hong Kong dollar (HKD) Exchange rates: 7.772 Hong Kong dollars (HKD) per U.S. dollar (2013 est.) Exports: $456.4 billion (2013 est.) Imports: $520.6 billion (2013 est.) Singapore Following in the footsteps of Hong Kong, Singapore has faced many economic and political challenges to become one of the world’s most prosperous nations. According to the 2014 Index of Economic Freedom, it is the second freest economy in the world, with favorable business practices, a corruption-free environment, stable prices and a higher than average GDP.36 Singapore’s open market is an investor’s dream, with no minimum capital required to launch a business, no statutory minimum wage and zero tariff rates.36 Behind this favorable trading climate is a firm central government and efficient judicial system that prides itself on a zero tolerance policy for bribery and corruption. Singapore at a Glance38 Population: 5,567,301 (July 2014 est.) GDP: U.S. $339 billion (2013 est.) Currency: Singapore dollar (SGD) Exchange rates: 1.25 Singapore dollars (SGD) per U.S. dollar (2013 est.) Exports: $410.3 billion (2013 est.) Imports: $373 billion (2013 est.) GOING GLOBAL IN ASIA: EMERGING TRENDS AND ECONOMIC INSIGHTS OF ASIA PACIFIC | 7 The future looks bright for Singapore, as its prime geographic location and connectivity to Asian markets continue to attract more companies each year. The economy is projected to grow by 3.3% per year from 2014 – 2018,37 with a new growth path that focuses on raising productivity and innovation. New Zealand Over the past 20 years, New Zealand has transformed from an agrarian society dependent on access to British markets to a highly industrialized, free market economy. And while it is always been recognized as a safe place to do business, this year’s rankings prove that New Zealand is also quickly becoming one of the best places as well. It is ranked first in the world for protecting investors, lack of corruption and ease of starting a business, which only takes one day to incorporate.39 The country also has a pro-business taxation system that supports capital development, research and development and international investment. In December 2013, Forbes ranked New Zealand the second best country for business after Ireland,40 and Q1 of this year, New Zealand’s economy skyrocketed to 3.3%, the fastest pace in eight years.41 Summary As inflation eases, macroeconomic policies remain accommodative and capital inflows resume, Asia will continue to stay ahead of the global growth average. With a knowledgeable partner by your side — someone who knows how to navigate diverse economies with ease and expertise — your business will be well prepared for all the opportunities that await in Asia. New Zealand at a Glance42 Population: 4,401,916 (July 2014 est.) GDP: U.S. $136 billion (2013 est.) Currency: New Zealand dollar (NZD) Exchange rates: 1.24 New Zealand dollar (NZD) per U.S. dollar (2013 est.) Exports: $37.84 billion (2013 est.) Imports: $37.35 billion (2013 est.) GOING GLOBAL IN ASIA: EMERGING TRENDS AND ECONOMIC INSIGHTS OF ASIA PACIFIC | 8 Endnotes Bank of America Merrill Lynch Annual Survey, “2014 CFO Outlook Asia,” 2013 (Victorin 9) 1 CIA World Factbook, “China Economy – Overview,” June 22, 2014 2 The Economist, “Chinese and American GDP Forecasts: Catching the Eagle,” May 2, 2014 3 Global Transaction Services: The Power of Global Connections, “China,” 2013 (Distelbrink 8) 4 The Diplomat, “World Bank: India Overtakes Japan as World’s Third Largest Economy,” May 1, 2014 5 CNN World, “Narenda Modi: Has New Prime Minister Given India Its Mojo Back?” July 10, 2014 6 Bloomberg News, “Indian Rupee Rises to 7 – Month High on Economy, Election Optimism,” March 24, 2014 7 Global Transaction Services: The Power of Global Connections, “India,” 2013 (Distelbrink 12) 8 9 CIA World Factbook, “Japan Economy – Overview,” June 22, 2014 10 Global Transaction Services: The Power of Global Connections, “Japan,” 2013 (Distelbrink 16) 11 Council on Foreign Relations, “Six Markets to Watch: South Korea,” January/February 2014 12 CIA World Factbook, “South Korea Economy – Overview,” June 22, 2014 13 Financial Times, “South Korea Records Fastest Economic Growth in 3 Years,” January 23, 2014 14 OECD Economic Surveys, “Korea,” June 2014 (OECD 37) 15 Global Transaction Services: The Power of Global Connections, “South Korea,” 2013 (Distelbrink 18) 16 CIA World Factbook, “Indonesia Economy – Overview,” June 22, 2014 17 Economic Outlook for Southeast Asia, China and India 2014, “Indonesia,” 2013/2014 (OECD 3) 18 Wall Street Journal: Southeast Asia, “Foreign Investors Cast Their Ballot in Indonesia for Reform,” July 9, 2014 19 Global Transaction Services: The Power of Global Connections, “Indonesia,” 2013 (Distelbrink 14) 20 Business Week, “Australia’s Economy Survives a Slowdown in China,” March 20, 2014 21 Parliament of Australia, “Australia’s Economic Relationship with China,” 2013 22 Global Transaction Services: The Power of Global Connections, “Australia,” 2013 (Distelbrink 6) 23 24 25 26 Global Transaction Services: The Power of Global Connections, “Taiwan,” 2013 (Distelbrink 28) Global Transaction Services: The Power of Global Connections, “Thailand,” 2013 (Distelbrink 30) 27 28 Wall Street Journal: Asia News, “Taiwan’s Economy Picks Up,” April 30, 2014 CIA World Factbook, “Taiwan Economy – Overview,” June 22, 2014 The World Bank, “Malaysia Overview,” February 28, 2014 The World Bank, “Boosting Trade Competitiveness Key for Sustained Growth in Malaysia,” June 27, 2014 29 Global Transaction Services: The Power of Global Connections, “Malaysia,” 2013 (Distelbrink 20) 30 Asian Development Outlook 2014, “Philippines,” 2014 31 Al Jazeera, “The Philippines: The Next Asian Tiger Economy?” June 14, 2014 32 Wall Street Journal: Asia, “American Businesses Flirt with Fast-Growing Philippines,” June 7, 2014 33 Global Transaction Services: The Power of Global Connections, “Philippines,” 2013 (Distelbrink 24) 34 The Index of Economic Freedom, “Hong Kong,” 2014 35 Global Transaction Services: The Power of Global Connections, “Hong Kong,” 2013 (Distelbrink 10) 36 The Index of Economic Freedom, “Singapore,” 2014 37 Economic Outlook for Southeast Asia, China and India 2014, “Singapore,” 2013/2014 (OECD 3) 38 Global Transaction Services: The Power of Global Connections, “Singapore,” 2013 (Distelbrink 26) 39 New Zealand Trade and Enterprise, “New Zealand’s Investment Advantage,” 2014 40 Forbes, “Best Countries for Business: New Zealand,” December 2013 41 The New Zealand Herald, “Economic Growth Will Keep Rate Hikes Coming,” June 19, 2014 42 Global Transaction Services: The Power of Global Connections, “New Zealand,” 2013 (Distelbrink 22) “Bank of America Merrill Lynch” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp., both of which are registered broker-dealers and members of SIPC, and, in other jurisdictions, by locally registered entities. Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA. Investment products offered by Investment Banking Affiliates: Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed. ©2014 Bank of America Corporation 07-14-0994